Western Digital Swings to Loss

October 26 2016 - 6:30PM

Dow Jones News

Western Digital Corp. said it swung to a loss in the latest

quarter as the disk-drive maker was hit by charges related to its

acquisition of SanDisk and other items.

The company's adjusted per-share earnings, which exclude such

items, and revenue beat expectations.

Western Digital's acquisition of SanDisk in May expanded its

portfolio of hard-drive and flash-storage products. With the

acquisition, Western Digital previously has said it is aiming to

capture a bigger share of the global data center, client device and

client-solution markets.

For the period ended Sept. 30, Western Digital reported a loss

of $366 million, or $1.28 a share, compared with a year-earlier

profit of $283 million, or $1.21 a share. Excluding items, adjusted

per-share earnings fell to $1.18 from $1.56. Revenue increased 40%

to $4.71 billion.

The company expected per-share profit of $1 to $1.05 and revenue

of $4.45 billion to $4.55 billion.

Shares fell 1.6% to $55.60 in recent after-hours trading

Wednesday.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

October 26, 2016 18:15 ET (22:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

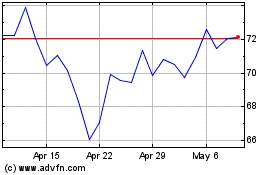

Western Digital (NASDAQ:WDC)

Historical Stock Chart

From Mar 2024 to Apr 2024

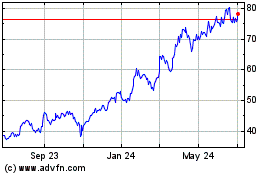

Western Digital (NASDAQ:WDC)

Historical Stock Chart

From Apr 2023 to Apr 2024