SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 23, 2017

ONCOGENEX PHARMACEUTICALS, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

|

Delaware

|

|

033-80623

|

|

95-4343413

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

19820 North Creek Parkway

Bothell, Washington

|

|

|

|

98011

|

|

(Address of Principal Executive Offices)

|

|

|

|

(Zip Code)

|

Registrant’s Telephone Number, Including Area Code: (425) 686-1500

N/A

(Former Name or

Former Address, if Changed Since Last Report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

|

☒

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 2.02

|

Results of Operations and Financial Condition.

|

On February 23, 2017, OncoGenex Pharmaceuticals,

Inc. (the “Company”) issued a press release announcing its financial results for the fourth quarter and year ended December 31, 2016. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on

Form 8-K.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

99.1

|

|

Press release of OncoGenex Pharmaceuticals, Inc. dated February 23, 2017

|

The information in Item 2.02 of this Form 8-K and Exhibit 99.1 attached hereto is furnished and shall not be deemed “filed” for purposes of

Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be

expressly set forth by specific reference in such filing.

Important Additional

Information about the Proposed Merger

This communication is being made in respect of the proposed merger involving OncoGenex

Pharmaceuticals, Inc. and Achieve Life Science, Inc. OncoGenex intends to file a registration statement on Form S-4 with the SEC, which will contain a joint proxy statement/prospectus and other relevant materials, and plans to

file with the SEC other documents regarding the proposed transaction. The final joint proxy statement/prospectus will be sent to the stockholders of OncoGenex and Achieve. The joint proxy statement/prospectus will contain information about

OncoGenex, Achieve, the proposed merger and related matters.

STOCKHOLDERS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS) AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY WHEN

THEY BECOME AVAILABLE, AS THEY WILL CONTAIN IMPORTANT INFORMATION THAT STOCKHOLDERS SHOULD CONSIDER BEFORE MAKING A DECISION ABOUT THE MERGER AND RELATED MATTERS.

In addition to receiving the joint proxy statement/prospectus and proxy card

by mail, stockholders will also be able to obtain the joint proxy statement/prospectus, as well as other filings containing information about OncoGenex, without charge, from the SEC’s website (http://www.sec.gov) or, without charge,

by directing a written request to: OncoGenex Pharmaceuticals, Inc., 19820 North Creek Parkway, Suite 201,Bothell, WA 98011, Attention: Investor Relations or to Achieve Life Science, Inc., 30 Sunnyside Avenue, Mill

Valley, CA 94941, Attention: Rick Stewart.

This communication shall not constitute an offer to sell or the solicitation of an offer

to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws

of any such jurisdiction. No offering of securities in connection with the proposed merger shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Participants in Solicitation

OncoGenex and its executive officers and directors may be deemed to be participants in the solicitation of proxies from OncoGenex’s stockholders with

respect to the matters relating to the proposed merger. Achieve and its officers and directors may also be deemed a participant in such solicitation. Information regarding OncoGenex’s executive officers and directors is available in

OncoGenex’s proxy statement on Schedule 14A, filed with the SEC on April 21, 2016. Information regarding any interest that OncoGenex, Achieve or any of the executive officers or directors of OncoGenex or Achieve may have in the

transaction with Achieve will be set forth in the joint proxy statement/prospectus that OncoGenex intends to file with the SEC in connection with its stockholder vote on matters relating to the proposed merger. Stockholders will be able to

obtain this information by reading the joint proxy statement/prospectus when it becomes available.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ONCOGENEX PHARMACEUTICALS, INC.

|

|

|

|

|

|

|

Date:

February 23, 2017

|

|

|

|

|

|

/s/ John Bencich

|

|

|

|

|

|

|

|

John Bencich

|

|

|

|

|

|

|

|

Chief Financial Officer

|

EXHIBIT INDEX

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

99.1

|

|

Press release of OncoGenex Pharmaceuticals, Inc. dated February 23, 2017

|

Exhibit 99.1

OncoGenex Pharmaceuticals, Inc. Reports Financial Results for Year End 2016

BOTHELL, WA, and VANCOUVER, British Columbia, Feb. 23, 2017

– OncoGenex Pharmaceuticals, Inc. (NASDAQ: OGXI) today announced its year end 2016

financial results.

Recent Events

|

|

•

|

|

In January 2017, OncoGenex, and Achieve Life Science, Inc., a privately held specialty pharmaceutical company, announced that they have entered into a definitive merger agreement under which OncoGenex will acquire

Achieve in an all-stock transaction. Upon completion of the proposed merger, Achieve’s stockholders are expected to own 75% of the combined company’s outstanding shares and current equityholders of OncoGenex are expected to own the

remaining 25% of the combined company’s outstanding shares. Following completion of the merger, OncoGenex Pharmaceuticals, Inc. will be renamed Achieve Life Sciences, Inc. The proposed merger is expected to close by

mid-2017, subject to customary closing conditions.

|

|

|

•

|

|

In October 2016, the company announced positive survival results from the final analysis of the Phase 2 Borealis-2™ trial of apatorsen in combination with docetaxel treatment that enrolled 200 patients with

metastatic bladder cancer whose disease had progressed following first-line platinum-based chemotherapy. Patients who received apatorsen treatment experienced a 20% reduction in risk of death, compared to patients receiving docetaxel alone.

|

|

|

•

|

|

In February 2017, results from the Pacific Trial were presented at the American Society of Clinical Oncology 2017 Genitourinary Cancers Symposium. The trial randomized 72 patients who were experiencing a rising PSA

while receiving Zytiga

®

(abiraterone acetate ). Apatorsen was well tolerated in combination with Zytiga with the median treatment duration of 106 days for apatorsen plus Zytiga compared to 75

days for continuing Zytiga alone. The proportion of patients who were progression free at Day 60 was 33% when apatorsen was added to Zytiga, compared to 17% with Zytiga alone.

|

|

|

•

|

|

OncoGenex discontinued the development of its custirsen and OGX-225 programs and is currently seeking a collaboration partnership to further develop apatorsen.

|

Financial Results

As of December 31, 2016, the

company’s cash, cash equivalents, and short-term investments decreased to $25.5 million from $55.2 million as of December 31, 2015. Based on current expectations, OncoGenex believes that its cash, cash equivalents, and short-term

investments will be sufficient to fund its currently planned operations for at least the next 12 months.

Revenue for the fourth quarter and year ended

December 31, 2016 was zero and $5.1 million, respectively. The advanced reimbursement payment made by Teva, as part of the Termination Agreement, was deferred and recognized as collaboration revenue on a dollar for dollar basis as costs were

incurred as part of the continuing research and development activities related to custirsen. The decrease in collaboration revenue in 2016 as compared to 2015 was due to the full recognition of the remaining amounts of deferred revenue in the first

half of 2016.

Total operating expenses for the fourth quarter and year ended December 31, 2016 were $6.0 million and $26.3

million, respectively. Net loss for the fourth quarter and year ended December 31, 2016 was $5.8 million and $20.1 million, respectively.

As of Feb

23, 2017 OncoGenex had 30,086,106 shares outstanding.

Important Additional Information about the Proposed Merger

This communication is being made in respect of the proposed merger involving OncoGenex Pharmaceuticals, Inc. and Achieve Life Science,

Inc. OncoGenex intends to file a registration statement on Form S-4 with the SEC, which will contain a joint proxy statement/prospectus and other relevant materials, and plans to file with the SEC other documents regarding the

proposed transaction. The final joint proxy statement/prospectus will be sent to the stockholders of OncoGenex and Achieve. The joint proxy statement/prospectus will contain information about OncoGenex, Achieve, the proposed merger and related

matters.

STOCKHOLDERS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS) AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE, AS THEY WILL CONTAIN IMPORTANT

INFORMATION THAT STOCKHOLDERS SHOULD CONSIDER BEFORE MAKING A DECISION ABOUT THE MERGER AND RELATED MATTERS.

In addition to receiving the joint proxy statement/prospectus and proxy card by mail, stockholders will also be able to obtain the

joint proxy statement/prospectus, as well as other filings containing information about OncoGenex, without charge, from the SEC’s website (

http://www.sec.gov

) or, without charge, by directing a written request

to: OncoGenex Pharmaceuticals, Inc., 19820 North Creek Parkway, Suite 201,Bothell, WA 98011, Attention: Investor Relations or to Achieve Life Science, Inc., 30 Sunnyside Avenue, Mill Valley, CA 94941,

Attention: Rick Stewart.

This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the

solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such

jurisdiction. No offering of securities in connection with the proposed merger shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Participants in Solicitation

OncoGenex and its executive

officers and directors may be deemed to be participants in the solicitation of proxies from OncoGenex’s stockholders with respect to the matters relating to the proposed merger. Achieve and its officers and directors may also be deemed a

participant in such solicitation. Information regarding OncoGenex’s executive officers and directors is available in OncoGenex’s proxy statement on Schedule 14A, filed with the SEC on April 21, 2016. Information regarding

any interest that OncoGenex, Achieve or any of the executive officers or directors of OncoGenex or Achieve may have in the transaction with Achieve will be set forth in the joint proxy statement/prospectus that OncoGenex intends to file with

the SEC in connection with its stockholder vote on matters relating to the proposed merger. Stockholders will be able to obtain this information by reading the joint proxy statement/prospectus when it becomes available.

About OncoGenex and Apatorsen

OncoGenex is a

biopharmaceutical company committed to the development and commercialization of new therapies that address treatment resistance in cancer patients. The company’s product candidate, apatorsen (OGX-427), is designed to inhibit production of

Hsp27, disable cancer cells’ defenses and

overcome treatment resistance. Hsp27 is an intracellular protein that protects cancer cells by helping them survive, leading to resistance and more aggressive cancer phenotypes. Both the

potential single-agent activity and synergistic activity of apatorsen with cancer treatments may increase the overall benefit of existing therapies and augment the durability of treatment outcomes, which could lead to increased patient survival.

More information is available at www.OncoGenex.com and at the company’s Twitter account: https://twitter.com/OncoGenex_IR.

OncoGenex’ Forward Looking Statements

This press

release contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements regarding the terms, timing, conditions to

and anticipated completion of the proposed merger with Achieve Life Science; the expected ownership of the combined company; the potential benefits and potential development of apatorsen; and the adequacy of cash reserves. All statements other than

statements of historical fact are statements that could be deemed forward-looking statements. OncoGenex and/or Achieve may not actually achieve the proposed merger, or any plans or product development goals in a timely manner, if at all, or

otherwise carry out the intentions or meet the expectations or projections disclosed in these forward-looking statements. These statements are based on management’s current expectations and beliefs and are subject to a number of risks,

uncertainties and assumptions that could cause actual results to differ materially from those described in the forward-looking statements, including, among others, the failure of the OncoGenex or Achieve stockholders to approve the transaction; the

failure of either party to meet the closing conditions of the transaction; delays in completing the transaction and the risk that the transaction may not be completed at all; the failure to realize the anticipated benefits from the transaction or

delay in realization thereof; the success of the combined businesses; operating costs and business disruption during the pendency of and following the proposed merger; the risk that apatorsen will not receive regulatory approval or be successfully

commercialized; the risk that new developments in the rapidly evolving cancer therapy landscape require changes in business strategy or clinical development plans; the risk that apatorsen may not demonstrate the hypothesized or expected benefits;

general business and economic conditions; and the other factors described in our risk factors set forth in OncoGenex’s filings with the Securities and Exchange Commission from time to time, including its Annual Report on Form 10-K and

Quarterly Reports on Form 10-Q. OncoGenex undertakes no obligation to update the forward-looking statements contained herein or to reflect events or circumstances occurring after the date hereof, other than as may be required by applicable law.

Borealis-2™ is a registered trademark of OncoGenex Pharmaceuticals, Inc.

OncoGenex Contact:

Jim DeNike

jdenike@oncogenex.com

(425) 686-1514

Consolidated Statements of Loss

(In thousands, except per share and share data)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended

December 31

|

|

|

Twelve months ended

December 31,

|

|

|

|

|

2016

|

|

|

2015

|

|

|

2016

|

|

|

2015

|

|

|

Collaboration revenue

|

|

$

|

—

|

|

|

$

|

6,024

|

|

|

$

|

5,062

|

|

|

$

|

18,160

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

|

1,702

|

|

|

|

6,587

|

|

|

|

14,788

|

|

|

|

25,108

|

|

|

General and administrative

|

|

|

2,295

|

|

|

|

2,915

|

|

|

|

8,933

|

|

|

|

11,805

|

|

|

Restructuring costs (recovery)

|

|

|

1,814

|

|

|

|

—

|

|

|

|

2,206

|

|

|

|

—

|

|

|

Recovery of lease termination loss

|

|

|

—

|

|

|

|

—

|

|

|

|

(1,250

|

)

|

|

|

—

|

|

|

Litigation settlement

|

|

|

—

|

|

|

|

—

|

|

|

|

1,375

|

|

|

|

—

|

|

|

Asset impairment charge

|

|

|

202

|

|

|

|

—

|

|

|

|

202

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses

|

|

|

6,013

|

|

|

|

9,502

|

|

|

|

26,254

|

|

|

|

36,913

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations

|

|

|

(6,013

|

)

|

|

|

(3,478

|

)

|

|

|

(21,192

|

)

|

|

|

(18,753

|

)

|

|

Other income (expense)

|

|

|

170

|

|

|

|

1,756

|

|

|

|

1,063

|

|

|

|

1,952

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(5,843

|

)

|

|

$

|

(1,722

|

)

|

|

$

|

(20,129

|

)

|

|

$

|

(16,801

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted net loss per share

|

|

$

|

(0.19

|

)

|

|

$

|

0.06

|

|

|

$

|

(0.67

|

)

|

|

$

|

(0.64

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of basic and diluted common shares

|

|

|

30,021,544

|

|

|

|

29,804,655

|

|

|

|

29,949,432

|

|

|

|

26,147,344

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Balance Sheets

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31,

2016

|

|

|

December 31,

2015

|

|

|

Assets:

|

|

|

|

|

|

|

|

|

|

Cash, cash equivalents, short term investments and restricted cash

|

|

$

|

25,735

|

|

|

$

|

55,458

|

|

|

Interest receivable

|

|

|

32

|

|

|

|

111

|

|

|

Amounts receivable

|

|

|

478

|

|

|

|

14

|

|

|

Prepaid expenses and other current assets

|

|

|

954

|

|

|

|

1,987

|

|

|

Property, equipment and other assets

|

|

|

271

|

|

|

|

639

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

$

|

27,470

|

|

|

$

|

58,209

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities

|

|

$

|

8,166

|

|

|

$

|

13,217

|

|

|

Current portion of long-term obligations

|

|

|

57

|

|

|

|

52

|

|

|

Warrant liability

|

|

|

232

|

|

|

|

1,105

|

|

|

Lease termination liability

|

|

|

—

|

|

|

|

1,250

|

|

|

Deferred collaboration revenue

|

|

|

—

|

|

|

|

5,040

|

|

|

Long term liabilities

|

|

|

49

|

|

|

|

105

|

|

|

Stockholders’ equity

|

|

|

18,966

|

|

|

|

37,440

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders’ equity

|

|

$

|

27,470

|

|

|

$

|

58,209

|

|

|

|

|

|

|

|

|

|

|

|

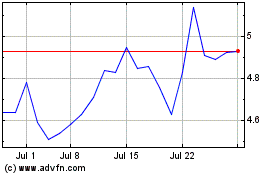

Achieve Life Sciences (NASDAQ:ACHV)

Historical Stock Chart

From Mar 2024 to Apr 2024

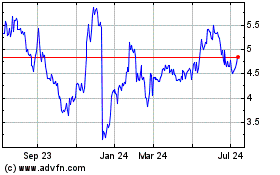

Achieve Life Sciences (NASDAQ:ACHV)

Historical Stock Chart

From Apr 2023 to Apr 2024