Square Faces Questions on Lending Strategy as Shares Tumble

May 06 2016 - 3:00PM

Dow Jones News

Shares in payment provider Square Inc. fell Friday at the

fastest clip since the company's initial public offering, a day

after the firm reported deepening losses and slow growth in its

lending business.

Square's shares fell as much as 20% Friday before recovering

slightly. In afternoon trading, Square shares were down about

18%.

The San Francisco company run by Twitter Inc. co-founder and

Chief Executive Jack Dorsey said it posted a first-quarter loss of

$96.8 million, wider than its year-earlier loss of $48 million.

Excluding costs like taxes and stock compensation, the loss of

$9 million was less than the $20 million in the first quarter of

2015. The company said it planned to earn $14 million on that

adjusted basis for the full year.

Square is best known for the white devices it sells to small

businesses to accept and process payments, but the company has

recently been investing in ancillary services like loans. But that

unit, Square Capital, reported loan growth of just 4% compared with

the fourth quarter of 2015.

BTIG analyst Mark Palmer said in a research note that the small

increase in loan volume was "a source of concern" and said the

delay in signing up new investors for Square Capital's loans

"likely raised a few eyebrows among shareholders."

The company said "more challenging credit-market conditions"

were a reason for the slow growth, as two new, unnamed investors

delayed their purchases of Square Capital credits.

Square finance chief Sarah Friar said on a conference call with

analysts Thursday that lending is a good business for Square to be

in. Unlike competitors that have to spend a lot of money upfront to

find borrowers and get them to apply, Square already has a large

base of potential small-business customers that use its payments

service.

"There is still tremendous demand [for Square loans] and I think

we're only beginning to scratch the surface of what's available to

us," she said.

Nevertheless, some analysts questioned that as a long-term

strategy. Gil Luria of Wedbush Securities called Square Capital a

"risky growth engine" that "significantly amplifies an already

highly cyclical growth profile."

On Deck Capital Inc., another online small-business lender, also

reported a drop-off in investor demand for its loans in the

beginning of the quarter, causing its shares to plunge by nearly a

third in value on Tuesday.

Write to Peter Rudegeair at Peter.Rudegeair@wsj.com

(END) Dow Jones Newswires

May 06, 2016 14:45 ET (18:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

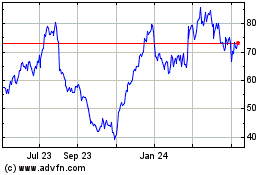

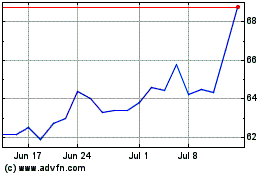

Block (NYSE:SQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Block (NYSE:SQ)

Historical Stock Chart

From Apr 2023 to Apr 2024