SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D/A

Under

the Securities Exchange Act of 1934

(Amendment

No. 3)

Oramed

Pharmaceuticals Inc.

(Name

of Issuer)

Common

Stock par value $0.012 per share

(Title

of Class of Securities)

68403P203

(CUSIP

Number)

Nadav

Kidron

c/o

Oramed Pharmaceuticals Inc.

Hi-Tech

Park 2/4 Givat Ram

PO

Box 39098

Jerusalem,

Israel 91390

(+972)

2-566-0001

(Name,

Address and Telephone Number of Person Authorized to Receive Notices and Communications)

December

28, 2015

(Date

of Event Which Requires Filing of This Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition which is the subject of this Schedule

13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ☐.

Note. Schedules

filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See

§240.13d-7 for other parties to whom copies are to be sent.

* The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the

subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in

a prior cover page.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section

18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act

but shall be subject to all other provisions of the Act (however, see the Notes).

| CUSIP

No. 68403P203 |

Schedule

13D/A |

Page 2 of 6

Pages |

| 1. |

Names

of Reporting Persons

Nadav

Kidron |

| 2. |

Check

the Appropriate Box if a Member of a Group

(a) ☐

(b)

☒ |

| 3. |

SEC

Use Only

|

| 4. |

Source

of Funds

N/A |

| 5. |

Check

If Disclosure of Legal Proceedings is Required Pursuant To Item 2(d) or 2(e)

☐ |

| 6. |

Citizenship

or Place of Organization

Israel |

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

7. |

Sole

Voting Power

1,183,685(1)

|

| 8. |

Shared

Voting Power

1,155,367(2) |

| 9. |

Sole

Dispositive Power

1,183,685(1) |

| 10. |

Shared

Dispositive Power

0 |

| 11. |

Aggregate

Amount Beneficially Owned by Each Reporting Person

2,339,052 |

| 12. |

Check

if the Aggregate Amount in Row (11) Excludes Certain Shares

☐ |

| 13. |

Percent

of Class Represented By Amount in Row (11)

17.9%(3) |

| 14. |

Type

of Reporting Person

IN |

| CUSIP

No. 68403P203 |

Schedule

13D/A |

Page

3 of 6 Pages |

(1) Includes 263,184 shares of Common Stock issuable upon the exercise

of outstanding stock options and 53,039 RSUs, all exercisable within 60 days of December 28, 2015.

(2) Consists of 1,155,367 shares of Common Stock owned of record by Hefei

Tianhui Incubator of Technologies Co., Ltd.

(3) Based on an aggregate of 13,364,651 shares of Common Stock, which includes

13,048,478 shares of Common Stock that the Issuer advised were issued and outstanding as of December 28, 2015 and 316,173

shares of Common Stock which may be acquired within 60 days of December 28, 2015, as described in footnote 1 above.

This Amendment No. 3 to Schedule 13D, which amends and

supplements the Schedule 13D initially filed with the Securities and Exchange Commission (the “SEC”) on March

6, 2006, as amended by Amendment No. 1 to Schedule 13D filed with the SEC on February 11, 2013 and Amendment No. 2 to Schedule

13D filed with the SEC on February 3, 2014 (as amended, the “Schedule 13D”) by Nadav Kidron (the “Reporting Person”),

is being filed to reflect a material increase in the percentage of the Common Stock, $0.012 par value per share (the “Common

Stock”), of Oramed Pharmaceuticals Inc., a Delaware corporation (the “Issuer”), beneficially owned by the Reporting

Person, in light of the issuance of shares of Common Stock pursuant to a Securities Purchase Agreement entered between the Issuer

and Hefei Tianhui Incubator of Technologies Co., Ltd. (“HTIT”) on November 30, 2015 (the “SPA”), which

appoints the Reporting Person as proxy and attorney in fact of HTIT with respect to such shares, as described in Item 6 below.

| Item 1. |

Security and Issuer. |

This Amendment No. 3 relates to the Common Stock of

the Issuer.

The principal executive offices of the Issuer are located

at Hi-Tech Park 2/4, Givat Ram, Jerusalem, 91390 Israel.

| Item 2. |

Identity and Background. |

There have been no material changes to the information

previously reported in the Schedule 13D with respect to the Reporting Person, except for his current residence address, which is

12 Eliezer Hagadol St., Jerusalem, Israel 9359038.

| Item 3. |

Source and Amount of Funds or Other Consideration. |

Not Applicable. As described above, the events

giving rise to the requirement of the Reporting Person to file this Amendment No. 3 did not involve any purchases effected by the

Reporting Person with respect to the Common Stock.

| Item 4. |

Purpose of Transaction. |

Item 4 of the Schedule 13D is hereby amended

and supplemented by the addition of the following:

Under the SPA, the Reporting Person was appointed

as proxy and attorney in fact of HTIT, as more fully described in Item 6 below. A copy of the SPA is attached as Exhibit 10.1

hereto and is incorporated herein by reference.

| CUSIP

No. 68403P203 |

Schedule

13D/A |

Page 4 of 6 Pages |

| Item 5. |

Interest in Securities of the Issuer. |

Item 5 of the Schedule 13D is hereby amended

and restated in its entirety as follows:

The information provided herein is based on

13,364,651 shares of Common Stock outstanding, which includes 13,048,478 shares of Common Stock that the Issuer advised were issued

and outstanding as of December 28, 2015 and 316,173 shares of Common Stock which may be acquired by the Reporting Person within

60 days of December 28, 2015, as set forth below.

(a), (b) See the responses (and footnotes) to Items

7 through 11 and 13 of page 2.

The aggregate number of shares of Common Stock

of the Issuer beneficially owned by the Reporting Person is 2,339,052, which represents approximately 17.9% of the aggregate number

of shares of Common Stock issued and outstanding and acquirable by the Reporting Person upon the exercise of options to purchase

shares of the Common Stock. This includes 864,312 shares of Common Stock of the Issuer acquired by the Reporting Person on March

3, 2006 pursuant to a private placement. In addition, the Issuer has granted to the Reporting Person options to purchase shares

of Common Stock (“Options”) to purchase an aggregate of 263,134 shares of Common Stock of the Issuer. The Issuer granted

Options to the Reporting Person as follows:

| |

● |

On

August 2, 2007, the Issuer granted 70,834 Options to the Reporting Person (all such Options have since expired). |

| |

● |

On

May 7, 2008, the Issuer granted 72,000 Options to the Reporting Person under the Issuer's 2008 Stock Incentive Plan (the "2008

Plan") at an exercise price of $6.48 per share; 12,000 of such Options vested immediately on the date of grant and the

remainder vested in twenty equal monthly installments, commencing on June 30, 2008. The Options have an expiration date of

May 7, 2018. |

| |

● |

On

April 21, 2010, the Issuer granted 72,000 Options to the Reporting Person under the 2008 Plan at an exercise price of $5.88

per share; 9,000 of such Options vested immediately on the date of grant and the remainder vested in twenty-one equal monthly

installments, commencing on May 31, 2010. The Options have an expiration date of April 20, 2020. |

| |

● |

On

August 8, 2012, the Issuer granted 72,000 Options to the Reporting Person under the 2008 Plan at an exercise price of $4.08

per share; 21,000 of such Options vested immediately on the date of grant and the remainder vests in seventeen equal monthly

installments, commencing on August 31, 2012. The Options have an expiration date of August 8, 2022. |

| |

● |

On

April 9, 2014, the Issuer granted 47,134 Options to the Reporting Person under the 2008 Plan at an exercise price of $12.45

per share; 15,710 of the Options vested on the April 30, 2014, and 3,928 Options vested on the last day of each month thereafter.

The Options have an expiration date of April 9, 2024. |

In

addition, the Issuer has granted to the Reporting Person Restricted Stock Units (“RSUs”) under the 2008 Plan as follows:

| |

● |

9,788

RSUs were granted under the 2008 Plan and vested in two equal installments, each of 4,894 shares, on November 30 and December

31, 2014. The shares of Common Stock underlying the RSUs will be issued upon request of the grantee. |

| |

● |

79,848

RSUs were granted under the 2008 Plan and vest in 23 installments consisting of one installment of 6,654 shares on February

28, 2015 and 22 equal monthly installments of 3,327 shares each, commencing March 31, 2015. The shares of Common Stock underlying

the RSUs will be issued upon request of the grantee. |

The

Reporting Person has the sole power to vote or direct the vote, and to dispose or direct the disposition, of 1,183,685

shares of Common Stock of the Issuer.

| CUSIP

No. 68403P203 |

Schedule

13D/A |

Page 5 of

6 Pages |

The Reporting Person has shared power, together with

HTIT, to vote or direct the vote of 1,155,367 shares of Common Stock of the Issuer pursuant to the SPA as described in Item 6 below.

(c) The Reporting Person has not effected any transaction

in the shares of Common Stock of the Issuer in the past 60 days.

(d) No person, other than the Reporting Person, is known

to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the shares

of Common Stock reported above in this Item 5.

(e) Not applicable.

| Item 6. |

Contracts, Arrangements, Understandings or Relationships with Respect

to Securities of the Issuer. |

Item 6 of the Schedule 13D is hereby amended and supplemented

by the addition of the following:

On November 30, 2015, the Issuer entered into the SPA

with HTIT. Pursuant to Section 4.8 of the SPA, effective as of December 28, 2015, the Reporting Person will serve as proxy and

attorney in fact of HTIT, with full power of substitution, to cast on behalf of HTIT all votes that HTIT is entitled to cast with

respect to 1,155,367 shares of Common Stock (the “Purchased Shares”) at any and all meetings of the shareholders of

the Issuer, to consent or dissent to any action taken without a meeting and to vote all the Purchased Shares held by HTIT in any

manner the Reporting Person deems appropriate except for matters related to the Issuer’s activities in the People’s

Republic of China, on which the Reporting Person will consult with HTIT before taking any action as proxy.

A copy of the SPA is attached hereto as Exhibit 10.1

and is incorporated herein by reference.

| Item 7. |

Material to be Filed as Exhibits. |

| Exhibit 10.1 |

Securities Purchase Agreement between Oramed Pharmaceuticals, Inc. and Hefei Tianhui Incubator of Technologies Co., Ltd., dated November 30, 2015. |

| CUSIP

No. 68403P203 |

Schedule

13D/A |

Page 6 of

6 Pages |

SIGNATURE

After reasonable inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: December 29, 2015

| |

/s/ Nadav Kidron |

| |

NADAV KIDRON |

Exhibit 10.1

SECURITIES PURCHASE AGREEMENT

This Securities Purchase Agreement (this “Agreement”)

is dated as of November 30, 2015, between Oramed Pharmaceuticals Inc., a Delaware corporation (the “Company”), and

Hefei Tianhui Incubator of Technologies Co., Ltd., a corporation organized under the laws of the People’s Republic of China

(the “Purchaser”).

WHEREAS, subject to the terms and conditions

set forth in this Agreement, the Company desires to issue and sell to the Purchaser, and the Purchaser desires to purchase from

the Company, securities of the Company as more fully described in this Agreement.

NOW, THEREFORE, IN CONSIDERATION of the mutual

covenants contained in this Agreement, and for other good and valuable consideration the receipt and adequacy of which are hereby

acknowledged, the Company and the Purchaser agree as follows:

ARTICLE 1

DEFINITIONS

1.1 Definitions. In addition to the terms defined elsewhere in this Agreement, for all purposes of this Agreement, the following

terms have the meanings set forth in this Section 1.1:

“Affiliate” means any Person

that, directly or indirectly through one or more intermediaries, controls or is controlled by or is under common control with a

Person as such terms are used in and construed under Rule 405 under the Securities Act.

“Business Day” means any day

except Saturday, Sunday, any day which is a federal legal holiday in the United States or any day on which banking institutions

in the State of New York are authorized or required by law or other governmental action to close.

“Closing” means the closing

of the purchase and sale of the Shares pursuant to Section 2.1 of this Agreement.

“Commission” means the United

States Securities and Exchange Commission.

“Closing Date” shall have

the meaning ascribed to such term in Section 2.1 of this Agreement

“Common Stock” means the common

stock of the Company, par value $0.012 per share, and any other class of securities into which such securities may hereafter be

reclassified or changed into.

“Discussion Time” shall have

the meaning ascribed to such term in Section 3.2(b) of this Agreement.

“Exchange Act” means the Securities

Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

“Governmental Approvals”,

means the required governmental approvals in China for the investment in the Company, conversion from Renminbi into United States

Dollars of the Subscription Amount and the ability to wire such Subscription Amount to the Company

“Per Share Purchase Price”

equals $10.38631.

“Person” means an individual

or corporation, partnership, trust, incorporated or unincorporated association, joint venture, limited liability company, joint

stock company, government (or an agency or subdivision thereof) or other entity of any kind.

“SEC Reports” shall have the

meaning ascribed to such term in Section 3.1(d) of this Agreement.

“Securities Act” means the

Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder.

“Shares” means the shares

of Common Stock issued or issuable to the Purchaser pursuant to this Agreement.

“Short Sales” means all “short

sales” as defined in Rule 200 of Regulation SHO under the Exchange Act (but shall not be deemed to include the location and/or

reservation of borrowable shares of Common Stock).

“Subscription Amount” means

$12,000,000, in United States dollars and in immediately available funds.

“Trading Day” means a day

on which the New York Stock Exchange is open for trading.

“Trading Market” means the

following markets or exchanges on which the Common Stock is listed or quoted for trading on the date in question: the Nasdaq Capital

Market, the Nasdaq Global Market, the Nasdaq Global Select Market, the NYSE MKT or the New York Stock Exchange.

“Transaction Documents” means

this Agreement and any other documents or agreements executed in connection with the transactions contemplated hereunder.

“Transfer Agent” means Continental

Stock Transfer & Trust, the current transfer agent of the Company, and any successor transfer agent of the Company.

ARTICLE 2

PURCHASE AND SALE

2.1 Closing. Upon the terms and subject to the conditions set forth herein, the Company agrees to sell, and the Purchaser agrees

to purchase 1,155,367 shares of Common Stock of the Company constituting 7.36% of all the issued and outstanding shares of the

Company on a fully diluted basis at the Per Share Purchase Price, in consideration for the Subscription Amount. The completion

of the purchase and sale of the Shares shall occur on or before December 21, 2015 (the “Closing Date”). On or

before the Closing Date, but no later than 2:00 pm (New York time) on the Closing Date, the Purchaser shall deliver to the Company,

via wire transfer, immediately available funds equal to the Subscription Amount and the Company shall, on the Closing Date, deliver

or cause to be delivered to the Purchaser the Shares as determined pursuant to Section 2.2(a) of this Agreement, and the Company

and the Purchaser shall deliver the other items set forth in Section 2.2 of this Agreement deliverable at the Closing. Upon satisfaction

of the covenants and conditions set forth in Sections 2.2 and 2.3 of this Agreement the Closing shall occur at the offices of Zysman,

Aharoni, Gayer and Sullivan & Worcester, LLP at 1633 Broadway New York, NY 10019, or at such other place (or remotely by facsimile

or other electronic transmission).

2.2 Deliveries.

(a) On or prior to the Closing Date, the Company shall deliver or cause to be delivered to the Purchaser (i) a stock certificate evidencing

the 1,155,367 shares of Common Stock purchased hereunder, registered in the name of the Purchaser (the “Stock Certificate”)

with a copy sent to the Purchaser’s counsel; and (ii) an opinion from the Company’s counsel regarding the legality,

validity and enforceability of this Agreement under Delaware law.

(b) On or prior to the Closing Date, the Purchaser shall deliver or cause to be delivered to the Company the Subscription Amount by

wire transfer to the account as specified in writing by the Company.

2.3 Closing Conditions.

(a) The obligations of the Company hereunder in connection with the Closing are subject to the following conditions being met:

(i) the accuracy in all material respects on the Closing Date of the representations and warranties of the Purchaser contained herein;

(ii) all obligations, covenants and agreements of the Purchaser required to be performed at or prior to the Closing Date shall have

been performed; and

(iii) the delivery by the Purchaser of the items set forth in Section 2.2(b) of this Agreement.

(b) The obligations of the Purchaser hereunder in connection with the Closing are subject to the following conditions being met:

(i) the accuracy in all material respects on the Closing Date of the representations and warranties of the Company contained herein;

(ii) all obligations, covenants and agreements of the Company required to be performed at or prior to the Closing Date shall have been

performed;

(iii) the delivery by the Company of the items set forth in Section 2.2(a) of this Agreement;

(iv) there shall have been no material adverse change with respect to the Company since the date hereof;

(v) from the date hereof to the Closing Date, trading in the Common Stock shall not have been suspended by the Commission or the Company’s

principal Trading Market (except for any suspension of trading of limited duration agreed to by the Company, which suspension shall

be terminated prior to the Closing), and, at any time prior to the Closing Date, trading in securities generally as reported by

Bloomberg L.P. shall not have been suspended or limited, or minimum prices shall not have been established on securities whose

trades are reported by such service, or on any Trading Market, nor shall a banking moratorium have been declared either by the

United States or New York State authorities nor shall there have occurred any material outbreak or escalation of hostilities or

other national or international calamity of such magnitude in its effect on, or any material adverse change in, any financial market

which, in each case, in the reasonable judgment of the Purchaser, makes it impracticable or inadvisable to purchase the Shares

at the Closing; and

(vi) the receipt by the Purchaser of the Governmental Approvals.

ARTICLE 3

REPRESENTATIONS AND WARRANTIES

3.1 Representations and Warranties of the Company. The Company hereby makes the following representations and warranties to

the Purchaser:

(a) Organization and Qualification. The Company is a corporation duly incorporated, validly existing and in good standing under

the laws of the State of Delaware, with the requisite power and authority to own and use its properties and assets and to carry

on its business as currently conducted.

(b) Authorization; Enforcement. The Company has all the requisite corporate power and authority to enter into and to consummate

the transactions contemplated hereby. The execution and delivery of this Agreement and Each Transaction Document by the Company

and the consummation by it of the transactions contemplated hereby, including the issuance of the Securities, has been duly authorized

by all necessary action on the part of the Company. This Agreement and each Transaction Document when delivered by the Company

in accordance with the terms hereof is the valid and binding obligation of the Company enforceable against the Company in accordance

with its terms, except: (i) as limited by general equitable principles and applicable bankruptcy, insolvency, reorganization, moratorium

and other laws of general application affecting enforcement of creditors’ rights generally, (ii) as limited by laws relating

to the availability of specific performance, injunctive relief or other equitable remedies and (iii) insofar as indemnification

and contribution provisions may be limited by applicable law.

(c)

Capitalization. The Company has a total of 30,000,000 authorized common stock, with 11,599,825 issued and outstanding and

2,635,402 warrants and options with average strike price of $7.11 and 307,562 restricted stock unites.

(d)

Issuance of the Securities. The Shares are duly authorized and, when issued and paid for in accordance with the applicable

Transaction Documents, will be duly and validly issued, fully paid and nonassessable.

(e) SEC Reports; Financial Statements. The Company has timely filed (or has received a valid extension of such time of filing

and has made such filing prior to the expiration of any such extension) all reports, schedules, forms, statements and other documents

required to be filed by the Company under the Exchange Act (the “SEC Reports”) for the twelve months preceding the

date hereof (or such shorter period as the Company was required by law or regulation to file such material). As of their respective

dates, the SEC Reports complied in all material respects with the requirements of the Exchange Act, as applicable, and none of

the SEC Reports, when filed, contained any untrue statement of a material fact or omitted to state a material fact required to

be stated therein or necessary in order to make the statements therein, in light of the circumstances under which they were made,

not misleading.

(f)

No Conflict. The execution and delivery of this Agreement and each other Transaction Document to which the Company is a

party, the consummation of the transactions contemplated hereby and thereby and the compliance with their respective provisions

by the Company will not (A) conflict with or violate any provision of the Company’s organizational documents ("Organizational

Documents"), (B) result in a breach of, constitute (with or without due notice or lapse of time or both) a default under,

result in the acceleration of, create in any party the right to accelerate, terminate, modify or cancel, or require any notice,

consent or waiver (other than such consents or waivers obtained by the Company prior to the Closing Date) under, any material contract

to which the company is a party to which the Company is a party or by which the Company is bound or to which any of its properties

or assets are subject, result in the imposition of any mortgage, pledge, security interest, encumbrance, charge or other lien (whether

arising by contract or operation of law) (a “Security Interest”) upon the properties or assets of the Company or (C)

violate any order, writ, injunction, decree, statute, rule or regulation applicable to the Company or any of its properties or

assets, except in the case of each of clauses (A) and (B), such as would not have a company material adverse effect.

(g)

Governmental Consents. Assuming the accuracy of the representations made by the Purchaser herein, no consent, approval,

permit, order or authorization of, or registration, qualification, designation, declaration or filing with, any federal, state,

regional, county, city, municipal or local government, whether foreign or domestic, or any court, arbitration tribunal, administrative

agency, commission or other regulatory body (each, a “Governmental Entity”), is required on the part of the Company

in connection with the offer, sale and delivery of the Shares or the other transactions to be consummated at the Closing, as contemplated

by this Agreement, except such filings as shall have been made prior to, and as shall be effective on and as of, the Closing and

such filings required to be made after the Closing under applicable federal and state securities laws. Based on the representations

made by the Purchaser in Article 5 of this Agreement, the offer and sale of the Shares to the Purchaser will be in compliance with

applicable federal and state securities laws in all material respects.

(h) Litigation. Except as disclosed in SEC Reports, there is no claim, action, suit or proceeding, or inquiry or investigation

(“Proceeding”), pending, or, to the Company’s knowledge, any written threat thereof, against the Company or any

of its assets or properties, (i) which questions the validity of this Agreement or the right of the Company to enter into this

Agreement or any other Transaction Document, or to consummate the transactions contemplated hereby and thereby, or (ii) which could

reasonably be expected to result, either individually or in the aggregate, in a Company material adverse effect. The Company is

not subject to any outstanding judgment, order or decree of any Governmental Entity. As of the date hereof, there is no Proceeding

by the Company pending or which the Company intends to initiate against others.

(i)

Financial Statements.

(i)

The financial statements of the Company contained in the SEC Reports are herein called the “Financial Statements”.

The Financial Statements, together with the notes thereto, are in accordance in all material respects with the books and records

of the Company, present accurately and fairly the financial condition of the Company at the dates indicated, and have been prepared

in accordance with U.S. GAAP consistently applied, except that the Financial Statements referred to in clause (ii) above are subject

to normal and recurring year-end audit adjustments, none of which is expected to be material, and do not include footnotes. The

Financial Statements reflect reserves appropriate and adequate for all known material liabilities and reasonably anticipated losses

as required by U.S. GAAP. The books and records of the Company have been maintained in accordance with good business practices

in all material respects.

(j) Absence of Undisclosed Liabilities.

Except as disclosed in SEC Reports, the Company

does not have any material liabilities (whether known or unknown and whether absolute or contingent), except for (a) liabilities

shown on the Balance Sheet or the Interim Balance Sheet,(b) liabilities which have arisen since the Interim Balance Sheet

Date incurred in the ordinary course of business consistent with past practice (none of which results from, arises out of, relates

to, is in the nature of, or was caused by any breach of contract, breach of warranty, tort, infringement, or violation of law)

and (c) liabilities not required to be reflected in the Company’s financial statements pursuant to GAAP or disclosed in filings

made with the Commission.

(k) Taxes.

(i) For purposes of this Agreement, the term “Tax” (and, with correlative meaning, “Taxes” and

“Taxable”) means all United States federal, state and local, and all foreign, income, profits, franchise, gross

receipts, payroll, transfer, sales, employment, use, property, excise, value added, ad valorem, license, severance, occupation,

premium, windfall profits, capital stock, social security, unemployment, disability, registration, estimated, stamp, alternative

or add-on minimum, recapture, environmental, withholding and any other taxes of any kind whatsoever, imposed by any taxing authority

or any liability for such Taxes incurred as a transferee or successor or by contract, or as a result of Treasury Regulation Section

1.1502-6 or any similar provision of applicable law or as a result of any tax sharing or similar agreements, together with all

interest, penalties and additions (whether disputed or not) imposed on or with respect to such amounts. “Tax Return”

means any return, declaration, report, claim for refund, or information return or statement filed or required to be filed with

respect to Taxes.

(ii) Except for matters that would not, individually or in the aggregate, have a Company material adverse effect: (a) all Tax Returns

required to be filed on or before the date hereof by or with respect to the Company; (b) all Tax Returns which have been filed

by or with respect to the Company are true, correct and complete in all material respects, and all Taxes owed by the Company, whether

or not shown on any Tax Return (including all withholding and payroll Taxes), have been paid in full and (c)the Company has not

received written notice of any claim by any taxing authority in a jurisdiction in which it does not file Tax Returns that the Company

is or may be subject to taxation by that jurisdiction.

(iii)

Except for matters that would not, individually or in the aggregate, have a Company material adverse effect: (a) no audit, examination

or investigation is currently pending with respect to any Tax Return or Taxes of the Company, nor has the Company received any

written communication from any taxing authority which has caused or should reasonably cause it to believe that an audit, examination

or investigation is forthcoming; and(b)no deficiency for any Taxes has been proposed against the Company in writing, which deficiency

has not been paid in full.

(iv) Notwithstanding anything in this Agreement to the contrary, the Company makes no representations or warranties regarding the amount,

value or condition of, or any limitations on, any Tax asset or attribute of the Company (that is, any net operating loss, net capital

loss, Tax credit or any other Tax attribute which could reduce Taxes (including deductions and credits related to alternative minimum

Taxes)) arising in any Tax period or portion thereof ending on or prior to the Closing Date, or the ability of Company, Purchaser

or any of their Affiliates to utilize such Tax assets or attributes after the Closing.

(v)

Notwithstanding any other representation and warranty made in this Article 3, the Company’s exclusive representations and

warranties with respect to Taxes and Tax Returns are set forth solely in this Section 3.10.

(l) Intellectual Property.

(i) As used in this Agreement, the following capitalized terms shall have meanings set forth below:

(ii) “Company Intellectual Property” means all Intellectual Property Rights owned or purported to be owned by the

Company, including but not limited to the Registered Intellectual Property.

(iii) “Intellectual Property Rights” means all U.S. and foreign: (i) patents and patent applications, including

continuations, divisionals, renewals, extensions, provisionals, continuations-in-part, or reissues of patent applications and patents

issuing thereon; (ii) trademarks, service marks, trade names, logos, service names, brand names and trade dress rights, whether

registered or unregistered, and all registrations and applications to register any of the foregoing with any agency or authority;

(iii) copyrights, whether registered or unregistered, and all applications, registrations and renewals thereof; (iv) internet domain

name registrations and applications therefore; (v) inventions, trade secrets and confidential business information, whether patentable

or unpatentable and whether or not reduced to practice, including all confidential formulae, processes, know-how, technical and

clinical data, shop rights, financial, marketing and business data, pricing and cost information, business and marketing plans

and customer and supplier lists and information and any media or other tangible embodiment thereof and all descriptions thereof;

and (vi) any similar or equivalent rights to any of the foregoing (anywhere in the world).

(iv) “Registered Intellectual Property” means all Intellectual Property Rights that are the subject of a pending

application or an issued patent, trademark, copyright, domain name or other similar registration formalizing exclusive rights and

that are owned by, or registered or currently applied for under the name of, the Company.

(v) To the knowledge of the Company, the Company owns, is licensed to use, or otherwise has the right to use, , all Intellectual Property

Rights necessary, or otherwise used or held for use in, the operation of the Company Business, where the failure to do so have

would have a Company material adverse effect.

(vi) To the knowledge of the Company, the Company does not materially violate any Intellectual Property Rights of any third party Except

as set forth in SEC Reports, the Company has no knowledge of any claim, and the Company has not received any notice or other communication

(written or otherwise) of any claim, from any Person asserting that the Company Business or any of the services or products of

the Company infringe or may infringe, constitute the misappropriation of, or violate, any Intellectual Property Rights of another

Person. The Company has no knowledge of any existing material infringement by any third party on the right to use or own any of

the Company Intellectual Property which infringement would result in a Company material adverse effect.

(vii) Except where the failure to do so would not have a Company material adverse effect, the Company has taken commercially reasonable

measures and precautions to establish and preserve the confidentiality, secrecy and ownership of all Company Intellectual Property.

(m) Insurance. All of the Company’s Insurance policies or binders are in full force and effect, are adequate for the Company

Business. To the Company's knowledge, the Company is not in a material default with respect to any material provision contained

in such Insurance policies. None of such Insurance policies shall become terminable as a result of any of the transactions contemplated

by this Agreement. Except as set forth in SEC Reports, the Company has no knowledge of any pending material claims against the

Company which would result in a Company material adverse effect. Neither the Company nor any Subsidiary has any reason to believe

that it will not be able to renew its existing insurance coverage as and when such coverage expires or to obtain similar coverage

from similar insurers as may be necessary to continue its business without a significant increase in cost.

(i) All of such agreements, contracts and instruments have been duly executed, authorized and delivered by the Company in a manner

consistent with the Organizational Documents and in accordance with the law, and the Company treats such agreements, contracts

and instruments as binding. All of such agreements, contracts and instruments are in full force and effect and binding against

the Company, and, to the knowledge of the Company, are binding against the other parties thereto in accordance with their respective

terms. None of the Company, or, to the Company’s knowledge, any other party thereto, is in material default of any of its

obligations under any of the agreements or contracts disclosed in SEC Reports, and no condition exists that with notice or lapse

of time or both would constitute a material default thereunder. The Company has delivered to the Purchaser true and complete copies

of all of the foregoing agreements or an accurate summary of any oral agreement (and all written amendments or other modifications

thereto). Except as disclosed in SEC Reports, the Purchaser’s acquisition of the Shares will not trigger material default

under any of these agreements, contracts and instruments.

(ii) Compliance with Laws. The Company is not subject to, or in violation of, any outstanding judgment, injunction, order or

decree of any Governmental Entity (an “Order”). The Company has complied and is in compliance, in all material respects,

with every federal, state, local or foreign law, rule, ordinance or regulation applicable to the Company Business (all of the foregoing,

collectively, “Laws and Regulations”), including, without limitation: (a) the Occupational Safety and Health Administration

(“OSHA”); (b) Laws and Regulations respecting labor, employment and employment practices, terms and conditions of employment

and wages and hours; (c) Laws and Regulations relating to data protection or data transfer issues; (d) Laws and Regulations relating

to health insurance, health information security, health information privacy, and health information transaction format laws, including,

without limitation, the Health Insurance Portability and Accountability Act of 1996 and its implementing regulations (“HIPAA”)

and any applicable state privacy laws; and (e) Laws and Regulations relating to the provision of professional services and reimbursement

therefor. The Company has no material liabilities, whether accrued, absolute, contingent or otherwise, for material violations

under any Laws and Regulations.

(n) Employee Relations.

(1)

Except as disclosed in SEC Reports, the Company is not involved in or, to the knowledge of the Company, threatened with, any employment

or labor dispute, grievance, or litigation relating to labor or employment, safety or discrimination matters involving any employee,

including without limitation, charges of unfair labor practices or discrimination complaints and claims regarding recharacterization

of independent contractors. The Company is not presently, nor has it been in the past, a party to or bound by any collective bargaining

agreement or union contract with respect to employees and no collective bargaining agreement is being negotiated by the Company.

No union organizing campaign or activity with respect to non-union employees of the Company is ongoing, pending or, to the knowledge

of the Company, threatened or contemplated.

(ii) Except as disclosed in the SEC Reports, each employee plan has been administered in all material respects in accordance with the

terms of such plan and the provisions of any and all statutes, orders or governmental rules or regulations, including without limitation

ERISA and the Code.

(o)

Books and Records. The minute books of the Company have been maintained in accordance with business practices in all material

respects.

(p) Permits. To the knowledge of the Company, personnel of the Company have all material Permits of any Governmental Entity

and from any professional organization required in connection with the Company Business. Such listed Permits are the material Permits

that are required for the Company to conduct the Company Business, each such Permit is in full force and effect, and, to the Company’s

knowledge, no suspension or cancellation of such Permit is threatened and there is no reasonable basis for believing that such

Permit will not be renewable upon expiration. To the Company’s knowledge, none of such Permits shall be suspended, terminated,

impaired, adversely modified or become terminable, in whole or in part, as a result of any of the transactions contemplated by

this Agreement.

(q)

FDA Matters.

(i) The Company has not tested, manufactured, distributed or sold any products or services prior to receiving any required or necessary

approvals or consents from any federal or state governmental authority, including but not limited to the FDA under the Food, Drug

& Cosmetics Act of 1938, as amended, 21 U.S.C. § 201 et seq. and the regulations promulgated thereunder, or

any corollary entity in any other jurisdiction. The Company has obtained, in all countries where it is marketing its products and

services, all material Permits required by any Governmental Entity to sell, promote and market its products and services. Except

as disclosed in SEC Reports, the Company has not received any written notice of, nor does the Company have any knowledge of any

actions, citations, decisions, product recalls, medical device reports, information requests, warning letters or Section 305 notices,

pertaining to the Company Business from the FDA or similar issues regulated by the FDA or any corollary entity in any other jurisdiction.

(ii) The Company has complied with all applicable Laws and Regulations in all material respects with respect to the manufacture, design,

sale, labeling, storing, testing, distribution, inspection, promotion and marketing of all of the products and services and the

operation of manufacturing facilities promulgated by the FDA or any corollary entity in any other jurisdiction.

(iii) All submissions made by the Company to the FDA and any corollary entity in any other jurisdiction, whether oral, written or electronically

delivered, were true, accurate and complete in all material respects as of the date made, and remain true, accurate and complete

in all material respects and do not materially misstate any of the statements or information included therein, or omit to state

a material fact necessary to make the statements therein not misleading.

(iv) The Company has never been the subject of an FDA seizure or injunction action.

(v) To the Company’s knowledge, the Company has never been investigated for possible FDA criminal violations.

(vi)

The Company has never received a FDA warning letter and has not been in violation of applicable FDA rules and regulations in any

material respect.

(r)

Environmental Matters.

(i) The Company, in all material respects, has complied at all times and is in compliance with all applicable Environmental Laws (as

defined below). Except as otherwise disclosed in SEC Reports, to the knowledge of the Company, there is no pending or threatened

civil or criminal litigation by any Governmental Entity or any other Person relating to any applicable Environmental Law involving

the Company, which would result in a Company material adverse effect.

(i) The Company has obtained and maintains in full force and effect all material Permits required by Environmental Laws to enable it

to conduct the Company Business and is in compliance in all material respects with such Permits. For purposes of this Agreement:

(1)

“Environmental Laws” means any federal, state, local or foreign laws (including common law), regulations, codes,

rules, orders, ordinances, permits, requirements and final governmental determinations pertaining to the environment, pollution

or protection of human health, safety or the environment, as adopted or in effect, including without limitation, the Comprehensive

Environmental Response Compensation and Liability Act of 1980, as amended by the Superfund Amendments and Reauthorization Act of

1986, 42 U.S.C. § 9601 et seq.; the Emergency Planning and Community Right-to-Know Act, 42 U.S.C. § 11001

et seq.; the Resource Conservation and Recovery Act, 42 U.S.C. § 6901 et seq.; the Federal Water Pollution Control

Act, 33 U.S.C. § 1251 et seq.; the Federal Insecticide, Fungicide and Rodenticide Act, 7 U.S.C. § 136

et seq.; the Toxic Substance Control Act, 15 U.S.C. § 2601 et seq.; the Oil Pollution Act of 1990, 33 U.S.C.

§ 1001 et seq.; the Hazardous Materials Transportation Act, as amended, 49 U.S.C. § 1801 et seq.; the

Atomic Energy Act, as amended 42 U.S.C. § 2011 et seq.; the Occupational Safety and Health Act, as amended, 29 U.S.C.

§ 651 et seq., and any state or local statute of similar effect; and including without limitation any laws relating to

protection of safety, health or the environment which regulate the use of biological agents or substances including medical or

infectious wastes as any such laws have been amended;

(2)

“Environmental Contaminant” means Hazardous Materials, or any other pollutants, contaminants, toxic or constituent

substances, radioactive substances, materials or special wastes, polychlorinated bi-phenals, or any other substance or material,

regulated by applicable Environmental Laws;

(3)

“Hazardous Materials” means (A) any chemicals, materials or substances defined as or included in the definition

of “hazardous substances,” “hazardous wastes,” “hazardous materials,” “extremely hazardous

wastes,” “restricted hazardous wastes,” “toxic substances,” “toxic pollutants,” “hazardous

air pollutants,” “contaminants,” “toxic chemicals,” “toxins,” “hazardous chemicals,”

“extremely hazardous substances,” “pesticides,” “oil” or related materials as defined in any

applicable Environmental Law, or (B) any petroleum or petroleum products, oil, natural or synthetic gas, radioactive materials,

asbestos-containing materials, urea formaldehyde foam insulation, radon, and any other substance defined or designated as hazardous,

toxic or harmful to human health, safety or the environment under any Environmental Law; and

(4)

“Release” has the meaning specified in CERCLA.

(s) Affiliated Transactions. Except as disclosed in SEC Reports, to the knowledge of the Company, none of the directors or officers

of the Company or any of their respective immediate family members is (a) a partner, member or stockholder or has any other material

economic interest in any customer or supplier of the Company; (b) a party to any transaction or contract with the Company; or (c)

a holder of Indebtedness to the Company. The Company has not paid, or incurred any obligation to pay, any fees, commissions or

other amounts to and is not a party to any agreement, business arrangement or course of dealing with any firm of or in which any

directors or officers of the Company, or any of their respective immediate family members, is a partner or stockholder or has any

other economic interest.

(t)

Disclosures. None of this Agreement, any other Transaction Document to which the Company is a party, nor any schedule, exhibit,

report, document, certificate or instrument furnished by the Company to the Purchaser or its counsel in connection with the transactions

contemplated by this Agreement or any other Transaction Document contains any untrue statement of a material fact or omits to state

a material fact necessary in order to make the statements contained herein or therein, in light of the circumstances under which

they were made, not misleading. There is no fact or circumstance known to the Company that has specific application to the Company

Business (other than general economic or industry conditions) that would reasonably be expected to result in a Company material

adverse effect.

(u)

Related Party Transaction. Except as disclosed in SEC Reports, the Company has not conducted transactions with any related

parties, including the Company’s subsidiaries, principal owners, management, their immediate family members and other affiliates.

(v) Overseas Operations. All of the Company’s overseas facilities and operations have been properly approved and inspected,

in all material respects, by relevant foreign governmental agencies and the Company has not been found in violations of laws and

regulations in foreign jurisdictions.

(w)

Material Adverse Change. Since the date of the latest SEC Report, there has been no material adverse change in the business

or financial condition of the Company.

3.2 Representations and Warranties of the Purchaser. The Purchaser hereby represents and warrants as of the date hereof and

as of the Closing Date to the Company as follows:

(a) Organization; Authority. The Purchaser is an entity duly organized, validly existing and in good standing under the laws

of the People Republic of China with full right, corporate or partnership power and authority to enter into and to consummate the

transactions contemplated by this Agreement and otherwise to carry out its obligations hereunder and thereunder. The execution

and delivery of this Agreement and performance by the Purchaser of the transactions contemplated by this Agreement have been duly

authorized by all necessary corporate or similar action on the part of the Purchaser. Each Transaction Document to which it is

a party has been duly executed by the Purchaser, and when delivered by the Purchaser in accordance with the terms hereof, will

constitute the valid and legally binding obligation of the Purchaser, enforceable against it in accordance with its terms, except:

(i) as limited by general equitable principles and applicable bankruptcy, insolvency, reorganization, moratorium and other laws

of general application affecting enforcement of creditors’ rights generally, (ii) as limited by laws relating to the availability

of specific performance, injunctive relief or other equitable remedies and (iii) insofar as indemnification and contribution provisions

may be limited by applicable law.

(b) Short Sales and Confidentiality Prior To The Date Hereof. Other than consummating the transactions contemplated hereunder,

the Purchaser has not, nor has any Person acting on behalf of or pursuant to any understanding with the Purchaser, directly or

indirectly executed any purchases or sales, including Short Sales, of the securities of the Company during the period commencing

from the time that the Purchaser was first contacted by the Company regarding the transactions contemplated hereby (“Discussion

Time”). Other than to other Persons party to this Agreement, the Purchaser has maintained the confidentiality of all

disclosures made to it in connection with this transaction (including the existence and terms of this transaction).

(c) Restricted Securities. Purchaser acknowledges and agrees that the shares of Common Stock purchased hereunder are ‘restricted

securities’ within the meaning of Rule 144 promulgated under the provisions of the Securities Act and that the stock certificate

evidencing such shares of Common Stock shall bear a restrictive legend, as customary for such stock certificates.

(d) Investment Purposes. The Purchaser is acquiring the Shares for its own account as principal, not as a nominee or agent,

for investment purposes only, and not with a view to, or for, resale, distribution or fractionalization thereof in whole or in

part and no other person has a direct or indirect beneficial interest in such Shares or any portion thereof.

(e) Investment Experience. The Purchaser is (i) experienced in making investments of the kind described in this Agreement,

(ii) able, by reason of the business and financial experience of its officers (if an entity) and professional advisors (who are

not affiliated with or compensated in any way by the Company or any of its affiliates or selling agents), to protect its own interests

in connection with the transactions described in this Agreement, and (iii) able to afford the entire loss of its investment in

the Shares.

(f) Exemption from Registration. The undersigned acknowledges its understanding that the offering and sale of the Shares

is intended to be exempt from registration under the Securities Act. In furtherance thereof, in addition to the other representations

and warranties of the undersigned made herein, the undersigned further represents and warrants to and agrees with the Company and

its affiliates as follows:

(i)

The undersigned has been provided an opportunity for a reasonable period of time prior to the date hereof to obtain additional

information concerning the offering of the Shares, the Company and all other information to the extent the Company possesses such

information or can acquire it without unreasonable effort or expense.

(ii)

Accredited Investor. The undersigned is an “accredited investor” as that term is defined in Rule 501 of the General

Rules and Regulations under the Securities Act by reason of Rule 501(a)(3).

(g) Receipt of Governmental Approvals.

Purchaser is not aware of any obstacles that will prevent Purchaser from obtaining the Governmental Approvals prior to the Closing.

ARTICLE 4

OTHER AGREEMENTS OF THE PARTIES

4.1

Securities Laws Disclosure; Publicity. The Company shall issue, to the extent it is required to do so under applicable law,

a Current Report on Form 8-K, disclosing the material terms of the transactions contemplated hereby, and including the Transaction

Documents as exhibits thereto. The Company may issue any other press releases with respect to the transactions contemplated hereby,

in its sole discretion. The Purchaser shall consult with the Company in issuing any other press releases with respect to the transactions

contemplated hereby, and the Purchaser shall not issue any such press release nor otherwise make any such public statement without

the prior consent of the Company, which consent shall not unreasonably be withheld or delayed, except if such disclosure is required

by law, in which case the Purchaser shall promptly provide the Company with prior notice of such public statement or communication.

4.2 Governmental Approvals. The Purchaser covenants to act in good faith and use best efforts to obtain the Governmental Approvals

prior to the Closing.

4.3

Reservation of Common Stock. As of the date hereof, the Company has reserved and the Company shall continue to reserve and

keep available at all times, a sufficient number of shares of Common Stock for the purpose of enabling the Company to issue Shares

pursuant to this Agreement.

4.4 Listing of Common Stock. The Company hereby agrees to use best efforts to maintain the listing and quotation of the Common

Stock on a Trading Market, and as soon as reasonably practicable following the Closing (but not later than the Closing Date) to

list or quote all of the Shares on such Trading Market. The Company further agrees, if the Company applies to have the Common Stock

traded on any other Trading Market, it will then include in such application all of the Shares, and will take such other action

as is necessary to cause all of the Shares to be listed or quoted on such other Trading Market as promptly as possible.

4.5

Short Sales and Confidentiality After The Date Hereof. The Purchaser covenants that neither it nor any Affiliate acting

on its behalf or pursuant to any understanding with it will execute any purchase or sale of Common Stock, including Short Sales,

during the period commencing with the Discussion Time and ending at such time the transactions contemplated by this Agreement are

first publicly announced as described in Section 4.1. The Purchaser covenants that until such time as the transactions contemplated

by this Agreement are publicly disclosed by the Company as described in Section 4.1, the Purchaser will maintain the confidentiality

of the existence and terms of these transactions. Notwithstanding the foregoing, the Purchaser makes no representation, warranty

or covenant hereby that it will not engage in Short Sales in the securities of the Company after the time that the transactions

contemplated by this Agreement are first publicly announced as described in Section 4.1. Notwithstanding the foregoing, to the

extent that the Purchaser is a multi-managed investment vehicle whereby separate portfolio managers manage separate portions of

the Purchaser’s assets and the portfolio managers have no direct knowledge of the investment decisions made by the portfolio

managers managing other portions of the Purchaser’s assets, the covenant set forth above shall only apply with respect to

the portion of assets managed by the portfolio manager that made the investment decision to purchase the Shares covered by this

Agreement.

4.6

Delivery of Shares After Closing. The Company shall deliver, or cause to be delivered, the original Stock Certificate to

the Purchaser within three Trading Days of the Closing Date.

4.7

Registration Rights. The Company hereby agrees to register the Shares in the immediate next or any other forth coming registration

statement to be filed by the Company for the resale by shareholders of Company’s shares issued to its shareholders, at the

discretion of the Purchaser. The Company shall notify the Purchaser of any planned filing of any such registration statement no

less then fifteen (15) business days prior to such filing and the Purchase shall reply to the Company within ten (10) business

days after receiving the notice from the Company as to whether the Purchaser wants to have the Shares registered in that particular

forth coming registration statement.

4.8

The Purchaser hereby appoints Mr. Nadav Kidron (“Mr. Kidron”), as proxy and attorney in fact of the Purchaser (the

“Proxy”), with full power of substitution, to cast on behalf of the Purchaser all votes that the Purchaser is entitled

to cast with respect to the Shares at any and all meetings of the shareholders of the Company, to consent or dissent to any action

taken without a meeting and to vote all the Shares held by the Purchaser in any manner Mr. Kidron deems appropriate except for

matters related to the Company’s activities in the People’s Republic of China on which Mr. Kidron shall consult with

the Purchaser before taking any action as the Proxy. This Proxy shall commence on the Closing Date.

4.9

Board Representation. Within two weeks from the Closing Date, the Purchaser shall have the right pursuant to this Agreement

to designate one (1) individual to be nominated to serve as a director on the board of directors of the Company until the first

annual shareholders meeting of the Company following the Closing Date. The individual designated by the Purchaser may then be elected

to continue to serve on the board of directors of the Company in future annual shareholders meetings of the Company in accordance

with the procedures set forth in the Organizational Documents.

ARTICLE 5

MISCELLANEOUS

5.1

Fees and Expenses. Each party shall pay the fees and expenses of its advisers, counsel, accountants and other experts, if

any, and all other expenses incurred by such party incident to the negotiation, preparation, execution, delivery and performance

of this Agreement. The Company shall pay all Transfer Agent fees, stamp taxes and other taxes and duties levied in connection with

the delivery of any Shares to the Purchaser.

5.2

Entire Agreement. The Transaction Documents, together with the exhibits and schedules thereto, contain the entire understanding

of the parties with respect to the subject matter hereof and supersede all prior agreements and understandings, oral or written,

with respect to such matters, which the parties acknowledge have been merged into such documents, exhibits and schedules.

5.3

Notices. Any and all notices or other communications or deliveries required or permitted to be provided hereunder shall

be in writing and shall be deemed given and effective on the earliest of: (a) the date of transmission, if such notice or communication

is delivered via facsimile at the facsimile number set forth on the signature pages attached hereto prior to 5:30 p.m. (New York

City time) on a Trading Day, (b) the next Trading Day after the date of transmission, if such notice or communication is delivered

via facsimile at the facsimile number set forth on the signature pages attached hereto on a day that is not a Trading Day or later

than 5:30 p.m. (New York City time) on any Trading Day, (c) the 2nd Trading Day following the date of mailing, if sent

by U.S. nationally recognized overnight courier service or (d) upon actual receipt by the party to whom such notice is required

to be given. The address for such notices and communications shall be as set forth on the signature pages attached hereto.

5.4

Amendments; Waivers. No provision of this Agreement may be waived or amended except in a written instrument signed by the

Company and the Purchaser. No waiver of any default with respect to any provision, condition or requirement of this Agreement shall

be deemed to be a continuing waiver in the future or a waiver of any subsequent default or a waiver of any other provision, condition

or requirement hereof, nor shall any delay or omission of any party to exercise any right hereunder in any manner impair the exercise

of any such right.

5.5

Headings. The headings herein are for convenience only, do not constitute a part of this Agreement and shall not be deemed

to limit or affect any of the provisions hereof.

5.6

Successors and Assigns. This Agreement shall be binding upon and inure to the benefit of the parties and their successors

and permitted assigns. The Company may not assign this Agreement or any rights or obligations hereunder without the prior written

consent of the Purchaser (other than by merger). The Purchaser may assign any or all of its rights under this Agreement to any

Person to whom the Purchaser assigns or transfers any Shares, provided such transferee agrees in writing to be bound, with respect

to the transferred Shares, by the provisions of the Transaction Documents that apply to the “Purchaser.”

5.7

No Third-Party Beneficiaries. This Agreement is intended for the benefit of the parties hereto and their respective successors

and permitted assigns and is not for the benefit of, nor may any provision hereof be enforced by, any other Person, except as otherwise

set forth in Section 4.2.

5.8

Governing Law. All questions concerning the construction, validity, enforcement and interpretation of the Transaction Documents

shall be governed by and construed and enforced in accordance with the internal laws of the State of New York, without regard to

the principles of conflicts of law thereof. Each party agrees that all legal proceedings concerning the interpretations, enforcement

and defense of the transactions contemplated by this Agreement and any other Transaction Documents (whether brought against a party

hereto or its respective affiliates, directors, officers, shareholders, employees or agents) shall be commenced and be finally

resolved by arbitration administered by the American Arbitration Association under its Commercial Arbitration Rules, and judgment

upon the award rendered by the arbitrators may be entered in any court having jurisdiction. The arbitration will be conducted

in the English language in the city of New York, New York, in accordance with the United States Arbitration Act. There shall be

three arbitrators, named in accordance with such rules. Each party hereby irrevocably waives personal service of process and consents

to process being served in any such arbitration, suit, action or proceeding by mailing a copy thereof via registered or certified

mail or overnight delivery (with evidence of delivery) to such party at the address in effect for notices to it under this Agreement

and agrees that such service shall constitute good and sufficient service of process and notice thereof. Nothing contained herein

shall be deemed to limit in any way any right to serve process in any other manner permitted by law. If either party shall commence

an action or proceeding to enforce any provisions of the Transaction Documents, then the prevailing party in such action or proceeding

shall be reimbursed by the other party for its reasonable attorneys’ fees and other costs and expenses incurred with the

investigation, preparation and prosecution of such action or proceeding.

5.9

Survival. The representations and warranties contained herein shall survive the Closing and the delivery of the Shares for

the applicable statute of limitations.

5.10 Execution.

This Agreement may be executed in two or more counterparts, all of which when taken together shall be considered one and the same

agreement and shall become effective when counterparts have been signed by each party and delivered to the other party, it being

understood that both parties need not sign the same counterpart. In the event that any signature is delivered by facsimile transmission

or by e-mail delivery of a “.pdf” format data file, such signature shall create a valid and binding obligation of the

party executing (or on whose behalf such signature is executed) with the same force and effect as if such facsimile or “.pdf”

signature page were an original thereof. If this Agreement is translated and signed again, in Chinese or another language, then

the English version shall prevail.

5.11 Severability.

If any term, provision, covenant or restriction of this Agreement is held by a court of competent jurisdiction to be invalid, illegal,

void or unenforceable, the remainder of the terms, provisions, covenants and restrictions set forth herein shall remain in full

force and effect and shall in no way be affected, impaired or invalidated, and the parties hereto shall use their commercially

reasonable efforts to find and employ an alternative means to achieve the same or substantially the same result as that contemplated

by such term, provision, covenant or restriction. It is hereby stipulated and declared to be the intention of the parties that

they would have executed the remaining terms, provisions, covenants and restrictions without including any of such that may be

hereafter declared invalid, illegal, void or unenforceable.

5.12 Saturdays,

Sundays, Holidays, etc. If the last or appointed day for the taking of any action or the expiration of any right required or

granted herein shall not be a Business Day, then such action may be taken or such right may be exercised on the next succeeding

Business Day.

5.13 Construction.

The parties agree that each of them and/or their respective counsel has reviewed and had an opportunity to revise the Transaction

Documents and, therefore, the normal rule of construction to the effect that any ambiguities are to be resolved against the drafting

party shall not be employed in the interpretation of the Transaction Documents or any amendments hereto.

5.14 WAIVER

OF JURY TRIAL. IN ANY ACTION, SUIT, OR PROCEEDING IN ANY JURISDICTION BROUGHT BY ANY PARTY AGAINST ANY OTHER PARTY, THE PARTIES

EACH KNOWINGLY AND INTENTIONALLY, TO THE GREATEST EXTENT PERMITTED BY APPLICABLE LAW, HEREBY ABSOLUTELY, UNCONDITIONALLY, IRREVOCABLY

AND EXPRESSLY WAIVES FOREVER TRIAL BY JURY.

(Signature Pages Follow)

IN WITNESS WHEREOF, the parties hereto have caused

this Securities Purchase Agreement to be duly executed by their respective authorized signatories as of the date first indicated

above.

| ORAMED

PHARMACEUTICALS INC. |

Address

of Notice |

| |

Hi-Tech

Park |

| |

|

| |

2/4

Givat Ram, P.O.Box 39098, |

| |

Jerusalem,

Israel |

| By: |

/s/

Nadav Kidron |

|

Fax: +972 73

714 6872 |

| Name: |

Nadav Kidron |

|

|

| Title: |

Chief Executive Officer |

|

|

| |

With

a copy to (which shall not constitute notice): |

|

|

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK

SIGNATURE PAGE FOR PURCHASER FOLLOWS]

IN WITNESS WHEREOF, the undersigned has caused

this Securities Purchase Agreement to be duly executed by its authorized signatory as of the date first indicated above.

Name of Purchaser: Hefei

Tianhui Incubator of Technologies Co., Ltd.

Signature of Authorized Representative of Purchaser:

/s/ Gao Xiao Ming

Name of Authorized Representative: Gao Xiao Ming

Title: Authorized Representative

Email Address of Authorized Representative:

Fax Number of Authorized Representative:

Address for Notice of Purchaser: No. 199 Fanhua Road, Heifei,

Anhui, China

Address for Delivery of Securities for Purchaser (if not same as

address for notice)

ACCEPTED AND AGREED WITH RESPECT TO SECTION

4.8 OF THIS AGREEMENT.

| /s/

Nadav Kidron |

|

| |

|

| Nadav

Kidron |

|

20

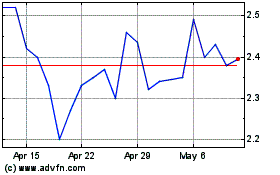

Oramed Pharmaceuticals (NASDAQ:ORMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

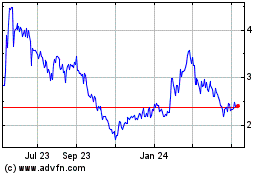

Oramed Pharmaceuticals (NASDAQ:ORMP)

Historical Stock Chart

From Apr 2023 to Apr 2024