Franklin Street Properties Corp. (the “Company”, “FSP”, “we” or

“our”) (NYSE MKT: FSP), a real estate investment trust (REIT),

announced its results for the third quarter ended September 30,

2016.

George J. Carter, Chairman and Chief Executive Officer,

commented as follows:

“As the fourth quarter begins, we continue to believe that

full-year 2016 will mark the bottom of the reductive effects that

our ongoing property portfolio transition is having on Funds From

Operations (FFO). Our current forecast is for resumed FFO growth in

2017 propelled from our projected realization of increased positive

leasing metrics in our more recently acquired urban office

properties, many of which contain meaningful value-add square

footage; select new investments and redevelopment efforts. We look

forward with anticipation to the balance of 2016 and beyond.”

Highlights

- FFO was $26.7 million or $0.26 per

share, for the third quarter ended September 30, 2016, and Net

Income was $2.5 million, or $0.02 per share for the third quarter

ended September 30, 2016.

- We are updating our full year FFO

guidance for 2016 to be approximately $1.03 per diluted share and,

for the fourth quarter of 2016, we estimate FFO to be approximately

$0.24 per diluted share. FFO guidance is being adjusted primarily

to reflect the increased shares outstanding from our recent equity

offering.

- Adjusted Funds From Operations (AFFO)

was $0.18 per share for the third quarter ended September 30,

2016.

- Portfolio was approximately 89.5%

leased as of September 30, 2016.

- Expanded our presence in Midtown

Atlanta, GA with the acquisition of Pershing Park Plaza for $45.5

million.

- On August 16, 2016, we completed an

equity offering issuing 7,043,750 shares of common stock and

raising $82.9 million in proceeds, net of offering expenses and

underwriter discounts.

- On July 21, 2016, we extended the

maturity of our $400 million term loan from September 27, 2017 to

September 27, 2021. On July 22, 2016, we entered into a forward

interest rate swap that fixed the base LIBOR interest rate for that

extension period at 1.12%. Accordingly, based upon our credit

rating as of September 30, 2016, the interest rate when the

extension commences would be 2.57%.

Leasing Update

- Our directly owned real estate

portfolio of 36 properties totaling approximately 9.7 million

square feet was approximately 89.5% leased as of September 30,

2016.

- During the quarter, we leased

approximately 270,000 square feet, of which approximately 127,000

square feet was with new tenants.

- Executed leases with NCS Pearson for

approximately 30,800 square feet at Northwest Point, Elk Grove, IL;

Blackboard for approximately 28,700 square feet at River Crossing,

Indianapolis, IN; Centene Management Company for approximately

26,600 square feet at Timberlake, Chesterfield, MO and Behringer

Harvard for approximately 30,800 square feet at Addison Circle,

Addison, TX.

Acquisition and Disposition

Update

- Acquired the 160,000 SF Pershing Park

Plaza in Midtown Atlanta, GA on August 10, 2016 for $45.5

million.

- Acquired the 325,800 SF Plaza Seven in

downtown Minneapolis, MN on June 6, 2016 for $82 million.

- Active potential acquisition pipeline.

Currently working on up to approximately $150 million in one or

more potential urban/CBD acquisitions within our five core

markets.

- Active potential disposition pipeline.

Currently working on up to approximately $100 million in one or

more potential dispositions.

801 Marquette Avenue, Minneapolis, MN

Development Update

- Continuing our efforts to transform the

property into a premier asset with a similar experience to

warehouse/brick and timber buildings.

- Interior demolition and construction

work commenced during the third quarter.

- Expected costs are anticipated to total

between $15 and $20 million including all leasing expenses, and

should result in about 120,000 RSF.

- Upon completion, expect to attain rents

of approximately $15 to $18 weighted average GAAP rent per square

foot compared to previously expired rents of about $4.75 net per

square foot.

- Anticipate construction completion at

the end of first quarter 2017.

Dividend Update

On October 7, 2016, the Company announced that its Board of

Directors declared a regular quarterly dividend for the three

months ended September 30, 2016 of $0.19 per share of common stock

that will be paid on November 10, 2016 to stockholders of record on

October 21, 2016.

Non-GAAP Financial

Information

A reconciliation of Net Income to FFO and AFFO and our

definitions of FFO and AFFO can be found on Supplementary Schedule

H.

FFO Guidance

We are updating our full year FFO guidance for 2016 to be

approximately $1.03 per diluted share and, for the fourth quarter

of 2016, we estimate FFO to be approximately $0.24 per diluted

share. This guidance (a) excludes the impact of future

acquisitions, developments, dispositions, debt financings or

repayments or other capital market transactions; (b) reflects

estimates from our ongoing portfolio of properties, other real

estate investments and general and administrative expenses; and (c)

reflects our current expectations of economic conditions. We will

update guidance quarterly in our earnings releases. There can be no

assurance that the Company’s actual results will not differ

materially from the estimates set forth above.

Real Estate Update

Supplementary schedules provide property information for the

Company’s owned real estate portfolio and for two non-consolidated

REITs in which the Company holds preferred stock interests as of

September 30, 2016. The Company will also be filing an updated

supplemental information package that will provide stockholders and

the financial community with additional operating and financial

data. The Company will file this supplemental information package

with the SEC and make it available on its website at

www.fspreit.com.

________________________________________________________________________________________

Today’s news release, along with other news about Franklin

Street Properties Corp., is available on the Internet at

www.fspreit.com. We routinely post information that may be

important to investors in the Investor Relations section of our

website. We encourage investors to consult that section of our

website regularly for important information about us and, if they

are interested in automatically receiving news and information as

soon as it is posted, to sign up for E-mail Alerts.

Earnings Call

A conference call is scheduled for October 26, 2016 at 9:00 a.m.

(ET) to discuss the third quarter 2016 results. To access the call,

please dial 1-877-507-4376. Internationally, the call may be

accessed by dialing 1-412-317-6014. To listen via live audio

webcast, please visit the Webcasts & Presentations section in

the Investor Relations section of the Company's website

(www.fspreit.com) at least ten minutes prior to the start of the

call and follow the posted directions. The webcast will also be

available via replay from the above location starting one hour

after the call is finished.

About Franklin Street Properties Corp.

Franklin Street Properties Corp., based in Wakefield,

Massachusetts, is focused on investing in institutional-quality

office properties in the U.S. FSP’s strategy is to invest in select

urban infill and central business district (CBD) properties, with

primary emphasis on our top five markets of Atlanta, Dallas,

Denver, Houston, and Minneapolis. FSP seeks value-oriented

investments with an eye towards long-term growth and appreciation,

as well as current income. FSP is a Maryland corporation that

operates in a manner intended to qualify as a real estate

investment trust (REIT) for federal income tax purposes. To learn

more about FSP please visit our website at www.fspreit.com.

Forward-Looking Statements

Statements made in this press release that state FSP’s or

management’s intentions, beliefs, expectations, or predictions for

the future may be forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995. This press

release may also contain forward-looking statements based on

current judgments and current knowledge of management, which are

subject to certain risks, trends and uncertainties that could cause

actual results to differ materially from those indicated in such

forward-looking statements. Accordingly, readers are cautioned not

to place undue reliance on forward-looking statements. Investors

are cautioned that our forward-looking statements involve risks and

uncertainty, including without limitation, economic conditions in

the United States, disruptions in the debt markets, economic

conditions in the markets in which we own properties, risks of a

lessening of demand for the types of real estate owned by us,

changes in government regulations and regulatory uncertainty,

uncertainty about governmental fiscal policy, geopolitical events

and expenditures that cannot be anticipated such as utility rate

and usage increases, unanticipated repairs, additional staffing,

insurance increases and real estate tax valuation reassessments.

See the “Risk Factors” set forth in Part I, Item 1A of our Annual

Report on Form 10-K for the year ended December 31, 2015, as the

same may be updated from time to time in subsequent filings with

the United States Securities and Exchange Commission. Although we

believe the expectations reflected in the forward-looking

statements are reasonable, we cannot guarantee future results,

levels of activity, acquisitions, dispositions, performance or

achievements. We will not update any of the forward-looking

statements after the date of this press release to conform them to

actual results or to changes in our expectations that occur after

such date, other than as required by law.

Franklin Street Properties

Corp.

Earnings Release

Supplementary Information

Table of Contents

Franklin Street Properties Corp. Financial Results

A-C Real Estate Portfolio Summary Information D Portfolio and Other

Supplementary Information E Percentage of Leased Space F Largest 20

Tenants – FSP Owned Portfolio G Reconciliation and Definitions of

Funds From Operations (FFO) and Adjusted Funds From Operations

(AFFO) H

Franklin Street Properties Corp. Financial

Results

Supplementary Schedule A

Condensed Consolidated Income (Loss)

Statements

(Unaudited)

For the For

the Three Months Ended Nine Months Ended

September 30, September

30, (in thousands, except per share amounts)

2016 2015 2016

2015 Revenue: Rental $ 61,925 $ 60,386 $ 179,738 $

178,200 Related party revenue: Management fees and interest income

from loans 1,338 1,470 4,108 4,355 Other

17 21 54

62 Total revenue

63,280 61,877 183,900

182,617 Expenses: Real estate

operating expenses 16,905 15,951 47,126 45,951 Real estate taxes

and insurance 10,218 9,941 29,522 29,458 Depreciation and

amortization 23,298 22,911 68,095 68,790 Selling, general and

administrative 3,419 3,071 10,443 10,163 Interest

6,767 6,425

19,617 18,977 Total expenses

60,607 58,299

174,803 173,339

Income before interest income, equity in losses of non-consolidated

REITs,other, gain (loss) on sale of properties and property held

for sale, lessapplicable income tax and taxes 2,673 3,578 9,097

9,278 Interest income — — — 1 Equity in losses of non-consolidated

REITs (196 ) (284 ) (568 ) (644 ) Other 621 — (388 ) — Gain (loss)

on sale of properties and property held for sale,less applicable

income tax (523 ) 1

(1,166 ) 11,411

Income before taxes on income 2,575 3,295 6,975 20,046 Taxes on

income 117 129

326 444 Net income

$ 2,458 $ 3,166 $

6,649 $ 19,602 Weighted average number

of shares outstanding, basic and diluted

103,709 100,187

101,370 100,187 Net income per

share, basic and diluted $ 0.02

$ 0.03 $ 0.07 $ 0.20

Franklin Street Properties Corp. Financial

Results

Supplementary Schedule B

Condensed Consolidated Balance Sheets

(Unaudited)

September 30, December

31, (in thousands, except share and par value amounts)

2016 2015 Assets: Real estate

assets: Land $ 177,505 $ 170,021 Buildings and improvements

1,713,296 1,637,066 Fixtures and equipment

3,205 2,528 1,894,006 1,809,615

Less accumulated depreciation 326,485

299,991 Real estate assets, net

1,567,521 1,509,624

Acquired real estate leases, less

accumulated amortization of $116,206 and $112,844,respectively

102,226 108,046 Investment in non-consolidated REITs 75,761 77,019

Asset held for sale 8,893 — Cash and cash equivalents 13,372 18,163

Restricted cash 48 23 Tenant rent receivables, less allowance for

doubtful accounts of $200 and $130, respectively 3,331 2,898

Straight-line rent receivable, less

allowance for doubtful accounts of $50 and $50, respectively

50,742 48,502 Prepaid expenses and other assets 6,460 5,484 Related

party mortgage loan receivables 79,045 118,641 Other assets:

derivative asset — 1,132

Office computers and furniture, net of

accumulated depreciation of $1,496 and $1,333,respectively

370 484

Deferred leasing commissions, net of

accumulated amortization of $20,853 and $20,002,respectively

32,676 28,999

Total assets $ 1,940,445

$ 1,919,015 Liabilities and Stockholders’ Equity:

Liabilities: Bank note payable $ 278,000 $ 290,000 Term loans

payable, less unamortized financing costs of $4,364 and $2,353,

respectively 615,636 617,647 Accounts payable and accrued expenses

53,964 49,489 Accrued compensation 3,238 3,726 Tenant security

deposits 4,719 4,829 Other liabilities: derivative liabilities

12,651 8,243

Acquired unfavorable real estate leases,

less accumulated amortization of $9,997 and $9,368,respectively

9,289 9,425

Total liabilities 977,497

983,359 Commitments and contingencies

Stockholders’ Equity: Preferred stock, $.0001 par value, 20,000,000

shares authorized, none issued or outstanding - -

Common stock, $.0001 par value,

180,000,000 shares authorized, 107,231,155 and 100,187,405shares

issued and outstanding, respectively

11 10 Additional paid-in capital 1,356,457 1,273,556 Accumulated

other comprehensive loss (12,263 ) (7,111 ) Accumulated

distributions in excess of accumulated earnings

(381,257 ) (330,799 ) Total

stockholders’ equity 962,948

935,656 Total liabilities and stockholders’

equity $ 1,940,445 $ 1,919,015

Franklin Street Properties Corp. Financial

Results

Supplementary Schedule C

Condensed Consolidated Statements of Cash

Flows

(Unaudited)

For the Nine Months Ended

September 30, (in thousands)

2016 2015 Cash flows from operating

activities: Net income $ 6,649 $ 19,602 Adjustments to

reconcile net income to net cash provided by operating activities:

Depreciation and amortization expense 69,750 70,340 Amortization of

above market lease (104 ) (96 ) Equity in losses of

non-consolidated REITs 568 644 Hedge ineffectiveness 388 — Gain

(loss) on sale of properties and propertyheld for sale, less

applicable income tax 1,166 (11,411 ) Increase (decrease) in

allowance for doubtful accounts 70 (125 ) Changes in operating

assets and liabilities: Restricted cash (25 ) 708 Tenant rent

receivables (503 ) 1,310 Straight-line rents (2,094 ) (1,573 )

Lease acquisition costs (679 ) (463 ) Prepaid expenses and other

assets (1,667 ) (997 ) Accounts payable, accrued expenses and other

items 1,478 (603 ) Accrued compensation (488 ) (522 ) Tenant

security deposits (110 ) 101 Payment of deferred leasing

commissions (9,147 )

(4,254 ) Net cash provided by operating activities

65,252 72,661

Cash

flows from investing activities: Property acquisitions (100,302

) (66,104 ) Acquired real estate leases (18,873 ) (10,604 )

Property improvements, fixtures and equipment (22,097 ) (15,005 )

Distributions in excess of earnings from non-consolidated REITs 691

81 Repayment of related party mortgage loan receivable 39,596 —

Proceeds received on sales of real estate assets

20,058 55,659 Net cash

used in investing activities (80,927 )

(35,973 )

Cash flows from financing

activities: Distributions to stockholders (57,108 ) (57,107 )

Proceeds from equity offering 83,511 — Offering costs (544 ) —

Borrowings under bank note payable 155,000 95,000 Repayments of

bank note payable (167,000 ) (63,000 ) Deferred financing costs

(2,975 ) — Net

cash provided by (used in) financing activities

10,884 (25,107 )

Net increase

(decrease) in cash and cash equivalents (4,791 ) 11,581

Cash

and cash equivalents, beginning of year

18,163 7,519

Cash and cash

equivalents, end of period $ 13,372

$ 19,100

Franklin Street Properties Corp. Earnings

Release

Supplementary Schedule D

Real Estate Portfolio Summary

Information

(Unaudited & Approximated)

Commercial portfolio

lease expirations (1) Total % of

Year

Square Feet Portfolio 2016 122,849 1.3 % 2017 749,059 7.7 % 2018

1,169,759 12.1 % 2019 1,319,416 13.6 % 2020 948,806 9.8 %

Thereafter (2) 5,373,957 55.5 % 9,683,846

100.0 %

(1) Percentages are determined based upon

total square footage.

(2) Includes 1,016,391 square feet of

current vacancies.

(dollars & square

feet in 000's) As of September 30, 2016 # of % of Square % of State

Properties Investment Portfolio Feet Portfolio Texas 9 $

359,076 23.0% 2,417 25.4% Colorado 5 425,990 27.3% 2,010 21.1%

Georgia 5 324,905 20.8% 1,998 19.3% Virginia 4 91,397 5.8% 685 7.2%

Minnesota (a) 2 92,089 5.9% 632 6.6% North Carolina 2 54,039 3.5%

322 3.4% Missouri 2 44,996 2.9% 352 3.7% Illinois 2 44,360 2.8% 372

3.9% Maryland 1 49,844 3.2% 325 3.4% Florida 1 40,893 2.6% 213 2.2%

Indiana 1 30,700 2.0% 205 2.2% California 1 3,758 0.2% 36 0.4%

Washington (b) 1 — 0.0% 117 1.2% Total

36 $ 1,562,047 100.0% 9,684 100.0%

(a) Excludes approximately $5,474, which

is our investment in a property being redeveloped.

(b) Includes asset held for sale of

$8,893.

Franklin Street Properties Corp. Earnings

Release

Supplementary Schedule E

Portfolio and Other Supplementary

Information

(Unaudited & Approximated)

Recurring Capital Expenditures

Owned Portfolio

Three Months Nine Months Three Months Nine Months Ended Ended Ended

Ended 30-Sep-16 30-Sep-16 30-Sep-15

30-Sep-15 Tenant improvements $ 3,325 $ 6,583 $ 1,794

$ 8,150 Deferred leasing costs 2,247 8,826 1,490 3,859

Non-investment capex 2,211 3,701

1,090 3,144 $ 7,783 $ 19,110 $

4,374 $ 15,153

Square foot & leased percentages September 30, December

31, 2016 2015 Owned portfolio of commercial real estate Number of

properties (a) 36 36 Square feet 9,683,846 9,494,953 Leased

percentage 89.5 % 91.6 % Investments in non-consolidated

REITs Number of properties 2 2 Square feet 1,396,071 1,396,071

Leased percentage 73.8 % 73.5 % Single Asset REITs (SARs)

managed Number of properties 5 7 Square feet 1,075,135 1,487,026

Leased percentage 89.6 % 77.0 % Total owned, investments

& managed properties Number of properties 43 45 Square feet

12,155,052 12,378,050 Leased percentage 87.7 % 87.8 %

(a) Excludes property in redevelopment in

2016.

The following table shows property

information for our investments in non-consolidated REITs:

Square

% Leased % Interest Single Asset REIT name

City State Feet 30-Sep-16 Held FSP 303 East Wacker Drive Corp.

Chicago IL 861,000 66.8% 43.7% FSP Grand Boulevard Corp. Kansas

City MO 535,071 85.0% 27.0% 1,396,071

73.8%

Franklin Street Properties Corp. Earnings

Release

Supplementary Schedule F

Percentage of Leased Space

(Unaudited & Estimated)

Second Third %

Leased (1) Quarter % Leased (1) Quarter

as of Average % as of Average %

Property Name Location Square Feet

30-Jun-16 Leased (2) 30-Sep-16 Leased

(2) 1 HILLVIEW CENTER Milpitas, CA 36,288 100.0 % 100.0

% 100.0 % 100.0 % 2 FOREST PARK Charlotte, NC 62,212 100.0 % 100.0

% 100.0 % 100.0 % 3 MEADOW POINT Chantilly, VA 138,537 100.0 %

100.0 % 100.0 % 100.0 % 4 TIMBERLAKE Chesterfield, MO 234,496 96.3

% 96.3 % 100.0 % 98.8 % 5 FEDERAL WAY Federal Way, WA 117,010 61.6

% 61.6 % 61.6 % 61.6 % 6 NORTHWEST POINT Elk Grove Village, IL

176,848 100.0 % 100.0 % 100.0 % 100.0 % 7 TIMBERLAKE EAST

Chesterfield, MO 117,036 96.2 % 96.2 % 100.0 % 98.7 % 8 PARK TEN

Houston, TX 157,460 65.4 % 63.9 % 65.4 % 65.4 % 9 ADDISON Addison,

TX 288,667 97.7 % 95.6 % 94.0 % 97.2 % 10 COLLINS CROSSING

Richardson, TX 300,887 100.0 % 100.0 % 100.0 % 100.0 % 11 GREENWOOD

PLAZA Englewood, CO 196,236 100.0 % 100.0 % 100.0 % 100.0 % 12

RIVER CROSSING Indianapolis, IN 205,059 91.7 % 91.7 % 96.6 % 93.4 %

13 LIBERTY PLAZA Addison, TX 218,934 81.7 % 81.7 % 81.5 % 81.8 % 14

INNSBROOK Glen Allen, VA 298,456 100.0 % 100.0 % 100.0 % 100.0 % 15

380 INTERLOCKEN Broomfield, CO 240,185 93.2 % 93.2 % 93.2 % 93.2 %

16 BLUE LAGOON Miami, FL 212,619 100.0 % 100.0 % 100.0 % 100.0 % 17

ELDRIDGE GREEN Houston, TX 248,399 100.0 % 100.0 % 100.0 % 100.0 %

18 ONE OVERTON PARK Atlanta, GA 387,267 90.4 % 90.4 % 94.0 % 92.6 %

19 390 INTERLOCKEN Broomfield, CO 241,751 94.6 % 94.2 % 95.2 % 95.2

% 20 EAST BALTIMORE Baltimore, MD 325,445 83.7 % 83.6 % 76.5 % 81.3

% 21 PARK TEN PHASE II Houston, TX 156,746 100.0 % 100.0 % 100.0 %

100.0 % 22 LOUDOUN TECH Dulles, VA 136,658 92.0 % 92.0 % 92.0 %

92.0 % 23 4807 STONECROFT Chantilly, VA 111,469 100.0 % 100.0 %

100.0 % 100.0 % 24 121 SOUTH EIGHTH ST Minneapolis, MN 305,990 56.3

% 56.2 % 56.0 % 56.4 % 25 EMPEROR BOULEVARD Durham, NC 259,531

100.0 % 100.0 % 100.0 % 100.0 % 26 LEGACY TENNYSON CTR Plano, TX

202,600 100.0 % 100.0 % 65.6 % 77.1 % 27 ONE LEGACY Plano, TX

214,110 100.0 % 100.0 % 100.0 % 100.0 % 28 909 DAVIS Evanston, IL

195,080 80.4 % 83.2 % 80.5 % 80.5 % 29 ONE RAVINIA DRIVE Atlanta,

GA 386,603 94.8 % 94.8 % 91.8 % 92.6 % 30 TWO RAVINIA Atlanta, GA

442,130 81.3 % 82.4 % 78.1 % 78.1 % 31 WESTCHASE I & II

Houston, TX 629,025 84.0 % 84.0 % 84.0 % 84.1 % 32 1999 BROADWAY

Denver, CO 676,379 80.0 % 81.0 % 81.5 % 81.3 % 33 999 PEACHTREE

Atlanta, GA 621,946 95.3 % 95.3 % 95.7 % 95.7 % 34 1001 17th STREET

Denver, CO 655,420 87.6 % 87.6 % 89.0 % 88.1 % 35 PLAZA SEVEN (3)

Minneapolis, MN 326,222 96.4 % 96.4 % 95.6 % 95.6 % 36 PERSHING

PLAZA (4) Atlanta, GA 160,145

(4 )

(4 ) 97.4 %

97.4 %

TOTAL WEIGHTED AVERAGE 9,683,846

90.1 % 90.1 %

89.5 % 89.8 %

(1) % Leased as of month's end includes all leases that expire

on the last day of the quarter.(2) Average quarterly percentage is

the average of the end of the month leased percentage for each of

the 3 months during the quarter.(3) Property was acquired June 6,

2016, averages are for the period held in the Second Quarter.(4)

Property was acquired August 10, 2016, averages are for the period

held in the Third Quarter.

Franklin Street Properties Corp. Earnings

Release

Supplementary Schedule G

Largest 20 Tenants – FSP Owned

Portfolio

(Unaudited & Estimated)

The following table includes the largest

20 tenants in FSP’s owned portfolio based on total square feet:

As of September 30, 2016

% of Tenant Sq Ft Portfolio 1 Quintiles IMS

Healthcare Incorporated 259,531 3.0 % 2 CITGO Petroleum Corporation

248,399 2.9 % 3 Newfield Exploration Company 234,495 2.7 % 4 US

Government 223,433 2.6 % 5 Sutherland Asbill Brennan LLP 222,422

2.6 % 6 Burger King Corporation 212,619 2.5 % 7 Centene Management

Company, LLC 206,262 2.4 % 8 Citicorp Credit Services, Inc 176,848

2.0 % 9 SunTrust Bank 159,671 1.8 % 10 T-Mobile South, LLC dba

T-Mobile 151,792 1.8 % 11 Petrobras America, Inc. 144,813 1.7 % 12

Murphy Exploration & Production Company 144,677 1.7 % 13 Jones

Day 140,342 1.6 % 14 Argo Data Resource Corporation 140,246 1.6 %

15 Vail Corp d/b/a Vail Resorts 125,588 1.4 % 16 Federal National

Mortgage Association 123,144 1.4 % 17 Kaiser Foundation Health Plan

120,979 1.4 % 18 Giesecke & Devrient America 112,110 1.3 % 19

Houghton Mifflin Harcourt Publishing Company 111,550 1.3 % 20

Northrop Grumman Systems Corp 111,469 1.3 % Total 3,370,390

38.9 %

Franklin Street Properties Corp. Earnings

Release

Supplementary Schedule H

Reconciliation and Definitions of Funds

From Operations (“FFO”) and

Adjusted Funds From Operations

(“AFFO”)

A reconciliation of Net Income to FFO and

AFFO is shown below and a definition of FFO and AFFO isprovided on

Supplementary Schedule I. Management believes FFO and AFFO are used

broadly throughoutthe real estate investment trust (REIT) industry

as measurements of performance. The Company has includedthe

National Association of Real Estate Investment Trusts (NAREIT) FFO

definition as of May 17, 2016 in thetable and notes that other

REITs may not define FFO in accordance with the current NAREIT

definition or mayinterpret the current NAREIT definition

differently. The Company’s computation of FFO and AFFO may notbe

comparable to FFO or AFFO reported by other REITs or real estate

companies that define FFO or AFFOdifferently.

Reconciliation of Net Income to FFO and AFFO: Three Months

Ended Nine Months Ended September 30, September 30, (In thousands,

except per share amounts) 2016 2015 2016 2015 Net income $

2,458 $ 3,166 $ 6,649 $ 19,602

Gain (loss) on sale of properties and

property heldfor sale, less applicable income tax

523 (1 ) 1,166 (11,411 ) GAAP loss from non-consolidated REITs 196

284 568 644 FFO from non-consolidated REITs 787 645 2,327 2,131

Depreciation & amortization 23,112 22,848

67,991 68,694 NAREIT FFO 27,076

26,942 78,701 79,660 Hedge ineffectiveness (621 ) — 388 —

Acquisition costs of new properties 215 12

349 154 Funds From Operations

(FFO) $ 26,670 $ 26,954 $ 79,438 $ 79,814

Funds From Operations (FFO) $ 26,670 $ 26,954 $

79,438 $ 79,814 Reverse FFO from non-consolidated REITs (787 ) (645

) (2,327 ) (2,131 ) Distributions from non-consolidated REITs 332

27 691 81 Amortization of deferred financing costs 622 516 1,656

1,550 Straight-line rent (119 ) (930 ) (2,094 ) (1,573 ) Tenant

improvements (3,325 ) (1,794 ) (6,583 ) (8,150 ) Leasing

commissions (2,247 ) (1,490 ) (8,826 ) (3,859 ) Non-investment

capex (2,211 ) (1,090 ) (3,701 ) (3,144

) Adjusted Funds From Operations (AFFO) $ 18,935 $ 21,548

$ 58,254 $ 62,588 Per Share Data EPS $

0.02 $ 0.03 $ 0.07 $ 0.20 FFO $ 0.26 $ 0.27 $ 0.78 $ 0.80 AFFO $

0.18 $ 0.22 $ 0.57 $ 0.62 Weighted average shares (basic and

diluted) 103,709 100,187 101,370 100,187

During the three months ended June 30, 2016 we changed the

definition of FFO to exclude hedge ineffectiveness, which does not

affect any prior period. Our interest rate swaps effectively fix

interest rates on our term loans, however, there is no floor on the

variable interest rate of the swaps whereas the current term loans

are subject to a zero percent floor. As a result there is a

mismatch and the ineffective portion of the derivatives’ changes in

fair value are recognized directly into earnings each quarter as

hedge ineffectiveness. We believe that FFO excluding hedge

ineffectiveness is useful supplemental information regarding our

operating performance as it provides a more meaningful and

consistent comparison of our operating performance and allows

investors to more easily compare our operating results.

Funds From Operations (“FFO”)

The Company evaluates performance based on Funds From

Operations, which we refer to as FFO, as management believes that

FFO represents the most accurate measure of activity and is the

basis for distributions paid to equity holders. The Company defines

FFO as net income (computed in accordance with GAAP), excluding

gains (or losses) from sales of property, hedge ineffectiveness and

acquisition costs of newly acquired properties that are not

capitalized, plus depreciation and amortization, including

amortization of acquired above and below market lease intangibles

and impairment charges on properties or investments in

non-consolidated REITs, and after adjustments to exclude equity in

income or losses from, and, to include the proportionate share of

FFO from, non-consolidated REITs.

FFO should not be considered as an alternative to net income

(determined in accordance with GAAP), nor as an indicator of the

Company’s financial performance, nor as an alternative to cash

flows from operating activities (determined in accordance with

GAAP), nor as a measure of the Company’s liquidity, nor is it

necessarily indicative of sufficient cash flow to fund all of the

Company’s needs.

Other real estate companies and NAREIT, may define this term in

a different manner. We have included the NAREIT FFO as of May 17,

2016 in the table and note that other REITs may not define FFO in

accordance with the current NAREIT definition or may interpret the

current NAREIT definition differently than we do.

We believe that in order to facilitate a clear understanding of

the results of the Company, FFO should be examined in connection

with net income and cash flows from operating, investing and

financing activities in the consolidated financial statements.

Adjusted Funds From Operations (“AFFO”)

The Company also evaluates performance based on Adjusted Funds

From Operations, which we refer to as AFFO. The Company defines

AFFO as (1) FFO, (2) excluding our proportionate share of FFO and

including distributions received, from non-consolidated REITs, (3)

excluding the effect of straight-line rent, (4) plus deferred

financing costs and (5) less recurring capital expenditures that

are generally for maintenance of properties, which we call

non-investment capex or are second generation capital expenditures.

Second generation costs include re-tenanting space after a tenant

vacates, which include tenant improvements and leasing

commissions.

We exclude development/redevelopment activities, capital

expenditures planned at acquisition and costs to reposition a

property. We also exclude first generation leasing costs, which are

generally to fill vacant space in properties we acquire or were

planned for at acquisition.

AFFO should not be considered as an alternative to net income

(determined in accordance with GAAP), nor as an indicator of the

Company’s financial performance, nor as an alternative to cash

flows from operating activities (determined in accordance with

GAAP), nor as a measure of the Company’s liquidity, nor is it

necessarily indicative of sufficient cash flow to fund all of the

Company’s needs. Other real estate companies may define this term

in a different manner. We believe that in order to facilitate a

clear understanding of the results of the Company, AFFO should be

examined in connection with net income and cash flows from

operating, investing and financing activities in the consolidated

financial statements.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161025006749/en/

Franklin Street Properties Corp.Georgia Touma, 877-686-9496

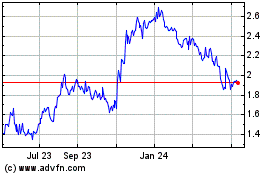

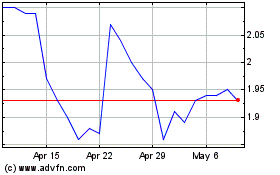

Franklin Street Properties (AMEX:FSP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Franklin Street Properties (AMEX:FSP)

Historical Stock Chart

From Apr 2023 to Apr 2024