Steven Cohen, SAC Reach $135 Million Insider-Trading Settlement

November 30 2016 - 9:10PM

Dow Jones News

Billionaire Steven A. Cohen and his former hedge fund SAC

Capital Advisors agreed to a $135 million class-action settlement

Wednesday, bringing legal costs tied to SAC-related insider-trading

cases close to $2 billion.

The new amount will be paid to investors in Elan Corp., now a

part of Perrigo Co. Elan played a part in a case involving a former

employee, Mathew Martoma, who was in 2014 sentenced to nine years

in prison for trading on inside tips in Elan and other stocks while

at SAC.

SAC agreed to plead guilty in 2013 to criminal-insider trading

charges, and paid $1.8 billion in penalties.

Mr. Cohen and SAC denied wrongdoing in the Elan class-action

case; they agreed to settle "solely to eliminate the uncertainty,

burden and expense of further protracted litigation," according to

a joint filing in U.S. District Court in New York.

Mr. Cohen now manages his multibillion-dollar family fortune at

Point72 Asset Management.

"We are pleased to have resolved this matter and close the books

on this chapter of SAC-era litigation," a Point72 spokesman said in

a statement.

Write to Rob Copeland at rob.copeland@wsj.com

(END) Dow Jones Newswires

November 30, 2016 20:55 ET (01:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

Perrigo Company Plc Irel... (NYSE:PRGO)

Historical Stock Chart

From Mar 2024 to Apr 2024

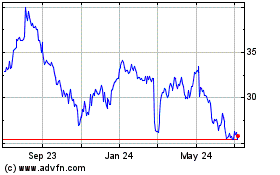

Perrigo Company Plc Irel... (NYSE:PRGO)

Historical Stock Chart

From Apr 2023 to Apr 2024