Wal-Mart to Cut 7,000 Back-Office Store Jobs

September 01 2016 - 12:30PM

Dow Jones News

Wal-Mart Stores Inc. plans to cut thousands of back office

positions around the country, a sign that the retailer's effort to

make its cavernous stores more efficient is also changing the face

of its workforce.

The country's largest private employer is eliminating about

7,000 U.S. store accounting and invoicing positions over the next

several months, jobs mostly held by long-term employees, often some

of the highest paid hourly workers in stores. The retailer wants

those employees working with shoppers, not in backrooms, say

company executives. Centralizing or automating much of those tasks

is more efficient, they say.

The jobs are coveted as a rare desk job in retail. "You are not

running around the store on your feet all day," and receive decent

pay, says a Wal-Mart store accounting employee who earns about $13

an hour, or $27,000 a year. "Everybody wants to get in there. The

jobs never open up," says this person, who has worked at the store

for nine years.

The back office cuts to Wal-Mart's 4,600 U.S. stores is a sign

that retail workers—one of the largest employee cohorts in

America—face big changes as their employers spend heavily to

compete with Amazon.com Inc. and grab foot traffic from other

chains.

The positions Wal-Mart is eliminating manage an individual

store's daily cash flow or processes claims from manufacturers

delivering goods directly to stores, among other tasks. Starting

early next year, much of that work will be handled by a central

office or new money-counting "cash recycler" machines in stores.

Wal-Mart tested the change in about 500 stores earlier this

year.

The company believes most displaced employees will find

customer-facing roles, says Deisha Barnett, a Wal-Mart spokeswoman.

"We've seen many make smooth transitions during the pilot," she

said. Their current wage level isn't guaranteed, she said.

Store workers at Wal-Mart and other retailers are being asked to

work differently in many way as retailers adjust to industry

changes. For example, Wal-Mart is rapidly expanding a service that

lets shoppers order groceries online and pick up curbside. That

requires employees to pick produce off shelves, pack orders and

deliver them to a customer's car, jobs that didn't exist at

Wal-Mart three years ago. Wal-Mart has changed how it stocks

shelves to bring more employees to the sales floor during the day,

not the middle of the night, to interact with customers.

Wal-Mart is spending billions to boost e-commerce sales and make

stores more efficient and pleasant places to shop, reducing

inventory and raising wages. Last year the retailer lifted its

store employee starting wage to $9, or about $18,700 a year, for a

full-time employee. Starting earlier this year new hires can move

to $10 an hour after completing a six month training program. In

August Wal-Mart said it planned to purchase discount online

retailer Jet.com Inc. for $3.3 billion.

While Wal-Mart's online sales have been sluggish, sales in

existing stores have risen for eight straight quarters, outshining

many competitors struggling to compete for recession-weary

customers or online shopping converts. Other retailers, including

Target Corp. and Costco Wholesale Corp., are also raising starting

wages.

In the wake of those investments in their workforces and online

efforts, retailers are making other cuts. "Anytime one expense line

goes up, you are likely to see a reduction in a corresponding

expense line," says Joel Bines, co-head of consulting firm

AlixPartners LLP's retail practice. In today's environment "any

dollar not being spent on delivering a better experience to the

customer or delivering the customer online is a wasted dollar," he

says.

A typical Wal-Mart Supercenter employs hundreds of people from

cashiers and cart wranglers to store managers who oversee around

$100 million in annual sales in a busy location. In the many small

towns and rural areas with a Wal-Mart, the store can be one of the

largest employers.

"Right now I'm getting my resume together," said one Wal-Mart

employee who works in invoicing earning about $15 an hour. After

almost 21 years with the company the employee isn't interested in

moving back out to the store floor, she says.

Write to Sarah Nassauer at sarah.nassauer@wsj.com

(END) Dow Jones Newswires

September 01, 2016 12:15 ET (16:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

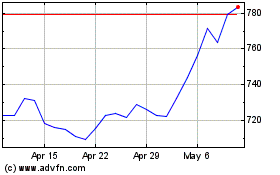

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Mar 2024 to Apr 2024

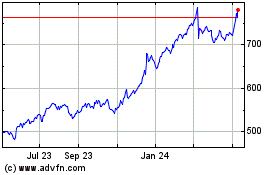

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Apr 2023 to Apr 2024