NextEra Sweetens Deal for Energy Future's Oncor

September 19 2016 - 2:08PM

Dow Jones News

By Peg Brickley

NextEra Energy Inc. has boosted its offer for Energy Future

Holdings Corp.'s Oncor electricity transmission business by $300

million, quieting creditor worries about the sale that will be the

key to getting the Dallas company out of bankruptcy.

Over the weekend, NextEra agreed to increase the cash component

of its deal to $4.4 billion from $4.1 billion. Additionally,

NextEra is making other changes to the proposed Oncor buyout that

will allow Energy Future creditors to receive $450 million more

from the sale of the crown jewel business than previously

planned.

The changes were made in a 48-hour flurry of activity, Energy

Future lawyer Chad Husnick told Judge Christopher Sontchi at a

hearing Monday in the U.S. Bankruptcy Court in Wilmington, Del., to

approve the deal. Judge Sontchi authorized Energy Future to move

ahead on the NextEra deal after lawyers lined up to speak in favor

of it.

"This is an improvement that's a significant improvement that

benefits all [Energy Future] creditors," said Gary Kaplan, lawyer

for mutual fund giant Fidelity Management & Research Co., a

former critic.

Many creditors of the parent Energy Future, which is the former

TXU Corp., are getting paid in full from the proceeds of the deal.

One class of junior investors who on Friday expected to recover 16

cents for each dollar they are owed can now count on collecting up

to 50 cents for each dollar of debt because of the higher price,

Mr. Kaplan estimated.

The Oncor sale is built into a chapter 11 exit plan that could

move through bankruptcy courts before the end of the year, given

the momentum of the improved deal price, Mr. Kaplan said. In

addition to $4.4 billion in cash, NextEra is paying off $5.4

billion in bankruptcy financing and shouldering some

liabilities.

Once the Oncor sale gets through court, it still must pass

muster before the Public Utility Commission of Texas, which killed

an earlier buyout offer in the spring. That offer, led by Hunt

Consolidated Inc., foundered due to concerns it involved financial

engineering.

The sale agreement carries a $275 million breakup fee, and

leading creditors questioned whether the bid protection was

necessary to keep NextEra interested in a deal.

Mr. Husnick said Fidelity, a former opponent, has now agreed to

support the Energy Future bankruptcy plan, which is premised on the

sale of Oncor to NextEra. Other objectors also dropped protests

over the breakup fee once NextEra improved the terms.

A few months after Energy Future filed for chapter 11 bankruptcy

protection in April 2014, NextEra went public with its interest in

buying Oncor, a thriving piece of the Texas electricity

infrastructure. The regulated company operates free and clear of

its parent's bankruptcy case.

Hunt beat NextEra in the first round of competition, which ran

from 2014 through 2015. When Texas regulators scuttled the Hunt

takeover, Energy Future returned to the bargaining table. The

result was a pair of chapter 11 plans: one involving Energy

Future's Luminant energy-generating business, and TXU Energy, the

retailing business; and the other involving the parent company,

which indirectly owns 80% of Oncor.

The Luminant and TXU Energy chapter 11 exit plan has already

been confirmed, clearing the way for those businesses to exit

bankruptcy having shed tens of millions of dollars in debt.

The Energy Future exit plan must be circulated for creditor

votes and then face another crucial court session.

Write to Peg Brickley at peg.brickley@wsj.com

(END) Dow Jones Newswires

September 19, 2016 13:53 ET (17:53 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

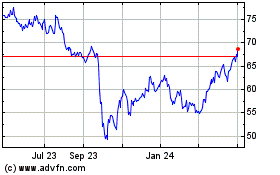

NextEra Energy (NYSE:NEE)

Historical Stock Chart

From Mar 2024 to Apr 2024

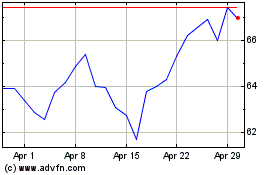

NextEra Energy (NYSE:NEE)

Historical Stock Chart

From Apr 2023 to Apr 2024