Statement of Changes in Beneficial Ownership (4)

September 28 2016 - 6:08PM

Edgar (US Regulatory)

|

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue.

See

Instruction 1(b).

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

SCHULTZ JOHN F

|

2. Issuer Name

and

Ticker or Trading Symbol

Hewlett Packard Enterprise Co

[

HPE

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director

_____ 10% Owner

__

X

__ Officer (give title below)

_____ Other (specify below)

EVP, GC & SEC

|

|

(Last)

(First)

(Middle)

C/O HEWLETT PACKARD ENTERPRISE COMPANY, 3000 HANOVER STREET

|

3. Date of Earliest Transaction

(MM/DD/YYYY)

9/26/2016

|

|

(Street)

PALO ALTO, CA 94304

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_

X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

|

Common Stock

|

9/26/2016

|

|

M

|

|

43164

|

A

|

$12.25

|

106959.956

(1)

|

D

|

|

|

Common Stock

|

9/26/2016

|

|

S

|

|

43164

(2)

|

D

|

$22.8375

(3)

|

63795.956

|

D

|

|

|

Common Stock

|

9/26/2016

|

|

M

|

|

273000

|

A

|

$7.69

|

336795.956

|

D

|

|

|

Common Stock

|

9/26/2016

|

|

S

|

|

273000

(2)

|

D

|

$22.8375

(3)

|

63795.956

|

D

|

|

Table II - Derivative Securities Beneficially Owned (

e.g.

, puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3)

|

2. Conversion or Exercise Price of Derivative Security

|

3. Trans. Date

|

3A. Deemed Execution Date, if any

|

4. Trans. Code

(Instr. 8)

|

5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

6. Date Exercisable and Expiration Date

|

7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4)

|

8. Price of Derivative Security

(Instr. 5)

|

9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4)

|

10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4)

|

11. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

(A)

|

(D)

|

Date Exercisable

|

Expiration Date

|

Title

|

Amount or Number of Shares

|

|

Employee Stock Option (right to buy)

|

$12.25

|

9/26/2016

|

|

M

|

|

|

43164

|

(5)

|

5/16/2020

(6)

|

Common Stock

|

43164

|

$0

|

0

|

D

|

|

|

Employee Stock Option (right to buy)

|

$7.69

|

9/26/2016

|

|

M

|

|

|

273000

|

12/6/2014

(4)

|

12/6/2020

(6)

|

Common Stock

|

273000

|

$0

|

273192

|

D

|

|

|

Restricted Stock Units

|

(7)

|

1/6/2016

|

|

A

|

|

195.276

(8)

|

|

(8)

|

(8)

|

Common Stock

|

195.276

|

(8)

|

20989.1462

|

D

|

|

|

Restricted Stock Units

|

(7)

|

1/6/2016

|

|

A

|

|

282.1304

(9)

|

|

(9)

|

(9)

|

Common Stock

|

282.1304

|

(9)

|

29777.4739

|

D

|

|

|

Restricted Stock Units

|

(7)

|

1/6/2016

|

|

A

|

|

926.8871

(10)

|

|

(10)

|

(10)

|

Common Stock

|

926.8871

|

(10)

|

95819.8871

|

D

|

|

|

Restricted Stock Units

|

(7)

|

1/6/2016

|

|

A

|

|

452.2058

(11)

|

|

(11)

|

(11)

|

Common Stock

|

452.2058

|

(11)

|

46748.2058

|

D

|

|

|

Explanation of Responses:

|

|

(

1)

|

The total beneficial ownership includes 381.746 shares at $15.8270 per share acquired under the Issuer's 2015 Employee Stock Purchase Plan ("ESPP") on 04/29/16 with respect to shares held under the ESPP. The total beneficial ownership includes the acquisition of 1.9570 shares at $14.9495 per share received on 01/06/16 through dividends paid in shares, 1.6520 shares at $17.7723 per share received on 04/06/16 through dividends paid in shares, and 1.6010 shares at $18.4008 per share received on 07/06/16 through dividends paid in shares.

|

|

(

2)

|

The sales reported on this Form 4 were effectuated pursuant to a Rule 10b5-1 trading plan adopted by the reporting person on 09/14/16.

|

|

(

3)

|

The price in Column 4 is a weighted average price. The prices actually paid ranged from $22.65 to $22.96. Upon request, the reporting person will provide to the Issuer, any security holder of the Issuer, or the SEC staff information regarding the number of shares purchased at each price within the range.

|

|

(

4)

|

This option became exercisable beginning on this date.

|

|

(

5)

|

This option vested 50% on the second anniversary of the grant date and 50% on the third anniversary of the grant date, in both cases subject to the satisfaction of certain stock price performance conditions prior to the fourth anniversary of the grant date.

|

|

(

6)

|

This option is no longer exercisable beginning on this date.

|

|

(

7)

|

Each restricted stock unit represents a contingent right to receive one share of Issuer's common stock.

|

|

(

8)

|

As previously reported, on 12/11/13 the reporting person was granted 33,346 restricted stock units ("RSUs"), 11,115 of which vested on 12/11/14, 11,115 of which vested early on 09/17/15, and 19,992 of which will vest on 12/11/16. Dividend equivalent rights accrue with respect to these RSUs when and as dividends are paid on Issuer's common stock. The 195.2760 dividend equivalent rights being reported reflect 74.2946 dividend equivalent rights at $14.80 per RSU credited to the reporting person's account on 01/06/16, 61.2227 dividend equivalent rights at $17.96 per RSU credited to the reporting person's account on 04/06/16, and 59.7587 dividend equivalent rights at $18.40 per RSU credited to the reporting person's account on 07/06/16.

|

|

(

9)

|

As previously reported, on 12/10/14 the reporting person was granted 24,090 RSUs, 8,030 of which vested early on 09/17/15, and 14,442 of which will vest on each of 12/10/16 and 12/10/17. Dividend equivalent rights accrue with respect to these RSUs when and as dividends are paid on Issuer's common stock. The 282.1304 dividend equivalent rights being reported reflect 107.3392 dividend equivalent rights at $14.80 per RSU credited to the reporting person's account on 01/06/16, 88.4532 dividend equivalent rights at $17.96 per RSU credited to the reporting person's account on 04/06/16, and 86.3380 dividend equivalent rights at $18.40 per RSU credited to the reporting person's account on 07/06/16.

|

|

(

10)

|

As previously reported, on 11/02/15 the reporting person was granted 94,893 RSUs, 31,631 of which will vest on each of 11/02/16, 11/02/17, and 11/02/18. Dividend equivalent rights accrue with respect to these RSUs when and as dividends are paid on Issuer's common stock. The 926.8871 dividend equivalent rights being reported reflect 352.6429 dividend equivalent rights at $14.80 per RSU credited to the reporting person's account on 01/06/16, 290.5966 dividend equivalent rights at $17.96 per RSU credited to the reporting person's account on 04/06/16, and 283.6476 dividend equivalent rights at $18.40 per RSU credited to the reporting person's account on 07/06/16.

|

|

(

11)

|

As previously reported, on 12/09/15 the reporting person was granted 46,296 RSUs, 15,432 of which will vest on each of 12/09/16, 12/09/17, and 12/09/18. Dividend equivalent rights accrue with respect to these RSUs when and as dividends are paid on Issuer's common stock. The 452.2058 dividend equivalent rights being reported reflect 172.0459 dividend equivalent rights at $14.80 per RSU credited to the reporting person's account on 01/06/16, 141.7751 dividend equivalent rights at $17.96 per RSU credited to the reporting person's account on 04/06/16, and 138.3848 dividend equivalent rights at $18.40 per RSU credited to the reporting person's account on 07/06/16.

|

Reporting Owners

|

|

Reporting Owner Name / Address

|

Relationships

|

|

Director

|

10% Owner

|

Officer

|

Other

|

SCHULTZ JOHN F

C/O HEWLETT PACKARD ENTERPRISE COMPANY

3000 HANOVER STREET

PALO ALTO, CA 94304

|

|

|

EVP, GC & SEC

|

|

Signatures

|

|

Derek Windham as Attorney-in-Fact for John F. Schultz

|

|

9/28/2016

|

|

**

Signature of Reporting Person

|

Date

|

|

Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly.

|

|

*

|

If the form is filed by more than one reporting person,

see

Instruction 4(b)(v).

|

|

**

|

Intentional misstatements or omissions of facts constitute Federal Criminal Violations.

See

18 U.S.C. 1001 and 15 U.S.C. 78ff(a).

|

|

Note:

|

File three copies of this Form, one of which must be manually signed. If space is insufficient,

see

Instruction 6 for procedure.

|

|

Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

|

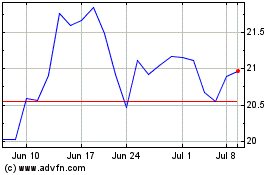

Hewlett Packard Enterprise (NYSE:HPE)

Historical Stock Chart

From Mar 2024 to Apr 2024

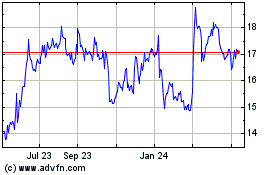

Hewlett Packard Enterprise (NYSE:HPE)

Historical Stock Chart

From Apr 2023 to Apr 2024