Current Report Filing (8-k)

December 05 2016 - 4:31PM

Edgar (US Regulatory)

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15 (D)

of

the

SECURITIES

EXCHANGE ACT OF 1934

Date of

Report (Date of earliest event reported): December 5,

2016

Arrayit Corporation

(Exact

name of registrant as specified in its charter)

NEVADA

(State

or other jurisdiction of incorporation or

organization)

|

33-119586

|

76-0600966

|

|

(Commission

File Number)

|

(IRS

Employer Identification Number)

|

927

Thompson Place

Sunnyvale,

CA 94085

(Address

of principal executive offices)

Rene A.

Schena

927

Thompson Place

Sunnyvale,

CA 94085

(Name

and address of agent for service)

408-744-1711

Check

the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

☐

Written

communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425)

☐

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

☐

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR 240.14d-2(b))

☐

Pre-commencement

communications pursuant to Rule 13e-4 (c) under the Exchange Act

(17 CFR 240.13e-4(c))

SECTION 1

–

REGISTRANT’S

BUSINESS AND OPERATIONS

Item 1.01 Entry into a Material Definitive Agreement

On October 25, 2016 with an effective date of October 21, 2016, the

Company and its subsidiaries as guarantors (collectively, the

“Credit Parties”) entered into a Second Amendment to

the Senior Secured Revolving Credit Facility Agreement by and

between TCA Global Credit Master Fund, LP, a Cayman Islands limited

partnership (the “Credit Agreement” and

“TCA,” respectively and effective December 18, 2015) as

amended by a First Amendment to the Credit Agreement on April 18,

2016, whereby the Company was approved for an additional $400,000

loan under the Credit Agreement (the “Additional

Advance”). The Second Replacement Revolving Note, in the

principal amount of $1,674,484 which aggregates all obligations due

and owing to the Lender by the Credit Parties, including the

Additional Advance as of October 21, 2016, has substantially the

same terms as the initial $750,000 and $250,000 loans. On October

25, 2016, the Company received $267,799 after (i) the escrowing of

$67,801 for payments to professionals and others in connection with

bringing the Company’s audited and unaudited financial

statements current; (ii) payment of $42,500 to accounting

professionals; (iii) payment of $20,500 in fees due TCA and its

professionals; (iv) miscellaneous payments of $1,400.

Item 2.03 Creation of a Direct Financial Obligation or an

Obligation under an Off-Balance Sheet Arrangement of a

Registrant.

See

discussion in Item 1.01.

Item

9.01 Financial Statements and Exhibits

Second Amendment to

Credit Agreement by and Among Arrayit Corporation as Borrower,

Telechem International, Inc. and Arrayit Scientific, Inc. as

Guarantors, and TCA Global Credit Master Fund, LP as Lender

effective October 21, 2016 and executed on October 25,

2016.

Second Replacement

Revolving Note ($400,000) between Arrayit Corporation, as Borrower

and TCA Global Credit Mater Fund as lender effective October 21,

2016 and executed on October 25, 2016.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

Arrayit

Corporation

|

|

|

|

|

|

|

|

Date

:

December 5, 2016

|

By:

|

/s/

Rene A.

Schena

|

|

|

|

|

Name:

Rene A.

Schena

|

|

|

|

|

Title:

Chief

Executive Officer

|

|

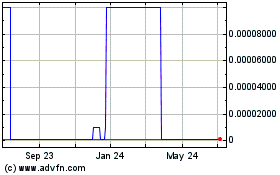

Arrayit (CE) (USOTC:ARYC)

Historical Stock Chart

From Mar 2024 to Apr 2024

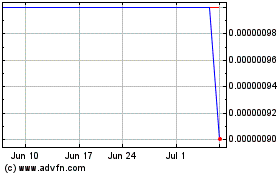

Arrayit (CE) (USOTC:ARYC)

Historical Stock Chart

From Apr 2023 to Apr 2024