UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of report (Date of earliest event reported): January 14, 2016

| ORAMED

PHARMACEUTICALS INC. |

| (Exact

name of registrant as specified in its charter) |

| DELAWARE |

|

001-35813 |

|

98-0376008 |

| (State or Other Jurisdiction |

|

(Commission |

|

(IRS Employer |

| of Incorporation) |

|

File Number) |

|

Identification No.) |

| Hi-Tech Park 2/4 Givat Ram, PO Box 39098, Jerusalem, Israel |

|

91390 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

+972-2-566-0001

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| ITEM 7.01. |

REGULATION FD DISCLOSURE. |

Oramed

Pharmaceuticals Inc. has posted an updated corporate presentation to its website. A copy of the presentation is furnished with

this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference.

| ITEM

9.01. |

FINANCIAL

STATEMENTS AND EXHIBITS. |

| |

99.1 |

Corporate

Presentation |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| |

ORAMED

PHARMACEUTICALS INC. |

| |

|

|

| |

By: |

/s/

Nadav Kidron |

| |

Name:

|

Nadav

Kidron |

| |

Title:

|

President

and CEO |

January

14, 2016

3

Exhibit 99.1

Addressing the Multibillion - Dollar Injectable Drug Markets with Oral Formulations January 2016

Safe Harbor Certain statements contained in this material are forward - looking statements . These forward - looking statements are based on the current expectations of the management of Oramed only, and are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forward - looking statements, including the risks and uncertainties related to the progress, timing, cost, and results of clinical trials and product development programs ; difficulties or delays in obtaining regulatory approval or patent protection for our product candidates ; competition from other pharmaceutical or biotechnology companies ; and our ability to obtain additional funding required to conduct our research, development and commercialization activities, and others, all of which could cause the actual results or performance of Oramed to differ materially from those contemplated in such forward - looking statements . Except as otherwise required by law, Oramed undertakes no obligation to publicly release any revisions to these forward - looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events . For a more detailed description of the risks and uncertainties affecting Oramed, reference is made to Oramed's reports filed from time to time with the Securities and Exchange Commission . which involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the company, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward - looking statements . Please refer to the company's filings with the Securities and Exchange Commission for a comprehensive list of risk factors that could cause actual results, performance or achievements of the company to differ materially from those expressed or implied in such forward - looking statements . Oramed undertakes no obligation to update or revise any forward - looking statements . 2

Oramed Snapshot ▪ Proprietary oral protein delivery platform ▪ Insulin first - initially targeting the lucrative insulin market. Additional huge markets in the pipeline ▪ Strong financial position $ 39M in cash and investments, no debt ▪ Strong management team backed by world - class scientific experts ▪ Multiple value - creation events for this year including completion of FDA Phase IIb study for oral insulin ▪ NASDAQ: ORMP 3

Funneling H uge I njectable D rug M arkets to Novel Oral F ormulations 4 Insulin 2014: $24 b GLP - 1 Analog 2014: $3 b Vaccines 2014: $33 b Flu vaccines 2011: $2.9 b Interferon 2015: $10+ b

Harsh pH Stomach acidity cleaves and shreds protein Protease attack Proteases attack and break down proteins An Unsolved C hallenge: Proteins and Peptides do Not S urvive the Digestive S ystem 5 Absorption barrier Most therapeutic proteins fail to be absorbed via the intestinal wall (barrier )

Oramed Technology P rotects D rug I ntegrity and Increases A bsorption 6 pH shield for passage through stomach pH sensitive enteric coating protects capsule contents. Capsule dissolves only once in small intestine Protease protection Special cocktail of protease inhibitors stave off and protect the active agent from protease attack Absorption enhancement Assists the permeation of proteins/peptides across intestinal membrane and into bloodstream

Diabetes: Millions of diabetics inject insulin today and wish for oral dosage 7

every 7 SECONDS 1 person dies from diabetes 4.9M deaths in 2014 1 in 12 People on the Planet H ave D iabetes 8 https://www.idf.org/worlddiabetesday/toolkit/gp/facts - figures WORLD 387 M People living with diabetes PREVALENCE 8.3% healthcare 1 in 9 Is spent on diabetes 2014 2035 MILLION expected increase +205 In 2014 diabetes expenditure reached US $ 612 billion

Type 1 and Type 2 Diabetes A re Different ▪ T1DM is autoimmune: The body destroys its own insulin - producing (beta) cells, leaving patients completely dependent on external insulin sources ▪ 5 - 10% of diabetics have T1DM: Up to 37 million people worldwide have T1DM ▪ Projected Market: $13 billion by 2023 ▪ T2DM is metabolic: The body becomes insulin resistant. Injections may be used to make up for the pancreas’s inability to create sufficient insulin to keep blood sugar at normal levels ▪ 371 million people worldwide needing treatment ▪ Projected Market: $39 billion by 2019 9 TYPE 1 � Diabetes TYPE 2 Diabetes Diabetes: A metabolic disease in which the body’s inability to produce any or enough insulin causes elevated levels of glucose in the blood

ORMD - 0801: Oramed’s Flagship P roduct for Oral T reatment of Diabetes 10 * Total number of study subjects: 196 . Total number of human doses: 2 , 063 ~200 study subjects * ~2000 human doses * Clean safety profile

The Drawbacks of Injected I nsulin vs. the Advantages of O ral Insulin ENDOGENOUS INSULIN produced by the pancreas and delivered to the body via the liver INJECTED INSULIN introduced directly to the bloodstream with only a fraction of it reaching the liver. This can cause excess sugar to be stored in fat and muscle which often results in weight gain. This may also cause hypoglycemia ORAL INSULIN like natural insulin is delivered first to the liver. This should lead to: ▪ Better blood glucose control ▪ Reduced hypoglycemia: liver metabolizes 80 % ▪ Reduced hyperglycemia: insulin closes down glucose overproduction/secretion ▪ Reduced weight gain (neutral ): vs. SC insulin focus on glucose disposal leads to substantial weight gain 11 portal vein liver small intestine stomach To systemic circulation

ORMD - 0801: Better type 2 diabetes (T2DM) treatment by interacting with the body like natural insulin 12

The T ype 2 Diabetes T reatment P aradigm 13 ADA guidance: Earlier use of insulin equals better outcome (source ) 01 Stage 1 : Initial Treatment - Lifestyle m odification - Diet & exercise 02 Stage 2: Single & Combination Oral Therapies - Reduce insulin resistance - Stimulate insulin secretion 03 Stage 3 : Late - Stage Treatment - Insulin ( injections)

Excessive Production of Glucose at Night: A S ignificant Challenge in D iabetes Management ▪ Excessive nocturnal glucose production by the liver is frequently demonstrated in diabetes patients ▪ Results of high blood sugar are measured by a fasting blood sugar (FBG) test, done after an 8 - hour fast. High FBG test results are a key concern in diabetes management ▪ Treatment today is suboptimal: In only 20 % of patients blood sugar is regulated with medication and return FBG to normal levels 14

Simple Oral A dministration at Bed T ime Managing D iabetes Oramed’s first indication, ORMD - 0801 , reduces excessive nocturnal glucose production in the liver, by acting the same way that natural insulin does. Key benefits 15 Reduction of FBG levels Increased patient compliance via simple oral administration Slowing down the progression of diabetes

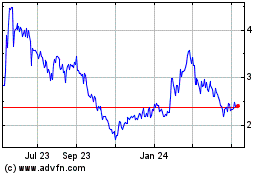

▪ 30 T 2 DM patients ▪ Primary objective: Safety and tolerability ▪ Secondary objective: Pharmacodynamic effects on mean nighttime glucose Phase IIa FDA Study: ORMD - 0801 Drug S afe With no Serious A dverse E vents 16 Placebo N= 10 Mean (SD ) 176.06 ( 63.70 ) ORMD - 0801 N=10 Mean (SD ) 153.23 (40.16) Placebo N=10 Mean (SD ) 167.95 (64.17) ORMD - 0801 N=10 Mean (SD ) 135.64 (39.40) Daytime CGM Glucose (mg/ dL ) Nighttime CGM Glucose (mg/ dL ) Last 2 days Last 2 days Placebo N= 10 Mean (SD ) 156.26 ( 58.62 ) ORMD - 0801 N=10 Mean (SD ) 126.02 (27.26) Fasting CGM Glucose (mg/ dL ) Last 2 days

▪ Observed to be safe and well tolerated for dosing regimen ▪ No hypoglycemic events at any point during the study in any member of treatment group ▪ No related adverse events observed ▪ Dose group showed a pronounced effect over placebo ▪ Sustained reduction observed at night, day and mean fasting glucose test Phase IIa FDA Study: ORMD - 0801 Demonstrates S ustained G lucose R eduction Safe and well tolerated Sustained glucose reduction 17

Ongoing 180 Patient FDA Phase IIb Study 18 ▪ Safety of ORMD - 0801 ▪ Evaluate PD effects of ORMD - 0801 on mean night glucose ! 30 US sites 28 day treatment 1 time a day at night Primary objectives: 180 patients

ORMD - 0801 Type 1 Diabetes (T 1 DM): Potentially eliminating the need for insulin before each meal 19

▪ Long - acting insulin (basal) helps maintain stable insulin levels during fasting periods ▪ Rapid - acting insulin (bolus) prior to each meal to stabilize blood sugar ▪ Administration is via injection or pump ▪ Easier use and reduced systemic exposure ▪ Potentially reducing multiple daily injections ▪ Tighter regulation and control of blood sugar levels by directly targeting liver glucose, due to portal administration Oramed: Potentially Superseding B olus R eplacement T herapy T 1 DM patients are treated with 2 types of insulin replacement therapy Oramed seeks to replace the mealtime (bolus) insulin doses 20

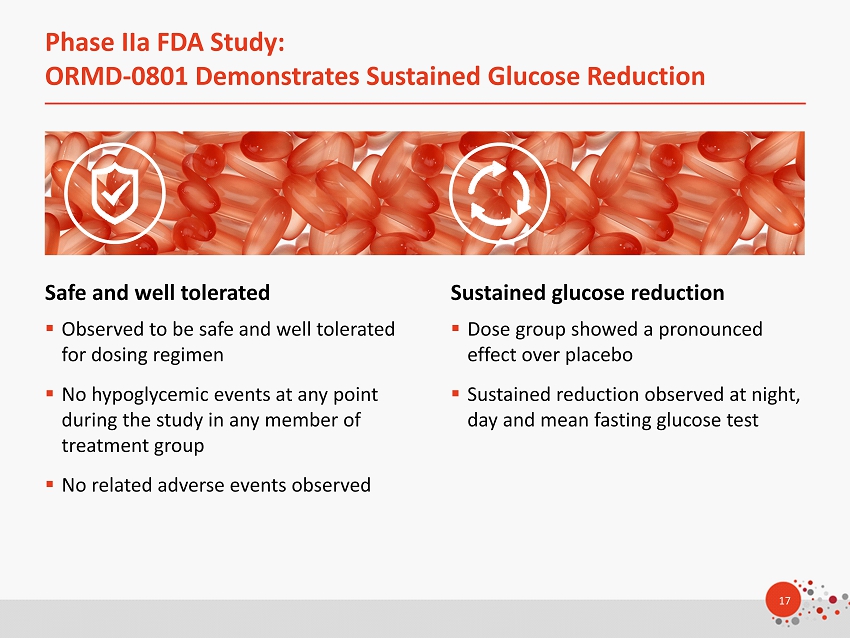

ORMD - 0801: Consistent Lowering of Glucose L evels - Day and Night in P reliminary Study Design: ▪ Monitor glycemic stability of orally administered ORMD - 0801 ▪ Uncontrolled T1DM patients ▪ 1 capsule of 8 mg insulin administered before meals, three times daily at mealtime ▪ Continuous glucose monitoring 21 Frequency glucose > 200 mg/ dL 20 30 40 50 60 6:00 8:59 9:00 11:59 12:00 13:59 14:00 18:59 19:00 20:59 21:00 23:59 00:00 5:59 Pretreatment Treatment Mean glucose n= 8 180 200 220 240 260 280 300 Day Night Pretreatment Treatment Time Glucose (mg// dL ) 11.5 % Frequency (%) Time

Blood glucose levels are lower, day and night, compared to control group Phase IIa FDA Study: Shows Consistent and Accumulative Effect of ORMD - 0801 22 Reduction in FBG 25 T 1 DM patients 7 days of treatment 3 times a day (at mealtime) To evaluate the change in exogenous insulin requirements in T 1 DM patients Primary objective: -18 -13 -8 -3 2 -70.00 -50.00 -30.00 -10.00 10.00 Day 1 Day 2 Day 3 Day 4 Day 5 Day 6 Day 7 Delta Basal Insulin Delta Bolus Insulin Delta FPG FPG (mg/dl) Delta Placebo vs ORMD Basal or Bolus Insulin (units) Delta Placebo vs ORMD

ORMD - 0801: Phase IIa FDA Study Demonstrates Oral Insulin Reduces Exogenous Insulin Requirements Safe and well tolerated for the pre - meal dosing regimen in this study. Encouraging trends in key areas vs. placebo: 23 Decreased use of rapid - acting insulin levels of post - meal glucose levels of daytime glucose Increased rate of mild hypoglycemia vs. placebo

China License Deal: 500 M patient potential 24 * Journal of the American Medical Association ▪ License: Exclusive right to ORMD - 0801 in Greater China ▪ Licensee: Hefei Tianhui ("HTIT") Owns with Sinopharm a state - of - the - art GMP API insulin manufacturing facility ▪ $ 50 M Payments + Royalties: - $ 12 M in restricted stock (at premium) - $ 38 M milestone payments - 10 % royalties on net sales diabetic ( 12 % of adult population) prediabetic ( 50 % of adult population) Chinese diabetes market* 114 M ~ 500 M

ORMD - 0901: Oral GLP - 1 Analog 25

▪ T 2 DM medication ▪ Mimics the natural hormone in the body ▪ Good safety profile ▪ Decreases blood glucose levels ▪ Does not cause hypoglycemia ▪ Effectively reduces HbA 1 c ▪ Preserves beta cell function ▪ Promotes weight loss ▪ Current therapy is via injection only ▪ IND - enabling tox studies in process ▪ Phase Ib ex - US study Q 4 , 2015 ▪ Phase IIb US study Q 4 , 2016 GLP - 1 Analog: ORMD - 0901 for Oral GLP - 1 (TD 2 M) GLP - 1 Analog ORMD - 0901 Clinical Status 26

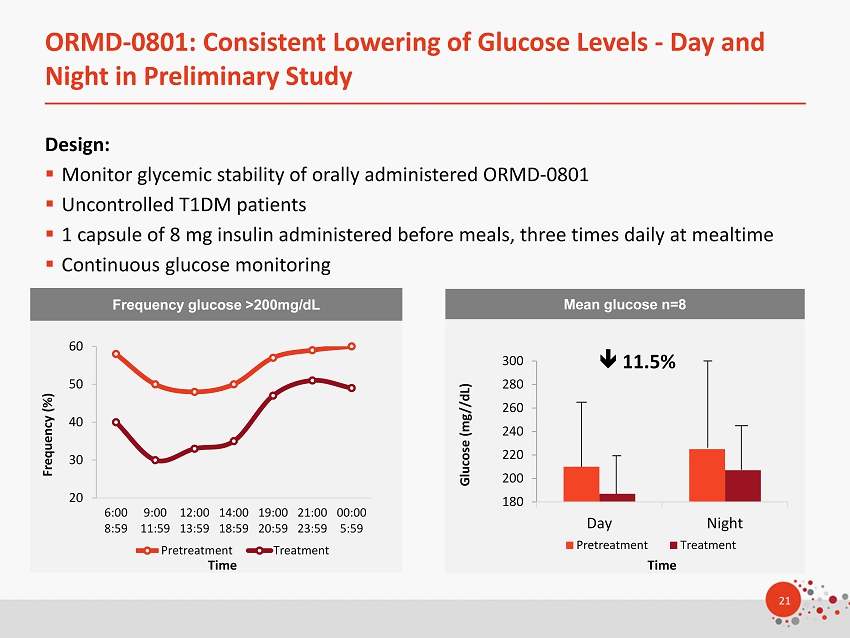

Dogs: Subcutaneous exenatide delivery amounted to a 51 % reduction in mean glucose Oral GLP - 1 - ORMD - 0901 �� 0 20 40 60 80 100 120 S.C. AG 4 AG 3 - + + + + Exenatide Glucose * * * Area (mg/dl)/minutes * 10 2 Preserved the biological activity of orally delivered exenatide . ORMD - 0901 successfully curbed blood sugar excursions following glucose challenge ORMD - 0901 formulations Human ( 4 healthy volunteers) 150 mg exenatide 0 20 40 60 80 100 120 140 -50 0 50 100 150 Insulin ( mU /mL) n= 4 ORMD - 0901 Placebo

ORMD - 0801 (Oral Insulin) Type 2 Diabetes ORMD - 0801 (Oral Insulin) Type 1 Diabetes ORMD - 0901 (Oral GLP - 1 ) Type 2 Diabetes Rich Pipeline: Multiple Value - Creation Events 28 Phase I Phase II Phase III Timeline Q 1 , ‘ 14 : Phase IIa completed Q 2 , ’ 15 : Phase IIb study initiated Q 2 , ‘ 16 : Phase IIb study projected topline data release Q 3 , ’ 14 : Phase IIa completed Q 3 , ’ 14 : Preclinical/IND studies initiated Q 1 , ’ 16 : Phase Ib ex - US study projected completion Q 4 , ’ 16 : IND / Phase II study projected initiation

Corporate Overview: On route to meet unmet market needs 29

Oramed (NASDAQ: ORMP): Corporate Overview 1 �� 1 As of January 12 , 2016 . 2 Including 1.7 M options, 0.7 M warrants and 0.3 M RSUs Financial Highlights ▪ $ 39 M cash and investments ▪ 13.1 M shares outstanding ( 15.7 M fully diluted 2 ) ▪ No Debt Analyst Coverage ▪ Rodman & Renshaw (PT $ 25 ) ▪ Aegis Capital (PT $ 18 ) ▪ FBR & Co. (PT $ 15 ) ▪ Zacks (PT $ 25 ) Intellectual Property Estate ▪ Methods and compositions for oral administration of proteins ▪ Methods and compositions for oral administration of exenatide ▪ Methods and compositions (insulin + exenatide ) ▪ Improved protease inhibitors

Lead Team 31 Michael Berelowitz , MD Chairman of Oramed SAB SVP Clinical Development & Medical Affairs, Pfizer (former) Harold Jacob, MD Chief Medical Officer, Given Imaging (former) Gerald Ostrov CEO, Bausch&Lomb (former) Senior level executive J&J (former) Leonard Sank Entrepreneur and business leader Board or Directors Management Nadav Kidron , Esq, MBA - CEO & Director Many years of business experience as well as corporate law and technology Miriam Kidron , PhD - CSO & Director Senior Researcher at the Diabetes Unit of Hadassah Medical Center for more than 25 years Josh Hexter - COO, VP Bus. Dev. More than 17 years of prominent leadership roles in biotech and pharma Yifat Zommer, CPA, MBA - CFO Extensive experience in corporate financial management

Scientific Advisory Board 32 Michael Berelowitz , MD Chairman of SAB Former SVP Clinical Development and Medical Affairs, Specialty Care Business at Pfizer Inc. Strong background in the Diabetes field John Amatruda , MD Former SVP and Franchise Head of the Diabetes and Obesity Unit at Merck & Co. Avram Herskho , MD, PhD Nobel Laureate, Chemistry, 2004 Distinguished professor in the biochemistry unit in the B. Rappaport Facility of Medicine, Technion , Haifa, Israel Nir Barzilai , MD Director for the Institute of Aging Research. Member of Diabetes Research Center, Albert Einstein University College of Medicine Derek LeRoith , MD, PhD Professor of Medicine and Chief of Endocrinology, Diabetes and Bone Disease Unit, Mount Sinai School of Medicine, NY Ele Ferrannini, MD, PhD Professor of Internal Medicine, University of Pisa School of Medicine. Professor of Medicine, Diabetes Unit Texas Health Science Center. Past President of the EASD

Oramed: Addressing the Multibillion - Dollar I njectable D rug M arkets with Oral F ormulations ▪ Proprietary platform for oral delivery of drugs, proven in clinical studies ▪ Initially targeting the lucrative insulin market . Additional huge markets in the pipeline ▪ Strong lead team backed by globally prominent scientific experts ▪ Value creating events until the end of 2016 - Insulin/T 2 DM: Completion of Phase IIb multi - site study - GLP - 1 Analog: Completion of Phase Ib ex - US study followed by initiation of Phase II US multi - site study - Big Pharma: Feasibility Study underway with the proprietary compound of a big pharma company 33

THANK YOU www.oramed.com Nadav Kidron CEO nadav@oramed.com Josh Hexter COO josh@oramed.com

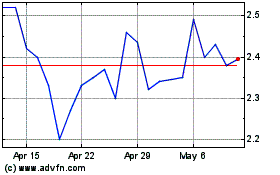

Oramed Pharmaceuticals (NASDAQ:ORMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Oramed Pharmaceuticals (NASDAQ:ORMP)

Historical Stock Chart

From Apr 2023 to Apr 2024