PepsiCo Stock Loses Its Fizz -- Ahead of the Tape

February 14 2017 - 3:46PM

Dow Jones News

By Steven Russolillo

The cola wars have turned from a stalemate to a rout

recently.

Over the past five years, PepsiCo shares have beaten those of

Coca-Cola Co. by 50 percentage points. By diversifying its

business, the snack-and-beverage giant's sales and volumes have

risen along with 15 consecutive quarters of profit margin

expansion. Last year, PepsiCo even successfully fended off activist

investor Nelson Peltz , who called for a breakup of the

company.

PepsiCo is set to report fourth-quarter earnings on Wednesday

and the numbers should be just fine. Analysts surveyed by FactSet

expect earnings of $1.16 a share, up 9.4% from a year earlier.

PepsiCo has exceeded expectations every quarter over at least the

past five years. Revenue is forecast to have increased 4.9% to

$19.5 billion, accelerating for the first time in nine

quarters.

Are the stock's best days behind it, though? PepsiCo shares hit

a record over the summer, right as investors' thirst for yield was

peaking, but have struggled ever since. The stock is down since the

November presidential election, underperforming the S&P 500 by

11 percentage points as the market has raced to records.

While PepsiCo's profitability has been boosted by cost cuts and

price increases, the fact remains that it still gets almost half of

its revenue from outside the U.S. That includes countries with weak

currencies, such as Mexico, Russia, the U.K. and Brazil.

PepsiCo's international exposure, particularly in today's

political environment, makes it more vulnerable to earnings

turbulence than domestically focused peers. Mexico and Russia are

two of PepsiCo's biggest revenue drivers outside of the U.S. In

2015, they represented 10% of the company's sales, down from 15% in

2011.

Even rival Dr Pepper Snapple Group Inc., which is more

domestically oriented than PepsiCo and Coke, warned Tuesday that

its profit this year would be pressured by the weak Mexican peso.

Dr Pepper Snapple gets roughly 8% of its sales from Mexico and the

Caribbean, according to its most recent annual report.

Meanwhile, PepsiCo's focus on waistlines has been less stellar

than its bottom line, creating some risks. Chief Executive Indra

Nooyi has stated she wants the maker of Lay's potato chips, Fritos

and Cheetos to be a truly health-conscious company, but PepsiCo is

learning consumers remain infatuated with chips.

The company has fallen behind a prior target of tripling revenue

from nutritious products to $30 billion this decade. PepsiCo's

products have added more sugars, despite threats from many

countries to tax or curb sugar consumption. In October the company

reframed its health target, saying it hopes sales growth of its

nutritious products "will outpace" the rest of its portfolio by

2025.

All of this comes as PepsiCo shares trade at a rather bubbly 20

times projected earnings over the next 12 months, near the 12-year

high it hit over the summer and about one-fifth above its average

over the past decade. Switching cola brands might not be the

answer, either, as Coke's multiple is even richer.

Leave them both on the shelf.

(END) Dow Jones Newswires

February 14, 2017 15:31 ET (20:31 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

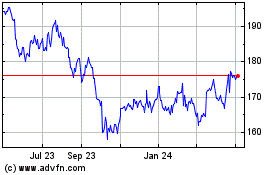

PepsiCo (NASDAQ:PEP)

Historical Stock Chart

From Mar 2024 to Apr 2024

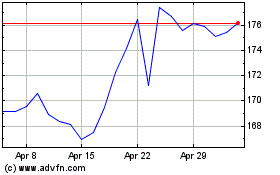

PepsiCo (NASDAQ:PEP)

Historical Stock Chart

From Apr 2023 to Apr 2024