Gabelli Global Small and Mid Cap Value Trust Declares Additional Distribution of $0.07 Per Share

December 20 2016 - 6:05PM

Business Wire

The Board of Trustees of The Gabelli Global Small and Mid Cap

Value Trust (NYSE:GGZ) (the “Fund”) declared an additional $0.07

per share cash distribution payable on January 6, 2017 to common

shareholders of record on December 30, 2016.

This distribution is being made to minimize any Federal excise

tax on undistributed investment company taxable income. The

distribution will be included in 2016 income for shareholders

subject to income tax. This raises the total distribution for the

year to $0.12 per share.

Based on the accounting records of the Fund currently available,

each of the distributions paid to common shareholders in 2016 would

include approximately 58% from net investment income and 42% from

net capital gains on a book basis. These percentages do not

represent information for tax reporting purposes. The estimated

components of each distribution are updated and provided to

shareholders of record in a notice accompanying the distribution

and are available on our website (www.gabelli.com). In addition,

certain U.S. shareholders who are individuals, estates, or trusts

and whose income exceeds certain thresholds will be required to pay

a 3.8% Medicare surcharge on their "net investment income," which

includes dividends received from the Fund and capital gains from

the sale or other disposition of shares of the Fund. The final

determination of the sources of all distributions in 2016 will be

made after year end and can vary from the above estimates.

Shareholders should not draw any conclusions about the Fund’s

investment performance from the amount of the current distribution.

All shareholders with taxable accounts will receive written

notification regarding the components and tax treatment for all

2016 distributions in early 2017 via Form 1099-DIV.

Investors should carefully consider the investment objectives,

risks, charges, and expenses of the Fund before investing. More

information regarding these and other information about the Fund is

available by calling 800-GABELLI (800-422-3554) or visiting

www.gabelli.com.

The Gabelli Global Small and Mid Cap Value Trust is a

diversified, closed-end management investment company with $128

million in total net assets whose primary investment objective is

to achieve long term capital growth of capital. Under normal market

conditions, the Fund will invest at least 80% of its total assets

in equity securities (such as common stock and preferred stock) of

companies with small or medium sized market capitalizations. The

Fund is managed by Gabelli Funds, LLC, a subsidiary of GAMCO

Investors, Inc. (NYSE:GBL).

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161220006113/en/

For The Gabelli Global Small and Mid Cap Value TrustCamillo

Schmidt-ChiariWayne C. Pinsent, CFA914-921-5070

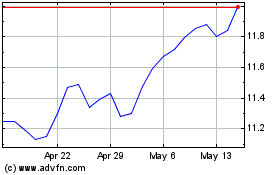

Gabelli Global Small and... (NYSE:GGZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

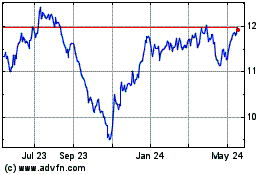

Gabelli Global Small and... (NYSE:GGZ)

Historical Stock Chart

From Apr 2023 to Apr 2024