Fox, Offering Buyouts, Targets $250 Million in Cost Cuts--Update

February 01 2016 - 4:20PM

Dow Jones News

By Joe Flint and Keach Hagey

21st Century Fox is offering buyouts at its film studio and

television networks group in an attempt to cut $250 million in

expenses in the next fiscal year, according to a person familiar

with the matter.

The voluntary buyout plans were announced to staff in memos sent

out Monday.

"Our industry is changing rapidly, presenting new challenges and

even more opportunities at every turn," wrote Peter Rice, the chief

executive of Fox Networks Group, in a memo to staff. "To ensure we

make the most of this new world, we need to adjust, adapt, and

organize for the future. With this in mind, through the remainder

of this fiscal year, we will be undertaking some structural

changes, increasing investment in some parts of the company while

making cost reductions in other areas."

Jim Gianopulos, CEO of the Twentieth Century Fox film studio,

sent a similar memo to his staff, saying that the studio was

"reviewing our organizational structure and looking at potential

cost reductions to position us for sustained growth." He added that

"colleagues who have extended tenure" will be offered "an enhanced

benefit package if they elect to voluntarily resign form the

company effective at the end of May 2016."

Despite new breakaway hits like "Empire," the Fox broadcast

network has struggled in the ratings with the aging of "American

Idol" and has been a drag on its parent company's financial results

in recent years.

A year ago, 21st Century Fox lowered its earnings forecast for

fiscal years 2015 and 2016, citing continued struggles at the

broadcast network among the reasons. Last fiscal year, which ended

June 30, 2015, the company's television division suffered an 8%

drop in revenue and a 19% decline in operating income.

But Mr. Rice acknowledged in the memo to staff that the buyouts

come on the heels of some recent successes for the network, which

he said "may be confusing." Sunday night's performance of "Grease:

Live!" on Fox averaged 12.2 million viewers and last week's

premiere of the "X-Files" reboot scored huge global ratings.

"It is important, however, that we organize ourselves for

tomorrow rather than resting on the laurels of today, and the best

time to do that is when we are in a position of strength," Mr. Rice

said.

Fox shares have fallen 18% in the past 12 months amid

industrywide fears about the rise of cord-cutting among consumers.

Fox shares were up less than 1% to $27.12 as of Monday

afternoon.

For the year ended June 30, 2015, Fox's filmed entertainment

segment suffered a 2% decline in revenue, though operating income

increased 6%.

Fox's cuts to its film division come as many Hollywood studios

have had to shrink their staffs in recent years, particularly

because of plummeting DVD sales, which were once a major source of

a movie's revenue.

For the entire company, operating expenses amounted to $18.6

billion in the most recent fiscal year, and the company had 20,500

full-time employees as of June, according to regulatory

filings.

21st Century Fox and Wall Street Journal-owner News Corp were

part of the same company until mid-2013.

Write to Joe Flint at joe.flint@wsj.com and Keach Hagey at

keach.hagey@wsj.com

(END) Dow Jones Newswires

February 01, 2016 16:05 ET (21:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

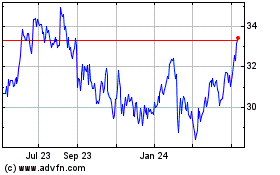

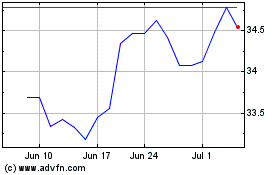

Fox (NASDAQ:FOXA)

Historical Stock Chart

From Aug 2024 to Sep 2024

Fox (NASDAQ:FOXA)

Historical Stock Chart

From Sep 2023 to Sep 2024