UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

|

Filed by the Registrant

☒

|

Filed by a party other than the Registrant

☐

|

Check the appropriate box:

|

☒

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐

|

Definitive Proxy Statement

|

|

☐

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material under §240.14a-12

|

|

LIQUIDMETAL TECHNOLOGIES, INC.

|

|

(Name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount previously paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

30452 Esperanza

Rancho Santa Margarita, California 92688

_________________________________

NOTICE OF 201

6

ANNUAL MEETING OF STOCKHOLDERS

TO

BE HELD ON

[·]

_________________________________

To the Stockholders of Liquidmetal Technologies, Inc.:

You are cordially invited to attend the annual meeting of stockholders of Liquidmetal Technologies, Inc. (the “Company”), which will be held at the Company’s corporate headquarters, located at 30452 Esperanza, Rancho Santa Margarita, California 92688, on [·], at [·] local time, for the following purposes:

|

|

1.

|

To elect as directors the six nominees named in the accompanying proxy statement to serve until the 2017 annual meeting of stockholders and until their successors are duly elected and qualified;

|

|

|

2.

|

To approve the amendment and restatement of our Certificate of Incorporation to increase the number of shares of common stock that we are authorized to issue from 700,000,000 shares to 1,100,000,000 shares;

|

|

|

3.

|

To hold an advisory vote on the compensation of our named executive officers as disclosed in the accompanying proxy statement;

|

|

|

4.

|

To ratify the appointment of SingerLewak LLP as our independent registered public accountants for the year ending December 31, 2016; and

|

|

|

5.

|

To transact such other business as may properly come before the meeting or any adjournment thereof.

|

Only stockholders of record at the close of business on [·] will be entitled to vote at the annual meeting. Information relating to the matters to be considered and voted on at the annual meeting is set forth in the accompanying proxy statement. We are also enclosing with the accompanying proxy statement a copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2015.

YOUR VOTE IS VERY IMPORTANT. Please read the proxy statement and vote your shares as soon as possible. Our board of directors unanimously recommends a vote “FOR” the election of each of the six nominees for director named in the accompanying proxy statement, “FOR” the approval of the amendment and restatement of our Certificate of Incorporation to increase the number of shares of common stock that we are authorized to issue from 700,000,000 shares to 1,100,000,000 shares

, “FOR” approval, on an advisory basis, of the compensation of our named executive officers, and “FOR” the ratification of the appointment of SingerLewak LLP as our independent registered public accountants for the year ending December 31, 2016.

If you are viewing the proxy statement on the Internet, you may grant your proxy electronically via the Internet by following the instructions on the Notice of Internet Availability of Proxy Materials previously mailed to you and the instructions listed on the Internet website. If you are receiving a paper copy of the proxy statement, you may vote by completing and mailing the proxy card enclosed with the proxy statement, or you may grant your proxy electronically via the Internet or by telephone by following the instructions on the proxy card. If your shares are held in “street name,” which means your shares are held of record by a broker, bank or other nominee, you should review the Notice of Internet Availability of Proxy Materials used by that firm to determine whether and how you will be able to submit your proxy by telephone or over the Internet.

By Order of the Board of Directors,

/s/ Thomas Steipp

President and Chief Executive Officer

[·]

30452 Esperanza

Rancho Santa Margarita, California 92688

_________________________________

PROXY STATEMENT FOR

201

6

ANNUAL MEETING OF STOCKHOLDERS

_________________________________

This proxy statement is furnished in connection with the solicitation of proxies on behalf of the board of directors of Liquidmetal Technologies, Inc. (“Liquidmetal,” the “Company,” “we,” “us” or “our”) for use at the annual meeting of the Company’s stockholders (the “Annual Meeting”) to be held at the Company’s corporate headquarters, located at 30452 Esperanza, Rancho Santa Margarita, California 92688, on [·], at [·] local time, and any adjournments or postponements of the Annual Meeting. A copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2015 (the “2015 Annual Report”) is enclosed with this proxy statement.

We have elected to provide access to our proxy materials over the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to our stockholders of record, while brokers, banks and other nominees who hold shares on behalf of beneficial owners will be sending their own similar notice. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to request a printed copy by mail or electronically may be found on the Notice and on the website referred to in the Notice, including an option to request paper copies on an ongoing basis. On [·], we intend to make this proxy statement available on the Internet and to mail the Notice to all stockholders entitled to vote at the Annual Meeting. We intend to mail this proxy statement, together with a proxy card, to those stockholders entitled to vote at the Annual Meeting who properly request paper copies of such materials, within three business days of such request.

Important Notice Regarding the Availability of Proxy Materials for the 2016 Annual Meeting of Stockholders to be Held on

[·]

:

This proxy statement and our 201

5

Annual Report are available for viewing, printing and downloading at

www.proxyvote.com

.

You can also find this proxy statement and our 2015 Annual Report on the Internet through the Securities and Exchange Commission’s electronic data system, called EDGAR, at www.sec.gov. You may also obtain a copy of our 2015 Annual Report, as filed with the Securities and Exchange Commission (which we sometimes refer to herein as the “Commission” or the “SEC”) without charge as provided in the Notice or upon written request to Liquidmetal Technologies, Inc., Attention: Investor Relations at 30452 Esperanza, Rancho Santa Margarita, California 92688. We will provide the 2015 Annual Report without exhibits unless you specify in writing that you are requesting copies of the exhibits.

Certain documents referenced in this proxy statement are available on our website at www.liquidmetal.com. We are not including the information contained on our website, or any information that may be accessed by links on our website, as part of, or incorporating it by reference into, this proxy statement.

VOTING RIGHTS AND SOLICITATION

Voting Your Shares and Revocation of Proxies

You may vote by attending the Annual Meeting and voting in person or you may vote by submitting a proxy.

The method of voting by proxy differs (1) depending on whether you are viewing this proxy statement on the Internet or receiving a paper copy, and (2) for shares held as a record holder and shares held in “street name.” If you hold your shares of stock as a record holder and you are viewing this proxy statement on the Internet, you may vote by submitting a proxy over the Internet or by telephone by following the instructions on the website referred to in the Notice previously mailed to you. If you hold your shares of stock as a record holder and you are reviewing a paper copy of this proxy statement, you may vote your shares by completing, dating and signing the proxy card that was included with the proxy statement and promptly returning it in the preaddressed, postage paid envelope provided to you, or by submitting a proxy over the Internet or by telephone by following the instructions on the proxy card. If you hold your shares of stock in “street name,” which means your shares are held of record by a broker, bank or nominee, you will receive a notice from your broker, bank or other nominee that includes instructions on how to vote your shares. Your broker, bank or nominee will allow you to deliver your voting instructions over the Internet and may also permit you to vote by telephone. In addition, you may request paper copies of the proxy statement and proxy card from your broker by following the instructions on the notice provided by your broker.

The Internet and telephone voting facilities will close at 11:59 p.m. eastern time on [·]. If you vote through the Internet, you should be aware that you may incur costs to access the Internet, such as usage charges from telephone companies or Internet service providers and that these costs must be borne by you. If you vote by Internet or telephone, then you need not return a written proxy card by mail.

Your vote is very important

. You should submit your proxy even if you plan to attend the Annual Meeting.

All shares held by stockholders who are entitled to vote and who are represented at the Annual Meeting by properly submitted proxies received before the polls are closed at the Annual Meeting will be voted in accordance with the instructions indicated on the proxy card, unless such proxy is properly revoked prior to the vote being taken on the matter submitted to the stockholders at the Annual Meeting.

A proxy may be revoked and your vote changed in advance of the

Annual Meeting

.

If you are a stockholder of record, you can change your vote and revoke your proxy at any time before the vote is taken at the Annual Meeting by doing any one of the following:

|

|

•

|

filing with our Corporate Secretary, at or before the taking of the vote, a written notice of revocation bearing a later date than the proxy;

|

|

|

|

|

|

|

•

|

duly executing a later dated proxy relating to the same shares and delivering it to our Corporate Secretary before the taking of the vote;

|

|

|

|

|

|

|

•

|

accessing the Internet and following the instructions for voting by Internet that appear on the enclosed proxy card;

|

|

|

|

|

|

|

•

|

following the instructions that appear on the enclosed proxy card for voting by telephone; or

|

|

|

|

|

|

|

•

|

attending the Annual Meeting and voting in person. Attendance at the Annual Meeting, if a stockholder does not vote, will not be sufficient to revoke a proxy.

|

Any written notice of revocation or subsequent proxy should be sent to us at the following address: Liquidmetal Technologies, Inc., Attention: Corporate Secretary, 30452 Esperanza, Rancho Santa Margarita, California 92688. If your shares are held in “street name,” which means your shares are held of record by a broker, bank or nominee, you must follow the instructions of your broker, bank or other nominee to revoke a previously given proxy.

If a proxy card does not specify how the proxy is to be voted, the shares represented by the proxy will be voted “FOR” the election of each of the six nominees for director named in the accompanying proxy statement, “FOR” the approval of the amendment and restatement of our Certificate of Incorporation to increase the number of shares of common stock that we are authorized to issue from 700,000,000 shares to 1,100,000,000 shares

, “FOR” approval, on an advisory basis, of the compensation of our named executive officers, and “FOR” the ratification of the appointment of SingerLewak LLP as our independent registered public accountants for the year ending December 31, 2016.

The form of proxy accompanying this proxy statement confers discretionary authority upon the named proxy holders with respect to amendments or variations to the matters identified in the accompanying notice of Annual Meeting and with respect to any other matters which may properly come before the Annual Meeting. Our board of directors does not know of any other matters that may come before the Annual Meeting. If any other matter properly comes before the Annual Meeting, including consideration of a motion to adjourn the Annual Meeting to another time or place (including for the purpose of soliciting additional proxies), the persons named in the proxy card that accompanies this proxy statement will exercise their judgment in deciding how to vote, or otherwise act, at the Annual Meeting with respect to that matter or proposal.

If you receive more than one proxy card, it means you hold shares that are registered in more than one account. To ensure that all of your shares are voted, sign and return each proxy card or, if you submit a proxy by telephone or the Internet, submit one proxy for each proxy card you receive.

Attendance at the

Annual Meeting

Only our stockholders as of the record date for the Annual Meeting, their proxy holders, and guests we may invite may attend the Annual Meeting. If you wish to attend the Annual Meeting in person but you hold your shares through someone else, such as a broker, bank or other nominee, you must bring proof of your ownership and photo identification to the Annual Meeting. For example, you could bring an account statement showing that you beneficially owned shares of our stock as of the record date as acceptable proof of ownership. You must also contact your broker, bank or other nominee and follow their instructions in order to vote your shares at the Annual Meeting. You may not vote your shares at the Annual Meeting unless you have first followed the procedures outlined by your broker, bank or other nominee.

Stockholders Entitled to Vote and Number of Votes

The record date for the Annual Meeting is [·]. Only stockholders of record as of the close of business on the record date are entitled to receive notice of the Annual Meeting and to vote at the Annual Meeting. As of the record date, there were [·] shares of our common stock outstanding and entitled to vote at the Annual Meeting. A list of stockholders eligible to vote at the Annual Meeting will be available for inspection at the Annual Meeting, and at our executive offices during regular business hours for a period of no less than ten days prior to the Annual Meeting.

Each share of common stock is entitled to one vote on all proposals at the Annual Meeting.

Quorum and Votes Required

Votes cast by proxy or in person at the Annual Meeting will be tabulated by the inspector of elections appointed for the Annual Meeting, who will also determine whether a quorum is present for the transaction of business. Our bylaws provide that the holders of a majority of the outstanding shares of each class of stock entitled to vote at the Annual Meeting must be present or represented by proxy in order to constitute a quorum for the transaction of any business. Abstentions will be counted as shares that are present and entitled to vote for purposes of determining whether a quorum is present. If a broker indicates on its proxy that it does not have discretionary voting authority to vote shares for which it is the holder of record at the Annual Meeting, such shares cannot be voted by the broker (a “broker non-vote”), although they will be counted in determining whether a quorum is present. Brokers or other nominees who hold shares in “street name” for the beneficial owner of those shares typically have the authority to vote in their discretion on “routine” proposals when they have not received instructions from the beneficial owner. However, brokers are not allowed to exercise their voting discretion with respect to the election of directors or other “non-routine” proposals without specific instructions from the beneficial owner. Only Proposals 2 and 4 ares considered to be a “routine” proposals for the purposes of brokers exercising their voting discretion.

Proposal 1 – Election of Directors.

Pursuant to our bylaws and Delaware law, if a quorum exists, directors are elected by a plurality of the votes cast by the shares present in person or represented by proxy at the meeting and entitled to vote in the election. Neither broker non-votes nor abstentions will be included in the tabulation of the voting results for this proposal.

Proposal

2

–

Approval of the Amendment and Restatement of Our Certificate of Incorporation

. Approval of the amendment and restatement of our Certificate of Incorporation to increase the number of shares of common stock that we are authorized to issue from 700,000,000 shares to 1,100,000,000 shares

will require the affirmative vote of a majority of the shares of our common stock present or represented by proxy at the Annual Meeting and entitled to vote on this matter. Abstentions will have the same effect as votes against this proposal. The approval of the amendment and restatement of our Certificate of Incorporation

is a routine proposal on which a broker or other nominee is generally empowered to vote in the absence of voting instructions from the beneficial owner, so broker non-votes are unlikely to result from this proposal.

Proposal 3 – A

dvisory

V

ote on

C

ompensation of

N

amed

E

xecutive

O

fficers

.

Approval (on a non-binding, advisory basis) of the compensation of our named executive officers requires the affirmative vote of a majority of the shares of our common stock present or represented by proxy at the Annual Meeting and entitled to vote on this matter. Abstentions will have the same effect as votes against this proposal, but broker non-votes will have no effect on the voting results for this proposal.

Because this vote is advisory, the results of the vote are not binding on our board of directors or our Compensation Committee. However, if there is a significant vote against the compensation of our named executive officers, our board of directors and our Compensation Committee will carefully evaluate whether any actions are necessary to address those concerns.

Proposal 4 -

Ratification of Accountants

. Ratification of SingerLewak LLP as our independent registered public accountants for the year ending December 31, 2016 will require the affirmative vote of a majority of the shares of our common stock present or represented by proxy at the Annual Meeting and entitled to vote on this matter. Abstentions will have the same effect as votes against this proposal. The ratification of accountants is a routine proposal on which a broker or other nominee is generally empowered to vote in the absence of voting instructions from the beneficial owner, so broker non-votes are unlikely to result from this proposal.

Other Matters

. In order to be approved, any other matter to properly come before the Annual Meeting will require the affirmative vote of a majority of the shares of our common stock present or represented by proxy at the Annual Meeting and entitled to vote on the matter.

Solicitation of Proxies

Proxies solicited by this proxy statement may be exercised only at the Annual Meeting and any adjournment of the Annual Meeting and will not be used for any other meeting. Proxies solicited by this proxy statement will be returned to our Secretary and will be tabulated by an inspector of elections designated by our board of directors who will not be employed by us.

We will bear the entire cost of solicitation of proxies by mail on behalf of the board of directors. Proxies also may be solicited by personal interview or by telephone by our directors, officers, and other employees without additional compensation. We also have made arrangements with brokerage firms, banks, nominees, and other fiduciaries to forward proxy solicitation materials for shares held of record to the beneficial owners of such shares. We will reimburse such record holders for their reasonable out-of-pocket expenses.

PROPOSAL 1—ELECTION OF DIRECTORS

At the Annual Meeting, six directors are to be elected, each to serve a one-year term expiring at the 2017 annual meeting of stockholders and until his successor is elected and qualified.

Our board of directors has nominated for election Thomas Steipp, Yeung Tak Lugee Li, Abdi Mahamedi, Bob Howard-Anderson, Richard Sevcik, and Walter Weyler. Each person nominated for election has agreed to serve if elected, and our board of directors has no reason to believe that any nominee will be unavailable or will decline to serve. In the event, however, that any nominee is unable or declines to serve as a director at the time of the Annual Meeting, the persons designated as proxies will vote for any nominee who is designated by our current board of directors to fill the vacancy.

For each person nominated to become a director there follows information given by each concerning his principal occupation and business experience for at least the past five years, the names of other public reporting companies for which he serves, or has during the past five years served, as a director, and his age and length of service as one of our directors. In addition, for each person nominated to become a director, there follows information regarding the specific experience, qualifications, attributes or skills that led to the conclusion (by our board of directors) that the person should serve as a director. There are no family relationships among any of our directors and executive officers. No director or executive officer is related by blood, marriage or adoption to any other director or executive officer. No arrangements or understandings exist between any director or person nominated for election as a director and any other person pursuant to which such person is to be selected as a director or nominee for election as a director except with respect to Mr. Li as noted below.

|

Name

|

Age

|

Principal Occupation and Other Information

|

|

Thomas Steipp

|

6

5

|

Thomas Steipp was elected by our board of directors to serve as our President and Chief Executive Officer in August 2010 and was also elected to our board of directors in August 2010. Mr. Steipp previously served in various roles at Symmetricom, Inc., a publicly traded provider of products for communications infrastructure and systems. Mr. Steipp served as Symmetricom’s Chief Executive Officer from December 1998 to June 2009, Chief Financial Officer from December 1998 to October 1999, and President and Chief Operating Officer of Telecom Solutions, a division of Symmetricom, from March 1998 to December 1998. Mr. Steipp also served on Symmetricom’s board of directors from 1998 to 2009. During his employment with Symmetricom, Mr. Steipp worked to transform the company from a technology holding company into a telecommunications hardware focused company, served as the company’s spokesman in working with investors, implemented a new business model, worked to reduce operating expenses, and led acquisition activities. Mr. Steipp received his B.S. in electrical engineering from the Air Force Academy and M.S. in industrial administration from Purdue University. Mr. Steipp holds an Advanced Professional Director Certification from the American College of Corporate Directors, a public company director education and credentialing organization.

Our board of directors believes that Mr. Steipp’s experience and background make him a qualified and valuable member of our board of directors. In particular, Mr. Steipp’s experience and background in working with publicly traded, technology-based industrial products companies, recruiting executives, working with investors, implementing new business models, and leading acquisition activities make him a valuable resource for our Company.

|

|

|

|

|

|

Yeung Tak Lugee Li

|

56

|

Yeung Tak Lugee Li was appointed to our board of directors in March 2016. Mr. Li is the founder, Chairman, and majority stockholder of DongGuan Eontec Co. Ltd., a Hong Kong company listed on the Shenzen Stock Exchange engaged in the production of precision die-cast products and the research and development of new materials. Mr. Li founded Eontec in 1993 and has served as Chairman since that date. At Eontec, Mr. Li is responsible for strategic development and research and development. Mr. Li is also the founder and sole shareholder of Leader Biomedical Limited, a Hong Kong company engaged in the supply of biomaterials and surgical implants. Mr. Lee serves as an analyst for the Institute of Metal Research at the Chinese Academy of Sciences and serves part-time as a professor at several universities in China. Mr. Li owns Liquidmetal Technology Limited, a Hong Kong company and the investor in our March 2016 Securities Purchase Agreement. The Securities Purchase Agreement provides the investor with the right to designate an individual to serve on our board of directors. Mr. Li was appointed to our board pursuant to that agreement. Our board of directors believes that Mr. Li’s experience and knowledge in the areas of metal die casting and bulk metallic glasses makes him a valuable resource for our Company.

|

|

|

|

|

|

Abdi Mahamedi

|

5

3

|

Abdi Mahamedi has served on our board of directors since May 2009 and became Chairman of our board of directors in March 2010. Since 1987, Mr. Mahamedi has served as the President and Chief Executive Officer of Carlyle Development Group of Companies (“CDG”), which develops and manages residential and commercial properties in the United States on behalf of investors worldwide. At CDG, Mr. Mahamedi evaluates and supervises all of the investment activities and management personnel. Prior to joining CDG, Mr. Mahamedi founded Emanuel Land Company, a subsidiary of Emanuel & Company, a Wall Street investment banking firm, and served as a managing director for Emanuel Land Company from 1986 to 1987. In 1983, Mr. Mahamedi received his B.S.E. degree in Civil and Structural Engineering from the University of Pennsylvania, and in 1984 he received his M.S.E. degree in Civil and Structural Engineering from the University of Pennsylvania. Our board of directors believes that Mr. Mahamedi’s experience and background make him a qualified and valuable member of our board of directors. In particular, his experience working with global investment companies and leading acquisition activities make him a valuable resource for our Company.

|

|

|

|

|

|

Bob Howard-Anderson

|

5

9

|

Bob Howard-Anderson began serving on our board of directors in February 2013. Since November 2013, Mr. Howard-Anderson has served as Chief Executive Officer of Fulham Co., Inc., a global supplier of industrial and residential lighting solutions. Since 2002, Mr. Howard-Anderson served as President and Chief Executive Officer of Occam Networks, a leading provider of broadband access solutions, until its acquisition by Calix Inc. in February 2011. Previously, Mr. Howard-Anderson served as Vice President of Product Operations at Procket Networks from 2000 to 2002, where he was responsible for research and development, product management and manufacturing operations. Prior to that, Mr. Howard-Anderson was Vice President of Engineering for Sun Microsystems Inc., responsible for developing and introducing a broad portfolio of products. Prior to Sun Microsystems, he served as Vice President of Engineering at First Pacific Networks as well as Network Equipment Technology. He also held management positions at Bolt Baranek and Newman (BBN) and Octocom Inc. Mr. Howard-Anderson holds a BS in Electrical Engineering and Physics from Tufts University. Our board of directors believes that Mr. Howard-Anderson’s experience and background make him a qualified and valuable member of our board of directors. In particular, his more than 30 years of experience in the data and telecommunication equipment industries managing large research and development and product development initiatives, as well as his experience managing startup companies to profitability, make him a valuable member of our board of directors.

|

|

|

|

|

|

Richard Sevcik

|

6

8

|

Mr. Sevcik began serving on our board of directors in May 2013. Mr. Sevcik currently serves as President of Sevcik Consulting, which he founded in 2006 and which provides consulting services to companies that provide semiconductor products and tools to their customers for consumer-oriented products such as smart phones, tablets, digital cameras and eBooks. In addition, Mr. Sevcik currently serves on the board of directors of AnDapt, an integrated power management software and hardware provider in the consumer electronics industry. Mr. Sevcik previously served on the boards of directors of SiliconBlue Technologies from 2008 until its acquisition by Lattice Semiconductor in 2011, and Alpha and Omega Semiconductor Limited through November 2013. Mr. Sevcik received his B.S. in engineering physics from the University of Illinois and M.S. in electrical engineering from Northwestern University. Our board of directors believes that Mr. Sevcik’s extensive directorial, management and governance experiences and his understanding of the business operation and reporting of publicly traded technology companies, as well as his background in electrical engineering, bring significant management expertise, scientific knowledge and appropriate perspective to our board of directors.

|

|

Walter Weyler

|

76

|

Mr. Weyler began serving on our board of directors in September 2015, after serving as a member of our technology board, a technology-focused advisory board, since October 2014. Mr. Weyler previously served, from 1995 to 2005, as the owner and president of Kinetics, Incorporated, a contract manufacturer of complex solid steel parts and a leader in metal injection molding. Prior to that time, Mr. Weyler served, from 1985 to 1993, as the president and chief operating officer and a director of Graco Inc., a publicly traded company that designs, manufactures and markets systems and equipment to move, measure, dispense and spray fluid and coating materials. Mr. Weyler has served as a member of the Oregon Symphony Board of Trustees since 2006 and a member of the Eliot Condominium Board since 2013. Mr. Weyler also served as a member of the Board of Trustees of the Oregon Museum of Science and Industry from 2011 to 2015. Our board of directors believes that Mr. Weyler’s experience and background will make him a qualified and valuable member of the board. In particular, Mr. Weyler’s experience with coatings and metal injection molding businesses make him a valuable resource for our board of directors

.

|

Our board of directors unanimously recommends the nominees for election as

directors and urges each stockholder to vote “FOR” the nominees.

BOARD OF DIRECTORS

Board Meetings and Director Independence

During 2015, our board of directors held

14 meetings. All directors attended at least 75% of the meetings of the board of directors and the committees on which they served during 2015. In addition, the independent directors met in executive session periodically in 2015.

We have not established a policy with regard to the attendance of board members at annual stockholder meetings. None

of our directors attended our 2015 annual stockholder meeting.

Our board of directors presently has six members, and biographical information regarding these directors (all of whom are director nominees) is set forth above under the caption “PROPOSAL 1—ELECTION OF DIRECTORS.” Our board of directors has determined that four of its current members, Mr. Mahamedi, Mr. Howard-Anderson, Mr. Sevcik, and Mr. Weyler, are “independent directors” as defined under the rules of The NASDAQ Stock Market, Inc. Mr. Mahamedi serves as the Chairman of our board of directors.

One of our former directors, Scott Gillis, recently resigned from our board of directors on March 24, 2016. Immediately prior to Mr. Gillis’ resignation, our board of directors had seven members. As a result of Mr. Gillis’ resignation, the size of our board of directors was reduced to six members. However, pursuant to the terms of the below-described Securities Purchase Agreement that we entered into on March 10, 2016, our board of directors may be once again expanded to seven members in the future as further described below under “PROPOSAL 2— AMENDMENT AND RESTATEMENT OF OUR CERTIFICATE OF INCORPORATION.”

Board Committees

The board of directors has established the following standing committees whose responsibilities are summarized as follows:

Compensation Committee.

Mr. Sevcik serves as chairman of the Compensation Committee, and Mr. Howard-Anderson

, and Mr. Weyler serve as the other members

of the Compensation Committee.

Our board of directors has determined that each of Mr.

Sevcik, Mr. Howard-Anderson

, and Mr. Weyler

is an

“independent director” as defined by the rules of The NASDAQ Stock Market, Inc. applicable to members of a compensation committee. The Compensation Committee is responsible for establishing the compensation of our senior management, including salaries, bonuses, termination arrangements, and other executive officer benefits. The Compensation Committee also administers our equity incentive plans.

During 2015, the Compensation Committee held

5 meetings. The Compensation Committee is governed by a written charter approved by the board of directors. A copy of the Compensation Committee’s charter is posted on the Company’s website at

www.liquidmetal.com

in the “Investors” section of the website.

The Compensation Committee works with the Chairman of the Board and Chief Executive Officer and reviews and approves compensation decisions regarding senior management including compensation levels and equity incentive awards. The Compensation Committee also approves employment and compensation agreements with our key personnel and directors. The Compensation Committee has the power and authority to conduct or authorize studies, retain independent consultants, accountants or others, and obtain unrestricted access to management, our internal auditors, human resources and accounting employees and all information relevant to its responsibilities.

Corporate Governance and Nominating Committee.

Mr. Sevcik serves as chairman of the Corporate Governance and Nominating Committee, and Mr. Howard-Anderson

and Mr. Weyler serve as the other members

of the Corporate Governance and Nominating Committee (the “Governance Committee”).

Our board of directors has determined that each of Mr.

Sevcik, Mr. Howard-Anderson

, and Mr. Weyler is an “independent director” as defined by the rules of The NASDAQ Stock Market, Inc. The Governance Committee is generally responsible for recommending to our full board of directors policies, procedures, and practices designed to help ensure that our corporate governance policies, procedures, and practices continue to assist the board of directors and our management in effectively and efficiently promoting the best interests of our stockholders. The Governance Committee is also responsible for selecting and recommending for approval by our board of directors and our stockholders a slate of director nominees for election at each of our annual meetings of stockholders, and otherwise for determining the board committee members and chairmen, subject to board of directors ratification, as well as recommending to the board director nominees to fill vacancies or new positions on the board of directors or its committees that may occur or be created from time to time, all in accordance with our bylaws and applicable law.

The Governance Committee’s principal functions include:

|

|

•

|

developing and maintaining our corporate governance policy guidelines;

|

|

|

•

|

developing and maintaining our codes of conduct and ethics;

|

|

|

•

|

overseeing the interpretation and enforcement of our Code of Conduct and our Code of Ethics for Chief Executive Officer and Senior Financial and Accounting Officers;

|

|

|

•

|

evaluating the performance of our board of directors, its committees, and committee chairmen and our directors; and

|

|

|

•

|

selecting and recommending a slate of director nominees for election at each of our annual meetings of the stockholders and recommending to the board director nominees to fill vacancies or new positions on the board of directors or its committees that may occur from time to time.

|

During 2015, the Governance Committee held

1 meeting.

The Governance Committee is governed by a written charter approved by our board of directors. A copy of the Governance Committee’s charter is posted on the Company’s website at

www.liquidmetal.com

in the “Investors” section of the website.

In identifying potential independent board of directors candidates with significant senior-level professional experience, the Governance Committee solicits candidates from the board of directors, senior management and others and may engage a search firm in the process. The Governance Committee reviews and narrows the list of candidates and interviews potential nominees. The final candidate is also introduced and interviewed by the board of directors and the lead director if one has been appointed.

In general, in considering whether to recommend any particular candidate for inclusion in our board of directors’ slate of recommended director nominees, the Governance Committee will apply the criteria set forth in our corporate governance guidelines. These criteria include the candidate’s integrity, business acumen, commitment to understanding our business and industry, experience, conflicts of interest and the ability to act in the interests of our stockholders. Further, specific consideration is given to, among other things, diversity of background and experience that a candidate would bring to our board of directors. The Governance Committee does not assign specific weights to particular criteria and no particular criterion is a prerequisite for each prospective nominee. We believe that the backgrounds and qualifications of our directors, considered as a group, should provide a composite mix of experience, knowledge and abilities that will allow our board of directors to fulfill its responsibilities.

Stockholders may recommend individuals to the Governance Committee for consideration as potential director candidates by submitting their names, together with appropriate biographical information and background materials to our Governance Committee at the following address: Liquidmetal Technologies, Inc., Attention: Investor Relations, 30452 Esperanza, Rancho Santa Margarita, California 92688. Assuming that appropriate biographical and background material has been provided on a timely basis, the Governance Committee will evaluate stockholder recommended candidates by following substantially the same process, and applying substantially the same criteria, as it follows for candidates submitted by others.

Audit Committee

. We have a separately-designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). As a result of the resignation of Scott Gillis as director on March 24, 2016, Mr. Weyler has been appointed as the chairman, and

Mr. Sevcik and Mr. Howard-Anderson serve as the other members of, the Audit Committee.

Our board of directors has determined that Mr. Weyler, Mr. Sevcik and Mr. Howard-Anderson are all “independent directors” as defined by the rules of The NASDAQ Stock Market, Inc. applicable to members of an audit committee and Rule 10A-3(b)(i) under the Exchange Act.

Prior to his resignation, Mr. Gillis qualified as an “audit committee financial expert” as defined by Item 407(d)(5) of SEC Regulation S-K, but our board of directors has not yet determined whether any of the remaining members of the Audit Committee are so qualified.

The Audit Committee is appointed by our board of directors to assist our board of directors in monitoring (1) the integrity of our financial statements, (2) our compliance with legal and regulatory requirements, and (3) the independence and performance of our internal and external auditors.

The Audit Committee’s principal functions include:

|

|

•

|

reviewing our annual audited financial statements with management and our independent auditors, including major issues regarding accounting and auditing principles and practices and financial reporting that could significantly affect our financial statements;

|

|

|

•

|

reviewing our quarterly financial statements with management and our independent auditor prior to the filing of our Quarterly Reports on Form 10-Q, including the results of the independent auditors’ reviews of the quarterly financial statements;

|

|

|

•

|

recommending to the board of directors the appointment of, and continued evaluation of the performance of, our independent auditor;

|

|

|

•

|

approving the fees to be paid to our independent auditor for audit services and approving the retention of our independent auditor for non-audit services and all fees for such services;

|

|

|

•

|

reviewing periodic reports from our independent auditor regarding our auditor’s independence, including discussion of such reports with the auditor;

|

|

|

•

|

reviewing significant reports to management prepared by our internal auditing department and management’s responses;

|

|

|

•

|

reviewing the adequacy of our overall control environment, including internal financial controls and disclosure controls and procedures; and

|

|

|

•

|

reviewing with our management and legal counsel legal matters that may have a material impact on our financial statements or our compliance policies and any material reports or inquiries received from regulators or governmental agencies.

|

During 2015, the Audit Committee met 6 times. The Audit Committee is governed by a written charter approved by our board of directors. A copy of the Audit Committee’s charter is posted on the Company’s website at

www.liquidmetal.com

in the “Investors” section of the website.

Code of Ethics

Our board of directors has adopted a written Code of Ethics for Chief Executive Officer and Senior Financial and Accounting Officers that applies to our Principal Executive Officer, Principal Financial Officer, Principal Accounting Officer or Controller, or persons performing similar functions. We have posted a current copy of the code on our website,

www.liquidmetal.com

, in the “Investors” section of the website.

In addition, we intend to post on our website all disclosures that are required by law concerning any amendments to, or waivers from, any provision of the Code of Ethics for Chief Executive Officer and Senior Financial and Accounting Officers.

Leadership and Risk Oversight

Our board of directors has determined that having a separate Chairman of the Board and Chief Executive Officer is in the best interest of our stockholders at this time. This structure promotes active participation of non-employee directors in setting agendas and establishing priorities for our board of directors. While our board of directors believes its current leadership structure is appropriate at this time, it may determine in the future that the positions of Chief Executive Officer and Chairman of the Board should be held by the same individual.

Our board of directors as a whole has oversight responsibility for our risk management process. This risk oversight function is carried out both by our full board of directors and by individual committees that are tasked by our board of directors with oversight of specific risks. The Audit Committee oversees risks associated with financial and accounting matters including compliance with legal and regulatory requirements, and our financial reporting and internal control systems. The Compensation Committee evaluates risks associated with our compensation policies and practices so as not to encourage or reward excessive risk-taking by our executives or employees.

On a regular basis our board of directors receives information and reports from committees, senior management and/or outside counsel and consultants and discusses the identification, assessment, management and mitigation of the risks associated with our strategic and business plans and operations. Our board of directors also holds regular sessions with members of management with the specific purpose of identifying, prioritizing and managing those risks that we believe are material to our operations.

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee has served as one of our officers or employees at any time. None of our executive officers serves as a member of the compensation committee of any other company that has an executive officer serving as a member of our board of directors. None of our executive officers serves as a member of the board of directors of any other company that has an executive officer serving as a member of the Compensation Committee.

Communications with Board of Directors

Stockholders may communicate with the full board of directors or individual directors by submitting such communications in writing to Liquidmetal Technologies, Inc., Attention: Board of Directors (or the individual director(s)), 30452 Esperanza, Rancho Santa Margarita, California 92688. Such communications will be delivered directly to the board of directors (or to the individual director(s)).

PROPOSAL 2—

AMENDMENT AND RESTATEMENT OF OUR CERTIFICATE OF INCORPORATION

Background

After careful consideration, our board of directors has approved and has determined to ask the stockholders to approve the amendment and restatement of our Certificate of Incorporation. Specifically, the board of directors is proposing to amend Article IV of our Certificate of Incorporation to increase the number of shares of common stock that we are authorized to issue from seven hundred million (700,000,000) to one billion one hundred million (1,110,000,000) shares.

Rationale for the Increase in Authorized Shares

Our board of directors has determined that it is advisable and in the best interests of the Company and our stockholders to increase the authorized shares of common stock in order that a sufficient number of shares of common stock are available for issuance pursuant to the Securities Purchase Agreement, dated March 10, 2016 (the “Purchase Agreement”), by and between the Company and Liquidmetal Technology Limited, a Hong Kong company organized and owned by Mr. Li (the “Investor”), as well as for future financing transactions, acquisitions, stock dividends, stock issuances pursuant to employee benefit plans and other appropriate corporate opportunities and purposes. Our board of directors believes that an increase in authorized shares beyond that required for issuance under the Securities Purchase Agreement is desirable so that, as the need may arise, we will have more financial flexibility and be able to issue additional shares of common stock without the expense and delay associated with a special stockholders’ meeting, except where stockholder approval is required by applicable law. Our ability to issue additional shares of common stock to the Investor and in connection with future financing transactions will be critical to raising the capital necessary to maintain our current business plan. The board of directors does not intend to issue any shares except on terms that it considers to be in the best interests of our Company and our stockholders.

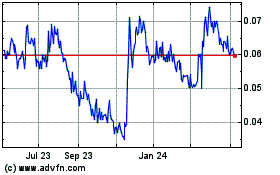

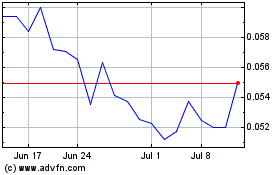

The Purchase Agreement provides that the Investor is obligated to purchase up to 405,000,000 shares of the Company’s common stock for an aggregate purchase price of $63.4 million, in multiple closings, with the Investor having purchased 105,000,000 shares at an aggregate purchase price of $8.4 million (or $0.08 per share) at the initial closing on March 10, 2016. The Purchase Agreement provides that the Investor will purchase the remaining 200,000,000 shares at $0.15 per share and 100,000,000 shares at $0.25 per share for an aggregate purchase price of $55.0 million no later than ninety (90) days after the satisfaction of certain conditions, including stockholder approval of this Proposal 2.

In addition to the shares issuable under the Purchase Agreement, the Company also issued to the Investor a warrant (the “Warrant”) to acquire 10,066,809 shares of common stock of the Company at an exercise price of $0.07 per share. The Warrant vests in increments on each closing date under the Purchase Agreement for a number of Warrant shares that is proportionate to the amount of shares purchased under the Purchase Agreement on such closing date (with 2,609,913 Warrant shares having initially vested on March 10, 2016). The Warrant will expire on the tenth (10th) anniversary of its issuance date; provided, however, that should the subsequent closings under the Purchase Agreement not occur prior to the ninetieth (90th) day after the filing of the proposed amendment and restatement of our Certificate of Incorporation, the Warrant will automatically terminate and the Investor shall have no further right to exercise the remaining unvested 7,456,896 warrant shares under the Warrant.

The Purchase Agreement provides that the Investor will have the right to designate one (1) individual to serve on the Company’s board of directors, which individual will initially be Mr. Li. Once the Investor purchases the remaining 300,000,000 shares of common stock under the Purchase Agreement, the Investor will thereafter have the right to designate an additional two (2) individuals to serve on the Company’s board of directors (such that the Investor would have designation rights with respect to three (3) of the then seven (7) total members of the Company’s board of directors). The Purchase Agreement also provides that, with certain limited exceptions, if the Company issues any shares of common stock at any time through the fifth (5th) anniversary of the Purchase Agreement, the Investor will have a preemptive right to subscribe for and to purchase at the same price per share (or at market price, in the case of issuance of shares pursuant to stock options) the number of shares necessary to maintain its ownership percentage of Company-issued shares of common stock.

The Purchase Agreement requires the Company to use commercially reasonable efforts to, on or before May 31, 2016, obtain stockholder approval of this Proposal 2, file the amendment and restatement of our Certificate of Incorporation with the State of Delaware, and reserve sufficient shares of its common stock for issuance to the Investor under the Purchase Agreement. If the Company does not obtain stockholder approval of the amendment and restatement of our Certificate of Incorporation in order to file it by May 31, 2016, the Investor will have the right to sell the 105,000,000 shares purchased at the first closing back to the Company for $0.08 per share, with such purchase price to be paid by means of a secured convertible promissory note issued by the Company in the principal amount of $8.4 million (the “Put Note”). Such note, if issued, would accrue interest at the rate of 3% per annum, would be convertible at $0.08 and be due and payable on the eighteen (18) month anniversary of its issuance. If the Put Note is issued, the Company and the Investor would enter into a security agreement which would grant a security interest to the Investor in all of the Company’s assets other than its intellectual property and its equity interests in its subsidiary, Crucible Intellectual Property, LLC.

If the Investor fails to purchase the remaining 300,000,000 shares of common stock within 90 days after the filing of the amendment and restatement of our Certificate of Incorporation (assuming all other conditions to such closing have been satisfied), the Investor will forfeit certain rights, including the right to designate additional directors to our board of directors following such failure and the right to exercise the above-described preemptive right. In such event, the Company will also have the right to repurchase all of the shares held by the Investor at a per-share price of $0.08 within 15 months following the approval and filing of the amendment and restatement of our Certificate of Incorporation. Even if the Investor fails to purchase the remaining 300,000,000 shares, our board of directors believes that the proposed increase is desirable to provide the Company with the flexibility to seek one or more alternative financing transactions.

The additional shares of common stock for which authorization is sought would be a part of the existing class of common stock. If and when issued, these shares would have the same rights and privileges as the shares of common stock presently outstanding except as otherwise described above with respect to the Shares under the Purchase. Except as described above with respect to the Investor, no other holder of common stock has any preemptive rights to acquire additional shares of common stock.

The issuance of additional shares to Investor and any other future holder could reduce existing stockholders’ percentage ownership and voting power and, depending on the transaction in which they are issued, could affect our per share book value or other per share financial measures.

Potential Anti-Takeover Effects

Although the amendment and restatement of our Certificate of Incorporation is not intended to be an anti-takeover measure, stockholders should note that, under certain circumstances, the additional shares of common stock could be used to make any attempt to gain control of our Company or our board of directors more difficult or time-consuming. Any of the additional shares of common stock could be privately placed with purchasers who might side with our board of directors in opposing a hostile takeover bid.

The amendment and restatement of our Certificate of Incorporation might be considered to have the effect of discouraging an attempt by another person or entity, through the acquisition of a substantial number of shares of our capital stock, to acquire control of us, since the issuance of the additional shares of common stock could be used to dilute the stock ownership of a person or entity seeking to obtain control and to increase the cost to a person or entity seeking to acquire a majority of the voting power of our Company. If so used, the effect of the additional authorized shares of common stock might be (i) to deprive stockholders of an opportunity to sell their stock at a temporarily higher price as a result of a tender offer or the purchase of shares by a person or entity seeking to obtain control of us or (ii) to assist incumbent management in retaining its present position.

Filing of Our Amended and Restated Certificate of Incorporation

Following the approval by the stockholders of the amendment and restatement of our Certificate of Incorporation, we will file the Amended and Restated Certificate of Incorporation, in substantially the form attached as

Appendix A

to this proxy statement, with the Secretary of State of Delaware.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS AND URGES EACH STOCKHOLDER

TO VOTE “FOR” THE APPROVAL OF THE AMENDMENT AND RESTATEMENT OF OUR CERTIFICATE OF

INCORPORATION TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK.

PROPOSAL 3—ADVISORY VOTE ON EXECUTIVE COMPENSATION

We are seeking an advisory vote of our stockholders on the compensation of our named executive officers, as required by Section 14A of the Exchange Act. Our board of directors recommends that you vote in favor of the resolution approving the compensation of our named executive officers as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables, and narrative discussion contained in this proxy statement. Since the vote is advisory in nature, the results will not be binding on our board of directors or our Compensation Committee. However, if there is a significant vote against the compensation of our named executive officers, our board of directors and our Compensation Committee will carefully evaluate whether any actions are necessary to address those concerns.

Following our 2013 annual stockholder meeting, we considered the voting results on the non-binding stockholder vote on the frequency of holding advisory votes on the compensation of our named executive officers. Based on all of the factors taken into consideration, we decided to hold an annual advisory vote on the compensation of our named executive officers until our 2018 annual stockholder meeting, when stockholders will be asked again on how frequently we should hold the advisory vote to approve the compensation of our named executive officers.

OUR BOARD OF DIRECTORS UNANIMOUSLY recommends AND URGES EACH STOCKHOLDER TO vote

“FOR” the approval of the compensation of our named executive officers, as disclosed in this

Proxy Statement pursuant to Item 402 of Regulation S-K.

PROPOSAL 4—RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our board of directors, upon recommendation of the Audit Committee, has appointed SingerLewak LLP (“Singer”) as our independent registered public accounting firm, to audit the accounts of our Company and our subsidiaries for the fiscal year ending December 31, 2016. Singer performed the audit of our consolidated financial statements for the year ended December 31, 2015. We have been advised by Singer that no member of that firm, to the best of its knowledge and belief, has any direct or any material indirect financial interest in our Company or our subsidiaries, and that, during the past three fiscal years, no member of the firm has had any connection with our Company or our subsidiaries in the capacity of promoter, underwriter, voting trustee, director, officer or employee. Although we do not expect a representative of Singer to attend our Annual Meeting, if a Singer representative does attend, the representative will respond to appropriate questions and will have the opportunity to make a statement if the representative desires to do so.

Although ratification by our stockholders is not a prerequisite to the Audit Committee’s ability to select Singer as our independent registered public accounting firm for the year ending December 31, 2016, the Audit Committee believes such ratification is advisable and in the best interests of our stockholders. Accordingly, stockholders are being requested to ratify, confirm and approve the selection of Singer as our independent registered public accounting firm for the year ending December 31, 2016. Notwithstanding ratification of the appointment of Singer as our independent registered public accounting firm for the year ending December 31, 2016, the Audit Committee may select another independent registered public accounting firm for such year without any vote of the stockholders. If the stockholders do not ratify the appointment, the matter of the appointment of the independent registered public accounting firm will be considered by our board of directors and the Audit Committee, but our board of directors and the Audit Committee may choose to retain Singer regardless of the vote.

Our board of directors unanimously recommends and urges each stockholder to vote "FOR"

THE RATIFICATION OF

the appointment of SingerLewak LLP as our

independent registered public accounting firm.

Audit Fees for 201

5 and 2014

:

The following table summarizes the aggregate fees billed to us by Singer for professional services during the years ended December 31, 2015 and December 31, 2014:

|

Fees

|

|

2015

|

|

|

2014

|

|

|

Audit Fees (1)

|

|

$

|

144,009

|

|

|

$

|

183,829

|

|

|

All Other Fees (2)

|

|

|

-

|

|

|

|

23,891

|

|

|

Total Fees

|

|

$

|

144,009

|

|

|

$

|

207,720

|

|

(1)

Audit Fees.

Fees for audit services billed in 2015 consisted of:

|

|

•

|

Progress billings for the audits of the Company’s financial statements for 2014 and 2015; and

|

|

|

•

|

Review of the Company’s quarterly financial statements for 2015.

|

Fees for audit services billed in 2014 consisted of:

|

|

•

|

Progress billings for the audits of the Company’s financial statements for 2013 and 2014; and

|

|

|

•

|

Review of the Company’s quarterly financial statements for 2014.

|

(2)

All Other Fees.

Fees for all other services billed in 2014 consisted of consent procedures performed in conjunction with the Company’s filing of registration statements.

Audit Committee Pre-Approval Policies

Our Audit Committee pre-approves all audit and permissible non-audit services provided by our independent public accountants on a case-by-case basis. Our Audit Committee approved 100% of the services performed by Singer in 2015 and 2014.

REPORT OF THE AUDIT COMMITTEE

The Audit Committee has:

|

|

•

|

reviewed and discussed the Company’s audited financial statements with management;

|

|

|

|

|

|

|

•

|

discussed with the independent auditors the matters required to be discussed by the statement on Auditing Standards No. 61, as amended, as adopted by the Public Company Accounting Oversight Board; and

|

|

|

|

|

|

|

•

|

received the written disclosures and the letter from the independent accountant required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant's communications with the audit committee concerning independence, and has discussed with the independent accountant the independent accountant's independence.

|

Based on the review and discussions described above, the Audit Committee recommended to our board of directors in March 2016 that the audited financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 2015 for filing with the Securities and Exchange Commission.

Walter Weyler, Chairman of Audit Committee

Rich Sevcik

Bob Howard-Anderson

Scott Gillis, Former Director and Chairman of Audit Committee

SECURITY OWNERSHIP OF MANAGEMENT AND PRINCIPAL STOCKHOLDERS

The following table sets forth certain information regarding the beneficial ownership of our common stock as of [·], by:

|

|

•

|

each person known by us to be the beneficial owner of more than 5% of our outstanding common stock;

|

|

|

•

|

each of our directors and director nominees;

|

|

|

•

|

each of our named executive officers; and

|

|

|

•

|

all directors and executive officers as a group.

|

The number and percentage of shares beneficially owned is determined under the rules of the SEC and is not necessarily indicative of beneficial ownership for any other purpose. The number of shares shown as beneficially owned in the table below are calculated pursuant to Rule 13d-3(d)(1) of the Exchange Act. Under Rule 13d-3(d)(1), shares not outstanding that are subject to options, warrants, rights or conversion privileges exercisable within 60 days are deemed outstanding for the purpose of calculating the number and percentage owned by such person, but are not deemed outstanding for the purpose of calculating the percentage owned by each other person listed. Unless otherwise indicated in the footnotes, each person has sole voting and investment power with respect to the shares shown as beneficially owned. A total of [·] shares of our common stock were issued and outstanding as of [·]. Unless otherwise indicated, the address of all directors and named executive officers is 30452 Esperanza, Rancho Santa Margarita, California 92688.

|

|

|

Common Stock

|

|

|

Name of Beneficial Owner

|

|

Number

of Shares(1)

|

|

|

Percent

of Class(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

Directors

and Named Executive Officers

|

|

|

|

|

|

|

|

|

|

Abdi Mahamedi

|

|

|

[·]

|

(2)

|

|

|

[·]

|

|

|

Thomas Steipp

|

|

|

[·]

|

(3)

|

|

|

[·]

|

|

|

Bob Howard-Anderson

|

|

|

[·]

|

(4)

|

|

|

[·]

|

|

|

Rich Sevcik

|

|

|

[·]

|

(5)

|

|

|

[·]

|

|

|

Walter Weyler

|

|

|

[·]

|

(6)

|

|

|

[·]

|

|

|

Paul Hauck

|

|

|

[·]

|

(7)

|

|

|

|

|

|

Bruce Bromage

|

|

|

[·]

|

(8)

|

|

|

[·]

|

|

|

Tony Chung

|

|

|

[·]

|

(9)

|

|

|

[·]

|

|

|

Lugee Li

|

|

|

[·]

|

(12)

|

|

|

[·]

|

|

|

Ricardo Salas

|

|

|

[·]

|

(13)

|

|

|

[·]

|

|

|

All directors and executive

officers as a group (11 persons)

|

|

|

[·]

|

|

|

|

[·]

|

|

|

|

|

|

|

|

|

|

|

|

|

5% Shareholders

|

|

|

|

|

|

|

|

|

|

Visser Precsion Cast, LLC

|

|

|

[·]

|

(10)

|

|

|

[·]

|

|

|

5641 N Broadway

|

|

|

|

|

|

|

|

|

|

Denver, CO 80216

|

|

|

|

|

|

|

|

|

|

Furniture Rowe, LLC

|

|

|

[·]

|

(11)

|

|

|

[·]

|

|

|

5641 N Broadway

|

|

|

|

|

|

|

|

|

|

Denver, CO 80216

|

|

|

|

|

|

|

|

|

|

Liquidmetal Technology Limited

|

|

|

[·]

|

(12)

|

|

|

[·]

|

|

|

Room 906, Tai Tung Building, 8 Fleming Rd

|

|

|

|

|

|

|

|

|

|

Wanchai, Hong Kong

|

|

|

|

|

|

|

|

|

Less than one percent

|

|

(1)

|

Shares of common stock beneficially owned and the respective percentages of beneficial ownership of common stock assumes the exercise or conversion of all options, warrants and other securities convertible into common stock, beneficially owned by such person or entity currently exercisable or exercisable within 60 days of [·]. Shares issuable pursuant to the exercise of stock options and warrants exercisable within 60 days of [·], or securities convertible into common stock within 60 days of [·]

, are deemed outstanding and held by the holder of such shares of common stock, options, warrants, or other convertible securities, for purposes of computing the percentage of outstanding common stock beneficially owned by such person, but are not deemed outstanding for computing the percentage of outstanding common stock beneficially owned by any other person. The percentage of common stock beneficially owned is based on

[·]

shares of common stock outstanding as of [·]

.

|

|

|

(a)

|

[·]

shares of common stock held of record by Carlyle Holdings, LLC. Mr. Mahamedi has the power to direct the voting and disposition of such shares as the president and sole shareholder of Carlyle Development Group, Inc

., which is a managing member of Carlyle Holdings, LLC;

|

|

|

(b)

|

[·]

shares of common stock held of record by Mr. Mahamedi; and

|

|

|

(c)

|

[·]

shares issuable pursuant to outstanding stock options which are exercisable currently or within 60 days of [·]. Does not include

[·]

shares that are issuable pursuant to outstanding stock options that are not exercisable currently or within 60 days of [·]

.

|

|

|

(a)

|

[·]

shares of common stock held of record by Mr. Steipp; and

|

|

|

(b)

|

[·]

shares issuable pursuant to outstanding stock options which are exercisable currently or within 60 days of [·]

. Does not include

[·]

shares that are issuable pursuant to outstanding stock options that are not exercisable currently or within 60 days of [·]

.

|

|

|

(4)

|

Includes

[·]

shares issuable pursuant to outstanding stock options, held of record by Mr. Howard-Anderson, which are exercisable currently or within 60 days of [·]. Does not include

[·]

shares that are issuable pursuant to outstanding stock options that are not exercisable currently or within 60 days of [·]

.

|

|

|

(5)

|

Includes

[·]

shares issuable pursuant to outstanding stock options, held of record by Mr. Sevcik, which are exercisable currently or within 60 days of [·]. Does not include

[·]

shares that are issuable pursuant to outstanding stock options that are not exercisable currently or within 60 days of [·]

.

|

|

|

(6)

|

Does not include

[·]

shares that are issuable pursuant to outstanding stock options, held of record by Mr. Weyler, that are not exercisable currently or within 60 days of [·]

.

|

|

|

(7)

|

Includes

[·]

shares issuable pursuant to outstanding stock options, held of record by Mr. Hauck, which are exercisable currently or within 60 days of [·]. Does not include

[·]

shares that are issuable pursuant to outstanding stock options that are not exercisable currently or within 60 days of [·]

.

|

|

|

(8)

|

Includes

[·]

shares issuable pursuant to outstanding stock options, held of record by Mr. Bromage, which are exercisable currently or within 60 days of [·]. Does not include

[·]

shares that are issuable pursuant to outstanding stock options that are not exercisable currently or within 60 days of [·]

.

|

|

|

(a)

|

[·]

shares of common stock held of record by Mr. Chung; and

|

|

|

(b)

|

[·]

shares issuable pursuant to outstanding stock options which are exercisable currently or within 60 days of [·]. Does not include

[·]

shares that are issuable pursuant to outstanding stock options that are not exercisable currently or within 60 days of [·]

.

|

|

|

(10)

|

Includes

[·]

shares of common stock and

[·]

shares issuable under currently exercisable warrants held of record by Visser Precision Cast, LLC.

|

|

|

(11)

|

Includes

[·]

shares of common stock and

[·]

shares issuable under currently exercisable warrants held of record by Visser Precision Cast, LLC. Furniture Rowe, LLC has the power to direct the voting and disposition of such shares as the sole shareholder of Visser Precision Cast, LLC.

|

|

|

(12)

|

Includes

[·]

shares of common stock held of record by Liquidmetal Technology Limited. Mr. Li is the sole owner, officer, and director of Liquidmetal Technology Limited and has sole power to direct the voting and disposition of such shares. Also includes

[·]

shares issuable pursuant to a Warrant held by Liquidmetal Technology Limited (the Warrant is for an aggregate of

[·]

shares, of which

[·]

are vested and will be exercisable within 60 days of [·])

.

|

|

|

(a)

|

[·]

shares of common stock held of record by Mr. Salas; and

|

|

|

(b)

|

[·]

shares issuable pursuant to outstanding stock options which are exercisable currently or within 60 days of [·]. Does not include 1,800,001 shares that are issuable pursuant to outstanding stock options that are not exercisable currently or within 60 days of [·]

. Note that Mr. Salas ceased being a director and employee of the Company on August 21, 2015.

|

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

During the fiscal year ended December 31, 2015, our officers, directors, and greater than 10% stockholders filed with the SEC, on a timely basis, all reports required to be filed by Section 16(a) of the Exchange Act, except that the following Form 4s were not timely filed: Form 4s for option grants made on January 27, 2015 to Messrs. Mahamedi, Gillis, Hauck, Bromage, Steipp, Chung, Howard-Anderson, and Sevcik. We have relied solely upon the written representations of our officers, directors, and greater than 10% stockholders and copies of the reports they have filed with the SEC in providing this information.

EXECUTIVE OFFICERS

Set forth below is a table identifying our executive officers who are not identified under “

PROPOSAL 1—ELECTION OF DIRECTORS

.”

|

Name

|

Age

|

Position

|

|

Tony Chung

|

4

6

|

Chief Financial Officer

|

|

Bruce Bromage

|

61

|

Executive Vice-President of Business Development and Operations

|

|

Paul Hauck

|

54

|

Vice President- Worldwide Sales and Support

|

Tony Chung