Dow 20000: Nike Is Missing Out -- Ahead of the Tape

December 19 2016 - 3:20PM

Dow Jones News

By Steven Russolillo

In the Dow Jones Industrial Average's march to 20000, Nike Inc.

is conspicuously absent.

The retail giant is one of only two blue-chip stocks that are

down in 2016. And it is the worst performer, off 19% this year and

down by roughly one-quarter since peaking in November 2015. The

worry is that changing fashion trends and intensifying competition

are eating away at Nike's global dominance.

But the stock rarely stays this depressed for long. And after

several lackluster quarters, Wall Street has uncharacteristically

lowered the bar for Nike heading into Tuesday's earnings report,

possibly providing a rare buying opportunity for this

highflier.

Analysts expect fiscal second-quarter earnings of 43 cents a

share, an estimate that was as high as 52 cents over the summer.

The lowered consensus forecast is the first time in at least a year

that Nike analysts have cut their views prior to an earnings

report, according to FactSet.

The worries aren't without merit, of course. Rivals such as

Adidas AG, Under Armour Inc. and Lululemon Athletica Inc. continue

to encroach on Nike's turf. But Nike is no stranger to competition.

Its shares have had only six down years over the past three

decades. The only time that they ever dropped in consecutive years

was in 1983-84, when it was losing market share to then-upstart

Reebok.

Even then, the tough times didn't last long. Nike shares

accumulated six consecutive years of double-digit percentage growth

through the early 1990s. And overall, the stock has gained 15%

annually since its initial public offering 36 years ago, nearly

double the pace of the S&P 500.

For Nike to get back on the right foot, it must prove to

investors that it has a plan to fend off its rivals. A tweak to its

earnings release could offer it that chance. Tuesday's release will

mark the first time Nike won't report so-called futures orders in

its quarterly report.

The stock often traded on this metric as opposed to top- or

bottom-line growth. But Nike said future orders don't mean as much

as they once did because the company is selling more items directly

to consumers either through its retail outlets or online. Sure

enough, sales guidance in recent years has typically been a better

predictor of sales growth than future orders. Nike has said it

would still discuss futures orders on conference calls with

analysts and in regulatory filings.

Nike also has a compelling valuation on its side. It fetches 20

times projected earnings, its cheapest multiple since 2013.

Had Nike shares just been flat this year, the price-weighted Dow

would be about 80 points higher than it is now. Investors who "just

do it" might finally help spur the long-awaited Dow 20000

celebration.

(END) Dow Jones Newswires

December 19, 2016 15:05 ET (20:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

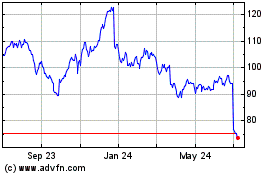

Nike (NYSE:NKE)

Historical Stock Chart

From Aug 2024 to Sep 2024

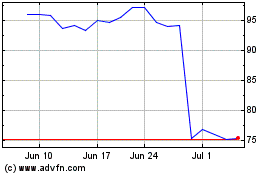

Nike (NYSE:NKE)

Historical Stock Chart

From Sep 2023 to Sep 2024