Tencent Holdings in Talks For $2 Billion Loan

April 15 2016 - 1:10AM

Dow Jones News

HONG KONG—Tencent Holdings Ltd. is in talks with banks to raise

$2 billion in a syndicated loan, people familiar with the matter

said, as the Chinese social network company seeks to raise funds

for more acquisitions and expand into new areas such as financial

services.

China's biggest Internet companies Tencent and online shopping

firm Alibaba Group Holding Ltd. have been raising billions of

dollars in bank loans over the past several months to finance their

expansion through acquisitions in China and abroad. Tencent's

discussions about the new loan come after the company in November

secured $1.5 billion in a syndicated bank loan.

Last month, Alibaba said it had secured a $3 billion syndicated

loan.

Tencent and Alibaba have been ramping up their investments in a

wide range of businesses, from ride-sharing to online entertainment

and financial services. In January, Tencent participated in a $3.3

billion investment round for Meituan-Dianping, China's biggest

online provider of restaurant bookings, movie ticketing and other

on-demand services.

Last week, people familiar with the matter told The Wall Street

Journal that both Tencent and Alibaba are participating in a new

$1.5 billion investment round for Beijing-based ride-sharing

company Didi Kuaidi Joint Co., the biggest Chinese competitor to

Uber Technologies Inc.

Earlier this week, Alibaba said it would invest about $1 billion

for a controlling stake in Singapore-based online shopping startup

Lazada Group.

Tencent's new loan, expected to close by next month, would

likely help finance more acquisitions as well as the company's

continued expansion in financial services, the people said.

The company, which last year started offering small personal

loans to users of its WeChat messaging app, is also the largest

shareholder of its online banking affiliate, WeBank.

WeBank competes with Alibaba's financial services affiliate, Ant

Financial Services Group.

The five banks that were underwriters for Tencent's previous

$1.5 billion loan in November—Citigroup Inc., Australia & New

Zealand Banking Group, Bank of China, HSBC Holdings PLC and Mizuho

Financial Group—will be underwriters again for the new $2 billion

loan, the people said.

Write to Juro Osawa at juro.osawa@wsj.com

(END) Dow Jones Newswires

April 15, 2016 00:55 ET (04:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

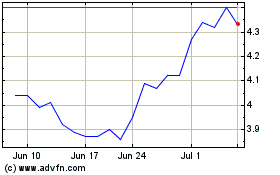

Mizuho Financial (NYSE:MFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

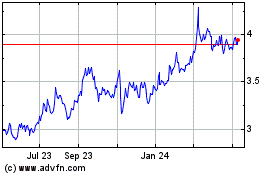

Mizuho Financial (NYSE:MFG)

Historical Stock Chart

From Apr 2023 to Apr 2024