Insider

Financial, a leading research site for small cap companies,

publishes new research on Oroplata Resources Inc

(OTCBB:ORRP).

A Bull Run For Oroplata Resources Inc

(OTCBB:ORRP)

Oroplata

Resources Inc (OTCBB:ORRP) is focused on becoming a substantial

profitable Lithium producer by the rapid development of valuable

production-grade Lithium Brine deposits in Nevada and throughout

the southwest U.S. ORRP has chosen to focus on Lithium brine and

this is a smart move. Lithium Brine projects have a number of

significant advantages over conventional hard rock Lithium mining

projects; they are cheaper to explore compared to the alternatives;

they are quicker in proving up a resource and reserves; they are

faster and much less capital intensive to put into production.

Lithium brine production also has a much smaller environmental

footprint and produces ready-to-ship Lithium carbonate.

On

June 1, ORRP announced that it entered into a binding

purchase agreement to acquire the Western Nevada Basin project in

Southwest Nevada. The Western Nevada Basin Project covers the south

central portion of an area that was first identified as Lithium

rich by the United States Geological Survey. The Project includes

500 mining claims covering approximately 10,000 acres. The company

also has an option to acquire another 600 mining claims,

approximately 22,000 acres.

Read

the Full Report on Oroplata Resources Inc (OTCBB:ORRP) at

InsiderFinancial.com

http://www.insiderfinancial.com/a-bull-run-for-oroplata-resources-inc-otcbborrp/116240/

Oroplata Resources Inc (OTCBB:ORRP) Hits The

OTC

Oroplata

Resources Inc (OTCBB:ORRP) has hit the OTC with a bang. The company

was long dormant until it announced early this month that it was

acquiring a Lithium property and Craig Alford was joining the

company as CEO. Penny stock investors know that lithium remains one

of the hottest sectors on the OTC Markets and explains the strong

interest in shares of ORRP. Investors are now asking how much

higher can shares of ORRP run?

Prices

for Lithium carbonate are up 47% from the average price in 2015 in

the first quarter of this year and numerous sources have reported

the potential growth in demand for Lithium to be very robust. The

Nevada-based Tesla Motors Inc (NASDAQ:TSLA) Gigafactory, expected

to open on July 29th 2016, will produce advanced lithium batteries

for Tesla. Elon Musk has stated that Tesla will need to consume the

entire lithium market to meet its demands of 500,000 Model 3’s by

2018. Chinese demand of lithium has been another factor behind the

surge of the lithium market which is driven by the country’s desire

for electric cars and buses.

In

a report from Goldman Sachs called “What if I told you” Goldman

refers to lithium as the “new gasoline”. This is due to increasing

demand for electric vehicles. The cause is that the lithium market

could triple from the current demand of 160,000mt to 470,000mt by

2025. Just 1% EV penetration into the market increases demand by

70,000mt a year.

Read

the Full Report on Oroplata Resources Inc (OTCBB:ORRP) at

InsiderFinancial.com

http://www.insiderfinancial.com/oroplata-resources-inc-otcbborrp-hits-the-otc/115765/

Other

Research From Insider Financial

Skyline Medical Inc (NASDAQ:SKLN) Looks To Regulatory

Approval For Catalysts

Skyline

Medical Inc (NASDAQ:SKLN) gained close to 10% after the bell on

Friday, and with a few key announcements hitting press over the

last several weeks, looks like it could be winding up for some

medium term strength. There’s plenty of potential upside catalysts

ahead, and while there’s some pretty murky capital structure risk,

as a quick turnaround position the company looks attractive. Here’s

why.

First,

a quick introduction to the company. Skyline is a Minnesota based

medical device company, with a current focus on waste management in

the healthcare space. Its lead product is called the Streamway

fluid management system, and it’s designed to streamline the

process through which healthcare related waste is

processed.

Read

the Full Report on Skyline Medical Inc (NASDAQ:SKLN) at

InsiderFinancial.com

http://www.insiderfinancial.com/skyline-medical-inc-nasdaqskln-looks-to-regulatory-approval-for-catalysts/116375/

Shares Of SolarWindow Technologies Inc (OTCMKTS:WNDW)

Come Crashing Down

Shares

of SolarWindow Technologies Inc (OTCMKTS:WNDW) got totally

destroyed after the company filed its latest 10-Q.

We said last month that shares remained range bound as investors

awaited news on the company’s efforts to achieve commercialization

of its solar window technology. It appears that the latest filing

has caused some investors to get nervous and dump their shares.

WNDW has also been a favorite of the shorts and no doubt they piled

on as well. Now investors are asking if it’s time to abandon ship

or buy the dip?

We’ll

admit that the 10-Q was not great, especially when you consider

that SolarWindow’s market cap was over $100 million before it was

filed. The filing showed just $123,541 in cash, $596,994 in total

assets, $1,038,153 in convertible notes, $4,166,917 in total

liabilities, and stockholder’s equity of negative $3,569,923. The

company has yet to generate a single dollar in revenues and posted

a net loss of $2,099,885 in the latest quarter.

Since

inception, the company has burned through over $34 million in

investor capital with the goal to bring its technology to life.

Nearly all of this money has come from one man – WNDW’s largest

individual shareholder Harmel Rayat. Mr Rayat owns nearly 74% of

the company and has been the company’s main backer and kept it

afloat for over 10 years. Obviously, he’s a financier who believes

in SolarWindow and has put his money where his mouth is. This is in

spite of shortsellers

relentlessly attacking both

Mr Rayat and SolarWindow Technologies.

Read

the Full Report on SolarWindow Technologies Inc (OTCMKTS:WNDW) at

InsiderFinancial.com

http://www.insiderfinancial.com/shares-of-solarwindow-technologies-inc-otcmktswndw-come-crashing-down/116362/

Insider Financial

Insider

Financial is a leading research site for small cap companies.

We specialize in finding tomorrow’s microcap runner ahead of the

crowd. We look for undervalued and mispriced securities as well as

today’s small caps that can grow into tomorrow’s mid cap and large

cap leaders.

Disclosure

Insider

Financial is a wholly-owned subsidiary of Archangel Media

Consulting, LLC. Remember always participate at your own risk. Our

profiles are based on research that we have done and do not provide

any warranties. We hold no investment licenses and are thus neither

licensed nor qualified to provide investment advice. The content in

this report or email is not provided to any individual with a view

toward their individual circumstances. We have no position in ORRP,

TSLA, SKLN, and WNDW. We have been compensated $7500 by Investing

Media Solutions, LLC for a two day awareness campaign on

ORRP.

Contact

Insider

Financial - http://www.insiderfinancial.com/

Email

- editor@insiderfinancial.com

Twitter

- https://twitter.com/InsidrFinancial

Insider

Financial

3675

Rainbow Blvd Suite #107-639

Las

Vegas , NV 89103

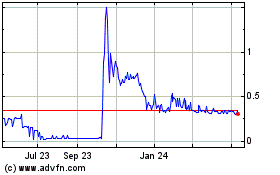

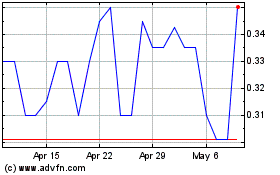

Solarwindow Technologies (PK) (USOTC:WNDW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Solarwindow Technologies (PK) (USOTC:WNDW)

Historical Stock Chart

From Apr 2023 to Apr 2024