Commodities Slump Batters Rio Tinto

February 12 2016 - 3:02AM

Dow Jones News

(FROM THE WALL STREET JOURNAL 2/12/16)

By Rhiannon Hoyle

SYDNEY -- Rio Tinto on Thursday lowered its dividend and slumped

to an annual loss, effectively conceding it had misread the

strength of China's commodities demand, signaling a new era of

diminished returns for mining investors.

Rio Tinto said it could no longer justify its commitment to

maintaining or steadily increasing its dividend each year when the

global economic outlook is worsening and the prices for many

commodities that the company produces, such as iron ore and coal,

are at multiyear lows.

"Future dividend outcomes will really rely on the market

conditions," Chief Executive Sam Walsh said.

"We don't run our business on hope," he said.

The dividend cut marks a decisive blow to the notion that

commodities companies were safe investments even during a prolonged

market slump. Rio Tinto and other mining companies ramped up

investor payouts for years to remain attractive to big investors

such as pension funds.

Its chief rival, BHP Billiton, the world's most valuable mining

company, is expected to abandon its progressive dividend at or

before its earnings announcement on Feb. 23. Swiss mining and

trading company Glencore PLC and the U.K.'s Anglo American PLC have

already slashed theirs to hoard cash during the current

downturn.

But Rio Tinto had been seen as a relatively strong performer

compared with such rivals, and its move highlights the substantial

measures mining companies are taking to bring their expenses in

line with their revenues.

"This signals a dramatic change in both the outlook for the

company and the industry," Citigroup said in a note about Rio

Tinto's results. "It does, however, align the dividend policy to

cash flow of the business."

Rio Tinto said this year's annual dividend could be roughly half

the US$2.15-a-share payout declared for 2015, a blow for investors

who supported years of heavy investment in new mines, especially in

Australia's remote Pilbara region.

In the run-up to Thursday's result, most brokers had argued that

Rio Tinto wouldn't need to pare this year's payout. Some said it

was the wrong move.

"I would have liked to see them hang on for longer," possibly

two or three more years, said Nik Stanojevic, an equity analyst at

Brewin Dolphin Ltd., a $44 billion private-wealth manager.

Mr. Walsh said changing gears was "prudent."

"I don't think anybody predicted what is happening in the world

economy today," he said.

Rio Tinto also reported a net loss of $866 million for 2015 on

Thursday, compared with a profit of $6.53 billion a year earlier.

The result was weighed down by impairment charges totaling $1.8

billion against the company's Simandou iron-ore project in Guinea

and uranium assets in Australia and Canada, as well as $3.3 billion

in foreign-exchange and derivatives losses.

Underlying earnings, a measure tracked by analysts that strips

out some one-time costs, fell 51% to $4.54 billion.

Behind Rio Tinto's troubles lies the slowdown in growth in

China, especially in its manufacturing and construction industries.

China buys three in every five tons of iron ore traded by sea to

make steel, and relies on Australia for most of its imports.

Rio Tinto has spent billions of dollars expanding its mines and

output in recent years. But the company could earn less from its

key iron-ore business this year than it did in 2006, Citi now

forecasts.

(END) Dow Jones Newswires

February 12, 2016 02:47 ET (07:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

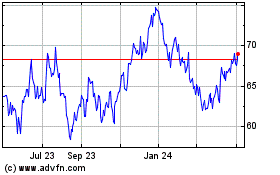

Rio Tinto (NYSE:RIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

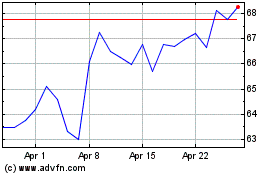

Rio Tinto (NYSE:RIO)

Historical Stock Chart

From Apr 2023 to Apr 2024