- Net income of $46.8 million for the

third quarter of 2016 and Adjusted net income of $94.6

million

- Net interest margin of 4.12% in Q3

2016, compared to 4.33% in Q2 2016

- Credit Quality (excluding covered

loans):

- Non-performing loans

held-in-portfolio (NPLs) increased by $1.6 million from Q2 2016;

NPLs to loans ratio stable at 2.6% QoQ;

- Net charge-offs (NCOs) remained flat

at $35.1 million; NCOs at 0.63% of average loans held-in-portfolio

flat at Q3 2016;

- Allowance for loan losses of $525.6

million vs. $518.1 million in Q2 2016; Allowance for loan losses to

loans held-in-portfolio at 2.33% vs. 2.30% in Q2 2016;

- Allowance for loan losses to NPLs at

90.7% vs. 89.7% in Q2 2016.

- Common Equity Tier 1 ratio of

16.64%, Book Value per Common Share of $51.85 and Tangible Book

Value per Share of $44.86 at September 30, 2016

Popular, Inc. (the “Corporation” or “Popular”) (NASDAQ:BPOP)

reported net income of $46.8 million for the quarter ended

September 30, 2016, compared to net income of $89.0 million for the

quarter ended June 30, 2016.

Mr. Richard L. Carrión, Chairman of the Board and Chief

Executive Officer, said: “The results for the third quarter reflect

the strength of our franchise and disciplined approach to risk

management. We achieved stable revenue and credit metrics

notwithstanding the economic challenges in Puerto Rico and the low

interest rate environment.”

Significant Events

As previously announced, on October 3, 2016 the review board

issued a final arbitration award denying Banco Popular de Puerto

Rico’s request for reimbursement of approximately $55 million in

shared loss claims that were the subject of one of the disputes

between Banco Popular de Puerto Rico (“BPPR”) and the Federal

Deposit Insurance Corporation, as receiver, under the commercial

loss share agreement entered into in connection with the

Westernbank FDIC-assisted transaction. As a result, for the quarter

ended September 30, 2016, Popular recognized a pre-tax charge of

approximately $55 million and a corresponding reduction to its FDIC

indemnification asset.

Earnings Highlights

(Unaudited) Quarters ended Nine months

ended (Dollars in thousands, except per share information)

30-Sep-16 30-Jun-16 30-Sep-15 30-Sep-16

30-Sep-15 Net interest income $353,687 $360,551 $350,735 $1,066,650

$1,056,483 Provision for loan losses 42,594 39,668 69,568 130,202

159,747 Provision (reversal) for loan losses - covered loans [1]

750 804 (2,890) (1,551) 23,200 Net interest

income after provision for loan losses 310,343 320,079 284,057

937,999 873,536 FDIC loss-share (expense) income (61,723) (12,576)

1,207 (77,445) 24,421 Other non-interest income 137,701 123,079

129,902 375,556 362,682 Goodwill impairment charge 3,801 - - 3,801

- Other operating expenses 319,871 309,149

306,897 930,963 982,412 Income from continuing operations

before income tax 62,649 121,433 108,269 301,346 278,227 Income tax

expense (benefit) 15,839 32,446 22,620 80,550

(478,344) Income from continuing operations 46,810

88,987 85,649 220,796 756,571 (Loss) income

from discontinued operations, net of tax - -

(9) - 1,347 Net income $46,810 $88,987

$85,640 $220,796 $757,918 Net income applicable to common

stock $45,880 $88,056 $84,709 $218,004

$755,126 Net income per common share from continuing operations -

Basic $0.44 $0.85 $0.82 $2.11 $7.33 Net

income per common share from continuing operations - Diluted

$0.44 $0.85 $0.82 $2.11 $7.31 Net income per

common share from discontinued operations - Basic $-

$- $- $- $0.01 Net income per common share from

discontinued operations - Diluted $- $- $- $-

$0.01 [1] Covered loans represent loans acquired in the

Westernbank FDIC-assisted transaction that are covered under an

FDIC loss-sharing agreement.

Adjusted results – Non-GAAP

The Corporation prepared its Consolidated Financial Statement

using accounting principles generally accepted in the U.S. (“U.S.

GAAP” or the “reported basis”). In addition to analyzing the

Corporation’s results on a reported basis, management monitors the

“Adjusted net income” of the Corporation and excludes the impact of

certain transactions on the results of its operations. Management

believes that the “Adjusted net income” provides meaningful

information about the underlying performance of the Corporation’s

ongoing operations. The “Adjusted net income” is a non-GAAP

financial measure.

The following tables reflect the results of operations for the

third and second quarters of 2016, with adjustments to exclude the

impact of certain events during the third and second quarters of

2016, to arrive at the adjusted net income.

Adjusted Net Income - Reconciliation to GAAP Financial

Measures

(Unaudited) (In

thousands) 30-Sep-16 Income tax Impact

on Pre-tax effect net income

U.S.

GAAP Net Income $46,810 Non-GAAP Adjustments: FDIC arbitration

award[1] 54,924 (10,985) 43,939 Goodwill impairment charge[2]

3,801 - 3,801

Adjusted net income

(Non-GAAP) $94,550

[1]Represents the arbitration decision

denying BPPR's request for reimbursement in certain shared loss

claims. Gains and losses related to assets acquired from

Westernbank as part of the FDIC assisted transaction are subject to

the capital gains tax rate of 20%.

[2]Represents goodwill impairment charge

in the Corporation’s securities subsidiary. The securities

subsidiary is a limited liability company with a partnership

election. Accordingly, its earnings flow through Popular, Inc.,

holding company, for income tax purposes. Since Popular, Inc. has a

full valuation allowance on its deferred tax assets, this results

in an effective tax rate of 0%.

(Unaudited) (In

thousands) 30-Jun-16 Income tax Impact

on Pre-tax effect net income

U.S.

GAAP Net Income $88,987 Non-GAAP Adjustments: Impact of EVERTEC

Restatement [1] 2,173 - 2,173 Bulk Sale of WB loans and OREO [2]

(891) 347 (544) Adjusted Net Income (Non-GAAP)

$90,616

[1]Represents Popular Inc.'s proportionate

share of the cumulative impact of EVERTEC restatement and other

corrective adjustments to its financial statements, as disclosed in

EVERTEC's 2015 Annual Report on Form 10K. Due to the

preferential tax rate on the income from EVERTEC, the tax effect of

this transaction was estimated at approximately $38 thousand.

[2]Represents the impact of the bulk sale

of Westernbank loans and OREO. Gains and losses related to assets

acquired from Westernbank as part of the FDIC assited

transaction are subject to the capital gains tax rate of 20%.

Net interest income

Net interest income for the quarter ended September 30, 2016 was

$353.7 million, compared to $360.6 million for the previous

quarter. Net interest margin was 4.12% for the quarter compared to

4.33% for the previous quarter. The impact of having one more day

in the quarter contributed $2.6 million to the net interest

income.

The decrease in net interest income was mainly related to:

- Lower income from the WB loan portfolio

by $8.9 million, or 129 basis points, which for the second quarter

included the benefit of $2.1 million, or 41 basis points, from the

bulk sale. The results were also impacted by lower yields as a

result of the quarterly recast process, the successful resolution

of certain loans in the second quarter and lower volume of loans,

due to the normal portfolio run-off.

- Higher cost of deposits by $1.7 million

or 2 basis points mainly in the U.S. associated to increase in

money market and time deposits to fund loan growth.

These negative variances were partially offset by:

- Higher income from investment

securities by $1.2 million mainly from higher levels of mortgage

backed securities both at BPPR and the U.S.

- Higher income from commercial loans by

$2.9 million due to higher levels from the U.S. portfolio.

BPPR’s net interest income amounted to $303.7 million for the

quarter ended September 30, 2016, compared to $310.4 million for

the previous quarter. The decrease of $6.7 million in net interest

income was mainly due to lower income from WB loans by $8.9 million

as mentioned above, partially offset by higher income from mortgage

backed securities and the $2.1 million impact of having one more

day in the quarter. Net interest margin declined to 4.49% from

4.71% in the previous quarter mainly driven by lower yields from WB

loans, as explained above, and higher volume of overnight

investments driven by the increase in Government deposits. Earning

assets in P.R. yielded 4.86%, down from 5.08% in the previous

quarter, while the cost of interest bearing liabilities remained

flat from the previous quarter at 0.53%.

BPNA’s net interest income was $65.3 million, compared to $65.5

million for the previous quarter. The decrease of $0.2 million in

the net interest income is mainly driven by higher expense from

deposits to fund loan growth and the purchase and reinvestment of

investment securities in a lower rate environment. These negative

variances were partially offset by higher income from commercial

loans due to the growth of this portfolio. Net interest margin

decreased 19 basis points to 3.61% compared to 3.80% for the

previous quarter driven by the above mentioned variances. U.S.

earning assets yielded 4.32%, compared to 4.47% in the previous

quarter, while the cost of interest bearing liabilities was 0.94%,

compared to 0.87% in the previous quarter.

Non-interest income

Non-interest income was $76.0 million for the third quarter of

2016, a decrease of $34.5 million when compared to the second

quarter of 2016. The decrease in non-interest income was driven

primarily by higher FDIC loss-share expense by $49.1 million as a

result of a $54.9 million charge related to the FDIC arbitration

award, partially offset by lower recoveries on assets to be shared

with the FDIC in the recovery period.

This decrease was partially offset by:

- Higher other service fees by $2.2

million due to higher life insurance commission revenues;

- Higher net gain on sale of loans by

$8.5 million as a result of the sale of a non-accrual public sector

credit during the third quarter; and

- Higher other operating income by $5.2

million mainly due to higher aggregated net earnings from

investments under the equity method, principally due to the

unfavorable adjustment of $2.2 million recorded during the second

quarter as a result of the EVERTEC restatement.

Refer to Table B for further details.

Financial Impact of the 2010 FDIC-Assisted Transaction

(Unaudited)

Quarters ended Nine months ended (In thousands) 30-Sep-16

30-Jun-16 30-Sep-15 30-Sep-16 30-Sep-15

Income

Statement

Interest income on WB loans $40,867 $49,794 $47,982 $135,566

$160,909 Total FDIC loss-share (expense) income (61,723) (12,576)

1,207 (77,445) 24,421 Provision (reversal) for loan losses- WB

loans 6,612 (7,282) 20,206 (1,026)

46,296 Total revenues less provision (reversal) for loan losses

$(27,468) $44,500 $28,983 $59,147

$139,034

Balance

Sheet

WB loans $1,896,099 $1,932,062 $2,223,731 FDIC loss-share asset

152,467 214,029 311,946 FDIC true-up payment obligation

134,487 127,876 122,527

See additional details on accounting for the 2010 FDIC-Assisted

transaction in Table O.

Operating expenses

Operating expenses amounted to $323.7 million for the third

quarter of 2016, an increase of $14.5 million when compared to the

second quarter of 2016. The increase in operating expenses was

driven primarily by:

- Higher personnel cost by $4.5 million

mainly due to higher salaries from increased full time equivalent

employees, an additional working day in the quarter and higher

commission compensation in the insurance and wealth management

subsidiaries;

- Higher other taxes by $1.2 million

mainly due to higher municipal license and sales tax;

- Higher professional fees by $0.6

million mainly due to higher programming, processing and other

technology services by $1.9 million and higher attorney fees by

$1.4 million related to the FDIC arbitration proceedings, partially

offset by lower credit related expenses and reduced other

professional fees from the bulk sale of Westernbank loans and OREO

during the second quarter;

- Higher other operating expense by $9.2

million mainly due to higher operational losses at BPPR and BPNA

including increased reserves for legal matters, curtailment losses

on insured mortgage claims in our mortgage servicing business and

higher incidence of credit card fraud losses; and

- A goodwill impairment charge of $3.8

million at the securities subsidiary, recorded as part of the

Corporation’s annual goodwill impairment analysis.

These increases were partially offset by:

- Lower OREO expenses by $1.7 million

mainly due to the loss on the bulk sale of Westernbank OREO during

the second quarter, partially offset by higher mortgage OREO

write-downs at BPPR; and

- Lower credit and debit card processing,

volume, interchange and other expenses by $3.0 million due mainly

to earned volume credits.

Non-personnel credit-related costs, which include collections,

appraisals, credit related fees, and OREO expenses, amounted to

$15.3 million for the third quarter of 2016, compared to $18.0

million for the second quarter of 2016. The decrease was

principally due to lower losses on sales of OREO at BPPR.

Full-time equivalent employees were 7,866 as of September 30,

2016, compared to 7,826 as of June 30, 2016.

For a breakdown of operating expenses by category refer to table

B.

Income taxes

For the quarter ended September 30, 2016, the Corporation

recorded an income tax expense of $15.8 million, compared to $32.4

million for the previous quarter. The decline in the income tax

expense is mainly driven by lower taxable income at BPPR.

Additionally, in the third quarter BPPR recognized a $4.4 million

benefit related to reversal of uncertain tax positions reserves

associated with expired statutory provisions.

The effective income tax rate for the third quarter of 2016 was

25%, compared to 27% for the previous quarter. The effective tax

rate is impacted by the composition and source of the taxable

income.

Credit Quality

The Corporation continued to experience stable credit trends

despite challenging economic conditions in Puerto Rico. The shift

in the composition and the risk profile of the credit portfolios

over the last few years has better positioned the Corporation to

operate in the Island’s environment. The Corporation continues to

closely monitor changes in credit quality trends and is focused on

taking measures to minimize risks. The U.S. operation continued to

reflect positive results with strong growth and favorable credit

quality metrics.

- Inflows of NPLs held-in-portfolio,

excluding consumer loans, decreased by $5.6 million

quarter-over-quarter, mainly driven by lower commercial inflows of

$13.5 million, offset by higher mortgage inflows of $7.7 million in

the BPPR segment.

- Non-performing loans held-in-portfolio

increased slightly by $1.6 million from the second quarter of 2016,

mainly driven by higher mortgage NPLs of $7.7 million, offset by

lower commercial NPLs of $5.5 million in the BPPR segment. At

September 30, 2016, NPLs to total loans held-in-portfolio remained

flat at 2.6% quarter-over-quarter.

- Net charge-offs remained flat at $35.1

million quarter over quarter. NCOs in the BPPR segment decreased by

$3.3 million mainly driven by a decrease of $7.1 million in the

consumer NCOs due to a $7.1 million recovery related to the sale of

previously charged-off credit cards and personal loans. BPPR

construction NCOs increased by $4.1 million, mostly related to

higher recoveries in the previous quarter. NCOs in the BPNA segment

increased by $3.0 million, mostly due to higher mortgage NCOs. The

ratio of annualized net charge-offs to average non-covered loans

held-in-portfolio was 0.63%, flat from the second quarter of 2016.

The $7.1 million recovery from consumer loans reduced the NCO ratio

by 13 bps. Refer to Table J for further information on net

charge-offs and related ratios.

- The allowance for loan losses increased

by $7.5 million from the second quarter 2016 to $525.6 million,

mostly driven by the $9.4 million reserve increase related to the

annual recalibration of the environmental factors adjustment. The

general and specific reserves related to non-covered loans totaled

$396.5 million and $129.1 million, respectively, at quarter-end,

compared with $395.3 million and $122.8 million, respectively, as

of June 30, 2016. The ratio of the allowance for loan losses to

loans held-in-portfolio was 2.33% in the third quarter of 2016,

compared to 2.30% from the previous quarter.

- The ratio of the allowance for loan

losses to NPLs held-in-portfolio increased to 90.7%, compared to

89.7% in the previous quarter.

- The provision for loan losses for the

third quarter of 2016 amounted to $42.6 million, increasing by $2.9

million from the previous quarter. The provision to net charge-offs

ratio was 121.2% in the third quarter 2016, compared to 127.4% in

the previous quarter, excluding the recoveries related to the bulk

sale of Westernbank loans.

Non-Performing Assets (Unaudited)

(In thousands)

30-Sep-16 30-Jun-16 30-Sep-15 Total non-performing

loans held-in-portfolio, excluding covered loans $579,325 $577,739

$634,902 Non-performing loans held-for-sale - 39,544 47,681 Other

real estate owned (“OREO”), excluding covered OREO 184,828

177,025 155,826 Total non-performing assets,

excluding covered assets 764,153 794,308 838,409 Covered loans and

OREO 41,211 41,466 39,888 Total non-performing

assets $805,364 $835,774 $878,297 Net

charge-offs for the quarter (excluding covered loans)

$35,140 $35,401 $46,302 Ratios

(excluding covered loans):

Non-covered loans held-in-portfolio $22,595,972 $22,540,661

$22,498,066 Non-performing loans held-in-portfolio to loans

held-in-portfolio 2.56% 2.56% 2.82% Allowance for loan losses to

loans held-in-portfolio 2.33 2.30 2.38 Allowance for loan losses to

non-performing loans, excluding loans held-for-sale 90.73

89.68 84.42 Refer to Table H for additional

information.

Provision for Loan Losses

(Unaudited) Quarters ended Nine months ended

(In thousands) 30-Sep-16 30-Jun-16 30-Sep-15

30-Sep-16 30-Sep-15 Provision (reversal) for loan losses: BPPR

$36,281 $38,351 $68,755 $118,503 $161,197 BPNA 6,313

1,317 813 11,699 (1,450) Total provision for loan losses-

non-covered loans $42,594 $39,668 $69,568

$130,202 $159,747 Provision (reversal) for loan losses -

covered loans 750 804 (2,890) (1,551) 23,200

Total provision for loan losses $43,344 $40,472

$66,678 $128,651 $182,947

Credit Quality by Segment

(Unaudited) (In thousands) Quarters ended

BPPR

30-Sep-16

30-Jun-16 30-Sep-15 Provision for loan losses $36,281

$38,351 $68,755 Net charge-offs 32,959 36,222 47,245 Total

non-performing loans held-in-portfolio, excluding covered loans

551,238 550,632 609,469 Allowance / non-covered loans

held-in-portfolio 2.80% 2.77% 2.83%

Quarters ended

BPNA 30-Sep-16 30-Jun-16

30-Sep-15 Provision for loan losses $6,313 $1,317 $813 Net

charge-offs (recoveries) 2,181 (821) (943) Total non-performing

loans held-in-portfolio 28,087 27,107 25,433 Allowance /

non-covered loans held-in-portfolio 0.78% 0.72%

0.68%

Financial Condition Highlights

(Unaudited) (In

thousands) 30-Sep-16 30-Jun-16 30-Sep-15 Money

market, trading and investment securities $11,931,499 $10,368,794

$8,321,397 Loans not covered under loss-sharing agreements with the

FDIC 22,595,972 22,540,661 22,498,066 Loans covered under

loss-sharing agreements with the FDIC 588,211 607,170 665,428 Total

assets 39,054,296 37,606,148 35,522,462 Deposits 30,327,045

28,737,856 26,713,206 Borrowings 2,364,984 2,428,752 2,753,144

Liabilities from discontinued operations 1,815 1,815 1,800 Total

liabilities 33,673,901 32,246,317 30,472,826 Stockholders’ equity

5,380,395 5,359,831 5,049,636

Total assets increased by $1.4 billion from the second quarter

of 2016 driven by:

- An increase of $1.2 billion in money

market investments mainly at BPPR due to an increase in cash

balances from deposits;

- An increase of $0.4 billion in

investment securities available-for-sale mainly at BPNA due to

purchases of mortgage-backed agency pools, partially offset by

sales and principal pay-downs; and

- A net increase of $58.5 million in

non-covered loans held-in-portfolio mainly driven by growth in the

commercial portfolio at BPNA by $138.4 million, partially offset by

a decrease in mortgage loans portfolio at BPPR of $73.7 million

impacted by lower originations of residential mortgages.

These positive variances were partially offset by a decrease of

$61.6 million in the FDIC loss-share asset due mainly to the $54.9

million charge related to review board’s denial of BPPR’s claim in

connection with arbitration proceedings with the FDIC.

Total liabilities increased by $1.4 billion from the first

quarter of 2016, principally driven by:

- An increase of $1.6 billion in deposits

mainly due to increases in deposits from the Puerto Rico

government, NOW accounts, and non-interest bearing demand deposits

at BPPR. Refer to Table G for additional information on

deposits.

Stockholders’ equity increased by approximately $20.6 million

from the second quarter of 2016, mainly as a result of net income

for the quarter of $46.8 million, partially offset by an

unfavorable variance of $14.4 million in unrealized gains on

securities available-for-sale, declared dividends of $15.6 million

on common stock and $0.9 million in dividends on preferred

stock.

Common equity tier-1 ratio (“CET1”), book value per share and

tangible book value per share were 16.64%, $51.85 and $44.86,

respectively at September 30, 2016 compared to 16.29%, $51.68 and

$44.62 at June 30, 2016. Refer to Table A for capital ratios.

Forward-Looking

Statements

The information contained in this news release contains

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements are based on management’s current expectations and are

subject to risks and uncertainties. Please refer to our Annual

Report on Form 10-K for the year ended December 31, 2015, the

Quarterly Reports on Form 10-Q for the quarters ended March 31,

2016 and June 30, 2016, and our other filings with the Securities

and Exchange Commission for a discussion of factors that may cause

the Corporation's actual results to differ materially from any

future results expressed or implied by such forward-looking

statements. Those filings are available on the Corporation’s

website (www.popular.com) and on the Securities and Exchange

Commission website (www.SEC.gov). The Corporation does not

undertake to update or revise any forward-looking statement to

reflect events or circumstances that may arise after the date of

such statements.

Founded in 1893, Popular, Inc. is the leading banking

institution by both assets and deposits in Puerto Rico and ranks

among the top 50 U.S. banks by assets. Popular provides retail,

mortgage and commercial banking services through its principal

banking subsidiary, Banco Popular de Puerto Rico, as well as auto

and equipment leasing and financing, investment banking,

broker-dealer and insurance services through specialized

subsidiaries. In the United States, Popular has established a

community-banking franchise providing a broad range of financial

services and products with branches in New York, New Jersey and

Florida under the name of Popular Community Bank.

An electronic version of this press release can be found at the

Corporation’s website: www.popular.com.

Popular will hold a conference call to discuss the financial

results today Tuesday, October 25, 2016 at 11:00 a.m. Eastern Time.

The call will be broadcast live over the Internet and can be

accessed through the investor relations section of the

Corporation’s website: www.popular.com.

Listeners are recommended to go to the website at least 15

minutes prior to the call to download and install any necessary

audio software. The call may also be accessed through a dial-in

telephone number 1-866-235-1201 or 1-412-902-4127.

A replay of the webcast will be archived in Popular’s website. A

telephone replay will be available one hour after the end of the

conference call through Thursday, November 24, 2016. The replay

dial in is 1-877-344-7529 or 1-412-317-0088. The replay passcode is

10093046.

Popular, Inc. Financial Supplement to Third Quarter 2016

Earnings Release Table A - Selected Ratios and Other

Information Table B - Consolidated Statement of Operations

Table C - Consolidated Statement of Financial Condition

Table D - Consolidated Average Balances and Yield / Rate

Analysis - QUARTER Table E - Consolidated Average Balances

and Yield / Rate Analysis - YEAR-TO-DATE Table F - Mortgage

Banking Activities and Other Service Fees Table G - Loans

and Deposits Table H - Non-Performing Assets Table I

- Activity in Non-Performing Loans Table J - Allowance for

Credit Losses, Net Charge-offs and Related Ratios Table K -

Allowance for Loan Losses - Breakdown of General and Specific

Reserves - CONSOLIDATED Table L - Allowance for Loan Losses

- Breakdown of General and Specific Reserves - PUERTO RICO

OPERATIONS Table M - Allowance for Loan Losses - Breakdown

of General and Specific Reserves - U.S. MAINLAND OPERATIONS

Table N - Reconciliation to GAAP Financial Measures Table O

- Financial Information - Westernbank Loans

POPULAR, INC.

Financial Supplement to Third Quarter 2016 Earnings Release

Table A - Selected Ratios and Other Information

(Unaudited)

Quarters ended Nine months ended

30-Sep-16 30-Jun-16 30-Sep-15

30-Sep-16 30-Sep-15 Basic EPS from continuing operations

$0.44 $0.85 $0.82 $2.11 $7.33 Basic EPS from discontinued

operations $- $- $- $- $0.01 Total Basic EPS $0.44 $0.85 $0.82

$2.11 $7.34 Diluted EPS from continuing operations $0.44 $0.85

$0.82 $2.11 $7.31 Diluted EPS from discontinued operations $- $- $-

$- $0.01 Total Diluted EPS $0.44 $0.85 $0.82 $2.11 $7.32 Average

common shares outstanding 103,296,443 103,245,717 102,969,214

103,243,851 102,923,018 Average common shares outstanding -

assuming dilution 103,465,385 103,343,486 103,150,482 103,383,949

103,137,762 Common shares outstanding at end of period 103,762,596

103,703,041 103,556,285 103,762,596 103,556,285 Market value

per common share $38.22 $29.30 $30.23 $38.22 $30.23 Market

capitalization - (In millions) $3,966 $3,038 $3,131 $3,966 $3,131

Return on average assets 0.49% 0.96% 0.95% 0.79% 2.89% . .

Return on average common equity 3.46% 6.80% 6.79% 5.59% 22.29%

Net interest margin 4.12% 4.33% 4.39% 4.29% 4.50%

Common equity per share $51.37 $51.20 $48.28 $51.37 $48.28

Book value per share $51.85 $51.68 $48.76 $51.85 $48.76

Tangible common book value per common share (non-GAAP) $44.86

$44.62 $42.71 $44.86 $42.71 Tangible common equity to

tangible assets (non-GAAP) 12.13% 12.53% 12.66% 12.13% 12.66%

Tier 1 capital

16.64%

16.29% 16.21%

16.64%

16.21% Total capital

19.65%

19.29% 18.78%

19.65%

18.78% Tier 1 leverage

11.21%

11.29% 11.75%

11.21%

11.75% Common Equity Tier 1 capital

16.64%

16.29% 16.21%

16.64%

16.21%

POPULAR, INC. Financial Supplement to Third

Quarter 2016 Earnings Release Table B - Consolidated

Statement of Operations (Unaudited)

Quarters ended Variance Quarter ended Variance

Nine months ended

Q3 2016

Q3 2016

(In thousands, except per share information)

30-Sep-16 30-Jun-16

vs. Q2 2016

30-Sep-15

vs. Q3 2015

30-Sep-16 30-Sep-15 Interest income: Loans $363,550

$369,721 $(6,171) $364,458 $(908) $1,096,468 $1,094,222 Money

market investments 4,568 3,889 679 2,003 2,565 11,320 5,294

Investment securities 37,732 36,725 1,007 31,671 6,061 110,728

93,269 Trading account securities 1,449 1,875

(426) 3,150 (1,701) 5,013 8,872

Total interest income 407,299 412,210

(4,911) 401,282 6,017 1,223,529

1,201,657 Interest expense: Deposits 32,362 30,599 1,763 28,357

4,005 92,835 80,479 Short-term borrowings 2,132 2,058 74 2,222 (90)

6,051 5,819 Long-term debt 19,118 19,002

116 19,968 (850) 57,993 58,876

Total interest expense 53,612 51,659

1,953 50,547 3,065 156,879 145,174 Net

interest income 353,687 360,551 (6,864) 350,735 2,952 1,066,650

1,056,483 Provision for loan losses - non-covered loans 42,594

39,668 2,926 69,568 (26,974) 130,202 159,747 Provision (reversal)

for loan losses - covered loans 750 804 (54)

(2,890) 3,640 (1,551) 23,200 Net

interest income after provision for loan losses 310,343

320,079 (9,736) 284,057 26,286

937,999 873,536 Service charges on deposit accounts 40,776

40,296 480 40,960 (184) 120,934 120,115 Other service fees 59,169

56,945 2,224 56,115 3,054 169,496 169,162 Mortgage banking

activities 15,272 16,227 (955) 24,195 (8,923) 42,050 58,372 Net

gain and valuation adjustments on investment securities 349 1,583

(1,234) 136 213 1,932 141 Other-than-temporary impairment losses on

investment securities - (209) 209 - - (209) (14,445) Trading

account (loss) profit (113) 1,117 (1,230) (398) 285 842 (3,092) Net

gain on sale of loans, including valuation adjustments on loans

held-for-sale 8,549 - 8,549 - 8,549 8,245 602 Adjustments (expense)

to indemnity reserves on loans sold (4,390) (5,746) 1,356 (5,874)

1,484 (14,234) (9,981) FDIC loss-share (expense) income (61,723)

(12,576) (49,147) 1,207 (62,930) (77,445) 24,421 Other operating

income 18,089 12,866 5,223 14,768

3,321 46,500 41,808 Total non-interest

income 75,978 110,503 (34,525) 131,109

(55,131) 298,111 387,103 Operating expenses:

Personnel costs Salaries 77,770 75,792 1,978 78,193 (423) 230,860

227,040 Commissions, incentives and other bonuses 18,528 16,982

1,546 18,618 (90) 56,279 61,290 Pension, postretirement and medical

insurance 13,413 12,279 1,134 12,578 835 38,803 33,666 Other

personnel costs, including payroll taxes 11,513

11,655 (142) 11,474 39 39,081

36,302 Total personnel costs 121,224 116,708 4,516 120,863 361

365,023 358,298 Net occupancy expenses 21,626 21,714 (88) 21,277

349 63,770 66,272 Equipment expenses 15,922 15,261 661 14,739 1,183

45,731 44,075 Other taxes 11,324 10,170 1,154 9,951 1,373 31,689

29,638 Professional fees Collections, appraisals and other credit

related fees 4,005 4,974 (969) 5,049 (1,044) 13,479 18,660

Programming, processing and other technology services 52,174 50,232

1,942 49,134 3,040 152,270 143,700 Legal fees, excluding

collections 11,428 10,009 1,419 6,624 4,804 27,691 19,401

Other professional fees 13,659 15,410 (1,751)

16,347 (2,688) 43,910 49,370 Total

professional fees 81,266 80,625 641 77,154 4,112 237,350 231,131

Communications 5,785 6,012 (227) 6,058 (273) 18,117 18,387 Business

promotion 12,726 13,705 (979) 12,325 401 37,541 36,914 FDIC deposit

insurance 5,854 5,362 492 7,300 (1,446) 18,586 22,240 Other real

estate owned (OREO) expenses 11,295 12,980 (1,685) 7,686 3,609

33,416 75,571 Credit and debit card processing, volume, interchange

and other expenses 3,640 6,617 (2,977) 6,449 (2,809) 15,979 17,032

Other operating expenses Operational losses 19,609 7,146 12,463

9,648 9,961 29,416 15,572 All other 6,503

9,752 (3,249) 9,454 (2,951) 25,037

41,377 Total other operating expenses 26,112 16,898 9,214

19,102 7,010 54,453 56,949 Amortization of intangibles 3,097 3,097

- 3,512 (415) 9,308 8,497 Goodwill impairment charge 3,801 - 3,801

- 3,801 3,801 - Restructuring costs - - -

481 (481) - 17,408 Total

operating expenses 323,672 309,149 14,523

306,897 16,775 934,764 982,412 Income

from continuing operations before income tax 62,649 121,433

(58,784) 108,269 (45,620) 301,346 278,227 Income tax expense

(benefit) 15,839 32,446 (16,607) 22,620

(6,781) 80,550 (478,344) Income from

continuing operations 46,810 88,987 (42,177) 85,649 (38,839)

220,796 756,571 (Loss) income from discontinued operations, net of

tax - - - (9) 9 -

1,347

Net income $46,810 $88,987

$(42,177) $85,640 $(38,830) $220,796

$757,918

Net income applicable to common stock

$45,880 $88,056 $(42,176) $84,709

$(38,829) $218,004 $755,126

Net income per common

share - basic: Net income from continuing operations $0.44

$0.85 $(0.41) $0.82 $(0.38) $2.11 $7.33 Net income from

discontinued operations - - - -

- - 0.01 Net income per common share - basic

$0.44 $0.85 $(0.41) $0.82

$(0.38) $2.11 $7.34

Net income per common share -

diluted: Net income from continuing operations $0.44 $0.85

$(0.41) $0.82 $(0.38) $2.11 $7.31 Net income from

discontinued operations - - - -

- - 0.01 Net income per common share - diluted

$0.44 $0.85 $(0.41) $0.82

$(0.38) $2.11 $7.32

Dividends Declared per Common

Share $0.15 $0.15 $- $0.15

$- $0.45 $0.15

Popular, Inc. Financial

Supplement to Third Quarter 2016 Earnings Release Table C -

Consolidated Statement of Financial Condition

(Unaudited)

Variance Q3 2016 vs. (In thousands) 30-Sep-16

30-Jun-16 30-Sep-15 Q2 2016 Assets: Cash and due from

banks $350,545 $365,308 $320,555 $(14,763) Money market investments

3,963,495 2,785,500 2,408,571 1,177,995 Trading account securities,

at fair value 72,584 72,530 137,943 54 Investment securities

available-for-sale, at fair value 7,628,656 7,242,676 5,500,931

385,980 Investment securities held-to-maturity, at amortized cost

97,973 99,525 100,295 (1,552) Other investment securities, at lower

of cost or realizable value 168,791 168,563 173,657 228 Loans

held-for-sale, at lower of cost or fair value 72,076 122,338

171,019 (50,262) Loans held-in-portfolio: Loans not covered under

loss-sharing agreements with the FDIC 22,714,358 22,655,877

22,601,271 58,481 Loans covered under loss-sharing agreements with

the FDIC 588,211 607,170 665,428 (18,959) Less: Unearned income

118,386 115,216 103,205 3,170 Allowance for loan

losses 555,855 548,720 570,514 7,135

Total loans held-in-portfolio, net 22,628,328

22,599,111 22,592,980 29,217 FDIC loss-share

asset 152,467 214,029 311,946 (61,562) Premises and equipment, net

537,975 535,865 495,103 2,110 Other real estate not covered under

loss-sharing agreements with the FDIC 184,828 177,025 155,826 7,803

Other real estate covered under loss-sharing agreements with the

FDIC 37,414 37,984 35,701 (570) Accrued income receivable 119,691

120,979 118,044 (1,288) Mortgage servicing assets, at fair value

200,354 203,577 210,851 (3,223) Other assets 2,163,939 2,179,060

2,212,722 (15,121) Goodwill 627,294 631,095 504,925 (3,801) Other

intangible assets 47,886 50,983 71,393

(3,097) Total assets $39,054,296 $37,606,148

$35,522,462 $1,448,148 Liabilities and Stockholders’ Equity:

Liabilities: Deposits: Non-interest bearing $6,950,287 $6,531,108

$6,070,719 $419,179 Interest bearing

23,376,758 22,206,748 20,642,487 1,170,010

Total deposits 30,327,045 28,737,856

26,713,206 1,589,189 Federal funds purchased and

assets sold under agreements to repurchase 765,251 821,604

1,085,765 (56,353) Other short-term borrowings 1,200 31,200 1,200

(30,000) Notes payable 1,598,533 1,575,948 1,666,179 22,585 Other

liabilities 980,057 1,077,894 1,004,676 (97,837) Liabilities from

discontinued operations 1,815 1,815 1,800

- Total liabilities 33,673,901 32,246,317

30,472,826 1,427,584 Stockholders’ equity: Preferred

stock 50,160 50,160 50,160 - Common stock 1,040 1,039 1,037 1

Surplus 4,234,842 4,232,835 4,200,805 2,007 Retained earnings

1,259,295 1,228,979 993,309 30,316 Treasury stock (7,647) (7,570)

(5,869) (77) Accumulated other comprehensive loss (157,295)

(145,612) (189,806) (11,683)

Total stockholders’ equity 5,380,395 5,359,831

5,049,636 20,564 Total liabilities and stockholders’ equity

$39,054,296 $37,606,148 $35,522,462

$1,448,148

Popular, Inc. Financial Supplement to Third

Quarter 2016 Earnings Release Table D - Consolidated Average

Balances and Yield / Rate Analysis - QUARTER (Unaudited)

Quarter ended Quarter ended Quarter

ended Variance Variance 30-Sep-16 30-Jun-16 30-Sep-15 Q3 2016 vs.

Q2 2016 Q3 2016 vs. Q3 2015 ($ amounts in millions; yields not

on a taxable Average Income /

Yield /

Average Income /

Yield /

Average Income /

Yield /

Average Income /

Yield /

Average Income /

Yield /

equivalent basis) balance Expense Rate balance

Expense Rate balance Expense Rate

balance Expense Rate balance Expense

Rate Assets: Interest earning assets: Money market, trading

and investment securities $11,159 $43.7 1.57 %

$10,286 $42.5 1.65 % $8,667 $36.8 1.70

% $873 $1.2 (0.08) % $2,492 $6.9 (0.13)

% Loans not covered under loss-sharing agreements with the FDIC:

Commercial 9,269 113.8 4.88 9,150 110.9 4.88 8,769 109.6 4.96 119

2.9 - 500 4.2 (0.08) Construction 739 10.1 5.44 723 9.7 5.43 681

10.8 6.30 16 0.4 0.01 58 (0.7) (0.86) Mortgage 6,637 88.3 5.32

6,743 88.9 5.27 7,072 88.8 5.02 (106) (0.6) 0.05 (435) (0.5) 0.30

Consumer 3,847 99.3 10.27 3,865 99.4 10.34 3,811 97.2 10.12 (18)

(0.1) (0.07) 36 2.1 0.15 Lease financing 669 11.2

6.72 651 11.0 6.73 594 10.0 6.75 18

0.2 (0.01) 75 1.2 (0.03) Total loans

(excluding WB loans) 21,161 322.7 6.08 21,132 319.9 6.08 20,927

316.4 6.02 29 2.8 - 234 6.3 0.06 WB loans 1,881 40.9

8.65 2,013 49.8 9.94 2,221 48.0 8.59

(132) (8.9) (1.29) (340) (7.1)

0.06 Total loans 23,042 363.6 6.29 23,145

369.7 6.41 23,148 364.4 6.26 (103)

(6.1) (0.12) (106) (0.8) 0.03 Total

interest earning assets 34,201 $407.3 4.75 % 33,431

$412.2 4.95 % 31,815 $401.2 5.02 % 770

($4.9) (0.20) % 2,386 $6.1 (0.27) %

Allowance for loan losses (553) (539) (559) (14) 6 Other

non-interest earning assets 4,443 4,479 4,584 (36) (141) Total

average assets $38,091 $37,371 $35,840 $720 $2,251

Liabilities and Stockholders' Equity: Interest bearing deposits:

NOW and money market $7,326 $7.0 0.38 % $7,023 $6.6 0.38 % $5,742

$4.9 0.34 % $303 $0.4 - % $1,584 $2.1 0.04 % Savings 7,550 4.6 0.24

7,487 4.4 0.24 7,055 4.1 0.23 63 0.2 - 495 0.5 0.01 Time deposits

7,859 20.7 1.05 7,866 19.6 1.00 8,158

19.4 0.94 (7) 1.1 0.05 (299) 1.3

0.11 Total interest bearing deposits 22,735 32.3 0.57 22,376

30.6 0.55 20,955 28.4 0.54 359 1.7 0.02 1,780 3.9 0.03 Borrowings

2,398 21.3 3.55 2,307 21.0 3.67 2,861

22.1 3.09 91 0.3 (0.12)

(463)

(0.8) 0.46 Total interest bearing liabilities 25,133

53.6 0.85 24,683 51.6 0.84 23,816

50.5 0.84 450 2.0 0.01 1,317 3.1

0.01 Net interest spread 3.90 % 4.11 % 4.18 % (0.21) %

(0.28) % Non-interest bearing deposits 6,676 6,481 6,144 195 532

Other liabilities 955 943 876 12 79 Liabilities from discontinued

operations 2 2 2 - - Stockholders' equity 5,325 5,262 5,002 63 323

Total average liabilities and stockholders' equity $38,091 $37,371

$35,840 $720 $2,251 Net interest income / margin non-taxable

equivalent basis $353.7 4.12 % $360.6 4.33 % $350.7

4.39 % ($6.9) (0.21) % $3.0 (0.27) %

Popular, Inc. Financial Supplement to Third Quarter 2016

Earnings Release Table E - Consolidated Average Balances and

Yield / Rate Analysis - YEAR-TO-DATE (Unaudited)

Nine months

ended Nine months ended 30-Sep-16 30-Sep-15 Variance Average Income

/ Yield / Average Income / Yield / Average Income / Yield / ($

amounts in millions; yields not on a taxable equivalent basis)

balance Expense Rate balance Expense

Rate balance Expense Rate Assets: Interest

earning assets: Money market, trading and investment securities

$10,136 $127.0 1.67 % $8,340 $107.4

1.72 % $1,796 $19.6 (0.05) % Loans not covered under

loss-sharing agreements with the FDIC: Commercial 9,126 335.3 4.91

8,627 318.5 4.93 499 16.8 (0.02) Construction 722 29.1 5.39 600

27.1 6.05 122 2.0 (0.66) Mortgage 6,736 266.9 5.28 6,989 267.9 5.11

(253) (1.0) 0.17 Consumer 3,839 296.7 10.32 3,826 289.8 10.13 13

6.9 0.19 Lease financing 650 32.9 6.74 582

30.1 6.89 68 2.8 (0.15) Total loans (excluding

WB loans) 21,073 960.9 6.09 20,624 933.4 6.05 449 27.5 0.04 WB

loans 1,984 135.6 9.12 2,392 160.9 8.99

(408) (25.3) 0.13 Total loans 23,057 1,096.5

6.35 23,016 1,094.3 6.35 41 2.2

- Total interest earning assets 33,193 $1,223.5 4.92

% 31,356 $1,201.7 5.12 % 1,837 $21.8

(0.20) % Allowance for loan losses (542) (589) 47 Other

non-interest earning assets 4,469 4,288 181 Total average assets

$37,120 $35,055 $2,065 Liabilities and Stockholders' Equity:

Interest bearing deposits: NOW and money market $6,689 $19.2 0.38 %

$5,413 $14.0 0.35 % $1,276 $5.2 0.03 % Savings 7,438 13.3 0.24

6,996 12.1 0.23 442 1.2 0.01 Time deposits 7,928 60.3

1.02 8,146 54.4 0.89 (218) 5.9 0.13

Total interest bearing deposits 22,055 92.8 0.56 20,555 80.5 0.52

1,500 12.3 0.04 Borrowings 2,382 64.0 3.59 2,865

64.7 3.01 (483) (0.7) 0.58 Total

interest bearing liabilities 24,437 156.8 0.86 23,420

145.2 0.83 1,017 11.6 0.03 Net interest

spread 4.06 % 4.29 % (0.23) % Non-interest bearing deposits 6,484

6,113 371 Other liabilities 937 942 (5) Liabilities from

discontinued operations 2 2 - Stockholders' equity 5,260 4,578 682

Total average liabilities and stockholders' equity $37,120 $35,055

$2,065 Net interest income / margin non-taxable equivalent

basis $1,066.7 4.29 % $1,056.5 4.50 % $10.2

(0.21) %

Popular, Inc.

Financial Supplement to Third Quarter 2016

Earnings Release Table F - Mortgage Banking Activities and

Other Service Fees (Unaudited) Mortgage

Banking Activities Variance Quarters ended Q3 2016 vs. Q3 2016

vs. Nine months ended Variance (In thousands) 30-Sep-16

30-Jun-16 30-Sep-15 Q2 2016 Q3 2015

30-Sep-16 30-Sep-15 2016 vs. 2015 Mortgage

servicing fees, net of fair value adjustments: Mortgage servicing

fees $14,520 $14,675 $17,020 $(155) $(2,500) $43,997 $43,957 $40

Mortgage servicing rights fair value adjustments

(6,062) (4,340) 1,038 (1,722) (7,100)

(18,879) (5,808) (13,071) Total mortgage

servicing fees, net of fair value adjustments 8,458

10,335 18,058 (1,877) (9,600) 25,118

38,149 (13,031) Net gain on sale of loans, including

valuation on loans held-for-sale 8,857 8,474

9,698 383 (841) 24,441 24,999

(558) Trading account (loss) profit: Unrealized (losses) gains on

outstanding derivative positions 95 (59) (69) 154 164 (44) (10)

(34) Realized (losses) gains on closed derivative positions

(2,138) (2,523) (3,492) 385

1,354 (7,465) (4,766) (2,699) Total trading

account (loss) profit (2,043) (2,582) (3,561)

539 1,518 (7,509) (4,776)

(2,733) Total mortgage banking activities $15,272

$16,227 $24,195 $(955) $(8,923) $42,050

$58,372 $(16,322)

Other Service Fees Variance

Quarters ended Q3 2016 vs. Q3 2016 vs. Nine months ended Variance

(In thousands) 30-Sep-16 30-Jun-16 30-Sep-15

Q2 2016 Q3 2015 30-Sep-16 30-Sep-15

2016 vs. 2015 Other service fees: Debit card fees $11,483

$11,382 $11,288 $101 $195 $34,153 $34,408 $(255) Insurance fees

15,943 13,885 14,517 2,058 1,426 42,678 40,163 2,515 Credit card

fees 17,644 17,700 16,879 (56) 765 52,202 50,639 1,563 Sale and

administration of investment products 5,542 5,417 5,737 125 (195)

15,798 18,269 (2,471) Trust fees 4,968 4,827 4,403 141 565 14,029

13,919 110 Other fees 3,589 3,734 3,291

(145) 298 10,636 11,764 (1,128)

Total other service fees $59,169 $56,945

$56,115 $2,224 $3,054 $169,496 $169,162

$334

Popular, Inc.

Financial Supplement to Third Quarter 2016 Earnings Release

Table G - Loans and Deposits (Unaudited)

Loans - Ending Balances Variance Q3 2016 vs.

Q3 2016 vs.

(In thousands) 30-Sep-16 30-Jun-16 30-Sep-15

Q2 2016

Q3 2015

Loans not covered under FDIC loss-sharing agreements: Commercial

$10,537,191 $10,359,815 $10,130,424 $177,376 $406,767 Construction

731,352 717,332 692,492 14,020 38,860 Legacy [1] 47,914 49,709

67,974 (1,795) (20,060) Lease financing 682,810 664,094 606,927

18,716 75,883 Mortgage 6,774,497 6,864,118 7,165,479 (89,621)

(390,982) Consumer 3,822,208 3,885,593

3,834,770 (63,385) (12,562) Total non-covered loans

held-in-portfolio $22,595,972 $22,540,661 $22,498,066 $55,311

$97,906 Loans covered under FDIC loss-sharing agreements

588,211 607,170 665,428 (18,959)

(77,217) Total loans held-in-portfolio $23,184,183

$23,147,831 $23,163,494 $36,352 $20,689 Loans

held-for-sale: Commercial $- $39,544 $47,447 $(39,544) $(47,447)

Construction - - 10 - (10) Mortgage 72,076 82,794

123,562 (10,718) (51,486) Total loans

held-for-sale $72,076 $122,338 $171,019

$(50,262) $(98,943) Total loans $23,256,259

$23,270,169 $23,334,513 $(13,910) $(78,254)

[1] The legacy portfolio is comprised of commercial loans,

construction loans and lease financings related to certain lending

products exited by the Corporation as part of restructuring efforts

carried out in prior years at the BPNA segment.

Deposits -

Ending Balances Variance Q3 2016 vs.

Q3 2016 vs.

(In thousands) 30-Sep-16 30-Jun-16 30-Sep-15

Q2 2016

Q3 2015

Demand deposits [1] $9,161,839 $8,106,291 $7,027,672 $1,055,548

$2,134,167 Savings, NOW and money market deposits (non-brokered)

12,872,072 12,289,793 11,178,357 582,279 1,693,715 Savings, NOW and

money market deposits (brokered) 391,128 387,026 405,903 4,102

(14,775) Time deposits (non-brokered) 7,619,232 7,570,673 6,870,816

48,559 748,416 Time deposits (brokered CDs) 282,774

384,073 1,230,458 (101,299) (947,684) Total

deposits $30,327,045 $28,737,856 $26,713,206

$1,589,189 $3,613,839 [1] Includes interest and

non-interest bearing demand deposits.

Popular, Inc. Financial

Supplement to Third Quarter 2016 Earnings Release Table H -

Non-Performing Assets (Unaudited) Variance As a %

of As a % of As a % of

loans HIP by

loans HIP by

loans HIP by

Q3 2016 vs.

Q3 2016 vs.

(Dollars in thousands) 30-Sep-16 category 30-Jun-16

category 30-Sep-15 category

Q2 2016

Q3 2015

Non-accrual loans: Commercial $170,571 1.6 % $175,615 1.7 %

$239,397 2.4 % $(5,044) $(68,826) Construction - - 2,523 0.4 3,605

0.5 (2,523) (3,605) Legacy [1] 3,450 7.2 3,839 7.7 4,059 6.0 (389)

(609) Lease financing 2,878 0.4 3,019 0.5 3,091 0.5 (141) (213)

Mortgage 345,776 5.1 338,048 4.9 343,410 4.8 7,728 2,366 Consumer

56,650 1.5 54,695 1.4 41,340 1.1 1,955

15,310 Total non-performing loans held-in- portfolio,

excluding covered loans 579,325 2.6 % 577,739 2.6 % 634,902 2.8 %

1,586 (55,577) Non-performing loans held-for-sale [2] - 39,544

47,681 (39,544) (47,681) Other real estate owned (“OREO”),

excluding covered OREO 184,828 177,025

155,826 7,803 29,002 Total

non-performing assets, excluding covered assets 764,153 794,308

838,409 (30,155) (74,256) Covered loans and OREO 41,211

41,466 39,888 (255)

1,323 Total non-performing assets $805,364

$835,774 $878,297 $(30,410)

$(72,933) Accruing loans past due 90 days or more [3]

$418,652 $413,319 $443,497

$5,333 $(24,845)

Ratios excluding covered

loans: Non-performing loans held-in-portfolio to loans

held-in-portfolio 2.56 % 2.56 % 2.82 % Allowance for loan losses to

loans held-in-portfolio 2.33 2.30 2.38 Allowance for loan losses to

non-performing loans, excluding loans held-for-sale 90.73

89.68 84.42

Ratios including covered loans: Non-performing assets

to total assets 2.06 % 2.22 % 2.47 % Non-performing loans

held-in-portfolio to loans held-in-portfolio 2.52 2.51 2.76

Allowance for loan losses to loans held-in-portfolio 2.40 2.37 2.46

Allowance for loan losses to non-performing loans, excluding loans

held-for-sale 95.32 94.41 89.97

[1] The legacy portfolio is

comprised of commercial loans, construction loans and lease

financings related to certain lending products exited by the

Corporation as part of restructuring efforts carried out in prior

years at the BPNA segment. [2] There were no non-performing loans

held-for-sale as of September 30, 2016 (June 30, 2016 - $40 million

in commercial loans; September 30, 2015 - $47 million in commercial

loans, $10 million in construction loans and $224 thousand in

mortgage loans.)

[3] It is the Corporation’s policy to

report delinquent residential mortgage loans insured by FHA or

guaranteed by the VA as accruing loans past due 90 days or more as

opposed to non-performing since the principal repayment is insured.

These balances include $174 million of residential mortgage loans

insured by FHA or guaranteed by the VA that are no longer accruing

interest as of September 30, 2016 (June 30, 2016 - $149 million;

September 30, 2015 - $159 million). Furthermore, the Corporation

has approximately $72 million in reverse mortgage loans which are

guaranteed by FHA, but which are currently not accruing interest.

Due to the guaranteed nature of the loans, it is the Corporation's

policy to exclude these balances from non-performing assets (June

30, 2016 - $63 million; September 30, 2015 - $71 million).

Popular, Inc. Financial Supplement to Third Quarter 2016

Earnings Release Table I - Activity in Non-Performing

Loans (Unaudited)

Commercial loans held-in-portfolio: Quarter

ended Quarter ended 30-Sep-16 30-Jun-16 (In thousands) BPPR

BPNA Popular, Inc. BPPR BPNA

Popular, Inc. Beginning balance NPLs $172,584 $3,031 $175,615

$182,639 $14,992 $197,631 Plus: New non-performing loans 12,520

1,609 14,129 26,029 2,254 28,283 Advances on existing

non-performing loans - 164 164 - 8 8 Reclassification from

construction loans to commercial loans 2,436 - 2,436 - - - Less:

Non-performing loans transferred to OREO (2,223) - (2,223) (1,815)

- (1,815) Non-performing loans charged-off (7,918) (141) (8,059)

(15,219) (254) (15,473) Loans returned to accrual status / loan

collections (10,352) (1,139) (11,491)

(19,050) (13,969) (33,019) Ending balance NPLs

$167,047 $3,524 $170,571 $172,584

$3,031 $175,615

Construction loans

held-in-portfolio: Quarter ended Quarter ended 30-Sep-16

30-Jun-16 (In thousands) BPPR BPNA Popular,

Inc. BPPR BPNA Popular, Inc. Beginning balance

NPLs $2,423 $100 $2,523 $3,270 $671 $3,941 Plus: New non-performing

loans 1,150 - 1,150 186 - 186 Less: Non-performing loans

charged-off (985) - (985) (8) - (8) Loans returned to accrual

status / loan collections (152) (100) (252) (1,025) (571) (1,596)

Reclassification from construction loans to commercial loans

(2,436) - (2,436) - - - Ending

balance NPLs $- $- $- $2,423

$100 $2,523

Mortgage loans held-in-portfolio:

Quarter ended Quarter ended 30-Sep-16 30-Jun-16 (In thousands)

BPPR BPNA Popular, Inc. BPPR

BPNA Popular, Inc. Beginning balance NPLs $323,658 $14,390

$338,048 $322,838 $12,069 $334,907 Plus: New non-performing loans

87,340 6,715 94,055 79,688 6,532 86,220 Less: Non-performing loans

transferred to OREO (14,398) (384) (14,782) (12,521) (445) (12,966)

Non-performing loans charged-off (9,481) (1,994) (11,475) (10,648)

(130) (10,778) Loans returned to accrual status / loan collections

(55,773) (4,297) (60,070) (55,699)

(3,636) (59,335) Ending balance NPLs $331,346

$14,430 $345,776 $323,658 $14,390

$338,048

Legacy loans held-in-portfolio: Quarter ended Quarter ended

30-Sep-16 30-Jun-16 (In thousands) BPPR BPNA

Popular, Inc. BPPR BPNA Popular, Inc.

Beginning balance NPLs $- $3,839 $3,839 $- $4,046 $4,046 Plus: New

non-performing loans - 45 45 - 552 552 Advances on existing

non-performing loans - 135 135 - - - Less: Non-performing loans

transferred to OREO - (44) (44) - - - Non-performing loans

charged-off - (146) (146) - (54) (54) Loans returned to accrual

status / loan collections - (379) (379)

- (705) (705) Ending balance NPLs $-

$3,450 $3,450 $- $3,839 $3,839

Total non-performing loans held-in-portfolio (excluding consumer

and covered loans): Quarter ended Quarter ended 30-Sep-16

30-Jun-16 (In thousands) BPPR BPNA

Popular, Inc. BPPR BPNA Popular, Inc.

Beginning balance NPLs $498,665 $21,360 $520,025 $508,747 $31,778

$540,525 Plus: New non-performing loans 101,010 8,369 109,379

105,903 9,338 115,241 Advances on existing non-performing loans -

299 299 - 8 8 Reclassification from construction loans to

commercial loans 2,436 - 2,436 - - - Less: Non-performing loans

transferred to OREO (16,621) (428) (17,049) (14,336) (445) (14,781)

Non-performing loans charged-off (18,384) (2,281) (20,665) (25,875)

(438) (26,313) Loans returned to accrual status / loan collections

(66,277) (5,915) (72,192) (75,774) (18,881) (94,655)

Reclassification from construction loans to commercial loans

(2,436) - (2,436) - - - Ending

balance NPLs $498,393 $21,404 $519,797

$498,665 $21,360 $520,025

Popular, Inc.

Financial Supplement to Third Quarter 2016 Earnings Release

Table J - Allowance for Credit Losses, Net Charge-offs and

Related Ratios (Unaudited)

Quarter ended Quarter ended Quarter ended

30-Sep-16 30-Jun-16 30-Sep-15

Non-covered

Covered Non-covered Covered

Non-covered

Covered (Dollars in thousands) loans loans

Total loans loans Total loans

loans Total Balance at beginning of period $518,139

$30,581 $548,720 $508,427 $30,045 $538,472 $512,739 $38,074

$550,813 Provision (reversal of provision) for loan losses

42,594 750 43,344 39,668 804

40,472 69,568 (2,890) 66,678

560,733 31,331 592,064 548,095

30,849 578,944 582,307 35,184 617,491

Net loans charged-off (recovered): BPPR Commercial 3,199 -

3,199 5,647 - 5,647 9,172 - 9,172 Construction 886 - 886 (3,226) -

(3,226) (2,648) - (2,648) Lease financing 816 - 816 434 - 434 894 -

894 Mortgage 15,237 661 15,898 13,464 699 14,163 15,524 601 16,125

Consumer 12,821 408 13,229 19,903

(431) 19,472 24,303 74 24,377

Total BPPR 32,959 1,069 34,028 36,222

268 36,490 47,245 675 47,920

BPNA Commercial (1,173) - (1,173) (1,265) - (1,265) (1,959)

- (1,959) Legacy [1] (520) - (520) (893) - (893) (603) - (603)

Mortgage 1,942 - 1,942 16 - 16 787 - 787 Consumer 1,932

- 1,932 1,321 - 1,321 832

- 832 Total BPNA 2,181 -

2,181 (821) - (821) (943) -

(943) Total loans charged-off - Popular, Inc.

35,140 1,069 36,209 35,401 268

35,669 46,302 675 46,977 Net

(write-downs) recoveries [2] - - -

5,445 - 5,445 - - -

Balance at end of period $525,593 $30,262

$555,855 $518,139 $30,581 $548,720

$536,005 $34,509 $570,514 POPULAR, INC.

Annualized net charge-offs to average loans held-in-portfolio 0.63

% 0.63 % 0.63 % 0.62 % 0.83 % 0.82 % Provision for loan losses to

net charge-offs [3] 1.21 x 1.20 x 1.27 x 1.29 x 1.50 x 1.42 x

BPPR Annualized net charge-offs to average loans

held-in-portfolio 0.77 % 0.77 % 0.83 % 0.81 % 1.07 % 1.04 %

Provision for loan losses to net charge-offs [3] 1.10 x 1.09 x 1.21

x 1.22 x 1.46 x 1.37 x BPNA Annualized net charge-offs

(recoveries) to average loans held-in-portfolio 0.17 % (0.06) %

(0.08) % Provision for loan losses to net charge-offs (recoveries)

2.89

(1.60) N.M. [1] The

legacy portfolio is comprised of commercial loans, construction

loans and lease financings related to certain lending products

exited by the Corporation as part of restructuring efforts carried

out in prior years at the BPNA segment. [2] Net write-downs are

related to loans sold or reclassified to held-for-sale. [3]

Excluding provision for loan losses and net (write-downs)

recoveries related to loans sold or reclassified to held-for-sale.

N.M. - Not meaningful.

Popular, Inc. Financial Supplement

to Third Quarter 2016 Earnings Release Table K - Allowance

for Loan Losses - Breakdown of General and Specific Reserves -

CONSOLIDATED (Unaudited)

30-Sep-16 Lease (Dollars in

thousands) Commercial Construction

Legacy [2] Mortgage financing Consumer

Total [3]

Specific ALLL $58,527 $- $- $45,557 $540 $24,433 $129,057 Impaired

loans [1] $328,868 $- $- $496,868 $1,899 $110,929 $938,564 Specific

ALLL to impaired loans [1] 17.80 % - % - % 9.17 % 28.44 %

22.03 % 13.75 % General ALLL $165,639 $9,942 $1,682 $93,971 $7,375

$117,927 $396,536 Loans held-in-portfolio, excluding impaired loans

[1] $10,208,312 $731,352 $47,914 $6,277,639 $680,911 $3,711,280

$21,657,408 General ALLL to loans held-in-portfolio, excluding

impaired loans [1] 1.62 % 1.36 % 3.51 % 1.50 % 1.08 % 3.18 %

1.83 % Total ALLL $224,166 $9,942 $1,682 $139,528 $7,915 $142,360

$525,593 Total non-covered loans held-in-portfolio [1] $10,537,180

$731,352 $47,914 $6,774,507 $682,810 $3,822,209 $22,595,972 ALLL to

loans held-in-portfolio [1] 2.13 % 1.36 % 3.51 % 2.06 % 1.16

% 3.72 % 2.33 % [1] Excludes covered loans acquired on the

Westernbank FDIC-assisted transaction. [2] The legacy portfolio is

comprised of commercial loans, construction loans and lease

financings related to certain lending products exited by the

Corporation as part of restructuring efforts carried out in prior

years at the BPNA reportable segment. [3] Excludes covered loans

acquired on the Westernbank FDIC-assisted transaction. As of

September 30, 2016 the general allowance on the covered loans

amounted to $30.3 million.

30-Jun-16 Lease (Dollars in thousands)

Commercial Construction Legacy [2]

Mortgage financing Consumer

Total [3]

Specific ALLL $53,350 $116 $- $43,909 $548 $24,898 $122,821

Impaired loans [1] $335,881 $1,036 $- $484,725 $2,110 $111,610

$935,362 Specific ALLL to impaired loans [1] 15.88 % 11.20 %

- % 9.06 % 25.97 % 22.31 % 13.13 % General ALLL $156,331 $10,949

$1,852 $97,577 $9,546 $119,063 $395,318 Loans held-in-portfolio,

excluding impaired loans [1] $10,023,934 $716,296 $49,709

$6,379,393 $661,984 $3,773,983 $21,605,299 General ALLL to loans

held-in-portfolio, excluding impaired loans [1] 1.56 % 1.53

% 3.73 % 1.53 % 1.44 % 3.15 % 1.83 % Total ALLL $209,681 $11,065

$1,852 $141,486 $10,094 $143,961 $518,139 Total non-covered loans

held-in-portfolio [1] $10,359,815 $717,332 $49,709 $6,864,118

$664,094 $3,885,593 $22,540,661 ALLL to loans held-in-portfolio

[1] 2.02 % 1.54 % 3.73 % 2.06 % 1.52 % 3.70 % 2.30 % [1]

Excludes covered loans acquired on the Westernbank FDIC-assisted

transaction. [2] The legacy portfolio is comprised of commercial

loans, construction loans and lease financings related to certain

lending products exited by the Corporation as part of restructuring

efforts carried out in prior years at the BPNA reportable segment.

[3] Excludes covered loans acquired on the Westernbank

FDIC-assisted transaction. As of June 30, 2016 the general

allowance on the covered loans amounted to $30.6 million.

Variance Lease

(Dollars in thousands) Commercial Construction

Legacy Mortgage financing Consumer

Total Specific ALLL $5,177 $(116) $- $1,648 $(8)

$(465) $6,236 Impaired loans $(7,013) $(1,036)

$- $12,143 $(211) $(681) $3,202

General ALLL $9,308 $(1,007) $(170) $(3,606) $(2,171)

$(1,136) $1,218 Loans held-in-portfolio, excluding impaired loans

$184,378 $15,056 $(1,795)

$(101,754) $18,927 $(62,703) $52,109

Total ALLL $14,485 $(1,123) $(170) $(1,958) $(2,179) $(1,601)

$7,454 Total non-covered loans held-in-portfolio

$177,365 $14,020 $(1,795) $(89,611)

$18,716 $(63,384) $55,311

Popular, Inc.

Financial Supplement to Third Quarter 2016 Earnings Release

Table L - Allowance for Loan Losses - Breakdown of General and

Specific Reserves - PUERTO RICO OPERATIONS (Unaudited)

30-Sep-16 Puerto

Rico Lease (In thousands) Commercial Construction

Mortgage financing Consumer Total

Allowance for credit losses: Specific ALLL non-covered loans

$58,527 $- $43,567 $540 $23,708 $126,342 General ALLL

non-covered loans 151,847 2,114 91,761

7,375 104,604 357,701 ALLL - non-covered loans

210,374 2,114 135,328 7,915 128,312

484,043 Specific ALLL covered loans - - - - - -

General ALLL covered loans - - 30,135 -

127 30,262 ALLL - covered loans - -

30,135 - 127 30,262 Total ALLL

$210,374 $2,114 $165,463 $7,915

$128,439 $514,305

Loans held-in-portfolio: Impaired

non-covered loans $328,868 $- $487,972 $1,899 $108,341 $927,080

Non-covered loans held-in-portfolio, excluding impaired

loans 6,925,290 81,054 5,476,876

680,911 3,185,490 16,349,621 Non-covered loans

held-in-portfolio 7,254,158 81,054 5,964,848

682,810 3,293,831 17,276,701 Impaired covered

loans - - - - - - Covered loans held-in-portfolio, excluding

impaired loans - - 571,349 -

16,862 588,211 Covered loans held-in-portfolio -

- 571,349 - 16,862 588,211 Total

loans held-in-portfolio $7,254,158 $81,054

$6,536,197 $682,810 $3,310,693 $17,864,912

30-Jun-16 Puerto Rico Lease (In thousands)

Commercial Construction Mortgage financing

Consumer Total

Allowance for credit losses:

Specific ALLL non-covered loans $53,350 $116 $42,106 $548 $24,167

$120,287 General ALLL non-covered loans 146,477

3,489 94,618 9,546 106,304

360,434 ALLL - non-covered loans 199,827 3,605

136,724 10,094 130,471 480,721 Specific ALLL

covered loans - - - - - - General ALLL covered loans

- - 29,951 - 630 30,581 ALLL -

covered loans - - 29,951 - 630

30,581 Total ALLL $199,827 $3,605

$166,675 $10,094 $131,101 $511,302

Loans

held-in-portfolio: Impaired non-covered loans $335,881 $1,036

$476,161 $2,110 $109,130 $924,318 Non-covered loans

held-in-portfolio, excluding impaired loans 6,881,171

102,606 5,544,401 661,984 3,212,552

16,402,714 Non-covered loans held-in-portfolio 7,217,052

103,642 6,020,562 664,094 3,321,682

17,327,032 Impaired covered loans - - - - - - Covered

loans held-in-portfolio, excluding impaired loans - -

589,256 - 17,914 607,170 Covered loans

held-in-portfolio - - 589,256 -

17,914 607,170 Total loans held-in-portfolio

$7,217,052 $103,642 $6,609,818 $664,094

$3,339,596 $17,934,202

Variance Lease (In thousands) Commercial

Construction Mortgage financing Consumer

Total

Allowance for credit losses: Specific ALLL

non-covered loans $5,177 $(116) $1,461 $(8) $(459) $6,055

General ALLL non-covered loans 5,370 (1,375)

(2,857) (2,171) (1,700) (2,733) ALLL -

non-covered loans 10,547 (1,491) (1,396)

(2,179) (2,159) 3,322 Specific ALLL covered

loans - - - - - - General ALLL covered loans -

- 184 - (503) (319) ALLL - covered

loans - - 184 - (503)

(319) Total ALLL $10,547 $(1,491) $(1,212)

$(2,179) $(2,662) $3,003

Loans

held-in-portfolio: Impaired non-covered loans $(7,013) $(1,036)

$11,811 $(211) $(789) $2,762 Non-covered loans

held-in-portfolio, excluding impaired loans 44,119

(21,552) (67,525) 18,927 (27,062)

(53,093) Non-covered loans held-in-portfolio 37,106

(22,588) (55,714) 18,716 (27,851)

(50,331) Impaired covered loans - - - - - - Covered loans

held-in-portfolio, excluding impaired loans - -

(17,907) - (1,052) (18,959) Covered

loans held-in-portfolio - - (17,907) -

(1,052) (18,959) Total loans held-in-portfolio

$37,106 $(22,588) $(73,621) $18,716

$(28,903) $(69,290)

Popular, Inc. Financial

Supplement to Third Quarter 2016 Earnings Release Table M -

Allowance for Loan Losses - Breakdown of General and Specific

Reserves - U.S. MAINLAND OPERATIONS (Unaudited)

30-Sep-16 U.S. Mainland

(In thousands) Commercial Construction Legacy

Mortgage Consumer Total

Allowance for

credit losses: Specific ALLL $- $- $- $1,990 $725 $2,715

General ALLL 13,792 7,828 1,682 2,210

13,323 38,835 Total ALLL $13,792 $7,828

$1,682 $4,200 $14,048 $41,550

Loans

held-in-portfolio: Impaired loans $- $- $- $8,896 $2,588

$11,484 Loans held-in-portfolio, excluding impaired loans

3,283,022 650,298 47,914 800,763

525,790 5,307,787 Total loans held-in-portfolio

$3,283,022 $650,298 $47,914 $809,659

$528,378 $5,319,271 30-Jun-16 U.S. Mainland

(In thousands) Commercial Construction Legacy

Mortgage Consumer Total

Allowance for

credit losses: Specific ALLL $- $- $- $1,803 $731 $2,534

General ALLL 9,854 7,460 1,852 2,959

12,759 34,884 Total ALLL $9,854 $7,460

$1,852 $4,762 $13,490 $37,418

Loans

held-in-portfolio: Impaired loans $- $- $- $8,564 $2,480

$11,044 Loans held-in-portfolio, excluding impaired loans

3,142,763 613,690 49,709 834,992

561,431 5,202,585 Total loans held-in-portfolio

$3,142,763 $613,690 $49,709 $843,556

$563,911 $5,213,629

Variance (In thousands) Commercial

Construction Legacy Mortgage Consumer

Total

Allowance for credit losses: Specific ALLL $- $- $-

$187 $(6) $181 General ALLL 3,938 368

(170) (749) 564 3,951 Total ALLL $3,938

$368 $(170) $(562) $558 $4,132

Loans held-in-portfolio: Impaired loans $- $- $- $332 $108

$440 Loans held-in-portfolio, excluding impaired loans

140,259 36,608 (1,795) (34,229)

(35,641) 105,202 Total loans held-in-portfolio

$140,259 $36,608 $(1,795) $(33,897)

$(35,533) $105,642

Popular, Inc.

Financial Supplement to Third Quarter 2016 Earnings Release

Table N - Reconciliation to GAAP Financial Measures

(Unaudited) (In thousands, except share or per

share information) 30-Sep-16 30-Jun-16

30-Sep-15 Total stockholders’ equity $5,380,395 $5,359,831

$5,049,636 Common shares outstanding at end of period 103,762,596

103,703,041 103,556,285 Book value per common share $51.85

$51.68 $48.76 Total stockholders’ equity

$5,380,395 $5,359,831 $5,049,636 Less: Preferred stock (50,160)

(50,160) (50,160) Less: Goodwill (627,294) (631,095) (504,925)

Less: Other intangibles (47,886) (50,983)

(71,393) Total tangible common equity $4,655,055

$4,627,593 $4,423,158 Total assets $39,054,296 $37,606,148

$35,522,462 Less: Goodwill (627,294) (631,095) (504,925) Less:

Other intangibles (47,886) (50,983) (71,393)

Total tangible assets $38,379,116 $36,924,070

$34,946,144 Tangible common equity to tangible assets 12.13% 12.53%

12.66% Common shares outstanding at end of period 103,762,596

103,703,041 103,556,285 Tangible book value per common share

$44.86 $44.62 $42.71

Popular, Inc.

Financial Supplement to Third Quarter 2016

Earnings Release Table O - Financial Information -

Westernbank Loans (Unaudited)

Revenues Quarters ended (In thousands) 30-Sep-16

30-Jun-16 Variance Interest income on WB loans

$40,867 $49,794 $(8,927) FDIC loss-share expense:

Amortization of indemnification asset (1,259) (4,036) 2,777 80%

mirror accounting on credit impairment losses (reversal) [1] 659

475 184 80% mirror accounting on reimbursable expenses 853 2,235

(1,382) 80% mirror accounting on recoveries on covered assets,

including rental income on OREOs, subject to reimbursement to the

FDIC (522) (3,956) 3,434 Change in true-up payment obligation

(6,611) (7,688) 1,077 Arbitration award expense (54,924) - (54,924)

Other 81 394 (313) Total FDIC

loss-share expense (61,723) (12,576) (49,147)

Total revenues (expense) (20,856) 37,218

(58,074) Provision (reversal) for loan losses- WB loans

6,612 (7,282) 13,894 Total revenues (expense) less

provision (reversal) for loan losses $(27,468)

$44,500 $(71,968) [1] Reductions in expected cash flows for

ASC 310-30 loans, which may impact the provision for loan losses,

may consider reductions in both principal and interest cash flow

expectations. The amount covered under the FDIC loss-sharing

agreements for interest not collected from borrowers is limited

under the agreements (approximately 90 days); accordingly, these

amounts are not subject fully to the 80% mirror accounting.

Non-personnel operating expenses Quarters ended [2]

(In thousands) [1] 30-Sep-16 30-Jun-16

Variance Professional fees $4,501 $5,991 $(1,490) OREO expenses

2,702 6,389 (3,687) Other operating expenses 1,738

1,924 (186) Total operating expenses $8,941

$14,304 $(5,363) [1] Includes expenses related to loans

subject, and not subject, to the FDIC loss-sharing agreement. [2]

Expense reimbursements from the FDIC may be recorded with a time

lag, since these are claimed upon the event of loss or charge-off

of the loans which may occur in a subsequent period.

Quarterly average assets Quarters ended (In millions)

30-Sep-16 30-Jun-16 Variance Loans $1,881 $2,013

$(132) FDIC loss-share asset 192 211 (19)

Activity in the carrying

amount and accretable yield of loans accounted for under ASC

310-30 Quarters ended 30-Sep-16

30-Jun-16

Carrying amount

Carrying amount

(In thousands)

Accretable yield

of loans

Accretable yield

of loans

Beginning balance $1,071,680 $1,799,943 $1,128,808 $1,935,441

Accretion (39,590) 39,590 (48,476) 48,476 Changes in expected cash

flows 6,602 - (8,652) - Collections / loan sales / charge-offs [2]

- (71,994) - (183,974) Ending balance

1,038,692 1,767,539 1,071,680 1,799,943 Allowance for loan

losses - ASC 310-30 loans - (69,571) -

(66,995) Ending balance, net of allowance for loan losses

$1,038,692 $1,697,968 $1,071,680 $1,732,948

[1] The carrying amount of loans acquired from Westernbank

and accounted for under ASC 310-30 which remain subject to the

loss-sharing agreement with the FDIC amounted to approximately $578

million as of September 30, 2016 and $597 million as of June 30,

2016.

[2] For the quarter ended June 30, 2016,

includes the impact of the bulk sale of loans with a carrying value

of approximately $99 million.

Activity in the carrying amount of the FDIC

indemnity asset Quarters ended (In thousands)

30-Sep-16 30-Jun-16 Balance at

beginning of period $214,029 $219,448 Amortization (1,259) (4,036)

Credit impairment losses (reversal) to be covered under

loss-sharing agreements 659 475 Reimbursable expenses to be covered

under loss-sharing agreements 853 2,235 Recoveries on covered

assets - (4,093) Net payments from FDIC under loss-sharing

agreements (6,819) - Arbitration award expense (54,924) - Other

adjustments attributable to FDIC loss-sharing agreements

(72) - Balance at end of period

$152,467 $214,029

Activity in the remaining FDIC loss-share asset

amortization Quarters ended (In thousands)

30-Sep-16 30-Jun-16 Balance at

beginning of period $23,191 $25,205 Amortization (1,259) (4,036)

Impact of change in projected losses (14,627)

2,022 Balance at end of period

$7,305 $23,191

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161025005500/en/

Popular, Inc.Investor Relations:Brett Scheiner,

212-417-6721Investor Relations OfficerBScheiner@BPOP.comorMedia

Relations:Teruca Rullán, 787-281-5170Mobile: 917-679-3596Senior

Vice President, Corporate Communications

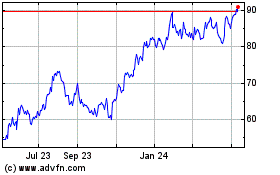

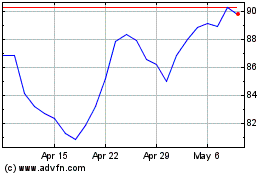

Popular (NASDAQ:BPOP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Popular (NASDAQ:BPOP)

Historical Stock Chart

From Apr 2023 to Apr 2024