SAS to Move Some Operations to Lower-Cost Countries; Wizz Air Cuts Profit Outlook

February 01 2017 - 5:36AM

Dow Jones News

By Robert Wall

LONDON--European airlines' intense price war is driving SAS AB

(SAS.SK) to move some operations to lower-cost countries and forced

Wizz Air Holdings PLC (WIZZ.LN) to cut its profit outlook

Wednesday.

SAS, a Scandinavian carrier that principally serves Sweden,

Norway and Denmark said Wednesday it would seek an Irish operating

license and set up bases in London and Spain to lower costs. The

airline would hire crew locally, with more flexible and less costly

labor contracts, to reduce its 20% to 25% cost-disadvantage over

some rivals, an airline spokesman said. No layoffs in Scandinavia

are planned.

The airline would base a small number of its Airbus SE A320neo

single-aisle planes in the new locations to fly European routes.

They would operate existing flights to Scandinavia and eventually

grow.

"The establishment of new bases means we can complement our

Scandinavian production and, in time, build an even broader network

with a superior schedule to the benefit of our customers," SAS

Chief Executive Officer Rickard Gustafson said.

The slump in oil prices that began mid-2014 led airlines to

boost capacity and cut ticket prices to lure passengers. Per-seat

revenue at some of Europe's main airlines has tumbled, even as

passenger numbers have risen. Pressure on ticket prices intensified

when terrorist attacks in Europe spooked travelers, forcing

airlines to offer discounts to fill planes.

SAS shares rose 4.6% Wednesday.

SAS's London base should be operational in 2017, with the

Spanish bases to follow in 2018. The airline said setting up the

additional license and overseas operations would incur unspecified

start-up costs.

SAS has been struggling amid fierce competition from lower-cost

rivals including Ryanair Holdings PLC, Europe's No. 1 carrier by

passenger numbers, and local rival Norwegian Air Shuttle ASA.

However, the fare war is also weighing on budget airlines. Wizz

Air, one of Europe's most rapidly expanding airlines, lowered its

full-year profit forecast Wednesday by 20 million euros ($21.5

million) to a range of EUR225 million to EUR235 million.

Half of the cut was linked to yield pressure, CEO Jozsef Varadi

said, with rebounding fuel costs and weather-induced cancellations

impacting earnings for the full-year ending March 31 by another

EUR10 million.

Mr. Varadi said the pressure on prices was expected to persist

through the summer before moderating next winter.

Shares in Wizz Air were down 8.3% in mid-morning London

trading.

EasyJet PLC, Europe's No. 2 discount carrier by passengers,

warned in January of earnings headwinds linked to competitive

pressure, fuel and sterling weakness after the June Brexit vote.

CEO Carolyn McCall said at the time she expected fare weakness to

persist throughout 2017 and that the airline would review its

capacity growth plans.

-Write to Robert Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

February 01, 2017 05:21 ET (10:21 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

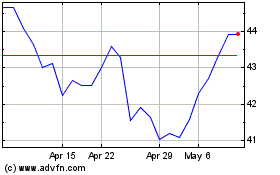

Airbus (PK) (USOTC:EADSY)

Historical Stock Chart

From Mar 2024 to Apr 2024

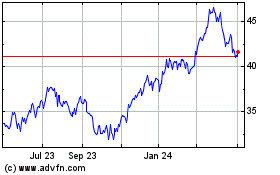

Airbus (PK) (USOTC:EADSY)

Historical Stock Chart

From Apr 2023 to Apr 2024