Emirates Airline Receives Lift From Low Oil Prices

May 10 2016 - 4:30AM

Dow Jones News

DUBAI—Emirates Airline on Tuesday reported a 56% jump in

full-year net profit, as the state-owned carrier was boosted by low

oil prices and increased passenger numbers.

Net profit for the financial year ending March 31 rose to $1.9

billion from $1.2 billion a year earlier, Emirates Chairman Sheikh

Ahmed bin Saeed Al Maktoum told a news conference. Full-year

revenue dropped 4% to $23.2 billion from $24.2 billion a year

earlier.

The drop in oil prices since the middle of 2014 has boosted

profits for global airlines. Emirates' fuel bill was reduced by 31%

and now constitutes 26% of its operational costs compared with 35%

the previous year, the company said.

At the same time, low fuel and the strong dollar have affected

the airline's revenues, Sheikh Ahmed said.

"Each year brings a new set of challenges and last year was no

different," Sheikh Ahmed said. "Low oil prices will continue to be

a double-edged sword," he said.

Emirates is the oldest and biggest of the three major Persian

Gulf airlines, along with Etihad Airways and Qatar Airways, which

over the past decade have overtaken more established competitors in

Europe and the U.S. They've done so by investing heavily in new

planes and by aggressively expanding their world-wide networks,

using major airports in cities like Doha and Dubai as hubs to

facilitate long-haul traffic between the continents.

The Gulf airlines' rapid ascension has irked some U.S. carriers

including Delta Air Lines and American Airlines Group Inc. who

accuse the trio of receiving state subsidies that give them an

unfair advantage over their competitors. The Gulf airlines deny

those allegations.

Emirates, whose history dates back to 1985, today is the world's

largest carrier by international capacity. In the last fiscal year,

the airline carried 51.9 million passengers, 8% more than the

previous year.

Emirates Group, which includes the airline, airport services

provider Dnata, a number of luxury hotels and other facilities in

Dubai, posted a 50% year-over-year increase in full-year net profit

to $2.2 billion.

The Abu Dhabi-based rival carrier Etihad Airways last month

posted a 41% jump in full-year net profit to $103 million as it

also carried more passengers.

Write to Nicolas Parasie at nicolas.parasie@wsj.com

(END) Dow Jones Newswires

May 10, 2016 04:15 ET (08:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

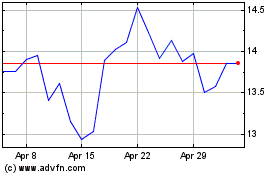

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

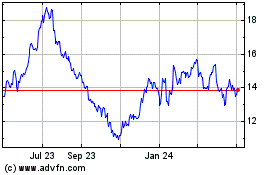

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Apr 2023 to Apr 2024