UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended: September 30, 2015

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________to _____________

Cellceutix Corporation |

(Exact name of registrant as specified in its charter) |

Commission File Number: 001-37357

Nevada | | 30-0565645 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Empl. Ident. No.) |

100 Cumming Center, Suite 151-B

Beverly, MA 01915

(Address of principal executive offices, Zip Code)

(978)-921-4125

(Registrant's telephone number, including area code)

______________________________________________________________________

(Former Name, Former Address and Former Fiscal Year if Changed Since Last Report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer | ¨ | Accelerated Filer | x |

Non-Accelerated Filer | ¨ | Smaller reporting company | ¨ |

(Do not check if a smaller reporting company) | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The number of shares outstanding of each of the issuer's classes of common equity, as of October 31, 2015 is as follows:

Class of Securities | | Shares Outstanding |

Common Stock Class A, $0.0001 par value | | 118,500,536 |

Common Stock Class B, $0.0001 par value | | None |

CELLCEUTIX CORPORATION

UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2015

PART I – FINANCIAL INFORMATION

Item 1. | Financial Statements (unaudited) | | 4 | |

| | Condensed Consolidated Balance Sheets as of September 30, 2015 (unaudited) and June 30, 2015 (audited) | | | 4 | |

| | Condensed Consolidated Statements of Operations (unaudited) for the three months ended September 30, 2015 and 2014 | | | 5 | |

| | Condensed Consolidated Statements of Cash Flows (unaudited) for the three months ended September 30, 2015 and 2014 | | | 6 | |

| | Notes to Condensed Consolidated Financial Statements (unaudited) | | | 7 | |

Item 2. | Management's Discussion and Analysis of Financial Condition and Results of Operations | | | 15 | |

Item 3. | Quantitative and Qualitative Disclosures About Market Risk | | | 23 | |

Item 4. | Controls and Procedures | | | 23 | |

PART II – OTHER INFORMATION

Item 1. | Legal Proceedings | | | 25 | |

Item 1A | Risk Factors | | | 25 | |

Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | | | 25 | |

Item 3. | Defaults Upon Senior Securities | | | 25 | |

Item 4. | Mine Safety Disclosures | | | 25 | |

Item 5. | Other Information | | | 25 | |

Item 6. | Exhibits | | | 26 | |

| | | | | | |

SIGNATURES | | | 27 | |

FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended. Any statements contained in this report that are not statements of historical fact may be forward-looking statements. When we use the words "intends," "estimates," "predicts," "potential," "continues," "anticipates," "plans," "expects," "believes," "should," "could," "may," "will" or the negative of these terms or other comparable terminology, we are identifying forward-looking statements. These forward-looking statements include, but are not limited to, statements concerning our future drug development plans and projected timelines for the initiation and completion of preclinical and clinical trials; the potential for the results of ongoing preclinical or clinical trials; other statements regarding our future product development and regulatory strategies, including with respect to specific indications; any statements regarding our future financial performance, results of operations or sufficiency of capital resources to fund our operating requirements; and any other statements which are other than statements of historical fact. Forward-looking statements involve risks and uncertainties, which may cause our actual results, performance or achievements to be materially different from those expressed or implied by forward-looking statements. These factors include, but are not limited to, our ability to continue to fund and successfully progress internal research and development efforts and to create effective, commercially-viable drugs; our ability to effectively and timely conduct clinical trials; our ability to ultimately distribute our drug candidates; compliance with regulatory requirements; and our capital needs, as well as other factors described elsewhere in this report and our other reports filed with the Securities and Exchange Commission (the "SEC"). Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements.

Forward-looking statements speak only as of the date on which they are made. Except as may be required by applicable law, we do not undertake or intend to update or revise our forward-looking statements, and we assume no obligation to update any forward-looking statements contained in this report as a result of new information or future events or developments. Thus, you should not assume that our silence over time means that actual events are bearing out as expressed or implied in such forward-looking statements. You should carefully review and consider the various disclosures we make in this report and our other reports filed with the SEC that attempt to advise interested parties of the risks, uncertainties and other factors that may affect our business. Readers are cautioned not to put undue reliance on forward-looking statements.

For further information about these and other risks, uncertainties and factors, please review the disclosure included in our Annual Report on Form 10-K under "Part I, Item 1A, Risk Factors" and in this report under "Part II, Item 1A, Risk Factors."

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

CELLCEUTIX CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(Rounded to nearest thousand except for per share data)

| | | September30 30, | | | June 30, | |

| | | 2015 | | | 2015 | |

| | Unaudited | | | | |

ASSETS |

Current Assets: | | | | | | |

Cash | | $ | 7,774,000 | | | $ | 8,410,000 | |

Prepaid expenses and security deposits | | | 257,000 | | | | 347,000 | |

Subscription receivable | | | 17,000 | | | | 12,000 | |

Total Current Assets | | | 8,048,000 | | | | 8,769,000 | |

| | | | | | | | | |

Other Assets: | | | | | | | | |

Patent costs - net | | | 4,960,000 | | | | 5,018,000 | |

Property, plant and equipment -net | | | 35,000 | | | | 38,000 | |

Deferred offering costs | | | 469,000 | | | | 494,000 | |

Total Other Assets | | | 5,464,000 | | | | 5,550,000 | |

| | | | | | | | | |

Total Assets | | $ | 13,512,000 | | | $ | 14,319,000 | |

| | | | | | | | | |

LIABILITIES AND STOCKHOLDERS' EQUITY |

Current Liabilities: | | | | | | | | |

Accounts payable - (including related party payables of approx. $1,486,000 and $1,686,000, respectively) | | $ | 2,057,000 | | | $ | 1,838,000 | |

Accrued expenses - (including related party accruals of approx. $149,000 and $115,000, respectively) | | | 620,000 | | | | 593,000 | |

Accrued salaries and payroll taxes -(including related party accrued salaries of approx. $2,777,000 and $2,777,000, respectively) | | | 2,778,000 | | | | 2,842,000 | |

Note payable - related party | | | 2,022,000 | | | | 2,022,000 | |

Total Current Liabilities | | | 7,477,000 | | | | 7,295,000 | |

| | | | | | | | | |

Total Liabilities | | | 7,477,000 | | | | 7,295,000 | |

| | | | | | | | | |

Commitments and contingencies (Note 7) | | | | | | | | |

| | | | | | | | | |

Stockholders' Equity | | | | | | | | |

Preferred stock, $0.001 par value, 500,000 designated shares, no shares issued and outstanding | | | - | | | | - | |

Common Stock - Class A, $.0001 par value, 300,000,000 shares authorized, 118,500,536 and 117,763,508 issued and outstanding as of September 30, 2015 and June 30, 2015, respectively | | | 12,000 | | | | 12,000 | |

Common Stock - Class B, (10 votes per share); $.0001 par value, 100,000,000 shares authorized, no shares issued and outstanding as of September 30, 2015 and June 30, 2015, respectively | | | - | | | | - | |

Additional paid-in capital | | | 49,765,000 | | | | 48,177,000 | |

Accumulated deficit | | | (43,742,000 | ) | | | (41,165,000 | ) |

Total Stockholders' Equity | | | 6,035,000 | | | | 7,024,000 | |

| | | | | | | | | |

Total Liabilities and Stockholders' Equity | | $ | 13,512,000 | | | $ | 14,319,000 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

CELLCEUTIX CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

FOR THE THREE MONTHS ENDED SEPTEMBER 30, 2015 AND 2014

(Unaudited)

(Rounded to nearest thousand except for shares and per share data)

| | | 2015 | | | 2014 | |

| | | | | | | |

Revenues | | $ | - | | | $ | - | |

| | | | | | | | | |

Operating expenses: | | | | | | | | |

Research and development expenses | | | 1,831,000 | | | | 3,855,000 | |

General and administrative expenses | | | 339,000 | | | | 229,000 | |

Officers' payroll and payroll tax expenses | | | 130,000 | | | | 130,000 | |

Professional fees | | | 227,000 | | | | 140,000 | |

| | | | | | | | | |

Total operating expenses | | | 2,527,000 | | | | 4,354,000 | |

| | | | | | | | | |

Loss from operations | | | (2,527,000 | ) | | | (4,354,000 | ) |

| | | | | | | | | |

Other expenses | | | | | | | | |

Interest income | | | 1,000 | | | | 1,000 | |

Interest expense | | | (51,000 | ) | | | (51,000 | ) |

Sundry income | | | - | | | | 9,000 | |

| | | | | | | | |

Total other expenses | | | (50,000 | ) | | | (41,000 | ) |

| | | | | | | | | |

Loss before provision for income taxes | | | (2,577,000 | ) | | | (4,395,000 | ) |

Provision for income taxes | | | - | | | | - | |

| | | | | | | | | |

Net loss | | | (2,577,000 | ) | | | (4,395,000 | ) |

| | | | | | | | | |

Deemed dividends | | | - | | | | - | |

Net loss attributable to common stockholders | | $ | (2,577,000 | ) | | $ | (4,395,000 | ) |

| | | | | | | | | |

Basic and diluted loss per share attributable to common stockholders | | $ | (0.02 | ) | | $ | (0.04 | ) |

| | | | | | | | | |

Weighted average number of common shares | | | 118,140,424 | | | | 111,121,912 | |

The accompanying notes are an integral part of these consolidated financial statements.

CELLCEUTIX CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOW

FOR THE THREE MONTHS ENDED SEPTEMBER 30, 2015 AND 2014

(Unaudited)

(Rounded to nearest thousand)

| | | 2015 | | | 2014 | |

| | | | | | | |

CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | | |

Net loss | | $ | (2,577,000 | ) | | $ | (4,395,000 | ) |

Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | | | |

Common stock and stock options issued as payment for services compensation, services rendered and financing costs | | | 98,000 | | | | - | |

Amortization of patent costs | | | 97,000 | | | | 97,000 | |

Depreciation of equipment | | | 3,000 | | | | 2,000 | |

Changes in operating assets and liabilities: | | | | | | | | |

Prepaid expenses and security deposits | | | 90,000 | | | | 436,000 | |

Accounts payable | | | 219,000 | | | | (407,000 | ) |

Accrued expenses | | | 27,000 | | | | 135,000 | |

Accrued officers' salaries and payroll taxes | | | (64,000 | ) | | | - | |

| | | | | | | | | |

Net cash used in operating activities | | | (2,107,000 | ) | | | (4,132,000 | ) |

| | | | | | | | | |

CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | | | | |

Additions to property, plant and equipment | | | - | | | | (9,000 | ) |

Patent costs | | | (39,000 | ) | | | (204,000 | ) |

| | | | | | | | | |

Net cash used in investing activities | | | (39,000 | ) | | | (213,000 | ) |

| | | | | | | | | |

CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | | | | |

Sale of common stock , net of offering costs | | | 1,498,000 | | | | 6,250,000 | |

Exercise of stock options and warrants | | | 12,000 | | | | 200,000 | |

| | | | | | | | | |

Net cash provided by financing activities | | | 1,510,000 | | | | 6,450,000 | |

NET (DECREASE) INCREASE IN CASH AND CASH EQUIVALENTS | | | (636,000 | ) | | | 2,105,000 | |

| | | | | | | | |

CASH AND CASH EQUIVALENTS, BEGINNING OF PERIOD | | | 8,410,000 | | | | 4,988,000 | |

| | | | | | | | |

CASH AND CASH EQUIVALENTS, END OF PERIOD | | $ | 7,774,000 | | | $ | 7,093,000 | |

| | | | | | | | | |

SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION | | | | | | | | |

Cash paid for interest | | $ | 15,000 | | | $ | 259,000 | |

| | | | | | | | | |

SUPPLEMENTAL DISCLOSURE OF NON-CASH FLOW INVESTING AND FINANCING ACTIVITIES | | | | | | | | |

Redeemable common stock | | $ | - | | | $ | (1,400,000 | ) |

The accompanying notes are an integral part of these consolidated financial statements.

CELLCEUTIX CORPORATION

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2015

(Unaudited)

1. Basis of Presentation and Nature of Operations

Unaudited Interim Financial Information

The accompanying unaudited condensed consolidated financial statements of Cellceutix Corporation have been prepared in accordance with the rules and regulations of the Securities and Exchange Commission, or the SEC, including the instructions to Form 10-Q and Regulation S-X. Certain information and note disclosures normally included in financial statements prepared in accordance with generally accepted accounting principles in the United States of America have been condensed or omitted from these statements pursuant to such rules and regulations and, accordingly, they do not include all the information and notes necessary for comprehensive consolidated financial statements and should be read in conjunction with our audited financial statements for the year ended June 30, 2015, included in our Annual Report on Form 10-K for the year ended June 30, 2015.

In the opinion of the management of the Company, all adjustments, which are of a normal recurring nature, necessary for a fair statement of the results for the three month periods have been made. Results for the interim periods presented are not necessarily indicative of the results that might be expected for the entire fiscal year. When used in these notes, the terms "Company", "we", "us" or "our" mean Cellceutix Corporation.

Cellceutix Corporation ("Cellceutix" or the "Company") was incorporated on August 1, 2005, in the State of Nevada. On December 6, 2007, the Company acquired Cellceutix Pharma, Inc., a privately owned corporation formed under the laws of the State of Delaware on June 20, 2007. Following the acquisition, the Company changed its name to Cellceutix Corporation. Cellceutix Corporation dissolved its subsidiary Cellceutix Pharma, Inc. in 2014. The Company is a clinical stage biopharmaceutical company and has no customers, products or revenues to date.

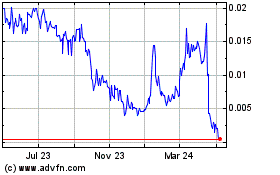

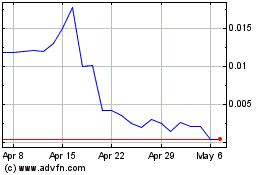

The Company's Common Stock is quoted on the Over the Counter market (OTC), symbol "CTIX". The Company's application to list its common stock on the NASDAQ Capital Market is in process.

All amounts, where it is designated in these notes to the financial statements as an approximate amount, are rounded to the nearest thousand dollars.

Nature of Operations -Overview

We are in the business of developing innovative small molecule therapies to treat diseases with significant medical need, particularly in the areas of cancer, antibiotics and inflammatory disease. Our strategy is to use our business and scientific expertise to maximize the value of our pipeline. We will do this by focusing initially on our lead compounds, Brilacidin, Kevetrin and Prurisol and advancing them as quickly as possible along the regulatory pathway. We will develop the highest quality data and broadest intellectual property to support our compounds.

We currently own all development and marketing rights to our products. In order to successfully develop and market our products, we may have to partner with other companies. Prospective partners may require that we grant them significant development and/or commercialization rights in return for agreeing to share the risk of development and/or commercialization.

2. Liquidity

At September 30, 2015, we had $7,774,000 in cash and cash equivalents. We have expended substantial funds on the research and development of our product candidates. Our net losses incurred for the three months ended September 30, 2015 and 2014, amounted to $2,577,000 and $4,395,000, respectively, and a working capital of approximately $571,000 and $1,474,000, respectively at September 30, 2015 and June 30, 2015.

On March 30, 2015, the Company entered into a common stock purchase agreement with Aspire Capital Fund, LLC, an Illinois limited liability company ("Aspire Capital") which provides that, upon the terms and subject to the conditions and limitations set forth therein, Aspire Capital is committed to purchase up to an aggregate of $30.0 million of the Company's common stock over the 36-month term of the Purchase Agreement. As of September 30, 2015, the available balance is $28.2 million.

The Company plans to incur expenses of approximately $18.5 million over the next twelve months, including approximately $12.0 million for clinical trials. The Company has limited experience with pharmaceutical drug development. As such, the budget estimate may not be accurate. In addition, the actual work to be performed is not known at this time, other than a broad outline, as is normal with any scientific work. As further work is performed, additional work may become necessary or change in plans or workload may occur. Such changes may have an adverse impact on our estimated budget and on our projected timeline of drug development.

Management believes that the amounts available from Aspire and under the Company's effective shelf registration statement will be sufficient to fund the Company's operations for the next 12 months.

If we are unable to generate enough working capital from our current financing agreement with Aspire Capital when needed or secure additional sources of funding, it may be necessary to significantly reduce our current rate of spending through further reductions in staff and delaying, scaling back or stopping certain research and development programs, including more costly Phase 2 and Phase 3 clinical trials on our wholly-owned development programs as these programs progress into later stage development. Insufficient liquidity may also require us to relinquish greater rights to product candidates at an earlier stage of development or on less favorable terms to us and our stockholders than we would otherwise choose in order to obtain up-front license fees needed to fund operations. These events could prevent us from successfully executing our operating plan.

3. Significant Accounting Policies and Recent Accounting Pronouncements

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect certain reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting periods. Significant items subject to such estimates and assumptions include contract research accruals, recoverability of long-lived assets, measurement of stock-based compensation, and the periods of performance under collaborative research and development agreements. The Company bases its estimates on historical experience and various other assumptions that management believes to be reasonable under the circumstances. Changes in estimates are recorded in the period in which they become known. Actual results could differ from those estimates.

Basic Earnings (Loss) per Share

Basic and diluted earnings (loss) per share are computed based on the weighted-average common shares and common share equivalents outstanding during the period. Common share equivalents consist of stock options, warrants and convertible notes payable. Common share equivalents of 44,436,980 and 45,775,332 were excluded from the computation of diluted earnings (loss) per share for the three months ended September 30, 2015 and 2014, respectively, because their effect is anti-dilutive.

Accounting for Stock Based Compensation

The stock-based compensation expense incurred by Cellceutix for employees and directors in connection with its stock option plan is based on the employee model of ASC 718, and the fair market value of the options is measured at the grant date. Under ASC 718 employee is defined as "An individual over whom the grantor of a share-based compensation award exercises or has the right to exercise sufficient control to establish an employer-employee relationship based on common law as illustrated in case law and currently under U.S. tax regulations". Our consultants do not meet the employer-employee relationship as defined by the IRS and therefore are accounted for under ASC 505-50.

ASC 505-50-30-11 (previously EITF 96-18) further provides that an issuer shall measure the fair value of the equity instruments in these transactions using the stock price and other measurement assumptions as of the earlier of the following dates, referred to as the measurement date:

| i. | The date at which a commitment for performance by the counterparty to earn the equity instruments is reached (a performance commitment); and |

| | |

| ii. | The date at which the counterparty's performance is complete. |

We have elected to use the Black-Scholes-Merton pricing model to determine the fair value of stock options on the dates of grant. Restricted stock units are measured based on the fair market values of the underlying stock on the dates of grant. We recognize stock-based compensation using the straight-line method.

The components of stock based compensation related to stock options in the Company's Statement of Operations for the three months ended September 30, 2015 and 2014 are as follows (rounded to nearest thousand):

| | | Three months ended

September 30 | |

| | | 2015 | | | 2014 | |

Research and development expenses | | | | | | |

Professional fees | | $ | 78,000 | | | $ | - | |

Employees' bonus | | | - | | | | - | |

Officers' bonus | | | 20,000 | | | | - | |

| | | | | | | | | |

Total share-based compensation expense | | $ | 98,000 | | | $ | - | |

Recent Accounting Pronouncements

Standards Issued Not Yet Adopted

In August 2014, the FASB issued ASU 2014-15, "Presentation of Financial Statements—Going Concern—Disclosure of Uncertainties about an Entity's Ability to Continue as a Going Concern" ("ASU 2014-15"). The ASU 2014-15 requires management to assess an entity's ability to continue as a going concern, and to provide related footnote disclosures in certain circumstances. ASU 2014-15 is effective for annual periods, and interim periods within those annual periods, starting December 15, 2016; the Company's first quarter of fiscal 2018. Management is currently evaluating the impact of this standard on our consolidated financial statements.

In May 2014, the FASB issued guidance on the accounting for revenue from contracts with customers that will supersede most existing revenue recognition guidance, including industry-specific guidance. The core principle requires an entity to recognize revenue to depict the transfer of goods and services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. In addition, the guidance requires enhanced disclosures regarding the nature, timing and uncertainty of revenue and cash flows arising from an entity's contracts with customers. This guidance is effective for interim and annual reporting periods beginning on or after December 15, 2017. Entities can choose to apply the guidance using either the full retrospective approach or a modified retrospective approach. Management believes that the adoption of this guidance will not have a material impact on our consolidated financial statements.

In June 2014, the FASB issued guidance that clarifies the accounting for share-based payments in which the terms of the award provide that a performance target that affects vesting could be achieved after the requisite service period. In this case, the performance target would be required to be treated as a performance condition, and should not be reflected in estimating the grant-date fair value of the award. The guidance also addresses when to recognize the related compensation cost. This guidance is effective for fiscal years, and interim periods within those years, beginning after December 15, 2015. Management believes that the adoption of this guidance will not have a material impact on our consolidated financial statements.

In June 2014, the FASB issued ASU 2014-12, Compensation - Stock Compensation. The amendments in this ASU apply to reporting entities that grant their employees share-based payments in which the terms of the award provide that a performance target can be achieved after the requisite service period. This ASU is the final version of Proposed ASU EITF-13D--Compensation--Stock Compensation (Topic 718): Accounting for Share-Based Payments When the Terms of an Award Provide That a Performance Target Could Be Achieved after the Requisite Service Period, which has been deleted. The amendments require that a performance target that affects vesting and that could be achieved after the requisite service period be treated as a performance condition. A reporting entity should apply existing guidance in Topic 718 as it relates to awards with performance conditions that affect vesting to account for such awards. As such, the performance target should not be reflected in estimating the grant-date fair value of the award. Compensation cost should be recognized in the period in which it becomes probable that the performance target will be achieved and should represent the compensation cost attributable to the period(s) for which the requisite service has already been rendered. If the performance target becomes probable of being achieved before the end of the requisite service period, the remaining unrecognized compensation cost should be recognized prospectively over the remaining requisite service period. The total amount of compensation cost recognized during and after the requisite service period should reflect the number of awards that are expected to vest and should be adjusted to reflect those awards that ultimately vest. The requisite service period ends when the employee can cease rendering service and still be eligible to vest in the award if the performance target is achieved. As indicated in the definition of vest, the stated vesting period (which includes the period in which the performance target could be achieved) may differ from the requisite service period. The amendments in this ASU are effective for annual periods and interim periods within those annual periods beginning after December 15, 2015, and early adoption is permitted. Management believes that the adoption of this guidance will not have a material impact on our consolidated financial statements.

In June 2015, FASB issued ASU No. 2015-10, Technical Corrections and Updates. ASU No. 2015-10 is intended to correct differences between original guidance and the Codification, clarify the guidance, correct references and make minor improvements affecting a variety of topics. ASU No. 2015-10 covers a wide range of topics in the Codification and is generally categorized as follows: Amendments Related to Differences between Original Guidance and the Codification; Guidance Clarification and Reference Corrections; Simplification; and Minor Improvements. The amendments are effective for fiscal years and interim periods within those fiscal years, beginning after December 15, 2015. Early adoption is permitted. Management believes that the adoption of this guidance will not have a material impact on our consolidated financial statements.

4. Patents, net

Patents, net consisted of the following (rounded to nearest thousand):

| | | Useful life | | | September 30,

2015 | | | June 30,

2015 | |

| | | | | | | | | | |

Purchased Patent Rights – Brilacidin, and related compounds | | 14 | | | $ | 4,082,000 | | | $ | 4,082,000 | |

Purchased Patent Rights – Delparantag and related compounds | | 12 | | | | 480,000 | | | | 480,000 | |

Purchased Patent Rights – Anti-microbial- surfactants and related compounds | | 12 | | | | 144,000 | | | | 144,000 | |

Patents – Kevetrin and related compounds | | 17 | | | | 1,031,000 | | | | 992,000 | |

| | | | | | | | | | | | |

| | | | | | | 5,737,000 | | | | 5,698,000 | |

Less: Accumulated amortization | | | | | | (777,000 | ) | | | (680,000 | ) |

| | | | | | | | | | | | |

| | | | | | $ | 4,960,000 | | | $ | 5,018,000 | |

The patents are amortized on a straight-line basis over the estimated remaining useful lives of the assets, determined 12-17 years from the date of acquisition.

Amortization expense for the three months ended September 30, 2015 and 2014, was approximately $97,000 and $97,000, respectively.

At September 30, 2015, the future amortization period for all patents was approximately 10.18 to 16.01 years. Future estimated annual amortization expenses are approximately $303,000 for 2016, $404,000 for each year from 2017 to 2025, $362,000 for the year 2026, $352,000 for the year 2027, $114,000 for the year 2028, $61,000 for the year 2029 to year 2031 and $8,000 for year 2032.

5. Accrued Expenses

Accrued expenses consisted of the following (rounded to nearest thousand):

| | | September 30, 2015 | | | June 30, 2015 | |

| | | | | | | |

Accrued research and development consulting fees | | $ | 471,000 | | | $ | 478,000 | |

Accrued rent (Note 8) – related parties | | | 40,000 | | | | 42,000 | |

Accrued interest – related parties | | | 109,000 | | | | 73,000 | |

| | | | | | | | | |

Total | | $ | 620,000 | | | $ | 593,000 | |

6. Accrued Salaries and Payroll Taxes – Related Parties And Other

Accrued salaries and payroll taxes consisted of the following (rounded to nearest thousand):

| | | September 30, 2015 | | | June 30, 2015 | |

| | | | | | | |

Accrued salaries – related parties | | $ | 2,647,000 | | | $ | 2,647,000 | |

Accrued payroll taxes – related parties | | | 130,000 | | | | 130,000 | |

Withholding tax | | | 1,000 | | | | 65,000 | |

| | | | | | | | | |

Total | | $ | 2,778,000 | | | $ | 2,842,000 | |

7. Commitments and Contingencies

Lease Commitments

Operating Leases

The Company signed a lease extension agreement with Cummings Properties which began on October 1, 2013. The lease is for a term of five years ending on September 30, 2018, and requires monthly payments of $17,728. Innovative Medical Research Inc., a company owned by Leo Ehrlich and Dr. Krishna Menon, officers of the Company, have co-signed the lease and will sublease 200 square feet of space previously used by the Company and pay the Company $900 per month.

As of September 30, 2015, future minimum lease payments to Cummings Properties required under the non-cancelable operating lease are as follows (rounded to nearest thousand):

Year ending June 30, | | | |

2016 | | $ | 160,000 | |

2017 | | | 213,000 | |

2018 | | | 213,000 | |

2019 | | | 53,000 | |

| | | | | |

Total minimum payments | | $ | 639,000 | |

Rent expense, net of lease income, under this operating lease agreement was approximately $50,000 for the both of three months ended September 30, 2015 and 2014. Before September 1, 2013, the Company paid rent to KARD for share of office space and details are shown at Note 8. Related Party Transactions.

Contractual Commitments

The Company has no contractual minimum commitments to Contract Research Organizations as of September 30, 2015. Services are billed to Cellceutix, when performed by the vendors.

Litigation

A complaint entitled O'Connell v. Cellceutix Corp. et al. (No. 1:15-cv-07194) was filed in September 2015 by a law firm in the United States District Court for the Southern District of New York against the Company and its officers alleging that the defendants made materially false and misleading statements, and omitted materially adverse facts, about the Company's business, operations and prospects. The Company believes that the claims are without merit and intends to vigorously defend itself.

8. Related Party Transactions

Office Lease

Dr. Menon, the Company's principal shareholder, President, and Director, also serves as the Chief Operating Officer and Director of Kard Scientific ("KARD"). On December 7, 2007, the Company began renting office space from KARD, on a month to month basis for $900 per month. This continued through August 2013 and since September 1, 2013, the Company no longer leases space from KARD or pays rent to KARD.

In September 2013, the Company signed a lease extension agreement with Cummings Properties for the company's offices and laboratories at 100 Cummings Center, Suite 151-B Beverly, MA 01915. The lease is for a term of five years from October 1, 2013 to September 30, 2018 and requires monthly payments of approximately $17,000. Cellceutix had taken over the space occupied by KARD. In addition, Innovative Medical Research Inc., ("Innovative Medical") a company owned by Leo Ehrlich and Dr. Krishna Menon, officers of Cellecutix has co-signed the lease and will rent approximately 200 square feet of office space, the space previously used by Cellceutix and will pay Cellceutix $900 per month , the same amount Cellceutix previously paid KARD. Innovative Medical paid total rent of approximately $3,000 to Cellceutix for both of the three months ended September 30, 2015 and 2014 and the rental payment was offset with the accrued rent owed to KARD.

At September 30, 2015 and June 30, 2015, rent payable to KARD of approximately $40,000 and $42,000, respectively, were included in accrued expenses.

Clinical Studies

The Company previously engaged KARD to conduct specified pre-clinical studies. The Company did not have an exclusive arrangement with KARD. The Company no longer uses KARD. During the three months ended September 30, 2015, the Company repaid $200,000 to KARD. At September 30, 2015 and June 30, 2015, the accrued research and development expenses to KARD was approximately $1,486,000 and $1,686,000 and this amount was included in accounts payable.

9. Note Payable – Related Party

During the year ended June 30, 2010, Mr. Ehrlich loaned the Company a total of approximately $973,000. A condition for this note was that the Ehrlich Promissory Note A and Ehrlich Promissory Note B be replaced with a new note, Ehrlich Promissory Note C. The Ehrlich Promissory Note C is an unsecured demand note that bears 9% simple interest per annum and is convertible into the Company's common stock at $0.50 per share. The note requires that the interest rate on the amounts due on Ehrlich Promissory Notes A and B be changed retroactively, beginning October 1, 2009, to 9%. On April 1, 2011, the Company amended the Ehrlich Promissory Note C and agreed to retroactively convert accrued interest of approximately $97,000 through December 31, 2010 into additional principal. During the year ended June 30, 2011, Mr. Ehrlich loaned the Company an additional (approximate) $997,000 which brought the total balance of the demand note to approximately $2,002,000. During the year ended June 30, 2012, Mr. Ehrlich loaned the Company an additional $20,000 which brought the balance of the demand note to approximately $2,022,000.

On May 8, 2012, the Company did not have the ability to repay the Ehrlich Promissory Note C loan and agreed to change the interest rate on the outstanding balance of principal and interest of approximately $2,248,000, as of March 31, 2012, from 9% simple interest to 10% simple interest, and the Company issued 2,000,000 Equity Incentive Options exercisable at $0.51 per share equal to 110% of the closing bid price of $0.46 per share on May 7, 2012. Options are valid for ten (10) years from the date of issuance.

At September 30, 2015 and June 30, 2015, approximately $109,000 and $73,000 was accrued as interest expense on this note.

At September 30, 2015 and June 30, 2015, principal balances of the demand note was approximately $2,022,000.

10. Stock Options and Warrants

Stock Options

The fair value of options granted for the three months ended September 30, 2015 was estimated on the date of grant using the Black Scholes model that uses assumptions noted in the following table. There was no new options granted during the three months ended September 30, 2014.

| | | Three months ended

September 30, | |

| | | 2015 | | | 2014 | |

Expected term (in years) | | | 3 | | | | – | |

Expected stock price volatility | | | 65.76 | % | | | – | |

Risk-free interest rate | | | 1.04 | % | | | – | |

Expected dividend yield | | | – | | | | – | |

On April 5, 2009 the Board of Directors of the Registrant adopted the 2009 Stock Option Plan ("the 2009 Plan"). The 2009 Plan permits the grant of 2,000,000 shares of both Incentive Stock Options ("ISOs"), intended to qualify under section 422 of the Code, and Non-Qualified Stock Options.

Under the 2010 Equity Incentive Plan the total number of shares of common stock reserved and available for issuance under the 2010 Plan shall be 45,000,000 shares. Shares of common stock under the 2010 Plan may consist, in whole or in part, of authorized and unissued shares or treasury shares. The term of each stock option shall be fixed as provided, however, an Incentive Stock Option may be granted only within the ten-year period commencing from the effective date of the 2010 Plan and may only be exercised within ten years of the date of grant (or five years in the case of an Incentive Stock Option granted to an optionee who, at the time of grant, owns common stock possessing more than 10% of the total combined voting power of all classes of voting stock of the Company).

On October 20, 2014 the Board of Directors approved the appointment of Dr. William James Alexander as the Chief Operations Officer of Cellceutix Corporation for the term of one year effective October 27, 2014. Pursuant to his employment agreement, Dr. Alexander received immediately 50,000 shares of the Company's Class A common stock as a sign-on bonus and 50,000 stock options to purchase shares of the Company's Class A common stock at $2.93 per share. The 25,000 stock options vested on July 27, 2015 and its option life of 3 years will expire on July 27, 2018. The remaining 25,000 stock options vested on October 27, 2015. Dr. William James Alexander resigned as the Chief Operations Officer on August 3, 2015 and continued working for the Company as a consultant.

On July 10, 2015, the Company issued 7,028 shares and 50,000 options to a consultant for his one year contract and exercisable for 3 years at $2.49 per share of common stock. The total value of these 50,000 options was approximately $60,000 and we recognized approximately $60,000 of stock based compensation costs and charged to additional paid-in capital as of September 30, 2015. The assumptions we used in the Black Scholes option-pricing model were disclosed as above.

The Company recognized approximately $77,000 and $0 of stock based compensation costs related to stock options awards for the three months ended September 30, 2015 and 2014, respectively.

The following table summarizes all stock option activity under the plans:

| | | Number of

Options | | | Weighted Average

Exercise Price | | | Weighted Average

Remaining Contractual Life (Years) | | | Aggregate Intrinsic Value | |

| | | | | | | | | | | | | |

Outstanding at June 30, 2015 | | | 38,762,500 | | | $ | 0.15 | | | | 5.54 | | | $ | 94,217,650 | |

| | | | | | | | | | | | | | | | | |

Granted | | | 50,000 | | | | 2.49 | | | | | | | | | |

Exercised | | | (30,000 | ) | | $ | 0.58 | | | | | | | | | |

Forfeited/expired | | | (115,000 | ) | | $ | 0.61 | | | | | | | | | |

Outstanding at September 30, 2015 | | | 38,667,500 | | | $ | 0.16 | | | | 5.31 | | | $ | 50,872,350 | |

| | | | | | | | | | | | | | | | | |

Exercisable at September 30, 2015 | | | 38,642,500 | | | $ | 0.15 | | | | 5.31 | | | $ | 50,872,350 | |

Exercise of options

For the three months ended September 30, 2015

During the three months ended September 30, 2015, the Company recorded subscription receivable of $17,400 for the exercise of 30,000 options at a price from $0.49 to $0.64 (See at Note 11 Equity Transactions).

Stock Warrants

For the three months ended September 30, 2015

The following table summarizes stock warrants:

| | | Warrants | | | Weighted Average Exercise Price | | | Weighted Average Remaining Contractual Life (Years) | | | Aggregate

Intrinsic

Value | |

| | | | | | | | | | | | | |

Outstanding at June 30, 2015 | | | 1,507,000 | | | | 1.14 | | | | 0.52 | | | $ | 2,156,310 | |

Extended | | | - | | | | - | | | | - | | | | | |

Granted | | | - | | | | - | | | | - | | | | | |

Exercised | | | - | | | | - | | | | - | | | | | |

Expired | | | - | | | | - | | | | - | | | | | |

| | | | | | | | | | | | | | | | | |

Outstanding at September30, 2015 | | | 1,507,000 | | | | 1.14 | | | | 0.27 | | | $ | 526,110 | |

| | | | | | | | | | | | | | | | | |

Exercisable at September 30, 2015 | | | 1,507,000 | | | | 1.14 | | | | 0.27 | | | $ | 526,110 | |

11. Equity Transactions

(1) Issuance of Common Stock for Cash

$30 million Class A Common Stock Purchase Agreement with Aspire Capital Fund, LLC – ("March 2015 Agreement")

On March 30, 2015, the Company entered into a common stock purchase agreement with Aspire Capital Fund, LLC, an Illinois limited liability company which provides that, upon the terms and subject to the conditions and limitations set forth therein, Aspire Capital is committed to purchase up to an aggregate of $30.0 million of the Company's common stock over the 36-month term of the Purchase Agreement. In consideration for entering into the Purchase Agreement, the Company issued to Aspire Capital 160,000 shares of its Class A Common Stock as a commitment fee. The commitment fee of $499,200 will be amortized as the funding is received. The amortized amount of approximately $30,000 was debited to additional paid-in capital. The unamortized portion is carried on the balance sheet as deferred offering costs and was approximately $469,000 at September 30, 2015.

Concurrently with entering into the Purchase Agreement, the Company also entered into a registration rights agreement with Aspire Capital, in which the Company agreed to file one or more registration statements, as permissible and necessary to register, under the Securities Act of 1933, as amended, the sale of the shares of the Company's common stock that have been and may be issued to Aspire Capital under the Purchase Agreement. The Company has filed with the Securities and Exchange Commission a prospectus supplement, dated March 31, 2015, to the Company's prospectus filed as part of the Company's effective $75,000,000 million shelf registration statement on Form S-3, File No. 333-199725, registering all of the shares of common stock that have been or may be offered and sold to Aspire Capital from time to time.

During the period from March 30, 2015 to September 30, 2015, the Company had completed sales to Aspire totaling 800,000 shares of common stock generating gross proceeds of approximately $1.8 million.

(2) Issuance of Common Stock by Exercise of Common Stock Options

The Board of Directors approved the exercise of 30,000 Common Stock options at a range of $0.49 to $0.64 per share for $17,400 during the three months ended September 30, 2015.

(3) Issuance of Common Stock to Consultants For Services

On July 10, 2015, the Company issued 7,028 Class A common shares to a consultant for service, valued at $17,500 based on the closing bid price as quoted on the OTC on July 10, 2015 at $2.49 per share.

12. Subsequent Events

On November 6, 2015 the Company issued 1 million stock options to a professional services firm. These options were issued with an exercise price of $1.70 and vested immediately, with a three year option term. These options have piggyback registration rights.

ITEM 2. MANAGEMENT'S DISCUSSION AND FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and plan of operations should be read in conjunction with the financial statements and the notes to those statements included in this Form 10-Q. This discussion includes forward-looking statements that involve risk and uncertainties. You should review our important note about forward-looking statements preceding the financial statements. As a result of many factors, such as those set forth under "Risk Factors" in this Form 10-Q and in our Annual Report on Form 10-K, actual results may differ materially from those anticipated in these forward-looking statements.

Management's Plan of Operation

Overview

The Company devotes most of its efforts and resources on its compounds already in clinical trials. These trials are evaluating our drug Kevetrin for the treatment of cancers, Prurisol for the treatment of psoriasis, and Brilacidin for the treatment of skin infections and prevention of oral mucositis complicating chemoradiation treatment for cancer. We anticipate using our expertise to manage and perform what we believe are the most critical aspects of the product development process which include: (i) design and oversight of clinical trials; (ii) development and execution of strategies for the protection and maintenance of intellectual property rights; and (iii) interactions with regulatory authorities domestically and internationally. We expect to concentrate on product development and engage in a limited way in product discovery, avoiding the significant investment of time and financial resources that is generally required for a promising compound to be identified and brought into clinical trials. At this time the Company is focusing its research and development efforts on Kevetrin, Prurisol, Brilacidin, and to a lesser extent on our other anti-bacterial and anti-fungal compounds.

We are a clinical stage company. We have no product sales to date and we will not receive any product revenue until we receive approval from the FDA or equivalent foreign regulatory agencies to begin marketing a pharmaceutical product. Developing pharmaceutical products, however, is a lengthy and very expensive process. Assuming we do not encounter any unforeseen safety or efficacy issues during the course of developing our product candidates, we do not expect to complete the development of a product candidate for several years, if ever.

Below is a list of our wholly-owned proprietary clinical programs and their stage in the drug development process:

| Proprietary Program | | Indication | | Clinical Status |

1. | Kevetrin | | Inhibitor for Solid Tumors | | Phase 1 |

2. | Prurisol | | Psoriasis | | Phase 2 |

3. | Brilacidin | | ABSSSI | | Phase 2 Completed |

4. | Brilacidin - OM | | Oral Mucositis | | Phase 2 |

Active Programs in Clinical Development

Kevetrin

Kevetrin, our anti-cancer compound, is being studied in a Phase 1 trial at Dana-Farber Cancer Institute and Beth Israel Deaconess Medical Center. The clinical trial is evaluating the safety and potential efficacy of Kevetrin in patients with advanced-stage solid tumors of various types. The primary endpoints for the study are safety, determining the maximum tolerated dose, and establishing the dose for future Phase 2 clinical trials.

The study is near completion. Exposure to Kevetrin as measured by plasma concentrations have been achieved which are greater than concentrations shown to induce apoptosis in non-clinical studies. While the trial is primarily to evaluate safety of repeated cycles of Kevetrin, it is encouraging that some patients have had stabilization of tumor status during treatment. Further, Kevetrin appears to be having the expected effects on p53 in a number of the patients treated, as measured by increases in the levels of the downstream protein p21 biomarker.

Enough data has been collected in the Phase 1 study for now advancing Kevetrin to a Phase 2 clinical trial. This data is being used to design the Kevetrin dosing regimen in the planned studies of patients with advanced ovarian carcinoma. An FDA meeting request had been submitted in the last week of October 2015. Subject to FDA guidance and authorization, the Company plans a multi-arm study evaluating Kevetrin as a mono-therapy and as a component of a combination therapy. To date, pharmacokinetic profiles found that the plasma half-life of Kevetrin is relatively short, supporting the projected administration of multiple infusions each week in the next study. The half-lives after the first dose and after the sixth dose do not differ appreciably. Longer durations of Kevetrin infusion have shown prolonged exposure to the drug. Prolonged exposure and high area-under-the-curve (AUC) may be desirable in therapy of solid tumors especially with Kevetrin since activation of cell death signaling requires multiple gene synthesis and the phase or phases of the tumor cell cycle most susceptible to the effect(s) of Kevetrin is not known.

Kevetrin was granted FDA Orphan Drug Designation for the treatment of ovarian cancer.

In August 2015 an application was submitted to the FDA requesting a Rare Disease Designation for Kevetrin for the treatment of pediatric retinoblastoma.

In 2012, we entered into an agreement with Beth Israel Deaconess Medical Center (BIDMC), a teaching hospital of Harvard Medical School, on an innovative research project with Kevetrin. The Medical Center wishes to exploit the nuclear and/or mitochondrial pro-apoptotic function of p53 in melanoma and renal cell carcinoma, two types of cancer that are particularly resistant to therapy. At the conclusion of the Phase 1 study we will engage in discussions with the hospital as to the logistics and costs, net of grants, to move this project forward into Phase 2 studies of renal cell carcinomas.

The University of Bologna in Italy (the "University") and The Italian Cooperative Study Group on Chronic Myeloid Leukemia (ICSG on CML) and Acute Leukemia (GIMEMA Group) after testing Kevetrin in preclinical studies, approached us to test Kevetrin in a clinical trial against Acute Myelogenous Leukemia (AML). The study proposed is a Phase 2 trial evaluating Kevetrin as a single agent or in combination with cytarabine in patients with Acute Myelogenous Leukemia (AML). The protocol was submitted in May 2015 by the principal investigator to the institutional committee. There had been delays in communication due to the summer schedules in Italy. In October 2015, we were advised by the Principal Investigator that there are difficulties with the funding in Italy and asked whether we would be interested in contributing financially to the study. We have requested budgets and timelines to help us with the decision making process as we are interested in engaging in clinical trials for the use of Kevetrin in leukemias.

In June 2013, we signed a Material Transfer Agreement with the University of Texas, MD Anderson Cancer Center. MD Anderson intends to utilize in vivo and in vitro methods to research specific pathways, gene expression, mechanism of action and apoptotic activity of Kevetrin in a range of concentrations and time points in both mutant and wild-type p53 Myeloma and Lymphoma cell lines. The National Cancer Institute estimates that more than 24,000 individuals will be diagnosed with myeloma in the United States in 2014, and more than 11,000 will die from this disease. They also wish to study our other cancer compounds against a broad array of Multiple Myeloma cell lines that are resistant to today's FDA-approved chemotherapies. MD Anderson is covering the expenses of the research, with Cellceutix only supplying the drugs.

Prurisol – Plaque Psoriasis

In August 2015, we commenced a Phase 2 trial of Prurisol, an orally administered small molecule for the treatment of plaque psoriasis. We are developing Prurisol under FDA guidance that a 505(b)(2) drug approval pathway is an acceptable pathway for its development. This offers the benefits of a faster development process. Prurisol was eligible because its active moiety of abacavir is the same as that of the marketed drug ZiagenÒ (abacavir sulfate). A murine xenograft model with human psoriatic tissue has shown robust activity of Prurisol in resolution of all signs of psoriasis without reoccurrence. Given that psoriasis is a chronic condition with limited effective therapies that the National Psoriasis Foundation lists as affecting 125 million people worldwide, we see a tremendous market opportunity for an effective new oral treatment. As previously reported, we expect to complete enrollment by year end 2015.

Brilacidin - Acute Bacterial Skin and Skin Structure Infections (ABSSSI)

The intravenous formulation of our lead antibiotic candidate, Brilacidin, has the potential to treat a variety of infections, including Acute Bacterial Skin and Skin Structure Infections ("ABSSSI"), caused by drug-sensitive or drug-resistant strains of Staphylococcus aureus, including Methicillin-Resistant Staphylococcus aureus (MRSA), and by other Gram-positive bacteria.

The Phase 2b trial entitled "A Randomized, Double-Blind Study Comparing Three Dosing Regimens of Brilacidin to Daptomycin in the Treatment of Acute Bacterial Skin and Skin Structure Infections (ABSSSI)" completed enrollment in August 2014. On October 23, 2014, we announced positive top-line efficacy data from this Phase 2b ABSSSI trial, and on January 5, 2015, we reported the corresponding 95% confidence intervals. In April 2015, safety and efficacy results from this 215-patient study of brilacidin in patients with ABSSSI, were presented at the 25th European Congress of Clinical Microbiology and Infectious Diseases (ECCMID). In addition, population pharmacokinetic data from this study were presented in a poster at the Interscience Conference on Antimicrobial Agents and Chemotherapy (ICAAC) in San Diego in September 2015.

In July 2015, at an End-of-Phase 2 Meeting, Cellceutix and FDA discussed data supporting advancement of brilacidin into Phase 3, as well as the basic elements of a Phase 3 program in ABSSSI. This is the first Host Defense Protein (HDP) mimic to advance through Phase 2. Because HDP mimics, such as brilacidin, represent an entirely new class of antibiotics, there is no potential cross-resistance with currently marketed antibiotics, and due to its unique mechanism of action, resistance to brilacidin is unlikely to develop. For this and other reasons, such as its high activity against methicillin-resistant Staphylococcus aureus (a leading cause of ABSSSI) brilacidin received designation as a Qualified Infectious Disease Product (QIDP) in November 2014. The QIDP designation was established as part of the Generating Antibiotic Incentives Now (GAIN) Act, passed by the U.S. Congress in July 2012, for the purpose of encouraging pharmaceutical companies to develop new antimicrobial drugs to treat serious and life-threatening infections. Receiving QIDP designation means that Brilacidin is now eligible for additional FDA incentives in the approval and marketing path, including Fast Track designation and Priority Review for development and a five-year extension of market exclusivity.

The Phase 3 ABSSSI program would include two Phase 3 ABSSSI studies, as required by FDA Guidance (October 2013), of approximately 700 subjects in each study. The two studies may enroll subjects simultaneously. In addition, the first study would include an interim analysis after a portion of the patients has been enrolled. This would provide an early assessment of both safety and efficacy.

The Company is now engaged in activities necessary for beginning the Phase 3 study. In September 2015, Cellceutix submitted its initial Pediatric Study Plan (PSP) to the Food and Drug Administration (FDA) for the use of Brilacidin IV in the treatment of ABSSSI in children. Cellceutix agreed to submit the PSP during its end-of-phase 2 meeting with FDA in mid-July. The submission of the PSP is the first of many requirements in expanding the use of brilacidin to children.

Brilacidin for Oral Mucositis (OM)

In animal models of oral mucositis induced by chemoradiation, topically applied Brilacidin was shown to significantly reduce the occurrence of severe ulcerative oral mucositis by more than 90% compared to placebo. Brilacidin and related compounds have shown antibacterial, anti-biofilm and anti-inflammatory properties in various pre-clinical studies. We believe that the combination of these attributes contributed to the efficacy of Brilacidin in these animal studies.

The Company is engaged in a clinical trial titled a "Phase 2, Multi-center, Randomized, Double-blind, Placebo-controlled Study to Evaluate the Efficacy and Safety of Brilacidin Oral Rinse Administered Daily for 7 Weeks in Attenuating Oral Mucositis in Patients with Head and Neck Cancer Receiving Concurrent Chemotherapy and Radiotherapy". Recruitment is ongoing and the Company is continually looking to add additional study sites to quicken the completion of the trial.

OM represents a great area of unmet medical need and is potentially a very important and valuable asset in the Brilacidin development pathway.

Brilacidin -- Ulcerative Proctitis / Colitis and Hidradenitis Suppurativa

We have also identified inflammatory gastrointestinal disease (ulcerative proctitis) and inflammatory skin disease (hidradenitis suppurativa) as indications for treatment with Brilacidin or our other HDP mimics. The Company is preparing to advance these programs upon review of preliminary results in the oral mucositis trial.

Brilacidin for Topical Applications and Otic Infections and Related Formulation Work

Cellceutix is formulating and conducting preclinical experiments on topical Brilacidin for use in topical skin applications such as diabetic foot ulcer infections, and for ear-related infections, such as otitis externa or draining otitis media. On July 14, 2014, the Company announced that a significant breakthrough had been made in the formulation of Brilacidin. Previously, Brilacidin was stored in a refrigerated state. The Company has now developed the formulation of Brilacidin to be stable at room temperature. However, further formulation work is still needed for each indication. Upon developing optimal formulations, the Company plans to advance these drugs into the clinic. The Company believes this work, though challenging, is very important.

Advancing the Platform and Developing Compounds with Activity Against Gram-Negative Bacteria and Fungi

Also in our antibiotic/antifungal portfolio, we are actively testing several of our compounds both in house and through research grants at major universities. In the Gram-negative program, our lead compounds are active in laboratory testing against some of the most problematic pathogens, such as Pseudomonas, Klebsiella, E. coli and Acinetobacter. We have compounds active against drug-susceptible strains as well as multi-drug resistant strains that produce Klebsiella pneumoniae carbapenamase (KPC). These are also called carbapenem-resistant Enterobacteriaceae (CRE). CRE has been identified by the Centers for Disease Control (CDC) as an "urgent threat" to public health. Importantly, several of our compounds have been shown to be active against CRE in the laboratory. These results were reported in an oral presentation at the European Society of Clinical Microbiology and Infectious Diseases (ECCMID) in Copenhagen in May 2015.

In our anti-fungal program, we have identified a series of HDP mimics that are highly active against Candida species and exhibit very low cytotoxicity against mammalian cell types. Last year, we announced our collaboration with Fox Chase Chemical Diversity Center, which led to the award of a $1.5 million Phase 2B Small Business Innovation Research (SBIR) Grant. Laboratory experiments have shown that, like the antibacterial HDP mimics, the potential for resistance development by Candida is very low. Early studies have delivered promising results in mouse models of Candida in both topical and systemic applications. Additional studies of our HDP mimics suggest possible new treatments for other fungal pathogens, including Aspergillus strains.

Other

In addition to their antimicrobial activity, we are evaluating the use of current and future host defense protein (HDP) mimics for disorders of barrier function, where the innate immune system plays a vital role. For these disorders, the goal is to exploit the anti-inflammatory and anti-biofilm properties to restore and maintain healthy skin and mucous membranes, and to treat refractory biofilm-related infections on natural and artificial surfaces. This would include inflammatory or trauma-related conditions of the skin, eyes, GI tract, and respiratory mucosa; exacerbations of chronic bronchitis and cystic fibrosis; and infections of catheters, valves, and prosthetic joints.

Polymedix Asset Acquisition

On September 4, 2013, the Company purchased substantially all of the assets of Polymedix Inc, and Polymedix Pharmaceuticals, Inc. from the U.S. Bankruptcy Court. PolyMedix Inc. was founded in 2002 based on technology licensed from the University of Pennsylvania (Penn). The purchased bankruptcy estate included two license agreements from Penn, an exclusive patent license agreement and a nonexclusive software license agreement. The list of material intellectual property, patents, and licenses acquired and their expiration dates was disclosed at "Part I, Item 1. Intellectual Property, Patents and Licenses Acquired" of our Annual Report for the year ended June 30, 2014.

Critical Accounting Policies and Estimates

Management's discussion and analysis of financial condition and results of operations are based upon our accompanying financial statements, which have been prepared in conformity with U.S. generally accepted accounting principles, or U.S. GAAP, and which requires us to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue and expenses, and related disclosure of contingent assets and liabilities. We base our estimates on historical experience and on various other assumptions that we believe are reasonable under the circumstances. These estimates are the basis for our judgments about the carrying values of assets and liabilities, which in turn may impact our reported revenue and expenses. Our actual results could differ significantly from these estimates under different assumptions or conditions.

Please see Note 3 of Part I, Item 1 of this Quarterly Report on Form 10-Q for the summary of significant accounting policies. In addition, please see Part I, Item 7, "Critical Accounting Policies and Estimates" in our Annual Report on Form 10-K for the year ended June 30, 2015. There have been no material changes to our critical accounting policies and estimates since our Annual Report on Form 10-K for the year ended June 30, 2015.

Recently Issued Accounting Pronouncements

See Note 3 to the Consolidated Financial Statements, Significant Accounting Policies and Recent Accounting Pronouncements, in the accompanying Notes to Consolidated Financial Statements for a discussion of recent accounting pronouncements and their effect, if any, on our consolidated financial statements.

Results of Operations

We expect to incur losses from operations for the next few years. We expect to incur increasing research and development expenses, including expenses related to additional clinical trials for our Proprietary Programs. We expect that our general and administrative expenses will also increase in the future as we expand our business development, by adding employees, consultants, additional infrastructure and incurring other additional costs. Based upon our expected rate of expenditures over the next 12 months, we currently expect to have sufficient cash reserves and financing available to us to meet all of our anticipated obligations through our fiscal year end of June 30, 2016.

Revenue

We generated no revenue and incurred operating expenses of $2.53 million and $4.35 million for the three months ended September 30, 2015 and 2014, respectively.

Research and Development Expenses for Proprietary Programs

Below is a summary of our research and development expenses for our proprietary programs by categories of costs for the three months ended September 30, 2015 and 2014, respectively (rounded to nearest thousand):

| | | For the three months ended | | | | | | | |

| | | September 30, | | | | | | | |

| | | 2015 | | | 2014 | | | 2015 vs. 2014 | |

| | | | | | | | | $ | | | % | |

Clinical studies and development research | | $ | 1,222,000 | | | $ | 3,533,000 | | | | (2,311,000 | ) | | (65 | %) |

Stock-based compensation | | | 98,000 | | | | - | | | | 98,000 | | | | - | |

R&D- Officers' payroll and payroll tax expenses | | | 106,000 | | | | 106,000 | | | | - | | | | - | |

R&D staff- Other wages, payroll tax expenses and share-based compensation | | | 305,000 | | | | 116,000 | | | | 189,000 | | | | 163 | % |

Depreciation and amortization Expenses | | | 100,000 | | | | 100,000 | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | |

Total | | $ | 1,831,000 | | | $ | 3,855,000 | | | | (2,024,000 | ) | | (53 | %) |

Research and development expenses for proprietary programs decreased during the three months ended September 30, 2015 primarily due to lower spending on our ABSSSI program which trial was completed in early 2015. The increase in employees payroll is primarily due to increases in wages and numbers of employees in our research and development department.

Our research and development expenses include costs related to preclinical and clinical trials, outsourced services and consulting, officers' payroll and related payroll tax expenses, other wages and related payroll tax expenses, share-based compensation, depreciation and amortization expenses. We manage our proprietary programs based on scientific data and achievement of research plan goals. Our scientists record their time to specific projects when possible; however, many activities occurring simultaneously benefit multiple projects and cannot be readily attributed to a specific project. Accordingly, the accurate assignment of time and costs to a specific project is difficult and may not give a true indication of the actual costs of a particular project. As a result, we do not report costs on an individual program basis.

General and Administrative Expenses

General and administrative expenses consist mainly of compensation and associated fringe benefits not included in cost of research and development expenses for proprietary programs and include other management, business development, accounting, information technology and administration costs, including patent filing and prosecution, recruiting, consulting and professional services, travel and meals, facilities, depreciation and other office expenses.

Below is a summary of our general and administrative expenses for the three months ended September 30, 2015 and 2014, respectively (rounded to nearest thousand):

| | | Three months ended | | | | | | | |

| | | September 30, | | | | | | | |

| | | 2015 | | | 2014 | | | 2015 vs. 2014 | |

| | | | | | | | | $ | | | % | |

Insurance and health expense | | $ | 122,000 | | | $ | 34,000 | | | | 88,000 | | | | 259 | % |

Patent expenses | | | 13,000 | | | | 18,000 | | | | (5,000 | ) | | (28 | %) |

Rent and utility expense | | | 68,000 | | | | 62,000 | | | | 6,000 | | | | 10 | % |

Other G&A | | | 136,000 | | | | 115,000 | | | | 21,000 | | | | 18 | % |

Total | | $ | 339,000 | | | $ | 229,000 | | | | 110,000 | | | | 48 | % |

General and administrative expenses increased during the three months ended September 30 2015 primarily related to increases in insurance and health expenses, rental expenses and travel expenses for meetings for our clinical trials and to the FDA, to further develop our compounds.

Officers' payroll and payroll tax expenses

Below is a summary of our Officers' payroll and payroll tax expenses for the three months ended September 30, 2015 and 2014, respectively (rounded to nearest thousand):

| | | Three months ended | | | | | | | |

| | | September 30, | | | | | | | |

| | | 2015 | | | 2014 | | | 2015 vs. 2014 | |

| | | | | | | | | $ | | | % | |

Officers' payroll and payroll tax expenses | | $ | 130,000 | | | $ | 130,000 | | | | - | | | | - | |

There was no change in Officers' payroll and payroll tax expenses for the Company during the three months ended September 30, 2015 and 2014.

Professional fees

Below is a summary of our Professional fees for the three months ended September 30, 2015 and 2014, respectively (rounded to nearest thousand):

| | | Three months ended | | | | | | | |

| | | September 30, | | | | | | | |

| | | 2015 | | | 2014 | | | 2015 vs. 2014 | |

| | | | | | | | | $ | | | % | |

Audit Fee, legal and professional fees | | $ | 227,000 | | | $ | 140,000 | | | | 87,000 | | | | 62 | |

Professional fees increased during the three months ended September 30, 2015 primarily related to increase in legal fees and other consulting services related to S-3 filings, tax and Sarbanes Oxley consulting services.

Other Income (Expense)

Below is a summary of our other income (expense) for the three months ended September 30, 2015 and 2014, respectively (rounded to nearest thousand):

| | | Three months ended | | | | | | | |

| | | September 30, | | | | | | | |

| | | 2015 | | | 2014 | | | 2015 vs. 2014 | |

| | | | | | | | | $ | | | % | |

Interest Income | | $ | 1,000 | | | $ | - | | | | 1,000 | | | | - | |

Sundry Income | | | - | | | | 9,000 | | | | (9,000 | ) | | (100 | %) |

Interest Expenses | | | (51,000 | ) | | | (51,000 | ) | | | - | | | | - | |

Other Income (Expense), net | | $ | (50,000 | ) | | $ | (42,000 | ) | | | 8,000 | | | | 19 | % |

Other expense, net increased slightly during the three months ended September 30, 2015 primarily related to the decrease in sundry income of $9,000. There was no change in interest expenses paid to the note payable – related party (see Note 9).

Net Losses

We incurred net losses of $2.58 million and $4.40 million for the three months ended September 30, 2015 and 2014, respectively because of above factors.

Liquidity and Capital Resources

Projected Future Working Capital Requirements – Next 12 Months

As of September 30, 2015, we had approximately $7.77 million in cash and cash equivalents and $28.20 million remaining available for stock sales under the terms of the purchase agreement with Aspire Capital, compared to $8.4 million of cash and cash equivalents as of June 30, 2015. We anticipate that future cash expenditures will be approximately $18.5 million over the next 12 months.

Management believes that our cash, cash equivalents and present financing arrangement with Aspire Capital as of September 30, 2015 will enable us to continue to fund operations in the normal course of business for at least the next 12 months. This assessment is based on current estimates and assumptions regarding our clinical development program and business needs. Actual results could differ materially from this projection. Also, we may plan to raise additional funds through the sales of debt and/or equity securities as needed.

Our ability to successfully raise sufficient funds through the sale of equity securities, when needed, is subject to many risks and uncertainties and even if we are successful, future equity issuances would result in dilution to our existing stockholders. Our risk factors are described under the heading "Risk Factors" in Part II, Item 1A and elsewhere of this Form 10-Q and in Part I Item 1A and elsewhere in our Annual Report on Form 10-K and in other reports we file with the SEC.

If we are unable to generate enough working capital from our current financing agreement with Aspire Capital when needed or secure additional sources of funding, it may be necessary to significantly reduce our current rate of spending through further reductions in staff and delaying, scaling back or stopping certain research and development programs, including more costly Phase 2 and Phase 3 clinical trials on our wholly-owned development programs as these programs progress into later stage development. Insufficient liquidity may also require us to relinquish greater rights to product candidates at an earlier stage of development or on less favorable terms to us and our stockholders than we would otherwise choose in order to obtain up-front license fees needed to fund operations. These events could prevent us from successfully executing our operating plan.

Aspire Capital Agreement and Other Equity Issuances

On March 30, 2015, the Company entered into a common stock purchase agreement ('March 30, 2015 Purchase Agreement") with Aspire Capital Fund, LLC, ("Aspire" or "Aspire Capital") an Illinois limited liability company, which provides that, upon the terms and subject to the conditions and limitations set forth therein, Aspire Capital is committed to purchase up to an aggregate of $30.0 million of the Company's common stock over the 36-month term of the purchase agreement. In consideration for entering into the purchase agreement, the Company issued to Aspire Capital 160,000 shares of its Class A Common Stock as a commitment fee.

From March 30, 2015 to September 30, 2015, the Company generated proceeds of approximately $1.8 million under the March 30, 2015 Purchase Agreement with Aspire from the sale 800,000 shares of its common stock. The Company has approximately $28.20 million remaining available for sale under the terms of the purchase agreement.

$75 Million Shelf Registration Statement

The Company has an effective shelf registration statement on Form S-3, registering the sale of up to $75 million of the Company's securities. The Company filed with the Securities and Exchange Commission a prospectus supplement, dated March 31, 2015, registering up to $30 million of our common stock that have been or may be offered and sold to Aspire Capital from time to time, leaving $45 million available under the Company's effective shelf registration statement.

Cash Flows

The following table provides information regarding our cash position, cash flows and capital expenditures for the three months ended September 30, 2015 and 2014 (rounded to nearest thousand):

| | | Three Months Ended

September 30, | | | % Change Increase/ | |

| | | 2015 | | | 2014 | | | (decrease) | |

| | | | | | | | | | |

Net cash used in operating activities | | $ | (2,107,000 | ) | | $ | (4,132,000 | ) | | | (2,025,000 | ) |

Net cash used in investing activities | | | (39,000 | ) | | | (213,000 | ) | | | (174,000 | ) |

Net cash provided by financing activities | | | 1,510,000 | | | | 6,450,000 | | | | 4,940,0000 | |

Net (decrease) increase in cash and cash equivalents | | $ | (636,000 | ) | | $ | 2,105,000 | | | | 2,741,000 | |

Operating activities

The decrease in net cash used in operating activities of $2.03 million versus the prior-year three-month period was mainly due to decrease in our losses from operations of $1.82 million.

Our operating activities used cash of $2.11 million and $4.13 million for the three months ended September 30, 2015 and 2014, respectively. The use of cash in these periods principally resulted from our losses from operations, as adjusted for non-cash charges for stock-based compensation and depreciation, and changes in our working capital accounts.

Investing activities

The decrease in net cash used in investing activities of $0.17 million versus the prior-year three-month period was due to a decrease in acquiring patents of $0.17 million.