Energy Future Wins Chapter 11 Plan Confirmation -- Update

February 17 2017 - 11:54AM

Dow Jones News

By Peg Brickley and Jonathan Randles

NextEra Energy Inc.'s planned acquisition of one of the

country's largest electricity transmissions businesses, Oncor,

moved to the next phase Friday, when a judge said he would confirm

the bankruptcy-exit plan of Oncor owner Energy Future Holdings

Corp.

Confirmation sets the stage for hearings before the Public

Utility Commission of Texas, which must approve the acquisition of

Oncor, a critical element of the state's power system, by NextEra,

a Florida company.

Judge Christopher Sontchi's confirmation ruling is the second

for an Energy Future bankruptcy-exit plan. An earlier chapter 11

plan built around the planned sale of Oncor to a group of investors

led by Hunt Consolidated Inc. was confirmed last year, but the deal

fell apart after Texas regulators put conditions on the

transaction.

NextEra will pay $4.4 billion in cash and stock, plus pay off

$5.4 billion in financing that helped Energy Future through

bankruptcy, to gain control of Oncor, which carries power to some

10 million Texans.

Energy Future, the former TXU Corp., filed for chapter 11

protection in April 2014 with $42 billion in debt. Most of the debt

was resolved when Energy Future's electricity generating and

retailing businesses exited bankruptcy last year as a new company

called Vistra Energy.

Parent company Energy Future remained in bankruptcy, with an 80%

stake in Oncor as its principal asset. NextEra had been trying to

buy Oncor since 2014. Two years later, NextEra was declared the

winner of a bidding contest that revived after the Hunt deal was

scrapped.

In the months leading up to Friday's confirmation ruling, Energy

Future's chapter 11 proceeding was rocked by a decision from a

federal appeals court in Philadelphia. Handed down in November, the

ruling marked a loss for Energy Future after years of wins in an

$800 million battle with lenders.

At issue was whether Energy Future was bound to pay lenders

"make-whole" premiums on debt that was refinanced early in the

bankruptcy proceeding. Make-whole provisions are common in

sophisticated debt deals, meant to protect lenders from losing

expected profits if a borrower pays off a loan early. Energy Future

said its bankruptcy excused it from making the payment and, for a

time, the courts agreed.

The appellate ruling shifted much of the value from the NextEra

deal into the pockets of senior lenders, upsetting junior creditors

and roiling the dynamics of the big chapter 11 case.

Talks ensued, and by the time Energy Future launched

confirmation hearings Tuesday in the U.S. Bankruptcy Court in

Wilmington, Del., agreements were in the works to settle the

make-whole trouble.

Confirmation came over the protests of lawyers for people

claiming asbestos injuries they say are attributable to Energy

Future affiliates. NextEra has set aside $100 million to pay

asbestos personal injury claims that were filed in Energy Future's

chapter 11 proceeding.

The problem, according to asbestos lawyers, is that Energy

Future's chapter 11 plan cut off the legal rights of people who

have no way to know they have grounds for personal injury claims.

The lung diseases that come from asbestos can take decades to

develop. So people exposed to asbestos while on the job for Energy

Future could become ill in a year or five or 10, and find their

right to sue has been barred because they hadn't filed a claim in

Energy Future's bankruptcy, lawyers said.

Judge Sontchi found Energy Future handled its asbestos problems

fairly, and overruled the objection from the asbestos claimants. He

said there was "clear evidence" that the reorganization plan was

developed in good faith and doesn't preclude future asbestos

claimants from seeking remedy later.

"This plan is not designed to avoid asbestos liabilities," Judge

Sontchi said.

Bankruptcy was popular among companies like chemical maker W.R.

Grace & Co. and building material manufacturer Owens Corning

Inc., which faced daunting liability for asbestos damages. Energy

Future's asbestos liabilities grew out of discontinued operations.

The company never made or sold asbestos products.

Energy Future's financial struggles grew out of diving energy

prices, which rendered the load of debt taken on in a leveraged

buyout unsupportable.

Write to Peg Brickley at peg.brickley@wsj.com and Jonathan

Randles at Jonathan.Randles@wsj.com

(END) Dow Jones Newswires

February 17, 2017 11:39 ET (16:39 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

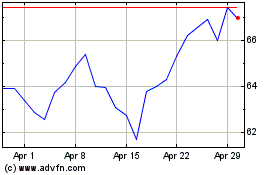

Nextera Energy (NYSE:NEE)

Historical Stock Chart

From Aug 2024 to Sep 2024

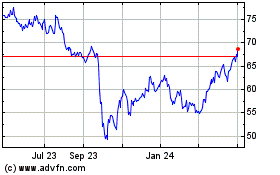

Nextera Energy (NYSE:NEE)

Historical Stock Chart

From Sep 2023 to Sep 2024