Insurers Hope Under Trump They are Deemed Less Important

November 12 2016 - 7:29AM

Dow Jones News

By Leslie Scism

Insurers are hoping in a Trump administration they will be

deemed less important, systemically, that is.

Three of the biggest insurers were designated as "systemically

important financial institutions," or SIFIs, in 2013 and 2014 by a

panel of federal regulators created under the 2010 Dodd-Frank

regulatory-overhaul law. Because of the designation, American

International Group Inc. and Prudential Financial Inc. face stiffer

regulation and capital cushions than peers, though final rules are

still being crafted.

MetLife Inc. was similarly tagged but went to court and won a

ruling in March rescinding the label on the basis of a flawed

designation process. The government is appealing.

A Trump presidency, industry experts and investors say, could

mean a friendlier regulatory environment. President-elect Donald

Trump told The Wall Street Journal on Friday he planned on

deregulating financial institutions. Mr. Trump's team, people

familiar with the matter said, is focused on rescinding certain

Dodd-Frank provisions Republicans find most objectionable, such as

the Financial Stability Oversight Council's authority to designate

large non-banks systemically important.

Since Tuesday's close, shares of MetLife have advanced 12%,

Prudential's are up 10% and AIG's have advanced 6.4%, while the

broader market is up 1.2%, according to FactSet.

MetLife Chief Executive Steven Kandarian briefly addressed the

election's impact at an investor event Thursday, saying it "may

result in a more constructive approach at the federal level."

In addition, some analysts think new conflict-of-interest

regulations issued in April by the Labor Department designed to

protect retirees' from unnecessarily expensive investment products

could also be pulled back. If so, that shift could benefit insurers

selling commission-based variable and indexed annuities.

More generally, insurers are already benefiting from upward

movement in the 10-year Treasury yield, which on Thursday reached

2.118%, up from 1.867% on Tuesday. The U.S. bond market was closed

Friday for Veterans Day. With higher rates, insurance firms earn

more on the bonds they buy with customers' premiums and hold until

paying future claims.

"Future capital market gyrations are obviously uncertain, but it

is difficult to challenge investors' initial read that a Trump

presidency is a major positive (might we say nirvana) to MET,"

Janney Montgomery Scott LLC analyst Larry Greenberg told clients in

a note.

He wrote further, on the government's appeal of the MetLife

decision, that "the Trump administration could theoretically drop

the case."

A Prudential spokesman said: "It would be premature to comment

on what the Trump administration may or may not do regarding Dodd

Frank." An AIG spokesman declined to comment Friday, and MetLife

didn't have immediate comment.

One concern for insurance firms in a Trump administration

surrounds possible tax changes.

Lower corporate income-tax rates are a positive for the

industry, but a simplified tax system might not be.

"What if taxes are vastly simplified and the Byzantine array of

loopholes, tax-advantaged investment products, and tax mitigation

products eliminated? That's probably bad for life insurers that

cater to the needs of high-income individuals," said Imperial

Capital LLC credit analyst David Havens.

Write to Leslie Scism at leslie.scism@wsj.com

(END) Dow Jones Newswires

November 12, 2016 07:14 ET (12:14 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

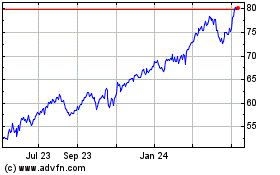

American (NYSE:AIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

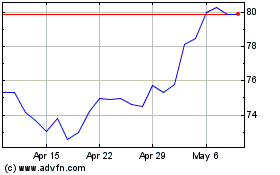

American (NYSE:AIG)

Historical Stock Chart

From Apr 2023 to Apr 2024