|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934. |

|

Date of Report: January 29, 2016

(Date of earliest event reported) |

|

Oak Valley Bancorp

(Exact name of registrant as specified in its charter) |

| |

|

CA

(State or other jurisdiction

of incorporation) |

001-34142

(Commission File Number) |

26-2326676

(IRS Employer

Identification Number) |

| |

|

125 N. Third Ave. Oakdale, CA

(Address of principal executive offices) |

95361

(Zip Code) |

|

|

(209) 848-2265

(Registrant's telephone number, including area code)

|

| |

|

Not Applicable

(Former Name or Former Address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 2.02. Results of Operations and Financial Condition

On January 29, 2016 Oak Valley Bancorp issued a press release, a copy of which is attached as Exhibit 99.1 and incorporated herein by reference. The press release announced the Company’s operating results for the quarter ended December 31, 2015.

The information in this Item 2.02 in this Form 8-K and the Exhibit 99.1 shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except as shall be expressly set forth by specific reference in such filing.

Item 7.01. Regulation FD Disclosure.

See “Item 2.02. Results of Operations and Financial Condition” which is incorporated by reference in this Item 7.01.

Item 9.01. Financial Statements and Exhibits

(a) Financial statements:

None

(b) Pro forma financial information:

None

(c) Shell company transactions:

None

(d) Exhibits

99.1 Press Release of Oak Valley Bancorp dated January 29, 2016

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Dated: February 1, 2016 |

OAK VALLEY BANCORP

By: /s/ Jeffrey A. Gall

Jeffrey A. Gall

Senior Vice President and Chief Financial Officer

(Principal Financial Officer and duly authorized signatory) |

|

Exhibit Index |

|

Exhibit No. |

Description |

| |

|

|

99.1 |

Press Release of Oak Valley Bancorp dated January 29, 2016 |

Exhibit 99.1

For Immediate Release

|

Contact: |

Chris Courtney/Rick McCarty |

|

Phone: |

(209) 848-2265 |

| |

www.ovcb.com |

OAK VALLEY BANCORP REPORTS 4th QUARTER RESULTS

OAKDALE, CA − Oak Valley Bancorp (NASDAQ: OVLY) (the “Company”), the bank holding company for Oak Valley Community Bank and Eastern Sierra Community Bank (the “Bank”), recently reported consolidated financial results for the fourth quarter and year of 2015. For the three months ended December 31, 2015, consolidated net income was $490,000, or $0.06 per diluted share. This compared to consolidated net income of $1,382,000, or $0.17 per diluted share, for the prior quarter and $1,642,000, or $0.20 per diluted share for the same period a year ago. The decrease in net income is attributable to one-time merger related expenses of $1,326,000, net of taxes ($1,971,000 pre-tax), associated with the Mother Lode Bank acquisition completed in December 2015.

Consolidated net income for 2015 totaled $4,908,000, or $0.61 per diluted share, representing a decrease of 31.1% compared to consolidated net income of $7,122,000, or $0.89 per diluted share for 2014. Year-to-date results in 2014 included a $1.88 million reversal of loan loss provisions related to the recovery of a charged off loan which bolstered net income in 2014 from normal operations, and combined with the 2015 merger expenses, further contributed to the year-over-year decrease in earnings.

Total assets were $897 million at December 31, 2015, an increase of $103.3 million over September 30, 2015 and $147.4 million over December 31, 2014. Gross loans were $541 million as of December 31, 2015, an increase of $63.7 million over September 30, 2015, and an increase of $86.6 million over December 31, 2014. The Company’s total deposits were $814.7 million as of December 31, 2015, an increase of $102.1 million over September 30, 2015, and an increase of $145.1 million over December 31, 2014.

The balance sheet growth figures include acquired balances of $77.3 million in assets, including $45.8 million in gross loans, and $71.1 million in total deposits from Mother Lode Bank, which if excluded would equate to organic year-over-year growth from normal operations of $70.1 million in assets, including $40.8 million in gross loans, and $74.0 million in total deposits.

Net interest income was $6,647,000 for the three months ended December 31, 2015, a slight increase of $26,000 from the $6,621,000 for the same period last year. The Company has managed to offset the compression of loan yield with strong loan growth resulting in the slight increase to net interest income. The Company’s net interest margin for the three months ended December 31, 2015 was 3.62%, compared to 3.61% for the prior quarter and 4.19% for the same period last year.

“Fourth quarter results were notably influenced by the Mother Lode acquisition. After absorbing these initial short-term expenses, we are excited about the long-term prospects the merger will bring and the financial impact it will have in 2016,” stated Chris Courtney, President and CEO of the Company and the Bank.

Non-interest expense for the three months ended December 31, 2015 totaled $7,085,000, compared to $5,299,000 during the prior quarter, and $5,252,000 for the same period last year. The increase compared to the prior year is mainly attributed to, as previously mentioned, one-time merger related expenses of $1,971,000 recorded in 2015. Additionally, the increase compared to the same period last year corresponds to growth in full time equivalent staff from 148 to 158, as well as, the addition of the newly constructed Downtown Sonora branch which opened in December 2015. Deposit servicing costs have also increased as a result of the increase in the number of deposit accounts.

Non-interest income for the three months ended December 31, 2015 totaled $962,000, compared to $965,000 during the prior quarter, and $1,086,000 for the same period last year. The decrease compared to the fourth quarter of 2014 is primarily the result of a $159,000 decrease in gains on called investment securities.

Non-performing assets as of December 31, 2015 were $8,167,000, or 0.91% of total assets, compared to $5,123,000, or 0.65% of total assets as of September 30, 2015, and $5,584,000, or 0.74% at December 31, 2014. The ratio of loan loss reserves to gross loans decreased to 1.36% as of December 31, 2015, compared to 1.55%, at September 30, 2015, and 1.66% at December 31, 2014. The increase in non-performing assets is due to one existing loan relationship that was placed on non-accrual status during the fourth quarter and the additional non-performing assets that were acquired from Mother Lode Bank. Improvement in economic conditions and noted trends of credit quality have allowed the Company to maintain its reserve level in spite of recent loan growth. Accordingly, the Company did not record a provision for loan losses in 2015. Additionally, loans acquired from Mother Lode Bank are recorded at fair value and thus did not require a loan loss reserve, which further decreased the loan loss reserve as a percentage of gross loans.

Oak Valley Bancorp operates Oak Valley Community Bank & Eastern Sierra Community Bank, through which it offers a variety of loan and deposit products to individuals and small businesses. They currently operate through 16 conveniently located branches: Oakdale, Turlock, Stockton, Patterson, Ripon, Escalon, Manteca, Tracy, two branches in Sonora, three branches in Modesto, and three branches in their Eastern Sierra Division, which includes Bridgeport, Mammoth Lakes and Bishop.

For more information, call 1-866-844-7500 or visit www.ovcb.com.

This press release includes forward-looking statements about the corporation for which the corporation claims the protection of safe harbor provisions contained in the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are based on management's knowledge and belief as of today and include information concerning the corporation's possible or assumed future financial condition, and its results of operations and business. Forward-looking statements are subject to risks and uncertainties. A number of important factors could cause actual results to differ materially from those in the forward-looking statements. Those factors include fluctuations in interest rates, government policies and regulations (including monetary and fiscal policies), legislation, economic conditions, including increased energy costs in California, credit quality of borrowers, operational factors and competition in the geographic and business areas in which the company conducts its operations. All forward-looking statements included in this press release are based on information available at the time of the release, and the Company assumes no obligation to update any forward-looking statement.

###

Oak Valley Bancorp

Financial Highlights (unaudited)

|

($ in thousands, except per share) |

|

4th Quarter |

|

|

3rd Quarter |

|

|

2nd Quarter |

|

|

1st Quarter |

|

|

4th Quarter |

|

|

Selected Quarterly Operating Data: |

|

2015 |

|

|

2015 |

|

|

2015 |

|

|

2015 |

|

|

2014 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income |

|

$ |

6,647 |

|

|

$ |

6,354 |

|

|

$ |

6,200 |

|

|

$ |

6,201 |

|

|

$ |

6,621 |

|

|

(Recovery of) provision for loan losses |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(125 |

) |

|

|

- |

|

|

Non-interest income |

|

|

962 |

|

|

|

965 |

|

|

|

1,156 |

|

|

|

1,027 |

|

|

|

1,086 |

|

|

Non-interest expense |

|

|

7,085 |

|

|

|

5,299 |

|

|

|

5,193 |

|

|

|

5,099 |

|

|

|

5,252 |

|

|

Net income before income taxes |

|

|

524 |

|

|

|

2,020 |

|

|

|

2,163 |

|

|

|

2,254 |

|

|

|

2,455 |

|

|

Provision for income taxes |

|

|

34 |

|

|

|

638 |

|

|

|

653 |

|

|

|

728 |

|

|

|

813 |

|

|

Net income |

|

$ |

490 |

|

|

$ |

1,382 |

|

|

$ |

1,510 |

|

|

$ |

1,526 |

|

|

$ |

1,642 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per common share - basic |

|

$ |

0.06 |

|

|

$ |

0.17 |

|

|

$ |

0.19 |

|

|

$ |

0.19 |

|

|

$ |

0.21 |

|

|

Earnings per common share - diluted |

|

$ |

0.06 |

|

|

$ |

0.17 |

|

|

$ |

0.19 |

|

|

$ |

0.19 |

|

|

$ |

0.20 |

|

|

Dividends paid per common share |

|

$ |

- |

|

|

$ |

0.11 |

|

|

$ |

- |

|

|

$ |

0.100 |

|

|

$ |

- |

|

|

Return on average common equity |

|

|

2.49 |

% |

|

|

7.17 |

% |

|

|

7.94 |

% |

|

|

8.22 |

% |

|

|

8.80 |

% |

|

Return on average assets |

|

|

0.24 |

% |

|

|

0.70 |

% |

|

|

0.81 |

% |

|

|

0.82 |

% |

|

|

0.91 |

% |

|

Net interest margin (1) |

|

|

3.62 |

% |

|

|

3.61 |

% |

|

|

3.70 |

% |

|

|

3.74 |

% |

|

|

4.19 |

% |

|

Efficiency ratio (2) |

|

|

66.65 |

% |

|

|

66.95 |

% |

|

|

68.23 |

% |

|

|

70.56 |

% |

|

|

64.50 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital - Period End |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Book value per common share |

|

$ |

9.69 |

|

|

$ |

9.55 |

|

|

$ |

9.43 |

|

|

$ |

9.39 |

|

|

$ |

9.29 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Credit Quality - Period End |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nonperforming assets/ total assets |

|

|

0.91 |

% |

|

|

0.65 |

% |

|

|

0.68 |

% |

|

|

0.70 |

% |

|

|

0.74 |

% |

|

Loan loss reserve/ gross loans |

|

|

1.36 |

% |

|

|

1.55 |

% |

|

|

1.59 |

% |

|

|

1.63 |

% |

|

|

1.66 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Period End Balance Sheet |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

($ in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

897,038 |

|

|

$ |

793,723 |

|

|

$ |

764,008 |

|

|

$ |

753,552 |

|

|

$ |

749,665 |

|

|

Gross loans |

|

|

541,032 |

|

|

|

477,327 |

|

|

|

463,463 |

|

|

|

453,165 |

|

|

|

454,471 |

|

|

Nonperforming assets |

|

|

8,167 |

|

|

|

5,123 |

|

|

|

5,197 |

|

|

|

5,246 |

|

|

|

5,584 |

|

|

Allowance for loan losses |

|

|

7,356 |

|

|

|

7,389 |

|

|

|

7,390 |

|

|

|

7,409 |

|

|

|

7,534 |

|

|

Deposits |

|

|

814,679 |

|

|

|

712,577 |

|

|

|

683,937 |

|

|

|

672,991 |

|

|

|

669,581 |

|

|

Common equity |

|

|

78,263 |

|

|

|

77,147 |

|

|

|

76,165 |

|

|

|

75,816 |

|

|

|

75,041 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-Financial Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Full-time equivalent staff |

|

|

158 |

|

|

|

150 |

|

|

|

152 |

|

|

|

148 |

|

|

|

148 |

|

|

Number of banking offices |

|

|

16 |

|

|

|

15 |

|

|

|

15 |

|

|

|

15 |

|

|

|

15 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Period end |

|

|

8,078,155 |

|

|

|

8,078,155 |

|

|

|

8,072,655 |

|

|

|

8,075,355 |

|

|

|

8,074,855 |

|

|

Period average - basic |

|

|

7,996,644 |

|

|

|

7,994,857 |

|

|

|

7,992,296 |

|

|

|

7,972,225 |

|

|

|

7,960,108 |

|

|

Period average - diluted |

|

|

8,045,090 |

|

|

|

8,040,577 |

|

|

|

8,036,691 |

|

|

|

8,024,756 |

|

|

|

8,015,511 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Market Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock Price |

|

$ |

10.40 |

|

|

$ |

9.46 |

|

|

$ |

9.86 |

|

|

$ |

9.86 |

|

|

$ |

10.16 |

|

|

Price/Earnings |

|

|

42.78 |

|

|

|

13.79 |

|

|

|

13.01 |

|

|

|

12.70 |

|

|

|

12.41 |

|

|

Price/Book |

|

|

1.07 |

|

|

|

0.99 |

|

|

|

1.05 |

|

|

|

1.05 |

|

|

|

1.09 |

|

| |

|

YEAR ENDED |

|

| |

|

DECEMBER 31, |

|

| |

|

2015 |

|

|

2014 |

|

| |

|

|

|

|

|

|

|

|

|

Net interest income |

|

$ |

25,402 |

|

|

$ |

25,289 |

|

|

(Recovery of) provision for loan losses |

|

|

(125 |

) |

|

|

(1,877 |

) |

|

Non-interest income |

|

|

4,110 |

|

|

|

3,764 |

|

|

Non-interest expense |

|

|

22,676 |

|

|

|

20,234 |

|

|

Net income before income taxes |

|

|

6,961 |

|

|

|

10,696 |

|

|

Provision for income taxes |

|

|

2,053 |

|

|

|

3,574 |

|

|

Net income |

|

$ |

4,908 |

|

|

$ |

7,122 |

|

| |

|

|

|

|

|

|

|

|

|

Earnings per common share - basic |

|

$ |

0.61 |

|

|

$ |

0.90 |

|

|

Earnings per common share - diluted |

|

$ |

0.61 |

|

|

$ |

0.89 |

|

|

Dividends paid per common share |

|

$ |

0.21 |

|

|

$ |

0.17 |

|

|

Return on average common equity |

|

|

6.41 |

% |

|

|

10.07 |

% |

|

Return on average assets |

|

|

0.63 |

% |

|

|

1.03 |

% |

|

Net interest margin (1) |

|

|

3.66 |

% |

|

|

4.11 |

% |

|

Efficiency ratio (2) |

|

|

68.07 |

% |

|

|

67.38 |

% |

| |

|

|

|

|

|

|

|

|

|

Capital - Period End |

|

|

|

|

|

|

|

|

|

Book value per common share |

|

$ |

9.69 |

|

|

$ |

9.29 |

|

| |

|

|

|

|

|

|

|

|

|

Credit Quality - Period End |

|

|

|

|

|

|

|

|

|

Nonperforming assets/ total assets |

|

|

0.91 |

% |

|

|

0.74 |

% |

|

Loan loss reserve/ gross loans |

|

|

1.36 |

% |

|

|

1.66 |

% |

| |

|

|

|

|

|

|

|

|

|

Period End Balance Sheet |

|

|

|

|

|

|

|

|

|

($ in thousands) |

|

|

|

|

|

|

|

|

|

Total assets |

|

$ |

897,038 |

|

|

$ |

749,665 |

|

|

Gross loans |

|

|

541,032 |

|

|

|

454,471 |

|

|

Nonperforming assets |

|

|

8,167 |

|

|

|

5,584 |

|

|

Allowance for loan losses |

|

|

7,356 |

|

|

|

7,534 |

|

|

Deposits |

|

|

814,679 |

|

|

|

669,581 |

|

|

Common equity |

|

|

78,263 |

|

|

|

75,041 |

|

| |

|

|

|

|

|

|

|

|

|

Non-Financial Data |

|

|

|

|

|

|

|

|

|

Full-time equivalent staff |

|

|

158 |

|

|

|

148 |

|

|

Number of banking offices |

|

|

16 |

|

|

|

15 |

|

| |

|

|

|

|

|

|

|

|

|

Common Shares outstanding |

|

|

|

|

|

|

|

|

|

Period end |

|

|

8,078,155 |

|

|

|

8,074,855 |

|

|

Period average - basic |

|

|

7,989,088 |

|

|

|

7,938,052 |

|

|

Period average - diluted |

|

|

8,036,845 |

|

|

|

7,992,731 |

|

| |

|

|

|

|

|

|

|

|

|

Market Ratios |

|

|

|

|

|

|

|

|

|

Stock Price |

|

$ |

10.40 |

|

|

$ |

10.16 |

|

|

Price/Earnings |

|

|

16.93 |

|

|

|

11.32 |

|

|

Price/Book |

|

|

1.07 |

|

|

|

1.09 |

|

| (1) |

|

Ratio computed on a fully tax equivalent basis using a marginal federal tax rate of 34%. |

| (2) |

|

Ratio computed on a fully tax equivalent basis using a marginal federal tax rate of 34%, and a marginal federal/state combined tax rate of 41.15% for applicable revenue. |

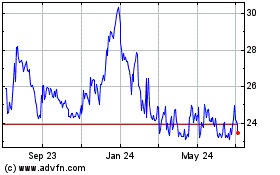

Oak Valley Bancorp (NASDAQ:OVLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

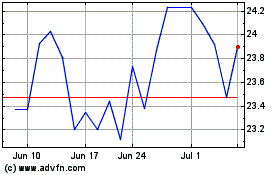

Oak Valley Bancorp (NASDAQ:OVLY)

Historical Stock Chart

From Apr 2023 to Apr 2024