UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 28, 2016

APPLIED INDUSTRIAL TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

|

| | |

OHIO | 1-2299 | 34-0117420 |

(State or Other Jurisdiction of | (Commission File | (I.R.S. Employer |

Incorporation or Organization) | Number) | Identification No.) |

One Applied Plaza, Cleveland, Ohio 44115

(Address of Principal Executive Officers) (Zip Code)

Registrant's Telephone Number, Including Area Code: (216) 426-4000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

q Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

q Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

q Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b))

q Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4(c))

ITEM 2.02. RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

On January 28, 2016, Applied Industrial Technologies, Inc. (“Applied”) issued a press release related to its earnings for the second quarter ended December 31, 2015. The release is attached as Exhibit 99.1 to this Report on Form 8-K.

The information in this Report on Form 8-K, including the Exhibit, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits.

Exhibit 99.1 - Press release of Applied Industrial Technologies, Inc. dated January 28, 2016.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

| |

| APPLIED INDUSTRIAL TECHNOLOGIES, INC. |

| (Registrant) |

| |

| |

| |

| By: /s/ Fred D. Bauer |

| Fred D. Bauer, Vice President-General Counsel & Secretary |

Date: January 28, 2016 | |

EXHIBIT INDEX

Exhibit No. Description

| |

99.1 | The following exhibit is furnished with this Report on Form 8-K: Press release of Applied Industrial Technologies, Inc. dated January 28, 2016. |

EXHIBIT 99.1

Applied Industrial Technologies Reports Fiscal 2016

Second Quarter Results and Increases Dividend

CLEVELAND, OHIO (January 28, 2016) - Applied Industrial Technologies (NYSE: AIT) today reported second quarter fiscal 2016 sales and earnings for the three months ended December 31, 2015.

Net sales for the quarter were $610.3 million, a decrease of 11.8% compared with $691.7 million in the same quarter a year ago. The overall sales decrease for the quarter reflects a 1.8% increase from acquisition-related volume offset by a negative 3.1% foreign currency translation impact and a 10.5% decrease in core underlying operations. This 10.5% decrease consists of a 3.8% decline attributable to sales in traditional core operations and a 6.7% decline attributable to sales by the upstream oil and gas subsidiaries. Net income for the quarter was $23.9 million, or $0.61 per share, compared with $29.7 million, or $0.72 per share, in the second quarter of fiscal 2015.

For the six months ended December 31, 2015, sales decreased 10.2% to $1.25 billion from $1.39 billion in the same period last year. Net income was $48.2 million, or $1.22 per share, compared to $58.8 million, or $1.41 per share, last year.

Commenting on the results, Applied’s President & Chief Executive Officer Neil A. Schrimsher said, “In our second quarter, we experienced a continuation of the economic and market headwinds that have been affecting our business, including reduced demand in oil and gas and other industrial end markets, as well as the negative impact of foreign currency translation. We will continue our disciplined approach to controlling costs and driving improved efficiencies across our business.

“Based on the current industrial economic environment and continued weakness in some of our served markets, we are revising our full-year guidance to include earnings per share between $2.45 and $2.60 per share on a sales decrease of 8% to 10%.

“We remain fully committed to generating shareholder value in any economic cycle through our business performance; expanding our product, service and solution offering; and creating opportunities with current and new customers. In addition, we will continue to optimize our capital allocation through dividends, share repurchases and acquisitions. We are pleased with the recent acquisition of HUB Industrial Supply, an excellent strategic fit that further strengthens and diversifies our Maintenance Supplies & Solutions business.”

During the quarter, the Company purchased 250,000 shares of its common stock in open market transactions for $9.8 million. Fiscal year to date, the Company has purchased 701,100 shares for a total of $27.8 million. At December 31, 2015, the Company had remaining authorization to purchase 546,200 additional shares.

In addition, Mr. Schrimsher announced that the Company’s Board of Directors declared a $0.01 increase in the quarterly cash dividend to $0.28 per common share. The dividend is payable on February 29, 2016, to shareholders of record on February 16, 2016. This marks the Company’s seventh dividend increase since 2010, representing a cumulative increase of more than 85% in the quarterly dividend over this six-year period. “Increasing our dividend demonstrates confidence in our

ongoing cash generation and profitable growth strategies, as well as our steadfast commitment to increasing shareholder value.”

Applied will host its quarterly conference call for investors and analysts at 10 a.m. ET on January 28. Neil A. Schrimsher - President & CEO, and Mark O. Eisele - CFO will discuss the Company's performance. To join the call, dial 1-800-931-6428 or 1-212-231-2913 (for International callers). A live audio webcast can be accessed online through the investor relations portion of the Company's website at www.applied.com. A replay of the call will be available for two weeks by dialing 1-800-633-8625 or 1-402-977-9141 (International) using passcode 21802812.

Founded in 1923, Applied Industrial Technologies is a leading industrial distributor that offers more than five million parts to serve the needs of MRO and OEM customers in virtually every industry. In addition, Applied provides engineering, design and systems integration for industrial and fluid power applications, as well as customized mechanical, fabricated rubber and fluid power shop services. Applied also offers maintenance training and inventory management solutions that provide added value to its customers. For more information, visit www.applied.com.

This press release contains statements that are forward-looking, as that term is defined by the Securities and Exchange Commission in its rules, regulations and releases. Applied intends that such forward-looking statements be subject to the safe harbors created thereby. Forward-looking statements are often identified by qualifiers such as “guidance,” “will,” and derivative or similar expressions. All forward-looking statements are based on current expectations regarding important risk factors including trends in the industrial sector of the economy, and other risk factors identified in Applied's most recent periodic report and other filings made with the Securities and Exchange Commission. Accordingly, actual results may differ materially from those expressed in the forward-looking statements, and the making of such statements should not be regarded as a representation by Applied or any other person that the results expressed therein will be achieved. Applied assumes no obligation to update publicly or revise any forward-looking statements, whether due to new information, or events, or otherwise.

#####

For investor relations information, contact Mark O. Eisele, Vice President - Chief Financial Officer, at 216-426-4417. For corporate information, contact Julie A. Kho, Manager - Public Relations, at 216-426-4483.

|

| | | | |

APPLIED INDUSTRIAL TECHNOLOGIES, INC. AND SUBSIDIARIES |

CONDENSED STATEMENTS OF CONSOLIDATED INCOME |

(In thousands, except per share data) |

| | | | |

| Three Months Ended | Six Months Ended |

| December 31, | December 31, |

| 2015 | 2014 | 2015 | 2014 |

Net Sales | $ 610,346 | $ 691,702 | $1,252,250 | $1,394,027 |

Cost of sales | 437,179 | 495,989 | 898,071 | 1,003,382 |

Gross Profit | 173,167 | 195,713 | 354,179 | 390,645 |

Selling, distribution and administrative, | | | | |

including depreciation | 134,805 | 148,906 | 274,791 | 297,673 |

Operating Income | 38,362 | 46,807 | 79,388 | 92,972 |

Interest expense, net | 2,158 | 1,955 | 4,345 | 3,617 |

Other expense, net | 55 | 380 | 1,059 | 624 |

Income Before Income Taxes | 36,149 | 44,472 | 73,984 | 88,731 |

Income Tax Expense | 12,202 | 14,765 | 25,746 | 29,902 |

Net Income | $ 23,947 | $ 29,707 | $ 48,238 | $ 58,829 |

Net Income Per Share - Basic | $ 0.61 | $ 0.72 | $ 1.22 | $ 1.42 |

Net Income Per Share - Diluted | $ 0.61 | $ 0.72 | $ 1.22 | $ 1.41 |

Average Shares Outstanding - Basic | 39,262 | 41,228 | 39,437 | 41,348 |

Average Shares Outstanding - Diluted | 39,485 | 41,533 | 39,661 | 41,678 |

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(1) Applied uses the last-in, first-out (LIFO) method of valuing U.S. inventory. An actual valuation of inventory under the LIFO method can only be made at the end of each year based on the inventory levels and costs at that time. Accordingly, interim LIFO calculations are based on management's estimates of expected year-end inventory levels and costs and are subject to the final year-end LIFO inventory determination.

(2) On August 3, 2015, the Company acquired substantially all of the net assets of Atlantic Fasteners, a distributor of C-Class consumables including industrial fasteners and related industrial supplies in Agawam, MA for a purchase price of $12,500. The financial results of the operations acquired have been included in the Service Center Based Distribution Segment as of the acquisition date.

On October 1, 2015, the Company acquired substantially all of the net assets of S.G. Morris Co., a distributor of hydraulic components throughout Ohio, Western Pennsylvania and West Virginia for a purchase price of $14,500. The financial results of the operations acquired have been included in the Fluid Power Businesses Segment as of the acquisition date.

(3) In November 2015, the FASB issued its final standard for the balance sheet classification of deferred taxes. The amendments in this standard require that deferred tax assets and liabilities be classified as noncurrent in the balance sheet. This update is effective for financial statements issued for annual periods beginning after December 15, 2016, with early adoption permitted. The Company has early adopted this standard in the second quarter of fiscal 2016 and has applied the new standard retrospectively to the prior period presented in the Condensed Consolidated Balance Sheets. The impact of this change in accounting principle on balances previously reported as of June 30, 2015 was to decrease other current assets $13.3 million, increase other assets $10.9 million and decrease other liabilities $2.4 million.

|

| | | | | | |

APPLIED INDUSTRIAL TECHNOLOGIES, INC. AND SUBSIDIARIES |

CONDENSED CONSOLIDATED BALANCE SHEETS |

(Amounts in thousands) |

| | | | | | |

| | | | December 31, | | June 30, |

| | | | 2015 | | 2015 |

| | | | | | |

Assets | | | | | | |

Cash and cash equivalents | | $ 55,634 | | $ 69,470 |

Accounts receivable, less allowances of $11,894 and $10,621 | 329,287 | | 376,305 |

Inventories | | | 359,726 | | 362,419 |

Other current assets | | 36,177 | | 37,816 |

Total current assets | | 780,824 | | 846,010 |

Property, net | | | 106,470 | | 104,447 |

Goodwill | | | 249,267 | | 254,406 |

Intangibles, net | | | 185,009 | | 198,828 |

Other assets | | | 28,825 | | 28,865 |

Total Assets | | | $ 1,350,395 | | $ 1,432,556 |

| | | | | | |

Liabilities | | | | | | |

Accounts payable | | | $ 114,824 | | $ 179,825 |

Current portion of long-term debt | 3,350 | | 3,349 |

Other accrued liabilities | | 103,200 | | 126,898 |

Total current liabilities | | 221,374 | | 310,072 |

Long-term debt | | | 363,640 | | 317,646 |

Other liabilities | | | 57,814 | | 63,510 |

Total Liabilities | | | 642,828 | | 691,228 |

Shareholders' Equity | | 707,567 | | 741,328 |

Total Liabilities and Shareholders' Equity | $ 1,350,395 | | $ 1,432,556 |

|

| | | | |

APPLIED INDUSTRIAL TECHNOLOGIES, INC. AND SUBSIDIARIES |

CONDENSED STATEMENTS OF CONSOLIDATED CASH FLOWS |

(In thousands) |

| | | | |

| | Six Months Ended |

| | December 31, |

| | 2015 | | 2014 |

| | | | |

Cash Flows from Operating Activities | | | | |

Net income | | $ 48,238 | | $ 58,829 |

Adjustments to reconcile net income to net cash provided | | | | |

by operating activities: | | | | |

Depreciation and amortization of property | | 8,010 | | 8,331 |

Amortization of intangibles | | 12,325 | | 13,059 |

Amortization of stock appreciation rights and options | | 939 | | 825 |

Loss (gain) on sale of property | | 51 | | (4) |

Other share-based compensation expense | | 954 | | 679 |

Changes in assets and liabilities, net of acquisitions | | (39,090) | | (80,863) |

Other, net | | 1,516 | | 317 |

Net Cash provided by Operating Activities | | 32,943 | | 1,173 |

Cash Flows from Investing Activities | | | | |

Property purchases | | (5,737) | | (7,806) |

Proceeds from property sales | | 194 | | 187 |

Acquisition of businesses, net of cash acquired | | (23,250) | | (165,646) |

Net Cash used in Investing Activities | | (28,793) | | (173,265) |

Cash Flows from Financing Activities | | | | |

Net borrowings under revolving credit facility | | 18,000 | | 10,000 |

Long-term debt borrowings | | 125,000 | | 170,241 |

Long-term debt repayments | | (97,006) | | (1,597) |

Purchases of treasury shares | | (27,767) | | (21,849) |

Dividends paid | | (21,369) | | (20,742) |

Excess tax benefits from share-based compensation | | 49 | | 906 |

Acquisition holdback payments | | (10,614) | | (287) |

Exercise of stock appreciation rights and options | | 264 | | 120 |

Net Cash (used in) provided by Financing Activities | | (13,443) | | 136,792 |

Effect of Exchange Rate Changes on Cash | | (4,543) | | (2,705) |

Decrease in cash and cash equivalents | | (13,836) | | (38,005) |

Cash and cash equivalents at beginning of period | | 69,470 | | 71,189 |

Cash and Cash Equivalents at End of Period | | $ 55,634 | | $ 33,184 |

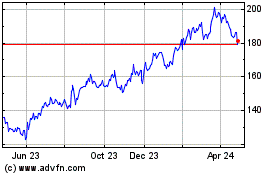

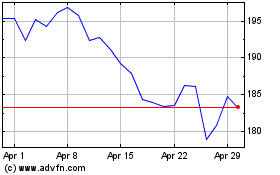

Applied Industrial Techn... (NYSE:AIT)

Historical Stock Chart

From Aug 2024 to Sep 2024

Applied Industrial Techn... (NYSE:AIT)

Historical Stock Chart

From Sep 2023 to Sep 2024