Lilly to Halt Development of Experimental Cholesterol Drug -- 2nd Update

October 12 2015 - 12:53PM

Dow Jones News

By Peter Loftus and Tess Stynes

Eli Lilly & Co. said it is ending development of its

experimental cholesterol-modifying drug for cardiovascular disease

because the treatment wasn't effective enough in a clinical

trial--the latest setback for a type of drug that was seen as a

high-risk investment.

Some analysts had predicted the drug, evacetrapib, could become

a blockbuster if it reached the market. The Indianapolis drug

maker's shares fell 8.1% to $79.13 in early trading Monday.

The setback makes it more challenging for Lilly to recover from

a series of patent expirations for older blockbuster drugs that

have hurt the company's sales and profits in recent years. Lilly

has had some success bringing newer drugs to market and continues

to develop other experimental drugs with solid sales potential, but

the absence of evacetrapib dims the company's growth outlook.

It's also the latest setback for a class of drugs known as

inhibitors of cholesteryl ester transfer protein, or CETP. The

pills were designed to raise levels of good cholesterol and to

lower levels of bad cholesterol, with the aim of reducing the risk

of heart attacks and strokes beyond what could be accomplished by a

widely used class of older drugs known as statins.

But so far, the CETP inhibitors haven't panned out in clinical

trials. In 2006, Pfizer Inc. halted a large study of its entry in

the class, torcetrapib, because the drug increased risk of heart

problems. Pfizer later scrapped the project. In 2012, Roche Holding

AG terminated development of its CETP inhibitor because of

insufficient efficacy in studies.

Lilly and Merck & Co. continued to develop their CETP

inhibitors, in hopes their drugs would sidestep the safety and

efficacy problems with Pfizer's and Roche's drugs.

Lilly's study, which began in 2012, had enrolled more than

12,000 patients with high-risk cardiovascular disease, at test

sites in 37 countries. Some were given the Lilly drug daily while

others were given a placebo for up to four years. All patients also

received older treatments for cardiovascular disease. The trial was

due to end in July 2016.

The study tracked whether evacetrapib reduced the risk of

cardiovascular death, heart attack, stroke, coronary surgery or

hospitalization for unstable angina among patients, versus a

placebo.

Lilly said Monday an independent committee monitoring the study

recommended that it be halted based on data indicating a low

probability that the therapy would meet its primary goals in the

study.

Evercore analyst Mark Schoenebaum said in a note on Monday,

"Bottom line: today's news is a negative for [Lilly]."

Without evacetrapib, Evercore estimates a negative impact of

about $5 a share on Lilly's valuation, reducing the firm's estimate

on the stock to about $80 a share from $85, and a negative impact

on its view for 2020 per-share earnings of 50 cents a share,

bringing its 2020 guidance to $6.28 a share.

"We're obviously disappointed in this outcome, as we hoped that

evacetrapib would offer an advance in treatment for people with

high-risk cardiovascular disease," said David Ricks, Lilly senior

vice president and president of Lilly Bio-Medicines. "We remain

confident in our pipeline as we prepare for launches in other

therapeutic areas with significant unmet needs."

The drug maker expects to record a fourth-quarter pretax charge

of as much as $90 million. The company plans to incorporate the

charge into its updated 2015 outlook when it releases its

third-quarter results on Oct. 22.

In February, Lilly said it would extend a phase III trial of

evacetrapib by six months to provide a better view of whether the

treatment in combination with statins is more effective than

statins alone in treating such cases.

A Merck spokeswoman said a 30,000-patient trial of its CETP

inhibitor, anacetrapib, continues, and that results are expected in

2017. "We need to see the data to better understand Lilly's

decision to discontinue its CETP program," she said. "Merck

continues to believe that anacetrapib has the potential to be an

important treatment in the management of atherosclerosis."

Merck shares declined 1.1% to $50.37 in recent trading.

Write to Peter Loftus at peter.loftus@wsj.com and Tess Stynes at

tess.stynes@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 12, 2015 12:38 ET (16:38 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

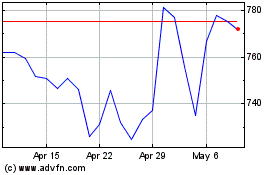

Eli Lilly (NYSE:LLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Eli Lilly (NYSE:LLY)

Historical Stock Chart

From Apr 2023 to Apr 2024