UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

January 25, 2016

Rambus Inc.

(Exact name of registrant as specified in its charter)

|

| | | | |

| | | | |

Delaware | | 000-22339 | | 94-3112828 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I. R. S. Employer Identification No.) |

|

| | | | |

1050 Enterprise Way, Suite 700 Sunnyvale, California | | | | 94089 |

(Address of principal executive offices) | | | | (ZIP Code) |

(408) 462-8000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 – Results of Operations and Financial Condition.

On January 25, 2016, Rambus Inc. (the “Company”) issued a press release announcing results for the quarter and year ended December 31, 2015. A copy of the press release is attached as Exhibit 99.1 to this current report on Form 8-K and is incorporated by reference herein.

The information under Item 2.02 in this current report on Form 8-K and the related information in the exhibit attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01 – Financial Statements and Exhibits.

(d) Exhibits.

|

| |

99.1 | Press release dated January 25, 2016. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | |

| | | | |

Date: January 25, 2016 | | | | Rambus Inc. |

| | |

| | | | /s/ Satish Rishi |

| | | | Satish Rishi, Senior Vice President, Finance and Chief Financial Officer |

Exhibit Index

|

| | |

| | |

Exhibit Number | | Exhibit Title |

| |

99.1 | | Press release dated January 25, 2016. |

Exhibit 99.1

News Release

RAMBUS REPORTS FOURTH QUARTER AND FISCAL YEAR 2015 FINANCIAL RESULTS

Business and Financial Highlights:

| |

• | Generated fourth quarter revenue of $76.8 million and annual revenue of $296.3 million |

| |

• | Acquired secure mobile payment and ticketing solutions to complement CryptoManager platform |

| |

• | Announced R+ DDR4 server memory chip for RDIMMs and LRDIMMs |

| |

• | Signed and renewed key license agreements with IBM, Renesas, SK hynix and Toshiba |

| |

• | Revealed Smart Data Acceleration research program to improve data center performance |

| |

• | Initiated $100 million Accelerated Share Repurchase Program |

| |

• | Fourth quarter GAAP diluted net income per share of $0.11; fourth quarter non-GAAP diluted net income per share of $0.18 |

| |

• | Annual GAAP diluted net income per share of $1.80; annual non-GAAP diluted net income per share of $0.60 |

SUNNYVALE, Calif. - January 25, 2016 - Rambus Inc. (NASDAQ:RMBS) today reported financial results for the fourth quarter and year ended December 31, 2015.

GAAP Financial Results:

Revenue for the fourth quarter of 2015 was $76.8 million, up 4% on a sequential basis from the third quarter of 2015 primarily due to higher contract and product revenue, offset by lower royalty revenue. As compared to the fourth quarter of 2014, revenue was up 7% primarily due to higher royalty revenue from SK hynix, IBM and the renewal of our patent license agreement with Toshiba in the fourth quarter of 2015 as well as higher contract revenue, offset by lower royalty revenue from Renesas and STMicroelectronics.

Total operating costs and expenses for the fourth quarter of 2015 were $56.4 million, 1% higher than the previous quarter and 4% higher than the fourth quarter of 2014. Fourth quarter operating costs and expenses of $56.4 million included $3.3 million of stock-based compensation expenses, $6.2 million of amortization expenses and $3.6 million of restructuring charges. In comparison, total operating costs and expenses for the third quarter of 2015 of $56.1 million included $3.6 million of stock-based compensation expenses and $6.3 million of amortization expenses. Total operating costs and expenses for the fourth quarter of 2014 were $54.5 million, which included $3.5 million of stock-based compensation expenses and $6.3 million of amortization expenses. The change in total operating costs and expenses in the fourth quarter of 2015 as compared to the third quarter of 2015 was primarily due to the restructuring charges in the fourth quarter of 2015 and higher prototyping costs, offset by lower consulting costs and lower marketing expenses. The change in total operating costs and expenses in the fourth quarter of 2015 as compared to the fourth quarter of 2014 was primarily attributable to the restructuring charges in the fourth quarter of 2015, lower gain from sale of intellectual property and higher expenses related to software design tools, offset by lower prototyping costs, lower headcount related costs and lower consulting costs.

Net income for the fourth quarter of 2015 was $13.0 million as compared to net income of $182.0 million in the third quarter of 2015 and net income of $7.8 million in the fourth quarter of 2014. Diluted net income per share for the fourth quarter of 2015 was $0.11 as compared to diluted net income per share of $1.52 in the third quarter of 2015 and diluted net income per share of $0.07 in the fourth quarter of 2014.

Revenue for the year ended December 31, 2015 was $296.3 million, which was relatively flat as compared to the prior year period, primarily due to lower royalty revenue from ST Microelectronics and NVIDIA Corporation, offset by higher revenue from SK hynix, IBM and higher sales of security and lighting products.

Total operating costs and expenses for the year ended December 31, 2015 were $224.9 million, 2% higher than the year ended December 31, 2014. The year ended December 31, 2015 operating costs and expenses of $224.9 million included $15.1 million of stock-based compensation expenses, $25.1 million of amortization expenses and $3.6 million of restructuring charges. This

is compared to total operating costs and expenses for the year ended December 31, 2014 of $221.2 million, which included $14.7 million of stock-based compensation expenses, $26.6 million of amortization expenses and $2.5 million of retention bonus expense from acquisitions. The change in total operating costs and expenses was primarily attributable to the restructuring charges in 2015, higher headcount related costs, higher expenses related to software design tools and higher cost of sales due to higher sales of security and lighting products and engineering services, offset by lower consulting costs and lower retention bonus expense from acquisitions.

Net income for the year ended December 31, 2015 was $211.4 million as compared to a net income of $26.2 million for the same period of 2014. Diluted net income per share for the year ended December 31, 2015 was $1.80 as compared to a diluted net income per share of $0.22 for the same period of 2014.

Non-GAAP Financial Results (1):

Total non-GAAP operating costs and expenses in the fourth quarter of 2015 were $43.4 million, 6% lower than the previous quarter, and 3% lower than the fourth quarter of 2014.

Non-GAAP net income in the fourth quarter of 2015 was $20.7 million, 22% higher than the prior quarter and 24% higher than the fourth quarter of 2014. Non-GAAP diluted net income per share was $0.18 in the fourth quarter of 2015 as compared to $0.14 in the prior quarter and $0.14 in the fourth quarter of 2014.

Total non-GAAP operating costs and expenses for the year ended December 31, 2015 were $181.1 million as compared to $177.4 million in the same period of 2014 due primarily to higher headcount related costs, higher expenses related to software design tools and higher cost of sales due to higher sales of security and lighting products offset by lower consulting costs.

Non-GAAP net income for the year ended December 31, 2015 was $70.6 million as compared to $70.1 million in the same period of 2014. Non-GAAP diluted net income per share was $0.60 for the year ended December 31, 2015 as compared to non-GAAP diluted net income per share of $0.60 for the year ended December 31, 2014.

Other Financial Highlights:

Cash, cash equivalents, and marketable securities as of December 31, 2015 were $287.7 million, a decrease of $75.2 million from September 30, 2015, mainly due to the repurchased 7.8 million shares of the Company's common stock under its share repurchase program via an accelerated share repurchase program.

During the fourth quarter of 2015, the Company recorded an income tax provision of approximately $4.6 million.

2016 First Quarter and Annual Outlook:

For the first quarter of 2016, the Company expects revenue to be between $71 million and $75 million. For 2016, the Company expects revenue to be between $310 million and $325 million. Revenue is not without risk and includes expectations that the Company will sign new customers for patent as well as solutions licensing and renew or extend agreements with existing customers.

Conference Call:

The Company will host a conference call at 2:00 p.m. PT today to discuss its financial results. The call, audio and slides will be available online at investor.rambus.com. A replay will be available following the call as a webcast on the Rambus Investor Relations website and for one week at the following numbers: (855) 859-2056 (domestic) or (404) 537-3406 (international) with ID#23967982.

| |

(1) | Non-GAAP Financial Information: |

In the commentary set forth above and in the financial statements included in this earnings release, the Company presents the following non-GAAP financial measures: operating costs and expenses, operating income (loss) and net income (loss). In computing each of these non-GAAP financial measures, the following items were considered as discussed below: stock-based compensation expense, acquisition-related transaction costs and retention bonus expense, restructuring charges, amortization expense, non-cash interest expense and certain other one-time adjustments. The non-GAAP financial measures disclosed by the Company should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP, and the financial results calculated in accordance with GAAP and reconciliations from these results should be carefully evaluated.

Management believes the non-GAAP financial measures are appropriate for both its own assessment of, and to show investors, how the Company’s performance compares to other periods. The non-GAAP financial measures used by the Company may be calculated differently from, and therefore may not be comparable to, similarly titled measures used by other companies. Reconciliation from GAAP to non-GAAP results is included in the financial statements contained in this release.

The Company’s non-GAAP financial measures reflect adjustments based on the following items:

Stock-based compensation expense. These expenses primarily relate to employee stock options, employee stock purchase plans, and employee non-vested equity stock and non-vested stock units. The Company excludes stock-based compensation expense from its non-GAAP measures primarily because such expenses are non-cash expenses that the Company does not believe are reflective of ongoing operating results. Additionally, given the fact that other companies may grant different amounts and types of equity awards and may use different option valuation assumptions, excluding stock-based compensation expense permits more accurate comparisons of the Company’s results with peer companies.

Acquisition-related transaction costs and retention bonus expense. These expenses include all direct costs of certain acquisitions and the current periods’ portion of any retention bonus expense associated with the acquisitions. The Company excludes these expenses in order to provide better comparability between periods.

Restructuring charges. These charges may consist of severance, contractual retention payments, exit costs and other charges and are excluded because such charges are not directly related to ongoing business results and do not reflect expected future operating expenses.

Amortization expense. The Company incurs expenses for the amortization of intangible assets acquired in acquisitions. The Company excludes these items because these expenses are not reflective of ongoing operating results in the period incurred. These amounts arise from the Company’s prior acquisitions and have no direct correlation to the operation of the Company’s core business.

Non-cash interest expense on convertible notes. The Company incurs non-cash interest expense related to its convertible notes. The Company excludes non-cash interest expense related to its convertible notes to provide more accurate comparisons of the Company’s results with other peer companies and to more accurately reflect the Company’s ongoing operations.

Income tax adjustments. For purposes of internal forecasting, planning and analyzing future periods that assume net income from operations, the Company estimates a fixed, long-term projected tax rate of approximately 36 percent, which consists of estimated U.S. federal and state tax rates, and excludes tax rates associated with certain items such as withholding tax, tax credits, deferred tax asset valuation allowance and the release of any deferred tax asset valuation allowance. Accordingly, the Company has applied the 36 percent tax rate to its non-GAAP financial results for all periods. The Company has provided below a reconciliation of its GAAP provision for income taxes and GAAP effective tax rate to the assumed non-GAAP provision for income taxes and non-GAAP effective tax rate.

On occasion in the future, there may be other items, such as asset impairments and significant gains or losses from contingencies that the Company may exclude in deriving its non-GAAP financial measures if it believes that doing so is consistent with the goal of providing useful information to investors and management.

Forward-Looking Statements

This release contains forward-looking statements under the Private Securities Litigation Reform Act of 1995 including those relating to Rambus’ expectations regarding 2016 revenue for the first quarter and year, and estimated, fixed, long-term projected tax rates. Such forward-looking statements are based on current expectations, estimates and projections, management’s beliefs and certain assumptions made by Rambus’ management. Actual results may differ materially. Rambus’ business generally is subject to a number of risks which are described more fully in Rambus’ periodic reports filed with the Securities and Exchange Commission. Rambus undertakes no obligation to update forward-looking statements to reflect events or circumstances after the date hereof.

About Rambus Inc.

Rambus creates cutting-edge semiconductor and IP products, spanning memory and interfaces to security, smart sensors and lighting. Our chips, customizable IP cores, architecture licenses, tools, services, training and innovations improve the competitive advantage of our customers. We collaborate with the industry, partnering with leading ASIC and SoC designers, foundries, IP developers, EDA companies and validation labs. For more information, visit www.rambus.com.

RMBSFN

Contacts:

Linda Ashmore

Corporate Communications

Rambus Inc.

(408) 462-8411

lashmore@rambus.com

Nicole Noutsios

Investor Relations

Rambus Inc.

(408) 462-8050

nnoutsios@rambus.com

Rambus Inc.

Condensed Consolidated Balance Sheets

(In thousands)

(Unaudited)

|

| | | | | | | |

| December 31, 2015 | | December 31, 2014 |

ASSETS | | | |

| | | |

Current assets: | | | |

Cash and cash equivalents | $ | 143,764 |

| | $ | 154,126 |

|

Marketable securities | 143,942 |

| | 145,983 |

|

Accounts receivable | 16,408 |

| | 6,001 |

|

Prepaids and other current assets | 11,476 |

| | 8,541 |

|

Deferred taxes | — |

| | 187 |

|

Total current assets | 315,590 |

| | 314,838 |

|

Intangible assets, net | 64,266 |

| | 89,371 |

|

Goodwill | 116,899 |

| | 116,899 |

|

Property, plant and equipment, net | 56,616 |

| | 64,023 |

|

Deferred taxes, long-term | 162,485 |

| | 536 |

|

Other assets | 3,648 |

| | 2,612 |

|

Total assets | $ | 719,504 |

| | $ | 588,279 |

|

| | | |

LIABILITIES & STOCKHOLDERS’ EQUITY | | | |

| | | |

Current liabilities: | | | |

Accounts payable | $ | 4,096 |

| | $ | 6,962 |

|

Accrued salaries and benefits | 12,278 |

| | 14,840 |

|

Other accrued liabilities | 11,992 |

| | 12,856 |

|

Total current liabilities | 28,366 |

| | 34,658 |

|

Long-term liabilities: | | | |

Convertible notes, long-term | 120,901 |

| | 115,089 |

|

Long-term imputed financing obligation | 38,625 |

| | 39,063 |

|

Other long-term liabilities | 5,079 |

| | 7,847 |

|

Total long-term liabilities | 164,605 |

| | 161,999 |

|

Total stockholders’ equity | 526,533 |

| | 391,622 |

|

Total liabilities and stockholders’ equity | $ | 719,504 |

| | $ | 588,279 |

|

Rambus Inc.

Condensed Consolidated Statements of Operations

(In thousands, except per share amounts)

(Unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2015 | | 2014 | | 2015 | | 2014 |

| |

Revenue: | | | | | | | |

Royalties | $ | 66,242 |

| | $ | 64,134 |

| | $ | 262,415 |

| | $ | 271,521 |

|

Contract and other revenue | 10,531 |

| | 7,906 |

| | 33,863 |

| | 25,037 |

|

Total revenue | 76,773 |

| | 72,040 |

| | 296,278 |

| | 296,558 |

|

Operating costs and expenses: | | | | | | | |

Cost of revenue (1) | 11,340 |

| | 10,748 |

| | 45,344 |

| | 41,947 |

|

Research and development (1) | 25,604 |

| | 28,445 |

| | 111,110 |

| | 110,025 |

|

Sales, general and administrative (1) | 16,853 |

| | 19,131 |

| | 70,554 |

| | 74,770 |

|

Restructuring charges | 3,576 |

| | — |

| | 3,576 |

| | 39 |

|

Gain from sale of intellectual property | (424 | ) | | (3,359 | ) | | (3,686 | ) | | (3,529 | ) |

Gain from settlement | (510 | ) | | (510 | ) | | (2,040 | ) | | (2,040 | ) |

Total operating costs and expenses | 56,439 |

| | 54,455 |

| | 224,858 |

| | 221,212 |

|

Operating income | 20,334 |

| | 17,585 |

| | 71,420 |

| | 75,346 |

|

Interest income and other income (expense), net | 350 |

| | 156 |

| | 1,224 |

| | (276 | ) |

Interest expense | (3,122 | ) | | (3,065 | ) | | (12,413 | ) | | (24,820 | ) |

Interest and other income (expense), net | (2,772 | ) | | (2,909 | ) | | (11,189 | ) | | (25,096 | ) |

Income before income taxes | 17,562 |

| | 14,676 |

| | 60,231 |

| | 50,250 |

|

Provision for (benefit from) income taxes | 4,570 |

| | 6,835 |

| | (151,157 | ) | | 24,049 |

|

Net income | $ | 12,992 |

| | $ | 7,841 |

| | $ | 211,388 |

| | $ | 26,201 |

|

Net income per share: | | | | | | | |

Basic | $ | 0.12 |

| | $ | 0.07 |

| | $ | 1.84 |

| | $ | 0.23 |

|

Diluted | $ | 0.11 |

| | $ | 0.07 |

| | $ | 1.80 |

| | $ | 0.22 |

|

Weighted average shares used in per share calculation | | | | | | | |

Basic | 111,476 |

| | 115,024 |

| | 114,814 |

| | 114,318 |

|

Diluted | 113,388 |

| | 117,620 |

| | 117,484 |

| | 117,624 |

|

| | | | | | | |

_________

(1) Total stock-based compensation expense for the three months and years ended December 31, 2015 and 2014 are presented as follows:

|

| | | | | | | | | | | | | | | |

| | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2015 | | 2014 | | 2015 | | 2014 |

Cost of revenue | $ | 12 |

| | $ | 10 |

| | $ | 63 |

| | $ | 44 |

|

Research and development | $ | 1,459 |

| | $ | 1,642 |

| | $ | 6,762 |

| | $ | 7,216 |

|

Sales, general and administrative | $ | 1,876 |

| | $ | 1,883 |

| | $ | 8,271 |

| | $ | 7,470 |

|

Rambus Inc.

Supplemental Reconciliation of GAAP to Non-GAAP Results

(In thousands)

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended |

| December 31, 2015 | | September 30, 2015 | | December 31, 2014 | | December 31, 2015 | | December 31, 2014 |

| | | | | | | | | |

Operating costs and expenses | $ | 56,439 |

| | $ | 56,139 |

| | $ | 54,455 |

| | $ | 224,858 |

| | $ | 221,212 |

|

Adjustments: | | | | | | | | | |

Stock-based compensation expense | (3,347 | ) | | (3,568 | ) | | (3,535 | ) | | (15,096 | ) | | (14,730 | ) |

Acquisition-related transaction costs and retention bonus expense | — |

| | — |

| | (6 | ) | | (2 | ) | | (2,475 | ) |

Amortization expense | (6,160 | ) | | (6,268 | ) | | (6,323 | ) | | (25,074 | ) | | (26,618 | ) |

Restructuring charges | (3,576 | ) | | — |

| | — |

| | (3,576 | ) | | (39 | ) |

Non-GAAP operating costs and expenses | $ | 43,356 |

| | $ | 46,303 |

| | $ | 44,591 |

| | $ | 181,110 |

| | $ | 177,350 |

|

| | | | | | | | | |

Operating income | $ | 20,334 |

| | $ | 17,640 |

| | $ | 17,585 |

| | $ | 71,420 |

| | $ | 75,346 |

|

Adjustments: | | | | | | | | | |

Stock-based compensation expense | 3,347 |

| | 3,568 |

| | 3,535 |

| | 15,096 |

| | 14,730 |

|

Acquisition-related transaction costs and retention bonus expense | — |

| | — |

| | 6 |

| | 2 |

| | 2,475 |

|

Amortization expense | 6,160 |

| | 6,268 |

| | 6,323 |

| | 25,074 |

| | 26,618 |

|

Restructuring charges | 3,576 |

| | — |

| | — |

| | 3,576 |

| | 39 |

|

Non-GAAP operating income | $ | 33,417 |

| | $ | 27,476 |

| | $ | 27,449 |

| | $ | 115,168 |

| | $ | 119,208 |

|

| | | | | | | | | |

Income before income taxes | $ | 17,562 |

| | $ | 15,062 |

| | $ | 14,676 |

| | $ | 60,231 |

| | $ | 50,250 |

|

Adjustments: | | | | | | | | | |

Stock-based compensation expense | 3,347 |

| | 3,568 |

| | 3,535 |

| | 15,096 |

| | 14,730 |

|

Acquisition-related transaction costs and retention bonus expense | — |

| | — |

| | 6 |

| | 2 |

| | 2,475 |

|

Amortization expense | 6,160 |

| | 6,268 |

| | 6,323 |

| | 25,074 |

| | 26,618 |

|

Restructuring charges | 3,576 |

| | — |

| | — |

| | 3,576 |

| | 39 |

|

Impairment of investment | — |

| | — |

| | — |

| | — |

| | 600 |

|

Non-cash interest expense on convertible notes | 1,627 |

| | 1,605 |

| | 1,536 |

| | 6,372 |

| | 14,762 |

|

Non-GAAP income before income taxes | $ | 32,272 |

| | $ | 26,503 |

| | $ | 26,076 |

| | $ | 110,351 |

| | $ | 109,474 |

|

GAAP provision for income taxes | 4,570 |

| | (166,971 | ) | | 6,835 |

| | (151,157 | ) | | 24,049 |

|

Adjustment to GAAP provision for income taxes | 7,048 |

| | 176,512 |

| | 2,552 |

| | 190,884 |

| | 15,362 |

|

Non-GAAP provision for income taxes | 11,618 |

| | 9,541 |

| | 9,387 |

| | 39,727 |

| | 39,411 |

|

Non-GAAP net income | $ | 20,654 |

| | $ | 16,962 |

| | $ | 16,689 |

| | $ | 70,624 |

| | $ | 70,063 |

|

| | | | | | | | | |

Non-GAAP basic net income per share | $ | 0.19 |

| | $ | 0.15 |

| | $ | 0.15 |

| | $ | 0.62 |

| | $ | 0.61 |

|

Non-GAAP diluted net income per share | $ | 0.18 |

| | $ | 0.14 |

| | $ | 0.14 |

| | $ | 0.60 |

| | $ | 0.60 |

|

Weighted average shares used in non-GAAP per share calculation: | | | | | | | | | |

Basic | 111,476 |

| | 116,444 |

| | 115,024 |

| | 114,814 |

| | 114,318 |

|

Diluted | 113,388 |

| | 119,542 |

| | 117,620 |

| | 117,484 |

| | 117,624 |

|

Supplemental Reconciliation of GAAP to Non-GAAP Effective Tax Rate (1)

|

| | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended |

| December 31, 2015 | | September 30, 2015 | | December 31, 2014 | | December 31, 2015 | | December 31, 2014 |

| | | | | | | | | |

GAAP effective tax rate | 26 | % | | (1,109 | )% | | 47 | % | | (251 | )% | | 48 | % |

Adjustment to GAAP effective tax rate | 10 | % | | 1,145 | % | | (11 | )% | | 287 | % | | (12 | )% |

Non-GAAP effective tax rate | 36 | % | | 36 | % | | 36 | % | | 36 | % | | 36 | % |

| |

(1) | For purposes of internal forecasting, planning and analyzing future periods that assume net income from operations, the Company estimates a fixed, long-term projected tax rate of approximately 36 percent, which consists of estimated U.S. federal and state tax rates, and excludes tax rates associated with certain items such as withholding tax, tax credits, deferred tax asset valuation allowance and the release of any deferred tax asset valuation allowance. Accordingly, the Company has applied the 36 percent tax rate to its non-GAAP financial results for all periods. |

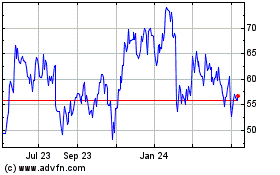

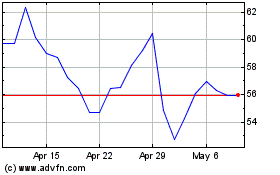

Rambus (NASDAQ:RMBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rambus (NASDAQ:RMBS)

Historical Stock Chart

From Apr 2023 to Apr 2024