By Mike Esterl and Jennifer Maloney

After a rocky eight-year run atop the world's biggest beverage

company, Muhtar Kent will step down as chief executive of Coca-Cola

Co. and hand the task of reviving sales growth to his top

deputy.

James Quincey, a 20-year Coca-Cola veteran who was appointed to

the No. 2 job last year, will succeed Mr. Kent in May. Mr. Kent,

who recently turned 64, will remain chairman of the $180 billion

company, Coke said. The transition had been expected though the

timing was uncertain.

Mr. Quincey, 51, who was born in Britain and spent most of his

career outside the U.S., takes over at one of the most powerful

global brands as it struggles with a consumer shift away from

sugary sodas. Coke's revenue has declined in each of the past three

years. Despite a diversification push into juices, bottled waters

and other beverages, soda still represents about 70% of company

sales.

One of Mr. Quincey's biggest challenges will be the increasing

number of governments weighing special taxes on sugary drinks amid

rising obesity and diabetes. The U.K. plans to introduce a levy in

2018, and countries including South Africa and Indonesia are

mulling similar steps. In November, five U.S. municipalities,

including Chicago's Cook County and San Francisco, approved

sweetened-drink taxes.

"We'd like to go faster" in diversifying beyond core soda

offerings that include Fanta, Sprite and the namesake cola, Mr.

Quincey said Friday. Coke is expanding its selection of low-calorie

and zero-calorie beverages, he said, and played down the prospect

that it would expand beyond beverages, as rival PepsiCo Inc. has

done. He said he still sees plenty of growth opportunities in soda

and other nonalcoholic drinks.

Mr. Kent has tried to boost Coca-Cola's profits by divesting

manufacturing and distribution in the U.S. and elsewhere to focus

on its higher-margin concentrate business. Coke has made a handful

of acquisitions of juice and dairy companies; last year, it bought

a 17% stake in Monster Beverage Corp., a leading energy-drink

maker.

But many investors have soured on the company. Coke's share

price has gained 24% over the past five years, less than a third of

the gain in the S&P 500. The stock rose 2.5% Friday to $42.

Mr. Kent won praise early in his tenure for boosting growth and

stabilizing the U.S. market. Many credited the strong operational

know-how he developed after starting with Coke in 1978. As CEO, he

continued to focus on the smallest details, keeping a red paint

chip in his wallet to make sure Coke trucks, packaging and store

signs were Coke red.

He also helped expand Coke's presence in foreign markets. The

son of a Turkish diplomat, he speaks several languages and mingled

easily with business leaders and heads of state. He opened

factories in the former Soviet Union and ran a major Coke bottler

in Europe before becoming CEO in 2008.

Some company insiders and observers have questioned whether Mr.

Kent moved quickly enough to diversify Coke's soda-heavy portfolio.

Mr. Kent has long called the company's namesake cola its

"oxygen."

On Friday, Mr. Kent noted that the company has made big strides

in the past 30 years after relying on Coca-Cola for a century. Coke

has 20 brands with at least $1 billion each in retail sales,

including Simply fruit juices, Powerade sports drinks, Dasani

bottled water and Gold Peak tea.

"I've always felt like from the very top level, starting with

Muhtar, there has been tremendous support for what we are

building," said Seth Goldman, co-founder of Honest Tea, an organic

brand Coke acquired under Mr. Kent.

Mr. Kent's biggest move came in 2010, when Coke agreed to pay

$12 billion to acquire the U.S. bottling and distribution assets of

Coca-Cola Enterprises. The goal was to modernize the U.S. network

so it would crank out new products more quickly, but the overhaul

proved more difficult than expected.

Mr. Kent also unveiled a five-year, $3 billion cost-cutting plan

in late 2014 that included thousands of layoffs and the

introduction of zero-based budgeting, which requires managers to

justify all spending plans rather than roll some over from year to

year.

Under the "asset light"' strategy, Coke plans to cut bottling

operations that it owns to 3% of output by the end of 2017, down

from 18%. It has estimated that after the divestments, revenue will

drop to $28.5 billion compared with $44.3 billion in 2015, and that

staff will shrink to 39,000 from 123,000 over the same period. Coke

also expects its operating margin to jump to 34% from 23% as

capital-intensive factories, warehouses and trucks come off its

balance sheet.

On Friday, Mr. Quincey said he plans to focus on completing

Coke's efforts to divest bottling and distribution assets by the

end of next year. Mr. Quincey put his stamp on the company in May

2016, when Coke replaced the heads of its Asia and Africa

businesses with company veterans and close Quincey allies.

The CEO change comes after a Coke board meeting this week when

Howard Buffett, the oldest son of billionaire Warren Buffett,

chairman of Berkshire Hathaway Inc., Coke's largest shareholder,

said he would leave the board. The elder Mr. Buffett on Friday

praised Mr. Kent's leadership and the selection of Mr. Quincey as

successor.

The son of a biochemist, Mr. Quincey studied electronic

engineering at the University of Liverpool before becoming a

management consultant and then joining Coke in 1996. He has led

Coke's presence in both Europe and Latin America. The low-key

executive is popular in Coke's management ranks, with a reputation

of being a good listener and a calm problem solver. He often wears

jeans to work, unlike the more formal Mr. Kent.

"He combines many things. He's strong in operations. He has a

very good sense of marketing," Coca-Cola's chief marketing officer,

Marcos de Quinto, said at an industry conference in New York

Friday.

"We have a model that is very complex," he added. "You can be a

very smart person but if you really don't know how to manage this

system and the bottler partners, probably you will not

succeed."

On Friday, the incoming CEO said the company can't be afraid to

take risks. "The transformation plan that has been put in place

under Muhtar's leadership serves us well, and now we have to

accelerate it to the next level," he wrote in a blog post. "In

short: be bold, be brave."

--Austen Hufford contributed to this article.

Write to Mike Esterl at mike.esterl@wsj.com

(END) Dow Jones Newswires

December 10, 2016 02:47 ET (07:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

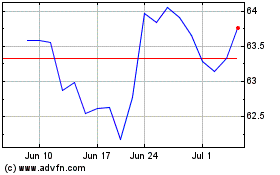

Coca Cola (NYSE:KO)

Historical Stock Chart

From Aug 2024 to Sep 2024

Coca Cola (NYSE:KO)

Historical Stock Chart

From Sep 2023 to Sep 2024