Las Vegas Sands Results Miss Wall Street Targets -- Update

January 25 2017 - 9:50PM

Dow Jones News

By Maria Armental

Casino mogul Sheldon Adelson's Las Vegas Sands Corp. reported a

second straight quarter of higher revenue, though a slowdown in

Macau drove down profit and revenue for the year.

Shares, up 45% over the past 12 months, fell 4% to $54.30 in

after-hours trading as results missed Wall Street targets.

Macau, considered the world's gambling capital, accounts for the

bulk of Las Vegas Sands' business -- and its falling fortunes last

year.

A corruption crackdown and weakening economy on the mainland cut

into business in the semiautonomous city, the only place in China

where casinos are legal. Gambling revenue fell for 26 consecutive

months before starting to rebound over the last five months of

2016, according to government figures, although low-stakes "mass

gamblers" now account for a larger portion of gamblers.

Las Vegas Sands' Cotai Strip properties in Macau, for example,

saw a 16% expansion in the mass gaming segment in the most recent

period, driven by the first full quarter of the Parisian Macao and

leading to the company's strongest growth in the segment since the

second quarter of 2014, Mr. Adelson said in a conference call with

analysts.

Company executives say they have hopes for The Parisian, with a

series of upgrades coming this year.

"It's a $400 million plus run rate," Chief Operating Officer

Robert Goldstein said during the call, adding, "It should do a lot

better, once it beats a few more customers.

Over all, fourth-quarter profit rose 9% to $509 million, or 64

cents a share. Excluding certain items, profit was roughly flat

from the year earlier at 62 cents a share.

Revenue, excluding promotional allowances, rose 7% to $3.08

billion.

Analysts surveyed by Thomson Reuters had projected adjusted

profit of 66 cents on $3.11 billion in revenue.

For the year, profit fell 15% to $1.67 billion while revenue

fell 2% to $11.41 billion.

Following the quarter's end, the casino operator reached a

settlement agreement with the Justice Department under which it

paid $6.96 million and entered into a nonprosecution agreement to

resolve a criminal matter over improper financial dealings in

China. Last year, Las Vegas Sands paid $9 million and hired an

independent monitor to resolve a related civil matter with the

Securities and Exchange Commission.

Meanwhile, Mr. Adelson said the company is preparing to sell a

49% interest in Singapore's The Shoppes at Marina Bay Sands as

restrictions in the development agreement lift and intends to keep

the cash on hand, rather than bringing it back to the U.S., citing

"noises coming out of Korea" now that Japan has shown its hand.

Mr. Adelson said they are looking at a sales price of $3 billion

to $3.5 billion, short of the $4 billion-range that Mr. Adelson

said he'd preferred.

The 83-year-old casino mogul said they are also keeping an eye

on Japan, one of the world's largest gambling nations, as the

country moves to legalize casinos.

"I'm optimistic, and people tell us we are in the pole position

in terms of getting the concessions," Mr. Adelson told analysts on

Wednesday.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

January 25, 2017 21:35 ET (02:35 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

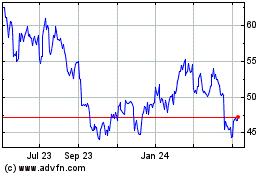

Las Vegas Sands (NYSE:LVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

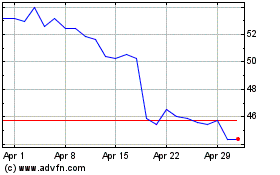

Las Vegas Sands (NYSE:LVS)

Historical Stock Chart

From Apr 2023 to Apr 2024