Amended Tender Offer Statement by Issuer (sc To-i/a)

January 19 2017 - 5:21PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

(Rule 14d-100)

Tender Offer Statement under Section

14(d)(1) or 13(e)(1)

of the Securities Exchange Act of 1934

(Amendment No. 4)

VAPOR

CORP.

(Name of Subject Company (Issuer) and Name

of Filing Person (Issuer))

Series A Warrants

(Title of Class of Securities)

922099114

(CUSIP Number of Class of Securities)

Jeffrey Holman

Chief Executive Officer

Vapor Corp.

3800 North 28

th

Way

Hollywood, Florida 33020

(888) 766-5351

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications

on Behalf of Filing Persons)

With a copy to:

Martin T. Schrier

Ellen Canan Grady

Cozen O’Connor

Southeast Financial Center

200 South Biscayne Blvd., Suite 4410

Miami, Florida 33131

(305) 704-5940

CALCULATION OF FILING FEE

|

Transaction Valuation*

|

Amount of Filing Fee**

|

|

$7,097,673

|

$822.62

|

* Estimated solely for purposes of calculating the amount of

the filing fee, based on Vapor Corp. (the “

Company

”)’s purchase of up to 32,262,152 of the Company’s

outstanding Series A Warrants at the tender offer price of $0.22 in cash per Series A Warrant.

** The amount of the filing fee, calculated in accordance with

Rule 0-11 under the Exchange Act, equals $115.90 per $1,000,000 of the transaction value.

x

Check the box

if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously

paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

Amount Previously Paid:

$11,151.84

Form of Registration No.:

333-208481

Filing Party:

Vapor Corp.

Date Filed:

December 11, 2015

|

|

¨

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

|

Check the appropriate boxes below to designate

any transactions to which the statement relates:

|

|

¨

|

third-party tender offer subject to Rule 14d-1.

|

|

|

x

|

issuer tender offer subject to Rule 13e-4.

|

|

|

¨

|

going-private transaction subject to Rule 13e-3.

|

|

|

¨

|

amendment to Schedule 13D under Rule 13d-2.

|

Check the following box if the filing is a final amendment reporting

the results of the tender offer:

x

SCHEDULE TO

This Amendment No. 4 to the Tender Offer

Statement on Schedule TO filed on January 19, 2017 (this “

Amendment No. 4

”) amends and supplements the

Tender Offer Statement on Schedule TO originally filed by Vapor Corp., a Delaware corporation (“

Vapor

”

or the “

Company

”), with the Securities and Exchange Commission (the “

SEC

”)

on December 7, 2016, as amended and supplemented by Amendment No. 1 to the Tender Offer Statement on Schedule TO filed by the Company

on December 21, 2016, Amendment No. 2 to the Tender Offer Statement on Schedule TO filed by the Company on January 10, 2017, and

Amendment No. 3 to the Tender Offer Statement on Schedule TO filed by the Company on January 18, 2017 (as amended and supplemented

from time to time, the “

Schedule TO

”). The Schedule TO relates to the Company’s offer to all holders

of the Company’s outstanding Series A Warrants (the “

Series A Warrants

”), to purchase up to 32,262,152

in the aggregate Series A Warrants for $0.22 in cash per Series A Warrant, upon and subject to the terms and conditions set forth

in the Company’s Offer to Purchase, dated December 7, 2016 (the “

Offer to Purchase

”), and

in the related Letter of Transmittal (the “

Letter of Transmittal

”) (the Offer to Purchase and the Letter

of Transmittal, together, as amended or supplemented from time to time, constitute the “

Offer

”).

This Amendment No. 4 is the final amendment

to the Company’s Schedule TO and is being filed to report the final results of the Offer. This Amendment No. 4 to the Schedule

TO, as it amends and supplements the Schedule TO, is intended to satisfy the reporting requirements of Rule 13e-4(c)(4) under the

Securities Exchange Act of 1934, as amended (the “

Exchange Act

”). Only those items of the Schedule TO

set forth below in this Amendment No. 4 are amended or supplemented. Except as specifically provided herein, the information set

forth in the Schedule TO, the Offer to Purchase and the Related Letter of Transmittal remains unchanged. This Amendment No. 4 should

be read in conjunction with the Schedule TO, the Offer to Purchase and the related Letter of Transmittal, as amended or supplemented

and filed with the SEC. Capitalized terms used and not defined herein have the meanings assigned to such terms in the Offer to

Purchase.

Items 1 through 11.

Items 1 through 11 of the

Schedule TO are hereby amended and supplemented as follows:

The Offer expired at 5:00

p.m., Eastern time, on January 17, 2017. Based upon information provided by Equity Stock Transfer, LLC, the depositary for the

Offer, a total of 10,073,884 Series A Warrants were validly tendered and not withdrawn in the Offer. The Company accepted for purchase all of 10,073,884 Series A Warrants tendered, for a total purchase price of approximately $2.21 million.

The depositary will promptly issue payment for the Series A Warrants accepted for purchase in the tender offer.

On January 19, 2017, the

Company issued a press release announcing the final results of the Offer as set forth above. A copy of the press release is filed

as Exhibit (a)(5)(F) to the Schedule TO and incorporated herein by this reference.

Item 12. Exhibits.

Item 12 of the Schedule TO is hereby amended and supplemented

by adding the following exhibit to the exhibit index:

Exhibit

Number

|

|

Description

|

|

|

|

|

|

(a)(5)(F)

|

|

Press Release dated January 19, 2017, filed on January 19, 2017 as Exhibit 99.1 to our Current Report on Form 8-K and incorporated herein by reference.

|

SIGNATURE

After due inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

VAPOR CORP.

|

|

|

|

|

|

|

By:

|

/s/ Jeffrey Holman

|

|

|

|

Jeffrey Holman

|

|

|

|

Chief Executive Officer

|

|

|

|

|

|

|

Date: January 19, 2017

|

INDEX TO EXHIBITS

Exhibit

Number

|

|

Description

|

|

(a)(1)(A)*

|

|

Offer to Purchase dated December 7, 2016.

|

|

(a)(1)(B)*

|

|

Letter of Transmittal.

|

|

(a)(1)(C)*

|

|

Form of letter to brokers, dealers, commercial banks, trust companies and other nominees to their clients.

|

|

(a)(1)(D)*

|

|

Form of letter to be used by brokers, dealers, commercial banks, trust companies and other nominees for their clients.

|

|

(a)(5)(A)

|

|

Press Release dated December 6, 2016 filed on December 6, 2016 as Exhibit 99.1 to our Current Report on Form 8-K and incorporated herein by reference.

|

|

(a)(5)(B)

|

|

Press Release dated December 7, 2016 filed on December 7, 2016 as Exhibit 99.1 to our Current Report on Form 8-K and incorporated herein by reference.

|

|

(a)(5)(C)

|

|

Press Release dated December 21, 2016 filed on December 21, 2016 as Exhibit 99.1 to our Current Report on Form 8-K and incorporated herein by reference.

|

|

(a)(5)(D)

|

|

Press Release dated January 9, 2017 filed on January 10, 2017 as Exhibit 99.1 to our Current Report on Form 8-K and incorporated herein by reference.

|

|

(a)(5)(E)

|

|

Press Release dated January 18, 2017 filed on January 18, 2017 as Exhibit 99.1 to our Current Report on Form 8-K and incorporated herein by reference.

|

|

(a)(5)(F)

|

|

Press Release dated January 19, 2017 filed on January 19, 2017 as Exhibit 99.1 to our Current Report on Form 8-K and incorporated herein by reference.

|

|

(b)

|

|

Not applicable.

|

|

(d)(1)

|

|

Form of Series A Warrant filed on July 10, 2015 as an exhibit to our Registration Statement on Form S-1/A (File No. 333- 204599) and incorporated herein by reference.

|

|

(d)(2)

|

|

Specimen certificate evidencing shares of Common Stock filed on December 31, 2013 as an exhibit to our Current Report on Form 8-K dated December 31, 2013 and incorporated herein by reference.

|

|

(d)(3)*

|

|

Depositary Agreement by and between Vapor Corp. and Equity Stock Transfer, LLC

|

|

(g)

|

|

Not applicable

|

|

(h)

|

|

Not applicable.

|

* Previously filed.

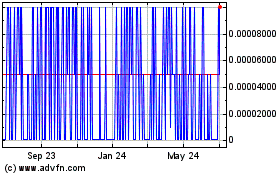

Healthier Choices Manage... (PK) (USOTC:HCMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

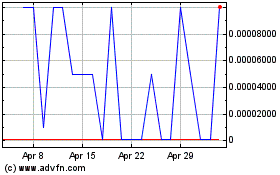

Healthier Choices Manage... (PK) (USOTC:HCMC)

Historical Stock Chart

From Apr 2023 to Apr 2024