Boston Properties, Inc. (NYSE: BXP), a real estate

investment trust, reported results today for the second quarter

ended June 30, 2016.

Net income available to common shareholders was $96.6 million

for the quarter ended June 30, 2016, compared to $79.5 million

for the quarter ended June 30, 2015. Net income available to

common shareholders per share (EPS) for the quarter ended

June 30, 2016 was $0.63 basic and $0.63 on a diluted basis.

This compares to EPS for the quarter ended June 30, 2015 of

$0.52 basic and $0.52 on a diluted basis. The weighted-average

number of basic and diluted shares outstanding totaled

approximately 153,662,000 and 153,860,000, respectively, for the

quarter ended June 30, 2016 and 153,450,000 and 153,815,000,

respectively, for the quarter ended June 30, 2015.

Funds from Operations (FFO) for the quarter ended June 30,

2016 were $220.6 million, or $1.44 per share basic and $1.43 per

share diluted. This compares to FFO for the quarter ended

June 30, 2015 of $208.7 million, or $1.36 per share basic and

$1.36 per share diluted.

The Company’s reported FFO of $1.43 per share diluted was

greater than the guidance previously provided of $1.36-$1.38 per

share diluted primarily due to earlier than anticipated tenant

termination income of $0.04 per share and better than expected

portfolio operations of $0.02 per share.

The reported results are unaudited and there can be no assurance

that these reported results will not vary from the final

information for the quarter ended June 30, 2016. In the

opinion of management, all adjustments considered necessary for a

fair presentation of these reported results have been made.

As of June 30, 2016, the Company’s portfolio consisted of

168 properties aggregating approximately 46.5 million square feet,

including eight properties under construction/redevelopment

totaling approximately 3.8 million square feet. The overall

percentage of leased space for the 157 properties in service

(excluding the Company’s two residential properties and hotel) as

of June 30, 2016 was 90.8%.

Significant events during the second quarter included:

- On April 4, 2016, a joint venture in

which the Company has a 50% interest extended the loan

collateralized by its Annapolis Junction Building Seven property.

At the time of the extension, the outstanding balance of the loan

totaled approximately $21.5 million and was scheduled to mature on

April 4, 2016. The extended loan has a total commitment amount of

$22.0 million, bears interest at a variable rate equal to LIBOR

plus 1.65% per annum and matures on April 4, 2017, with one,

one-year extension option, subject to certain conditions. Annapolis

Junction Building Seven is a Class A office property with

approximately 127,000 net rentable square feet located in

Annapolis, Maryland.

- On April 11, 2016, the Company used

available cash to repay the mortgage loan collateralized by its

Fountain Square property located in Reston, Virginia totaling

approximately $211.3 million. The mortgage loan bore interest at a

fixed rate of 5.71% per annum and was scheduled to mature on

October 11, 2016. There was no prepayment penalty.

- On April 11, 2016, a joint venture in

which the Company has a 50% interest received a Notice of Event of

Default from the lender for the loan collateralized by its

Annapolis Junction Building One property. The Event of Default

relates to the loan to value ratio not being in compliance with the

loan agreement. The joint venture is currently in discussions with

the lender regarding the Event of Default, although there can be no

assurance as to the outcome of those discussions. The loan has an

outstanding balance of approximately $39.8 million, is non-recourse

to the Company, bears interest at a variable rate equal to LIBOR

plus 1.75% per annum and has a stated maturity date of March 31,

2018, with one, three-year extension option, subject to certain

conditions. Annapolis Junction Building One is a Class A office

property with approximately 118,000 net rentable square feet

located in Annapolis, Maryland.

- On April 22, 2016, the Company acquired

3625-3635 Peterson Way located in Santa Clara, California for a

purchase price of approximately $78.0 million in cash. 3625-3635

Peterson Way is an approximately 218,000 net rentable square foot

office property. The property is 100% leased to a single tenant

through March 2021. Following the lease expiration, the Company

intends to develop the site into a Class A office campus containing

an aggregate of approximately 632,000 net rentable square

feet.

- On May 27, 2016, the Company completed

and fully placed in-service 601 Massachusetts Avenue, a Class A

office project with approximately 479,000 net rentable square feet

located in Washington, DC. The property is 90% leased.

- On May 27, 2016, the Company completed

and fully placed in-service 804 Carnegie Center, a Class A office

project with approximately 130,000 net rentable square feet located

in Princeton, New Jersey. The property is 100% leased.

- On June 24, 2016, the Company completed

and fully placed in-service 10 CityPoint, a Class A office project

with approximately 241,000 net rentable square feet located in

Waltham, Massachusetts. The property is 97% leased.

Transactions completed subsequent to June 30, 2016:

- On July 1, 2016, the Company entered

the Los Angeles market through its acquisition of a 49.8% interest

in an existing joint venture that owns and operates Colorado Center

located in Santa Monica, California for a gross purchase price of

approximately $511.1 million, or approximately $503.6 million in

cash net of credits for free rent, unfunded leasing costs and other

adjustments. Colorado Center is a six-building office complex that

sits on a 15-acre site and contains an aggregate of approximately

1,184,000 net rentable square feet with an underground parking

garage for 3,100 vehicles. The property is 68% leased.

EPS and FFO per Share Guidance:

The Company’s guidance for the third quarter and full year 2016

for EPS (diluted) and FFO per share (diluted) is set forth and

reconciled below. Except as described below, the estimates reflect

management’s view of current and future market conditions,

including assumptions with respect to rental rates, occupancy

levels and the earnings impact of the events referenced in this

release and otherwise referenced during the conference call

referred to below. The estimates do not include possible future

gains or losses or the impact on operating results from other

possible future property acquisitions or dispositions, other

possible capital markets activity or possible future impairment

charges. EPS estimates may be subject to fluctuations as a result

of several factors, including changes in the recognition of

depreciation and amortization expense and any gains or losses

associated with disposition activity. The Company is not able to

assess at this time the potential impact of these factors on

projected EPS. By definition, FFO does not include real

estate-related depreciation and amortization, impairment losses or

gains or losses associated with disposition activities. There can

be no assurance that the Company’s actual results will not differ

materially from the estimates set forth below.

As shown below, the Company has updated its projected EPS

(diluted) for the full year 2016 to $3.04 - $3.11 per share from

$3.00 - $3.10 per share. This is an increase of approximately $0.03

per share at the mid-point of the Company’s guidance consisting of

$0.02 per share due to the acquisition of a 49.8% interest in the

joint venture that owns Colorado Center (net of $0.03 per share of

real estate depreciation and amortization expense) and $0.01

per share due to higher portfolio performance. In addition, the

Company has updated its projected guidance for FFO per share

(diluted) for the full year 2016 to $5.92 - $5.99 per share from

$5.85 - $5.95 per share. This is an increase of approximately $0.06

per share at the mid-point of the Company’s guidance consisting of

$0.05 per share from the acquisition of a 49.8% interest in

Colorado Center and $0.01 per share due to higher portfolio

performance.

Third Quarter 2016 Full Year 2016 Low - High

Low - High Projected EPS (diluted) $ 0.57 - $ 0.59 $ 3.04 - $ 3.11

Add: Projected Company Share of Real Estate Depreciation and

Amortization 0.83 - 0.83 3.27 - 3.27 Less: Projected Company Share

of Gains on Sales of Real Estate — - — 0.39 -

0.39 Projected FFO per Share (diluted) $ 1.40 - $ 1.42 $

5.92 - $ 5.99

Boston Properties will host a conference call on Wednesday, July

27, 2016 at 10:00 AM Eastern Time, open to the general public, to

discuss the second quarter 2016 results, the 2016 projections and

related assumptions, and other related matters that may be of

interest to investors. The number to call for this interactive

teleconference is (877) 706-4503 (Domestic) or (281) 913-8731

(International) and entering the passcode 23627785. A replay of the

conference call will be available through August 12, 2016, by

dialing (855) 859-2056 (Domestic) or (404) 537-3406 (International)

and entering the passcode 23627785. There will also be a live audio

webcast of the call which may be accessed on the Company’s website

at www.bostonproperties.com in the Investor Relations section.

Shortly after the call a replay of the webcast will be available in

the Investor Relations section of the Company’s website and

archived for up to twelve months following the call.

Additionally, a copy of Boston Properties’ second quarter 2016

“Supplemental Operating and Financial Data” and this press release

are available in the Investor Relations section of the Company’s

website at www.bostonproperties.com.

Boston Properties is a fully integrated, self-administered and

self-managed real estate investment trust that develops,

redevelops, acquires, manages, operates and owns a diverse

portfolio of primarily Class A office space, five retail

properties, four residential properties (including two properties

under construction) and one hotel. The Company is one of the

largest owners and developers of Class A office properties in the

United States, concentrated in five markets - Boston, Los Angeles,

New York, San Francisco and Washington, DC.

This press release contains forward-looking statements within

the meaning of the Federal securities laws. You can identify these

statements by our use of the words “assumes,” “believes,”

“estimates,” “expects,” “guidance,” “intends,” “plans,” “projects”

and similar expressions that do not relate to historical matters.

You should exercise caution in interpreting and relying on

forward-looking statements because they involve known and unknown

risks, uncertainties and other factors which are, in some cases,

beyond Boston Properties’ control and could materially affect

actual results, performance or achievements. These factors include,

without limitation, the Company’s ability to enter into new leases

or renew leases on favorable terms, dependence on tenants’

financial condition, the uncertainties of real estate development,

acquisition and disposition activity, the ability to effectively

integrate acquisitions, the uncertainties of investing in new

markets, the costs and availability of financing, the effectiveness

of our interest rate hedging contracts, the ability of our joint

venture partners to satisfy their obligations, the effects of

local, national and international economic and market conditions,

the effects of acquisitions, dispositions and possible impairment

charges on our operating results, the impact of newly adopted

accounting principles on the Company’s accounting policies and on

period-to-period comparisons of financial results, regulatory

changes and other risks and uncertainties detailed from time to

time in the Company’s filings with the Securities and Exchange

Commission. Boston Properties does not undertake a duty to update

or revise any forward-looking statement, including its guidance for

the third quarter and full fiscal year 2016, whether as a result of

new information, future events or otherwise.

Financial tables follow.

BOSTON PROPERTIES,

INC.CONSOLIDATED BALANCE SHEETS(Unaudited)

June 30,2016

December 31,2015

(in thousands, except for

shareand par value amounts)

ASSETS Real estate, at cost $ 18,690,403 $ 18,465,405

Construction in progress 865,359 763,935 Land held for future

development 241,106 252,195 Less: accumulated depreciation

(4,056,716 ) (3,925,894 ) Total real estate 15,740,152

15,555,641 Cash and cash equivalents 1,180,044 723,718 Cash held in

escrows 65,654 73,790 Investments in securities 21,775 20,380

Tenant and other receivables, net 84,861 97,865 Accrued rental

income, net 776,816 754,883 Deferred charges, net 697,823 704,867

Prepaid expenses and other assets 144,222 185,118 Investments in

unconsolidated joint ventures 252,618 235,224

Total assets $ 18,963,965 $ 18,351,486

LIABILITIES AND EQUITY Liabilities: Mortgage notes payable,

net $ 3,189,013 $ 3,435,242 Unsecured senior notes, net 6,257,274

5,264,819 Unsecured line of credit — — Mezzanine notes payable

307,797 308,482 Outside members’ notes payable 180,000 180,000

Accounts payable and accrued expenses 287,464 274,709 Dividends and

distributions payable 113,071 327,320 Accrued interest payable

222,175 190,386 Other liabilities 508,952

483,601 Total liabilities 11,065,746

10,464,559 Commitments and contingencies —

— Equity: Stockholders’ equity attributable to

Boston Properties, Inc.: Excess stock, $0.01 par value, 150,000,000

shares authorized, none issued or outstanding — — Preferred stock,

$0.01 par value, 50,000,000 shares authorized; 5.25% Series B

cumulative redeemable preferred stock, $0.01 par value, liquidation

preference $2,500 per share, 92,000 shares authorized, 80,000

shares issued and outstanding at June 30, 2016 and December 31,

2015 200,000 200,000 Common stock, $0.01 par value, 250,000,000

shares authorized, 153,753,830 and 153,658,866 issued and

153,674,930 and 153,579,966 outstanding at June 30, 2016 and

December 31, 2015, respectively 1,537 1,536 Additional paid-in

capital 6,316,191 6,305,687 Dividends in excess of earnings

(702,361 ) (780,952 ) Treasury common stock at cost, 78,900 shares

at June 30, 2016 and December 31, 2015 (2,722 ) (2,722 )

Accumulated other comprehensive loss (79,748 )

(14,114 ) Total stockholders’ equity attributable to Boston

Properties, Inc. 5,732,897 5,709,435 Noncontrolling interests:

Common units of the Operating Partnership 612,385 603,092 Property

partnerships 1,552,937 1,574,400 Total

equity 7,898,219 7,886,927 Total

liabilities and equity $ 18,963,965 $ 18,351,486

BOSTON PROPERTIES,

INC.CONSOLIDATED STATEMENTS OF

OPERATIONS(Unaudited)

Three months endedJune

30,

Six months endedJune 30,

2016 2015 2016 2015

(in thousands, except for per share amounts) Revenue Rental

Base rent $ 493,386 $ 486,609 $ 1,029,514 $ 977,291 Recoveries from

tenants 85,706 86,795 175,292 175,388 Parking and other

26,113 26,552 50,938

51,340 Total rental revenue 605,205 599,956 1,255,744

1,204,019 Hotel revenue 12,808 13,403 21,565 22,488 Development and

management services 5,533 4,862

12,222 10,190 Total revenue 623,546

618,221 1,289,531

1,236,697 Expenses Operating Rental 217,938 214,464 437,110

435,814 Hotel 7,978 8,495 15,612 16,071 General and administrative

25,418 22,284 54,771 51,075 Transaction costs 913 208 938 535

Depreciation and amortization 153,175 167,844

312,623 322,067 Total expenses

405,422 413,295 821,054

825,562 Operating income 218,124 204,926 468,477

411,135 Other income (expense) Income from unconsolidated joint

ventures 2,234 3,078 4,025 17,912 Interest and other income 1,524

1,293 3,029 2,700 Gains (losses) from investments in securities 478

(24 ) 737 369 Interest expense (105,003 ) (108,534 )

(210,312 ) (217,291 ) Income before gains on sales of

real estate 117,357 100,739 265,956 214,825 Gains on sales of real

estate — — 67,623

95,084 Net income 117,357 100,739 333,579 309,909 Net income

attributable to noncontrolling interests Noncontrolling interests

in property partnerships (6,814 ) (9,264 ) (17,278 ) (24,472 )

Noncontrolling interest—redeemable preferred units of the Operating

Partnership — (3 ) — (6 ) Noncontrolling interest—common units of

the Operating Partnership (11,357 ) (9,394 )

(32,771 ) (29,530 ) Net income attributable to Boston

Properties, Inc. 99,186 82,078 283,530 255,901 Preferred dividends

(2,589 ) (2,618 ) (5,207 ) (5,207 ) Net

income attributable to Boston Properties, Inc. common shareholders

$ 96,597 $ 79,460 $ 278,323 $ 250,694

Basic earnings per common share attributable to Boston Properties,

Inc. common shareholders: Net income $ 0.63 $ 0.52 $

1.81 $ 1.63 Weighted average number of common shares

outstanding 153,662 153,450

153,644 153,341 Diluted earnings per common

share attributable to Boston Properties, Inc. common shareholders:

Net income $ 0.63 $ 0.52 $ 1.81 $ 1.63

Weighted average number of common and common equivalent shares

outstanding 153,860 153,815

153,889 153,845

BOSTON PROPERTIES, INC.FUNDS

FROM OPERATIONS (1)(Unaudited)

Three months endedJune

30,

Six months endedJune 30,

2016

2015

2016

2015

(in thousands, except for per share amounts) Net

income attributable to Boston Properties, Inc. common shareholders

$ 96,597 $ 79,460 $ 278,323 $ 250,694 Add: Preferred dividends

2,589 2,618 5,207 5,207 Noncontrolling interest - common units of

the Operating Partnership 11,357 9,394 32,771 29,530 Noncontrolling

interest - redeemable preferred units of the Operating Partnership

— 3 — 6 Noncontrolling interests in property partnerships 6,814

9,264 17,278 24,472 Less: Gains on sales of real estate —

— 67,623 95,084

Income before gains on sales of real estate 117,357 100,739 265,956

214,825 Add: Real estate depreciation and amortization (2) 157,431

171,384 321,011 320,138 Less: Noncontrolling interests in property

partnerships’ share of funds from operations 26,183 36,699 56,202

73,214 Noncontrolling interest - redeemable preferred units of the

Operating Partnership — 3 — 6 Preferred dividends 2,589

2,618 5,207 5,207

Funds from operations (FFO) attributable to the Operating

Partnership common unitholders (including Boston Properties, Inc.)

246,016 232,803 525,558 456,536 Less: Noncontrolling interest -

common units of the Operating Partnership’s share of funds from

operations 25,421 24,072 54,277

47,423 Funds from operations attributable to

Boston Properties, Inc. common shareholders $ 220,595 $

208,731 $ 471,281 $ 409,113 Boston Properties,

Inc.’s percentage share of funds from operations - basic

89.67 % 89.66 % 89.67 % 89.61 % Weighted

average shares outstanding - basic 153,662

153,450 153,644 153,341 FFO per

share basic $ 1.44 $ 1.36 $ 3.07 $ 2.67

Weighted average shares outstanding - diluted 153,860

153,815 153,889 153,845

FFO per share diluted $ 1.43 $ 1.36 $ 3.06 $

2.66

(1) Pursuant to the revised definition of Funds from Operations

adopted by the Board of Governors of the National Association of

Real Estate Investment Trusts (“NAREIT”), we calculate Funds from

Operations, or “FFO,” by adjusting net income (loss) attributable

to Boston Properties, Inc. common shareholders (computed in

accordance with GAAP, including non-recurring items) for gains (or

losses) from sales of properties, impairment losses on depreciable

real estate consolidated on our balance sheet, impairment losses on

our investments in unconsolidated joint ventures driven by a

measurable decrease in the fair value of depreciable real estate

held by the unconsolidated joint ventures, real estate-related

depreciation and amortization, and our share of income (loss) from

unconsolidated partnerships and joint ventures. FFO is a non-GAAP

financial measure, but we believe the presentation of FFO, combined

with the presentation of required GAAP financial measures, has

improved the understanding of operating results of REITs among the

investing public and has helped make comparisons of REIT operating

results more meaningful. Management generally considers FFO and FFO

per share to be useful measures for understanding and comparing our

operating results because, by excluding gains and losses related to

sales of previously depreciated operating real estate assets,

impairment losses and real estate asset depreciation and

amortization (which can differ across owners of similar assets in

similar condition based on historical cost accounting and useful

life estimates), FFO and FFO per share can help investors compare

the operating performance of a company’s real estate across

reporting periods and to the operating performance of other

companies.

Our computation of FFO may not be comparable to FFO reported by

other REITs or real estate companies that do not define the term in

accordance with the current NAREIT definition or that interpret the

current NAREIT definition differently.

FFO should not be considered as a substitute for net income

attributable to Boston Properties, Inc. common shareholders

(determined in accordance with GAAP). FFO does not represent cash

generated from operating activities determined in accordance with

GAAP, and is not a measure of liquidity or an indicator of our

ability to make cash distributions. We believe that to more

comprehensively understand our operating performance, FFO should be

considered along with our reported net income attributable to

Boston Properties, Inc. and our cash flows in accordance with GAAP,

as presented in our consolidated financial statements.

(2) Real estate depreciation and amortization consists of

depreciation and amortization from the Consolidated Statements of

Operations of $153,175, $167,844, $312,623 and $322,067 and our

share of unconsolidated joint venture real estate depreciation and

amortization of $4,618, $3,886, $9,114 and $(1,246), less

corporate-related depreciation and amortization of $362, $346, $726

and $683 for the three and six months ended June 30, 2016 and

2015, respectively.

BOSTON PROPERTIES, INC.

PORTFOLIO LEASING PERCENTAGES

% Leased by Location June 30,

2016 December 31, 2015 Boston 91.3 % 90.6 % New York

90.7 % 91.5 % San Francisco 90.5 % 93.8 % Washington, DC 90.3 %

91.0 % Total Portfolio 90.8 % 91.4 %

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160726006573/en/

Boston PropertiesMichael LaBelle, 617-236-3352Executive Vice

President, Chief Financial Officer and TreasurerorArista Joyner,

617-236-3343Investor Relations Manager

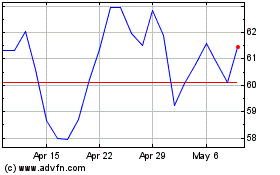

Boston Properties (NYSE:BXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

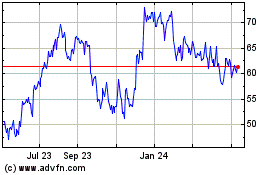

Boston Properties (NYSE:BXP)

Historical Stock Chart

From Apr 2023 to Apr 2024