CSX Results Hurt by Sagging Demand for Coal -- WSJ

July 14 2016 - 3:04AM

Dow Jones News

By Ezequiel Minaya

CSX Corp. said Wednesday that revenue for its second quarter

fell 12% as falling coal shipments -- a key business for freight

lines -- continued to pressure the railroad operator.

Shares of CSX, though, rose 4.4% to $28.21 on Wednesday as the

company's earnings topped expectations. The stock is up 9% for the

year.

The Jacksonville, Fla., company released its earnings report

more than an hour earlier than expected to correct "information

released via Twitter earlier today."

A spokeswoman for CSX said in an email message that the posting,

which went up on the social media site at about 2 p.m. ET, was

removed "immediately." She didn't specify what the message said but

added that CSX officials moved ahead with an early release of their

earnings report to provide "investors the correct information as

quickly as possible."

CSX has struggled over the past two years as sagging demand for

coal, amid plunging energy prices and a strong U.S. dollar, has cut

into rail traffic.

For the latest quarter, coal volume for CSX was down 30%. The

company has said it expects the market to remain challenging, with

coal volumes down about 25% for the year.

"The environment that we see is really typified by low

natural-gas prices, low commodity prices and a strong U.S. dollar,

and we expect those to continue even though we had seen some small

moderation in those in the past few weeks," CSX Chief Financial

Officer Frank Lonegro said in May at an industry conference,

according to a FactSet transcript.

On Wednesday, CSX said it expects 2016 full-year earnings per

share to decline. The company, though, didn't provide a specific

forecast.

CSX has met or exceeded earnings expectations over the past

three quarters, having responded to sector turmoil with efficiency

moves that included layoffs and the mothballing of trains.

For the quarter ended June 24, CSX reported a profit of $445

million, or 47 cents a share, down from a year-ago profit of $553

million, or 56 cents a share.

Revenue fell 12% to $2.7 billion.

Analysts surveyed by Thomson Reuters expected earnings to

decline to 44 cents a share on revenue of $2.7 billion.

According to the Association of American Railroads, U.S.

carloads through the past six months fell 12.5% compared with the

same period last year, with coal carloads plunging 30.2%. Petroleum

and associated products also dragged on the traffic tally, falling

21.6%.

Hopes that intermodal traffic -- the hauling of shipping

containers -- would help offset the drop-off in other categories,

haven't quite been met. Total intermodal units fell a modest

2.7%.

Write to Ezequiel Minaya at ezequiel.minaya@wsj.com

(END) Dow Jones Newswires

July 14, 2016 02:49 ET (06:49 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

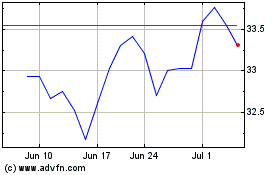

CSX (NASDAQ:CSX)

Historical Stock Chart

From Mar 2024 to Apr 2024

CSX (NASDAQ:CSX)

Historical Stock Chart

From Apr 2023 to Apr 2024