By Eyk Henning, Dana Mattioli and Dana Cimilluca

Qualcomm Inc. is in talks to acquire NXP Semiconductors NV, a

deal that likely would cost more than $30 billion and accelerate a

consolidation rush in the semiconductor industry.

The companies could strike an agreement in the next two to three

months, according to people familiar with the matter. As always, it

is possible there won't be one, and some of the people said

Qualcomm is simultaneously exploring other deal options.

Shares of NXP, which is based in the Netherlands and trades on

Nasdaq, surged Thursday after The Wall Street Journal reported on

the talks. They rose 17%, giving the company a market value of $33

billion. Qualcomm stock jumped too, in a sign its shareholders

approve of the San Diego company potentially joining the

consolidation fray. Its shares rose 6.3% and the company's market

value now stands at $100 billion.

Several forces are driving consolidation among chips makers,

which have announced more than $200 billion in deals since the

beginning of 2015.

Sales growth has faded at many of the once-burgeoning companies,

as big chip markets such as those for smartphones and personal

computers have ebbed.

As with all deals, one goal is to slash costs and create more

efficiency. But a more significant factor, industry executives say,

is the rising cost of internal product development, as

miniaturization makes chips more risky and expensive to design.

Acquiring established products allows companies to expand without

wasting money trying to design chips that don't turn into hits,

said Lincoln Clark, a partner who heads KPMG's LLP's semiconductor

practice.

That point was echoed recently by Keith Jackson, chief executive

of ON Semiconductor Corp., which recently completed the $2.4

billion purchase of industry pioneer Fairchild Semiconductor Corp.

"It is a lot easier to add to your portfolio through acquisitions,"

he said in an interview last week.

Becoming broader also allows chip makers to be more valuable

suppliers to major customers and thereby more difficult to displace

by rivals.

NXP Chief Executive Richard Clemmer said in a recent interview

that he expects the company to play a bigger role in the evolution

of vehicles by adding technology from Freescale Semiconductor Ltd.,

which it bought last year for $12 billion.

Semiconductor M&A hit an all-time high in 2015 as companies

such as Intel Corp., Avago Technologies Ltd. and NXP made major

acquisitions.

There have been chip deals totaling more than $75 billion this

year, helping make technology the busiest sector for M&A --

with more than $463 billion of transactions, according to

Dealogic.

Just a couple months ago, Japan's SoftBank agreed to buy

U.K.-based microprocessor designer ARM Holdings PLC in a $32

billion deal.

An acquisition of NXP would be one of the largest in another

strong overall year for mergers and acquisitions.

It radically would reshape Qualcomm, a company that rose to

prominence by supplying wireless chips. Qualcomm has an unusual

business model: While it derives most of its revenue from designing

and selling chips, the company earns more than half of its profits

from licensing its wireless patents to nearly all makers of mobile

phones.

That has helped Qualcomm generate outsize profits for most of

its history. The company held $31 billion in cash and securities on

its balance sheet at the end of June, almost all of it offshore --

another incentive to buy a foreign company such as NXP.

Buying the Dutch company would expand Qualcomm's chip business

from dozens of major product lines to hundreds spanning many

industries outside mobile devices. It would instantly become the

No. 1 supplier of chips used in cars -- one of the hottest target

markets for semiconductor makers -- hoping to benefit as

automobiles add greater computing power and self-driving models

develop.

The possibility of an NXP tie-up has been long-speculated given

the complementary nature of the companies and its ability to

significantly boost Qualcomm's earnings.

Indeed, before the Journal report on Thursday, Sanford C.

Bernstein analysts put out a note on the possibility. NXP's large

size makes it potentially attractive to Qualcomm, they wrote, as

does the company's exposure to the automotive, security and

mobile-payments industries.

The deal could add 30% to Qualcomm's earnings before any cost

savings, they estimate. They also noted it would face "considerable

integration/execution risks."

If a deal were to be struck, it would be the largest in

Qualcomm's history, and would come after activist investor Jana

Partners LLC exited its investment in the company earlier this

year. Last year, Jana pressed the company to consider splitting its

chip unit from its patent business. Qualcomm evaluated a split but

ultimately decided against it.

Based in Eindhoven in the Netherlands, NXP reported $6.1 billion

in revenue and $1.5 billion in profit last year. The company was

founded more than 60 years ago as a division of Royal Philips NV.

It was sold to a private-equity consortium in 2006 and became a

public company in 2010

--Don Clark and Stu Woo contributed to this article.

Write to Eyk Henning at eyk.henning@wsj.com, Dana Mattioli at

dana.mattioli@wsj.com and Dana Cimilluca at

dana.cimilluca@wsj.com

(END) Dow Jones Newswires

September 30, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

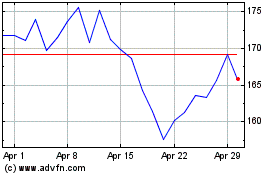

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Aug 2024 to Sep 2024

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Sep 2023 to Sep 2024