Insurer Sues Executives Tied to Platinum Hedge Fund

September 29 2016 - 11:20PM

Dow Jones News

An Indiana insurance company Thursday filed a lawsuit seeking to

recapture hundreds of millions of dollars from an advisory firm

with ties to embattled hedge fund Platinum Partners.

The lawsuit against executives of Beechwood Re, which alleges

widespread conspiracy, fraud and negligence, adds to the mounting

fallout from multiple federal investigations swirling around

Platinum.

In addition, the insurer, CNO Financial Group Inc., said it was

ending its reinsurance agreements with Beechwood and planned to

recapture around $550 million in long-term care policies. In a

recapture, an insurance company takes back some or all of its

business from a reinsurer.

Beechwood is expected to contest any effort by CNO to recapture

the money.

Beechwood, founded in 2013, was part-owned by family-member

trusts of Platinum's founders, and some employees of Platinum have

gone on to work for Beechwood. Since early 2014, Beechwood has put

more than $200 million in Platinum-linked investments, The Wall

Street Journal has reported.

The 12-count civil complaint filed Thursday by CNO units Bankers

Conseco Life Insurance Co. and Washington National Life Insurance

Co., in Manhattan federal court includes charges of racketeering,

fraud and negligence against Beechwood executives Moshe "Mark"

Feuer and Scott Taylor and former Beechwood Chief Investment

Officer David Levy.

Lawyers for the three men couldn't be reached for comment.

While Beechwood itself isn't named as a defendant, the complaint

describes Beechwood as a criminal enterprise in which executives

allegedly conspired to enrich Platinum through assets invested in

Beechwood and for years concealed the companies' overlapping

ownership.

"The scheme to attract institutional investors in the Platinum

funds had succeeded," the complaint alleges. "Plaintiffs gave

Beechwood the keys to a $550 million reinsurance trust, without

ever suspecting that they were in reality doing business with

Platinum."

"There have been no losses, including to CNO, and Beechwood has

acted properly at all times," said David Goldin, a spokesman for

Beechwood. "Beechwood will take every possible step to refute these

false claims and regrets CNO's inappropriate decision to file a

meritless lawsuit filled with baseless innuendo as a method of

gaining leverage in a business negotiation."

Since June, when Platinum emerged as the focus of investigations

by two sets of federal prosecutors and securities regulators, the

firm has moved to shut down.

One of Platinum's founders, Murray Huberfeld, was arrested in

June in connection with an alleged bribery and kickback scheme

involving the New York City corrections officers' union.

Mr. Huberfeld has pleaded not guilty in that case, brought by

the U.S. attorney's office in Manhattan. At the same time,

investigators with the Brooklyn U.S. attorney's office are probing

possible securities fraud at Platinum, people familiar with the

matter have said.

Platinum has denied wrongdoing in both matters.

CNO said in the suit that Beechwood used assets from reinsurance

agreements to meet Platinum investor demands, conducted business

with associates of Mr. Huberfeld and Platinum executive Mark

Nordlicht and lent money to "at least a dozen entities controlled

by Platinum that any reasonable investment manager would pass on

because they were too risky for reinsurance trusts."

The complaint alleges that Messrs. Nordlicht, Huberfeld and

Levy, who is Mr. Huberfeld's nephew, owned 40% of Beechwood and

that Beechwood's professional staff was serving Platinum.

In February 2014, CNO brought in Beechwood to manage about $500

million of long-term-care policies. In an SEC filing last month,

CNO said it had audited $126 million of that total and believed

"some or all of those assets may bear some connection to Platinum"

or to parties with a link to Platinum.

CNO said in a statement Thursday that it recently expanded the

audit to include an additional $90 million in potentially-impacted

investments.

Rob Copeland

(END) Dow Jones Newswires

September 29, 2016 23:05 ET (03:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

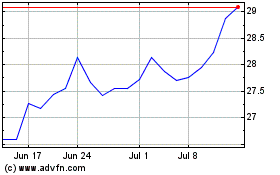

CNO Financial (NYSE:CNO)

Historical Stock Chart

From Aug 2024 to Sep 2024

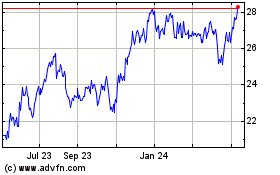

CNO Financial (NYSE:CNO)

Historical Stock Chart

From Sep 2023 to Sep 2024