Zara Owner Inditex's Profit Beats Expectations -- Update

September 21 2016 - 3:07AM

Dow Jones News

By Patricia Kowsmann

Inditex SA, the retailer behind the Zara fast-fashion chain,

reported a better-than-expected rise in first-half net profit,

continuing to benefit from its focus on easily renewed inventory

and quick deliveries to drive up sales.

The world's largest fashion retailer by revenue said on

Wednesday that net profit rose 7.7% to EUR1.26 billion in the six

months to end-July from EUR1.17 billion in the same period last

year on an 11% rise in sales to EUR10.47 billion. Based on

Inditex's first-quarter report, that implied an 8.8% rise in

second-quarter profit to EUR645 million on an 11% rise in sales to

EUR5.59 billion.

Inditex, whose official name is Industria de Diseño Textil SA,

said sales continued to grow in recent weeks, with 13% growth in

physical and online sales in constant currency terms between Aug. 1

and Sept. 18.

The clothing supplier's robust growth, ahead of the average of

analysts' second-quarter forecasts, contrasts with many of its

rivals' recent performance.

Gap Inc. reported falling second-quarter sales as retailers in

the U.S. continued to struggle with shrinking foot traffic and

growing competition among companies seeking to deliver quicker and

cheaper fashion. Inditex's closest competitor, Swedish fast-fashion

giant Hennes & Mauritz AB, last week said August sales were hit

by an unusually hot late-summer weather. Overall, H&M's sales

growth has lagged behind that of Inditex, which has more physical

stores.

Analysts say Inditex has an edge over rivals because of its

centralized operations in Spain and close-by production centers.

According to Société Générale, while 65% of its products are

sourced in Spain, Portugal, Turkey and North Africa, most other

retailers source about 80% of their products from Asia.

The proximity allows Inditex to quickly respond to customer

demand, new tastes and even the weather, which in turn gives it a

pricing power rivals like H&M don't have.

"We continue to believe Inditex is a structural winner with its

strong brand and well adapted business model," Berenberg analysts

said in a note.

Inditex's pricing power means it can offer customer-friendly

services, including free online delivery and returns, without

hurting margins, according to Société Générale analyst Anne

Critchlow. Its centralized operations, meanwhile, make the cost of

adapting its business to cope with growth in online shopping lower

than at H&M, for instance, which has several warehouses spread

around the globe.

Ms. Critchlow estimates online sales should account for roughly

6% of overall sales this year, leaving it with much room to

grow.

While online offers expand, the company has vowed to slow down

the pace of retail space growth over the years and focus on the

more profitable flagship stores. In the first half of the year,

Inditex opened 83 stores, bringing the total number to 7,096

world-wide. Out of 92 markets where it is present, 39 have online

stores.

Analysts polled by Thomson had expected second-quarter net

profit of EUR691 million on sales of EUR5.57 billion.

Write to Patricia Kowsmann at patricia.kowsmann@wsj.com

(END) Dow Jones Newswires

September 21, 2016 02:52 ET (06:52 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

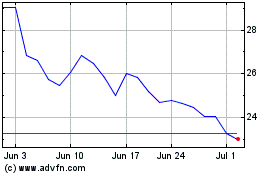

Gap (NYSE:GPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gap (NYSE:GPS)

Historical Stock Chart

From Apr 2023 to Apr 2024