Dow Crosses 20K for First Time Intraday

January 25 2017 - 10:03AM

Dow Jones News

By Riva Gold

The Dow Jones Industrial Average hit 20000 for the first time,

the latest milestone in the U.S. stock market's postelection

rally.

The Dow industrials have surged since Election Day, buoyed by

investors' bets that the administration of Donald Trump will pursue

policies such as tax cuts, regulatory rollbacks and infrastructure

spending that could improve the outlook for U.S. companies. The

index has risen roughly 8.6% since Nov. 8, notching several highs,

and closed above 19000 for the first time ever Nov. 22.

(Please follow our live coverage here.)

The Dow industrials gained 118 points, or 0.6%, to 20031 shortly

after the opening bell. The S&P 500 gained 0.4%, and the Nasdaq

Composite rose 0.6%.

Boeing was the best performer in the blue-chip index, up 2%,

after beating expectations for earnings in the final quarter of the

year.

Elsewhere, shares of Seagate Technology added 17% after revenue

slid less than expected.

Haven assets were under pressure, with gold down 1.2% at

$1,196.90 an ounce and government bond yields close to their

highest this year.

Overseas, the Stoxx Europe 600 advanced 1.3% while Japanese

shares added 1.4% as a climb of more than 100 points in the Dow and

record finishes for the S&P and Nasdaq Composite on Tuesday

rippled through Europe and Asia.

Mining and manufacturing companies led the charge on Wall Street

Tuesday in a move some traders and analysts attributed to President

Donald Trump's plans to boost infrastructure projects. Mr. Trump

took steps to revive two oil pipeline projects and issued

directives that aim to ease regulations on infrastructure

developments and U.S. manufacturing.

"We're guardedly optimistic," said Michael Thompson, managing

director at S&P Global Market Intelligence. "The U.S. was

inexorably poised to move out of this kind of this slow growth

trajectory, and some of the policy changes are certainly going to

facilitate that, as long as the worst pitfalls are avoided."

He said he would watch any news on border-adjustment measures

carefully in the coming days.

In Europe, banks and financials were the best performers as bond

yields recovered and corporate earnings proved supportive. Shares

of Banco Santander gained 4.2% after the Spanish lender kicked off

Europe's bank earnings season with a bigger-than-expected rise in

fourth-quarter profit.

European bank shares have gained roughly 17% in the past three

months after a steep fall last summer. "The recovery in their stock

prices has probably been correct, but it's difficult to see how it

can go further," said Edward Smith, asset allocation strategist at

Rathbones.

"There are still problems in the recapitalization of Italian

banks, exposure to Italian and Eastern European loans, and yield

curves that are unlikely to steepen much more in Europe," he

said.

Europe's auto and construction and materials sectors also rose

sharply Wednesday, while the basic resources sector wobbled between

small gains and losses after closing at its highest since 2014.

In government bonds, the 10-year German bund yield rose to

0.384% Wednesday from 0.325%. A top European Central Bank official

said Tuesday the bank should start to wind down its massive

bond-purchase program soon.

"I am...optimistic that we can soon turn to the question of an

exit" from easy-money policies, said Sabine Lautenschläger, who

sits on the ECB's executive board.

Germany's Ifo business sentiment index separately came in below

forecasts, dropping unexpectedly at the start of the year.

The yield on the 10-year U.S. Treasury note edged up to 2.479%

from 2.471% after its biggest daily gain of 2017, while Japanese

government bonds came under selling pressure at 0.065%.

Chinese government bond yields neared their highest levels since

2015 after the central bank unexpectedly raised interest rates on a

type of special loans to certain financial institutions.

In currencies, the WSJ Dollar Index fell 0.2%, with the dollar

last down 0.5% against the yen and the British pound.

The Mexican peso reversed early losses to gain 0.2% with Mr.

Trump expected to announce plans shortly to expedite construction

of a wall along the Mexican border.

Brent crude oil fell 0.9% to $54.94 a barrel, while copper

futures pulled back from a 19-month high.

--

Amy Harder

,

Shen Hong

, Katherine Dunn and Tom Fairless contributed to this

article.

Write to Riva Gold at riva.gold@wsj.com

(END) Dow Jones Newswires

January 25, 2017 09:48 ET (14:48 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

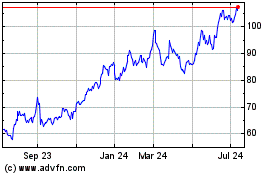

Seagate Technology (NASDAQ:STX)

Historical Stock Chart

From Aug 2024 to Sep 2024

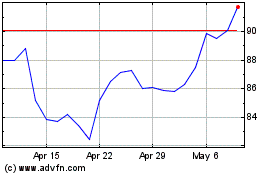

Seagate Technology (NASDAQ:STX)

Historical Stock Chart

From Sep 2023 to Sep 2024