UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the Securities

Exchange

Act of 1934 (Amendment No. __)

| Filed

by Registrant |

[X] |

|

| |

|

|

| Filed by Party

other than Registrant |

[ ] |

|

| |

|

|

| Check the appropriate

box: |

|

|

| [ ] |

Preliminary

Proxy Statement |

[ ] |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

|

|

| [X] |

Definitive Proxy

Statement |

[ ] |

Definitive Additional

Materials |

| |

|

|

|

| [ ] |

Soliciting Materials

Pursuant to §240.14a-12 |

|

|

VAPOR

CORP.

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

| [X] |

No

fee required. |

| |

|

| [ ] |

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

(1) |

Title

of each class of securities to which transaction applies: |

| |

|

|

| |

(2) |

Aggregate

number of securities to which transaction applies: |

| |

|

|

| |

(3) |

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which

the filing fee is calculated and state how it was determined): |

| |

|

|

| |

|

$_____

per share as determined under Rule 0-11 under the Exchange Act. |

| |

|

|

| |

(4) |

Proposed

maximum aggregate value of transaction: |

| |

|

|

| |

(5) |

Total

fee paid: |

| [ ] |

Fee

paid previously with preliminary materials. |

| |

|

| [ ] |

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date

of its filing. |

| |

(1) |

Amount

previously paid: |

| |

|

|

| |

(2) |

Form, Schedule

or Registration Statement No.: |

| |

|

|

| |

(3) |

Filing Party: |

| |

|

|

| |

(4) |

Date Filed: |

TABLE

OF CONTENTS

Vapor

Corp.

3001

Griffin Road

Dania

Beach, Florida 33312

(888)

482-7671

To

The Shareholders of Vapor Corp.:

We

are pleased to invite you to attend a Special Meeting of the shareholders of Vapor Corp., which will be held at 1:00 PM on Friday,

October 16, 2015 at our corporate headquarters in Dania, Florida, at the above address, for the following purposes:

| |

1. |

To

approve an amendment to our Certificate of Incorporation to increase our authorized shares of common stock; |

| |

|

|

| |

2. |

To

approve an amendment to our Certificate of Incorporation to increase our authorized shares of preferred stock; |

| |

|

|

| |

3. |

To

approve the issuance of certain shares of common stock in compliance with the requirements of the Nasdaq Capital Market; |

| |

|

|

| |

4. |

To

approve an amendment to the exercise price of certain previously issued warrants in compliance with the requirements of the

Nasdaq Capital Market; and |

| |

|

|

| |

5. |

To

approve an amendment to the conversion price of certain previously issued convertible notes in compliance with the requirements

of the Nasdaq Capital Market. |

Vapor’s

Board of Directors has fixed the close of business on August 18, 2015 as the record date for a determination of shareholders entitled

to notice of, and to vote at, this Special Meeting or any adjournment thereof.

Important

Notice Regarding the Availability of Proxy Materials for the Special Meeting of Shareholders to Be Held on Friday, October

16, 2015: We are mailing to many of our shareholders a Notice of Internet Availability of Proxy Materials (which we refer

to as a “Notice”), rather than mailing a full paper set of the materials. The Notice contains instructions on how

to access our proxy materials on the Internet, as well as instructions on obtaining a paper copy of the proxy materials. This

process is more environmentally friendly and reduces our costs to print and distribute these materials. All shareholders who do

not receive such a Notice, including shareholders who have previously requested to receive a paper copy of the materials, will

receive a full set of paper proxy materials by U.S. mail. An electronic version of the Proxy Statement are available at: https://www.proxyvote.com

If

You Plan to Attend

Please

note that space limitations make it necessary to limit attendance to shareholders. Registration and seating will begin at 12:30

PM. Shares can be voted at the meeting only if the holder is present in person or by valid proxy.

For

admission to the meeting, each shareholder may be asked to present valid picture identification, such as a driver’s license

or passport, and proof of stock ownership as of the record date, such as the enclosed proxy card or a brokerage statement reflecting

stock ownership. Cameras, recording devices and other electronic devices will not be permitted at the meeting.

If

you do not plan on attending the meeting, please vote your shares via the Internet, by phone or by signing and dating the enclosed

proxy and return it in the business envelope provided. Your vote is very important.

| |

By

the Order of the Board of Directors: |

| |

|

| |

/s/

Jeffrey Holman |

| |

Jeffrey Holman

|

| |

Chairman of the

Board and Chief Executive Officer |

Dated:

August 25, 2015

Whether

or not you expect to attend in person, we urge you to vote your shares at your earliest convenience. This will ensure the presence

of a quorum at the meeting. Promptly voting your shares via the Internet, by phone or by signing, dating, and returning the enclosed

proxy card will save us the expenses and extra work of additional solicitation. An addressed envelope for which no postage is

required if mailed in the United States is enclosed if you wish to vote by mail. Submitting your proxy now will not prevent you

from voting your shares at the meeting if you desire to do so, as your proxy is revocable at your option. Your vote is important,

so please act today!

Vapor

Corp.

3001

Griffin Road

Dania

Beach, Florida 33312

(888)

482-7671

2015

SPECIAL MEETING OF SHAREHOLDERS

PROXY

STATEMENT

Why

am I receiving these materials?

These

proxy materials are being sent to the holders of shares of the voting stock of Vapor Corp., a Delaware corporation, which we refer

to as “Vapor” or the “Company,” in connection with the solicitation of proxies by our Board of Directors,

which we refer to as the “Board,” for use at the Special Meeting of Shareholders to be held at 1:00 PM on Friday,

October 16, 2015 at our corporate headquarters at the above address in Dania, Florida. The proxy materials relating to the Special

Meeting are first being mailed to shareholders entitled to vote at the meeting on or about August 25, 2015.

Why

did I receive a notice in the mail regarding the Internet availability of the proxy materials instead of a paper copy of the full

set of proxy materials?

We

are pleased to be using the SEC rule that allows companies to furnish their proxy materials over the Internet. As a result, we

are mailing to many of our shareholders a notice of the Internet availability of the proxy materials instead of a paper copy of

the proxy materials. All shareholders receiving the notice will have the ability to access the proxy materials over the Internet

and request to receive a paper copy of the proxy materials by mail. Instructions on how to access the proxy materials over the

Internet or to request a paper copy may be found in the notice of the Internet availability of the proxy materials. In addition,

the notice contains instructions on how you may request to access proxy materials in printed form by mail or electronically on

an ongoing basis.

Why

didn’t I receive a notice in the mail about the Internet availability of the proxy materials?

We

are providing some of our shareholders, including shareholders who have previously requested to receive paper copies of the proxy

materials, with paper copies of the proxy materials instead of a notice of the Internet availability of the proxy materials.

In

addition, we are providing notice of the Internet availability of the proxy materials by e-mail to those shareholders who have

previously elected delivery of the proxy materials electronically. Those shareholders should have received an e-mail containing

a link to the website where those materials are available and a link to the proxy voting website.

How

can I access the proxy materials over the Internet?

Your

notice of the Internet availability of the proxy materials, proxy card or voting instruction card will contain instructions on

how to:

| |

● |

View our proxy

materials for the Special Meeting on the Internet; and |

| |

|

|

| |

● |

Instruct us to

send our future proxy materials to you electronically by e-mail. |

Our

proxy materials are also available at www.proxyvote.com.

Your

notice of the Internet availability of the proxy materials, proxy card or voting instruction card will contain instructions on

how you may request to access proxy materials electronically on an ongoing basis. Choosing to access your future proxy materials

electronically will help us conserve natural resources and reduce the costs of distributing our proxy materials. If you choose

to access future proxy materials electronically, you will receive an e-mail with instructions containing a link to the website

where those materials are available and a link to the proxy voting website. Your election to access proxy materials by e-mail

will remain in effect until you terminate it.

How

may I obtain a paper copy of the proxy materials?

Shareholders

receiving a notice of the Internet availability of the proxy materials will find instructions about how to obtain a paper copy

of the proxy materials on their notice. Shareholders receiving notice of the Internet availability of the proxy materials by e-mail

will find instructions about how to obtain a paper copy of the proxy materials as part of that e-mail. All shareholders who do

not receive a notice or an e-mail will receive a paper copy of the proxy materials by mail.

Who

is Entitled to Vote?

Our

Board has fixed the close of business on August 18, 2015 as the record date for a determination of shareholders entitled to notice

of, and to vote at, this Special Meeting or any adjournment thereof. On the record date, there were 8,563,090 shares of common

stock outstanding. Each share of Vapor common stock represents one vote that may be voted on each matter that may come before

the Special Meeting. As of the record date, Vapor had no other outstanding securities with voting rights.

What

is the difference between holding shares as a record holder and as a beneficial owner?

If

your shares are registered in your name with our transfer agent, Equity Stock Transfer, you are the “record holder”

of those shares. If you are a record holder, these proxy materials have been provided directly to you by Vapor.

If

your shares are held in a stock brokerage account, a bank or other holder of record, you are considered the “beneficial

owner” of those shares held in “street name.” If your shares are held in street name, these proxy materials

have been forwarded to you by that organization. As the beneficial owner, you have the right to instruct this organization on

how to vote your shares.

Who

May Attend the Meeting?

Record

holders and beneficial owners may attend the Special Meeting. If your shares are held in street name, you will need to bring a

copy of a brokerage statement or other documentation reflecting your stock ownership as of the record date. Please see below for

instructions on how to vote at the Special Meeting if your shares are held in street name.

How

Do I Vote?

Whether

you hold shares directly as the shareholder of record or through a broker, trustee or other nominee as the beneficial owner, you

may direct how your shares are voted without attending the Special Meeting. There are three ways to vote by proxy:

| |

1. |

Vote

by Internet. By following the instructions on the notice, proxy card or voting instruction card. |

| |

|

|

| |

2. |

Vote

by phone. Shareholders of record may vote by phone by calling 1 (800) 690-6903. Shareholders who are beneficial owners

of their shares may vote by phone by calling the number specified on the voting instruction card provided by their broker,

trustee or nominee. |

| |

|

|

| |

3. |

Vote

by mail. Shareholders of record may vote by mail by completing, signing and dating their proxy card or voting instruction

card and mailing it in the accompanying pre-addressed envelope. |

If

you vote by Internet or phone, please DO NOT mail your proxy card.

What

constitutes a Quorum?

To

carry on the business of the Special Meeting, we must have a quorum. A quorum is present when a majority of the outstanding shares

of stock entitled to vote, as of the record date, are represented in person or by proxy. Shares owned by Vapor are not considered

outstanding or considered to be present at the Special Meeting. Broker non-votes (because there are routine matters presented

at the Special Meeting) and abstentions are counted as present for the purpose of determining the existence of a quorum.

What

happens if Vapor is unable to obtain a Quorum?

If

a quorum is not present to transact business at the Special Meeting or if we do not receive sufficient votes in favor of the proposals

by the date of the Special Meeting, the persons named as proxies may propose one or more adjournments of the Special Meeting to

permit solicitation of proxies.

What

is a broker non-vote?

If

your shares are held in street name, you must instruct the organization who holds your shares how to vote your shares. If you

do not provide voting instructions, your shares will not be voted on any non-routine proposal. This vote is called a “broker

non-vote.” Broker non-votes do not count as a vote “FOR” or “AGAINST” any of the proposals. Because

proposals 1 and 2 require a majority of our outstanding shares to vote “FOR” approval, a broker non-vote will adversely

affect these proposals.

If

you are the shareholder of record, and you sign and return a proxy card without giving specific voting instructions, then the

proxy holders will vote your shares in the manner recommended by our Board on all matters presented in this Proxy Statement and

as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the

meeting. If your shares are held in street name and you do not provide specific voting instructions to the organization that holds

your shares, the organization may generally vote at its discretion on routine matters, but not on non-routine matters. If you

sign your vote instruction form but do not provide instructions on how your broker should vote, your broker will vote your shares

as recommended by our Board on any non-routine matter. See the note below and the following question and answer.

Which

Proposals are considered “Routine” or “Non-Routine”?

Proposals

1 and 2 are considered routine and Proposals 3, 4 and 5 are considered non-routine.

How

are abstentions treated?

Abstentions

only have an effect on the outcome of any matter being voted on that requires the approval based on our total voting stock outstanding.

Thus, abstentions will have an adverse effect on Proposals 1 and 2.

How

Many Votes are Needed for Each Proposal to Pass, is Broker Discretionary Voting Allowed and What is the Effect of an Abstention?

| Proposals | |

Vote

Required | |

Broker

Discretionary

Vote Allowed | |

Effect

of

Abstentions on

the Proposal |

| | |

| |

| |

|

| 1. To approve the amendment to the Certificate of Incorporation to increase the authorized shares

of common stock | |

Majority of the outstanding voting shares | |

Yes | |

Vote against |

| | |

| |

| |

|

| 2. To approve the amendment to the Certificate of Incorporation to increase the authorized shares

of preferred stock | |

Majority of the outstanding voting shares | |

Yes | |

Vote against |

| | |

| |

| |

|

| 3. To approve the issuance of certain additional shares | |

Majority of the votes cast | |

No | |

No effect |

| | |

| |

| |

|

| 4. To approve an amendment to the exercise price of certain warrants | |

Majority of the votes cast | |

No | |

No effect |

| | |

| |

| |

|

| 5. To approve an amendment to the conversion price of certain convertible notes | |

Majority of the votes cast | |

No | |

No effect |

What

are the Voting Procedures?

In

voting by proxy with regard to the proposals, you may vote in favor of each proposal or against each proposal, or in favor of

some proposals and against others, or you may abstain from voting on any of these proposals. You should specify your respective

choices on the accompanying proxy card or your vote instruction form.

Is

My Proxy Revocable?

You

may revoke your proxy and reclaim your right to vote up to and including the day of the Special Meeting by giving written notice

to the Corporate Secretary of Vapor, by delivering a proxy card dated after the date of the proxy or by voting in person at the

Special Meeting. All written notices of revocation and other communications with respect to revocations of proxies should be addressed

to: Vapor Corp., 3001 Griffin Road, Dania Beach, Florida 33312, Attention: Corporate Secretary.

Who

is Paying for the Expenses Involved in Preparing and Mailing this Proxy Statement?

All

of the expenses involved in preparing, assembling and mailing these proxy materials and all costs of soliciting proxies will be

paid by Vapor. In addition to the solicitation by mail, proxies may be solicited by our officers and regular employees by telephone

or in person. Such persons will receive no compensation for their services other than their regular salaries. Arrangements will

also be made with brokerage houses and other custodians, nominees and fiduciaries to forward solicitation materials to the beneficial

owners of the shares held of record by such persons, and we may reimburse such persons for reasonable out of pocket expenses incurred

by them in so doing. We may hire an independent proxy solicitation firm.

What

Happens if Additional Matters are Presented at the Special Meeting?

Other

than the items of business described in this Proxy Statement, we are not aware of any other business to be acted upon at the Special

Meeting. If you submit a signed proxy card, the persons named as proxy holders, Messrs. Jeffrey Holman and Greg Brauser, will

have the discretion to vote your shares on any additional matters properly presented for a vote at the Special Meeting.

What

is “householding” and how does it affect me?

Record

holders who have the same address and last name will receive only one copy of their proxy materials, unless we are notified that

one or more of these record holders wishes to continue receiving individual copies. This procedure will reduce our printing costs

and postage fees. Shareholders who participate in householding will continue to receive separate proxy cards.

If

you are eligible for householding, but you and other record holders with whom you share an address, receive multiple copies of

these proxy materials, or if you hold Vapor stock in more than one account, and in either case you wish to receive only a single

copy of each of these documents for your household, please contact our Corporate Secretary at: Vapor Corp., 3001 Griffin Road,

Dania Beach, Florida 33312, (888) 482-7671.

If

you participate in householding and wish to receive a separate copy of these proxy materials, or if you do not wish to continue

to participate in householding and prefer to receive separate copies of these documents in the future, please contact our Corporate

Secretary as indicated above. Beneficial owners can request information about householding from their brokers, banks or other

holders of record.

Do

I Have Dissenters’ (Appraisal) Rights?

Appraisal

rights are not available to Vapor shareholders with any of the proposals brought before the Special Meeting.

Interest

of Officers and Directors in Matters to Be Acted Upon

If

any of the proposals described in this proxy statement are approved, none of our officers and directors will receive any extra

or special benefit not shared on a pro rata basis by all other holders of the Company’s securities.

The

Board Recommends that Shareholders Vote “For” Proposal Nos. 1, 2, 3, 4, and 5.

Security

Ownership of Certain Beneficial Owners and Management

The

following table sets forth certain information regarding the beneficial ownership of our common stock as of August 18, 2015 for:

| |

● |

our

Named Executive Officers, which include all Chief Executive Officers serving during fiscal year 2014 and our two other most

highly compensated executive officers, as determined by reference to total compensation for fiscal year 2014, who were serving

as executive officers at the end of fiscal year 2014; |

| |

|

|

| |

● |

each

of our directors; |

| |

|

|

| |

● |

all

of our current directors and executive officers as a group; and |

| |

|

|

| |

● |

each

shareholder known by us to own beneficially more than five percent of our common stock. |

Except

as indicated in footnotes to this table, we believe that the shareholders named in this table have sole voting and investment

power with respect to all shares of common stock shown to be beneficially owned by them, based on information provided to us by

such shareholders. Unless otherwise indicated, the address for each director and executive officer listed is: c/o Vapor Corp.,

3001 Griffin Road, Dania Beach, Florida 33312.

| Name of Beneficial Owner | |

Number of Common

Share Equivalents

Beneficially Owned (1) | | |

Percentage of Common

Share Equivalents

Beneficially Owned | |

| Named Executive Officers and Directors: | |

| | | |

| | |

| | |

| | | |

| | |

| Jeffrey Holman (2) | |

| 256,221 | | |

| 3.0 | % |

| | |

| | | |

| | |

| Kevin Frija (3) | |

| 46,895 | | |

| * | |

| | |

| | | |

| | |

| Harlan Press (4) | |

| 31,399 | | |

| * | |

| | |

| | | |

| | |

| Christopher Santi (5) | |

| 11,556 | | |

| * | |

| | |

| | | |

| | |

| Gregory Brauser (6) | |

| 189,752 | | |

| 2.2 | % |

| | |

| | | |

| | |

| William Conway III (7) | |

| 0 | | |

| 0 | % |

| | |

| | | |

| | |

| Daniel MacLachlan (8) | |

| 0 | | |

| 0 | % |

| | |

| | | |

| | |

| Nikhil Raman (9) | |

| 0 | | |

| 0 | % |

| | |

| | | |

| | |

| All Executive Officers and Directors as a Group (7

Persons) (10) | |

| 499,072 | | |

| 5.8 | % |

| | |

| | | |

| | |

| Other Five Percent Shareholder: | |

| | | |

| | |

| | |

| | | |

| | |

| Alpha Capital Anstalt (11) | |

| 668,330 | | |

| 7.8 | % |

| * |

Represents

less than 1% of the outstanding shares of common stock |

| |

|

| (1)

|

Applicable

percentages are based on 8,563,090 shares outstanding as of August 18, 2015, adjusted as required by rules of the SEC. Beneficial

ownership is determined under the rules of the SEC and generally includes voting or investment power with respect to securities.

Shares of common stock underlying options, warrants and convertible notes currently exercisable or convertible, or exercisable

or convertible within 60 days are deemed outstanding for computing the percentage of the person holding such securities but

are not deemed outstanding for computing the percentage of any other person. |

| |

|

| (2)

|

Jeffrey

Holman: A director and executive officer. Includes 24,000 vested options. |

| |

|

| (3) |

Kevin

Frija: Former chief executive officer. Because Mr. Frija served as a Chief Executive Officer during fiscal 2014, he is

a Named Executive Officer under the SEC’s rules and regulations. Includes 36,000 vested options and 895 shares underlying

warrants. The shares of common stock owned by Mr. Frija are based on the Company’s transfer agent records. |

| |

|

| (4)

|

Harlan

Press: A former executive officer. Includes 8,000 vested options and 620 shares underlying warrants. |

| |

|

| (5)

|

Christopher

Santi: An executive officer. Represents vested options. |

| |

|

| (6)

|

Gregory

Brauser: A director and executive officer. Includes 13,848 shares of common stock

underlying restricted stock units which are deliverable within 60 days.

|

| |

|

| (7)

|

William

Conway III: A director. |

| |

|

| (8) |

Daniel

MacLachlan: A director. |

| |

|

| (9) |

Nikhil

Raman: A director. |

| |

|

| (10) |

Total

D&O: Includes securities beneficially owned by executives who are not a Named Executive Officer. |

| |

|

| (11) |

Alpha

Capital Anstalt: Does not include additional shares underlying warrants and convertible notes that cannot be exercised

within 60 days due to a 4.99% blocker. Address is Lettstrasse 32, P.O. Box 1212, FL 9490, Vaduz Furstentum Liechtenstein c/o

LH Financial Services Corp., 510 Madison Avenue, Ste. 1400, New York, New York 10022. |

PROPOSAL

1.

AMENDMENT

TO OUR CERTIFICATE OF INCORPORATION TO INCREASE OUR AUTHORIZED COMMON STOCK FROM 150 MILLION TO 500 MILLION SHARES

Our

Board adopted a resolution to amend our Certificate of Incorporation, which we refer to as “Certificate,” to increase

the number of shares of common stock that we are authorized to issue from 150,000,000 to 500,000,000 shares and has directed that

the proposed amendment be submitted to our shareholders for their approval and adoption. If only Proposal 1, and not Proposal

2 (which relates to our authorized preferred stock and is described below) is approved by shareholders, the amendment will not

change the number of shares of preferred stock that are authorized, and the total authorized shares will be increased from 151,000,000

to 501,000,000. The form of the amendment that will be adopted if only Proposal 1, and not Proposal 2, is approved by shareholders

is attached as Annex A to this Proxy Statement.

If

both Proposal 1 and Proposal 2 are approved by shareholders, our authorized preferred stock will also be increased to 5,000,000

authorized shares, and our total authorized shares will be increased from 151,000,000 to 505,000,000. The form of the amendment

that will be adopted if both Proposal 1 and Proposal 2 are approved by shareholders is attached as Annex C to this Proxy

Statement.

Overview

We

may issue shares of capital stock to the extent such shares have been authorized under our Certificate. Our Certificate currently

authorizes us to issue up to 150,000,000 shares of common stock and 1,000,000 shares of preferred stock. No shares of our common

stock are held in treasury.

In

July 2015, the Company closed a registered public offering of units of the Company’s securities consisting of one-fourth

of a share of the Company’s Series A Convertible Preferred Stock (convertible into 10 shares of common stock) and 20 Series

A Warrants, for gross proceeds of $41.4 million. Pursuant to the underwriting agreement entered into in connection with the offering,

the Company agreed to seek shareholder approval of an amendment to the Company’s Certificate increasing authorized capital

to 500,000,000 shares. In addition to complying with the Company’s contractual obligations under the underwriting agreement,

the Company also believes it is in the Company’s and shareholders’ best interests to increase authorized capital because

of certain provisions of the Series A Warrants sold in the registered offering. The Company does not presently have sufficient

authorized capital to issue shares of common stock upon exercise of all outstanding Series A Warrants. If the Company continues

to lack sufficient authorized capital to issue shares of common stock upon exercise of the Series A Warrants when such warrants

become exercisable, the Company will be required to make cash payments to warrant holders upon exercise. The Company believes

it is advantageous to the Company and its financial condition to have the ability to settle warrant exercises with the issuance

of shares rather than cash payments. Increasing the Company’s authorized common stock to 500,000,000 authorized shares will

give the Company this flexibility.

Other

than issuing shares of common stock upon the conversion of the Series A Convertible Preferred Stock and the exercise of the Series

A Warrants, as described above, the Company presently has no specific plans to issue the shares of common stock that will become

newly authorized upon amendment of the Certificate.

The

additional shares of common stock to be authorized after the amendment to the Certificate would have rights identical to the currently

outstanding shares, except for effects incidental to increasing the number of outstanding shares, such as the dilution of current

shareholders’ ownership and voting interests when shares are issued. Under our Certificate, our shareholders do not have

preemptive rights with respect to our common stock. Thus, should our Board elect to issue additional shares, existing shareholders

would not have any preferential rights to purchase any shares.

Possible

Anti-Takeover Effects of the Amendment

The

proposed amendment to our Certificate is not being recommended in response to any specific effort of which our Board is aware

to obtain control of Vapor by means of a merger, tender offer, solicitation, or otherwise, and our Board does not intend or view

the proposed increase in authorized common stock as an anti-takeover measure. However, the ability of our Board to authorize the

issuance of the additional shares of common stock that would be available if the proposed amendment is approved and adopted could

have the effect of discouraging or preventing a hostile takeover.

The

Board recommends a vote “For” this proposal.

PROPOSAL

2.

AMENDMENT

TO OUR CERTIFICATE OF INCORPORATION TO INCREASE OUR AUTHORIZED PREFERRED STOCK FROM 1 MILLION TO 5 MILLION SHARES

Our

Board adopted a resolution to amend our Certificate to increase the number of shares of preferred stock that we are authorized

to issue from 1,000,000 to 5,000,000 shares and has directed that the proposed amendment be submitted to our shareholders for

their approval and adoption. If only Proposal 2, and not Proposal 1 (which relates to our authorized common stock and is described

above) is approved by shareholders, the amendment will not change the number of shares of common stock that are authorized, and

the total authorized shares will be increased from 151,000,000 to 155,000,000. The form of the amendment that will be adopted

if only Proposal 2, and not Proposal 1, is approved by shareholders is attached as Annex B to this Proxy Statement.

If

both Proposal 1 and Proposal 2 are approved by shareholders, our authorized common stock will also be increased to 500,000,000

authorized shares, and our total authorized shares will be increased from 151,000,000 to 505,000,000. The form of the amendment

that will be adopted if both Proposal 1 and Proposal 2 are approved by shareholders is attached as Annex C to this Proxy

Statement.

Overview

We

may issue shares of capital stock to the extent such shares have been authorized under our Certificate. Our Certificate currently

authorizes us to issue up to 150,000,000 shares of common stock and 1,000,000 shares of preferred stock with designations, rights

and preferences as may be determined from time to time by our Board of Directors.

As

of the date of this proxy statement, the Company has designated 1,000,000 shares of its preferred stock as the Series A Convertible

Preferred Stock and has issued 940,414 shares of Series A Convertible Preferred Stock. Consequently, although the Company has

the ability to re-designate its unissued shares of Series A Convertible Preferred Stock, it is presently has a very limited ability

to issue additional shares of preferred stock. The Board believes it is in the best interests of both the Company and shareholders

to increase the Company’s authorized shares of preferred stock in order to give the Company maximum flexibility as it structures

future capital raising transactions, strategic asset acquisitions and/or business combinations.

The

Company presently has no specific plans to issue the shares of preferred stock that will become newly authorized upon amendment

of the Certificate. Because the rights and preferences of any future series of preferred stock which the Board may designate are

presently unknown, it is not possible to determine what effect the issuance of such future shares of preferred stock may have

on existing shareholders.

Possible

Anti-Takeover Effects of the Amendment

Our

Certificate of Incorporation, both presently and as proposed to be amended, authorizes the issuance of shares of “blank

check” preferred stock with designations, rights and preferences as may be determined from time to time by our Board of

Directors. Our Board is empowered, without shareholder approval, to issue a series of preferred stock with dividend, liquidation,

conversion, voting or other rights which could dilute the interest of, or impair the voting power of, our common shareholders.

The issuance of a series of preferred stock could be used as a method of discouraging, delaying or preventing a change in control.

For example, it would be possible for our Board of Directors to issue preferred stock with voting or other rights or preferences

that could impede the success of any attempt to effect a change in control of our company. Therefore, approval of the proposed

amendment, and the designation and issuance of future series of preferred stock, could assist the Company in delaying or preventing

unsolicited takeovers and changes in control or changes in our management. However, the proposed amendment to our Certificate

is not being recommended in response to any specific effort of which our Board is aware to obtain control of Vapor by means of

a merger, tender offer, solicitation, or otherwise, and our Board does not intend or view the proposed amendment as an anti-takeover

measure.

The

Board recommends a vote “For” this proposal.

PROPOSAL

3.

issuance

of 1,798,676

additional shares of common stock

Overview

On

June 19, 2015, to facilitate the Company’s ability to raise capital, the Company entered into waiver agreements with certain

investors in each of its private placement offerings under the securities purchase agreements dated March 3, 2015 and November

14, 2014. The waiver agreements amended certain terms of the securities purchase agreements in exchange for which the Company

agreed to issue the investors under the agreements additional shares of common stock in the event of certain future lower-priced

issuances of securities of the Company.

On

July 29, 2015, pursuant to the waiver agreements and in connection with the closing of the Company’s registered public offering

described under Proposal 1, above, the Company became obligated to issue prior investors a total of 2,559,437 additional shares

of common stock. However, under Nasdaq Marketplace Rule 5635(d), which we are subject to because our common stock is listed on

the Nasdaq Capital Market, we must obtain shareholder approval before we may issue 1,798,676 of these additional shares of common

stock. Therefore, the Company is seeking shareholder approval to permit the issuance of these 1,798,676 shares of common stock

in order to be able to comply with both the Company’s contractual obligations to its past investors and the requirements

of the Nasdaq Capital Market.

The

issuance of the additional shares of common stock is not expected to affect existing shareholders other than effects incidental

to increasing the number of outstanding shares, such as the dilution of current shareholders’ ownership and voting interests

when shares are issued.

Accordingly,

we ask our shareholders to vote “FOR” the following resolution at the Special Meeting:

“RESOLVED,

that the issuance of an additional 1,798,676 shares of common stock to investors in the Company’s November 2014 and March

2015 private placements in accordance with the waiver agreements dated June 19, 2015 is hereby APPROVED.”

The

Board recommends a vote “For” this proposal.

PROPOSAL

4.

Amendment

of 1,442,126 Warrants to Reduce Exercise Price to $1.10

Overview

As

described above, under Proposal 3, in June 2015, the Company entered into waiver agreements with certain prior investors amending

past securities purchase agreements in order to facilitate the Company’s future capital-raising efforts. In addition to

agreeing to issue additional shares to these prior investors in the event of certain future lower-priced equity issuances, the

Company also agreed to reduce the exercise price of certain outstanding warrants, including the warrants issued to investors in

its November 2014 and March 2015 private placements, certain warrants to be issued under the waiver agreements, and a warrant

issued to Chardan Capital Management, LLC in connection with the Company’s June 2015 private placement of debentures.

The

closing in July 2015 of the registered public offering described elsewhere in this proxy statement triggered an obligation by

the Company to reduce the exercise price of a total of 1,442,126 outstanding warrants from their original exercise prices, ranging

from $2.50 to $10.00, to an adjusted exercise price of $1.10. Nasdaq Marketplace Rule 5635(d) requires shareholder approval before

the adjustment to the exercise price of these warrants can take effect. Therefore, in order to permit the Company to comply with

its contractual obligations to past investors and the requirements of the Nasdaq Capital Market, the Company is seeking shareholder

approval to reduce the exercise price of these outstanding warrants to $1.10 per share.

The

repricing of the warrants is not expected to have any effect on existing shareholders.

Accordingly,

we ask our shareholders to vote “FOR” the following resolution at the Special Meeting:

“RESOLVED,

that the Company is authorized to reduce the exercise price of 1,442,126 outstanding warrants to purchase shares of common stock

issued to investors under the Company’s November 2014 private placement, the Company’s March 2015 private placement,

the waiver agreements dated June 19, 2015, and the June 2015 warrant issued to Chardan Capital Management, LLC to $1.10 per share.”

The

Board recommends a vote “For” this proposal.

PROPOSAL

5.

Amendment

of conversion PRICE OF $1,250,000 original principle amount of convertible notes to $1.10

Overview

As

previously described, in June 2015, the Company entered into waiver agreements with certain prior investors amending past securities

purchase agreements in order to facilitate the Company’s future capital-raising efforts. In addition to agreeing to issue

additional shares to these prior investors in the event of certain future lower-priced equity issuances, the Company also agreed

to reduce the conversion price of certain outstanding convertible notes issued to investors in its November 2014 private placements

in the original principal amount of $1,250,000.

The

closing in July 2015 of the registered public offering described elsewhere in this proxy statement triggered an obligation by

the Company to reduce the conversion price of these notes from their original conversion price of $5.50 to an adjusted conversion

price of $1.10. At the adjusted conversion price of $1.10 per share, a total of 1,215,911 shares of common stock are issuable

upon conversion in full of the original outstanding principal amount and maximum accruable interest. Nasdaq Marketplace Rule 5635(d)

requires shareholder approval before the adjustment to the conversion price of these notes can take effect. Therefore, in order

to permit the Company to comply with its contractual obligations to past investors and the requirements of the Nasdaq Capital

Market, the Company is seeking shareholder approval to reduce the conversion price of these outstanding notes to $1.10 per share.

The

amendment of the conversion price of the notes is not expected to affect existing shareholders other than effects incidental to

increasing the number of outstanding shares upon conversion of the notes, such as the dilution of current shareholders’

ownership and voting interests when shares are issued.

Accordingly,

we ask our shareholders to vote “FOR” the following resolution at the Special Meeting:

“RESOLVED,

that the Company is authorized to reduce the exercise price of $1,250,000 original principal amount of its convertible notes issued

November 2014, and additional interest accruable thereon, to $1.10 per share.”

The

Board recommends a vote “For” this proposal.

SHAREHOLDERS

SHOULD NOT DESTROY ANY AMENDED WARRANT(S) OR CONVERTIBLE NOTE(S) AND SHOULD NOT SUBMIT ANY WARRANT(S) OR NOTE(S) FOR REPLACEMENT

UNLESS REQUESTED TO DO SO.

SHAREHOLDERS

who may be affected by the reduction in the exercise price of the warrants described in Proposal 3 and the reduction in the conversion

price of the convertible notes described in Proposal 4 ARE advised to consult THEIR OWN tax advisors as to any possible tax consequences

based on EACH shareholder’s own particular situation.

OTHER

MATTERS

Vapor

has no knowledge of any other matters that may come before the Special Meeting and does not intend to present any other matters.

However, if any other matters shall properly come before the Meeting or any adjournment, the persons soliciting proxies will have

the discretion to vote as they see fit unless directed otherwise.

If

you do not plan to attend the Special Meeting, in order that your shares may be represented and in order to assure the required

quorum, please sign, date and return your proxy promptly. In the event you are able to attend the Special Meeting, at your request,

Vapor will cancel your previously submitted proxy.

Annex

A

CERTIFICATE

OF AMENDMENT TO CERTIFICATE OF INCORPORATION OF VAPOR CORP.

Vapor

Corp. (the “Company”), a corporation organized and existing under the General Corporation Law of the State of Delaware

(the “Delaware General Corporation Law”), hereby certifies as follows:

1.

Pursuant to Sections 242 and 228 of the Delaware General Corporation Law, the amendment herein set forth has been duly approved

by the Board of Directors and holders of a majority of the outstanding capital stock of the Company.

2.

Section 4 of the Certificate of Incorporation is amended to read as follows:

4.

The total number of shares of stock which the Corporation is authorized to issue is 501,000,000. 500,000,000 shares shall be common

stock, par value $0.001 per share (“Common Stock”), and 1,000,000 shall be preferred stock, par value $0.001

per share (“Preferred Stock”). Except as otherwise provided in this Corporations Certificate of Incorporation,

authority is hereby vested in the Board of Directors of the Corporation from time to time to provide for the issuance of shares

of one or more series of Preferred Stock and in connection therewith to fix by resolution or resolutions providing for the issue

of any such series, the number of shares to be included therein, the voting powers thereof, and such of the designations, preferences

and relative participating, optional or other special rights and qualifications, limitations and restrictions of each such series,

including, without limitation, dividend rights, voting rights, rights of redemption, or conversion into Common Stock rights, and

liquidation preferences, to the fullest extent now or hereafter permitted by the Delaware General Corporation Law and any other

provisions of this Amended and Restated Certificate of Incorporation. The Board of Directors is further authorized to increase

or decrease (but not below the number of such shares of such class or series then outstanding) the number of shares of any such

class or series subsequent to the issuance of shares of that class or series.

3.

This Certificate of Amendment to Certificate of Incorporation was duly adopted and approved by the shareholders of this Company

on the _____ day of ______ 2015 in accordance with Section 242 of the Delaware General Corporation Law.

IN

WITNESS WHEREOF, the undersigned has executed this Certificate of Amendment to Certificate of Incorporation as of the ___ day

of ______ 2015.

| |

VAPOR

CORP. |

| |

|

|

| |

By: |

|

| |

|

____________________________________, |

| |

|

____________________________ |

Annex

B

CERTIFICATE

OF AMENDMENT TO CERTIFICATE OF INCORPORATION OF VAPOR CORP.

Vapor

Corp. (the “Company”), a corporation organized and existing under the General Corporation Law of the State of Delaware

(the “Delaware General Corporation Law”), hereby certifies as follows:

1.

Pursuant to Sections 242 and 228 of the Delaware General Corporation Law, the amendment herein set forth has been duly approved

by the Board of Directors and holders of a majority of the outstanding capital stock of the Company.

2.

Section 4 of the Certificate of Incorporation is amended to read as follows:

4.

The total number of shares of stock which the Corporation is authorized to issue is 155,000,000. 150,000,000 shares shall be common

stock, par value $0.001 per share (“Common Stock”), and 5,000,000 shall be preferred stock, par value $0.001

per share (“Preferred Stock”). Except as otherwise provided in this Corporations Certificate of Incorporation,

authority is hereby vested in the Board of Directors of the Corporation from time to time to provide for the issuance of shares

of one or more series of Preferred Stock and in connection therewith to fix by resolution or resolutions providing for the issue

of any such series, the number of shares to be included therein, the voting powers thereof, and such of the designations, preferences

and relative participating, optional or other special rights and qualifications, limitations and restrictions of each such series,

including, without limitation, dividend rights, voting rights, rights of redemption, or conversion into Common Stock rights, and

liquidation preferences, to the fullest extent now or hereafter permitted by the Delaware General Corporation Law and any other

provisions of this Amended and Restated Certificate of Incorporation. The Board of Directors is further authorized to increase

or decrease (but not below the number of such shares of such class or series then outstanding) the number of shares of any such

class or series subsequent to the issuance of shares of that class or series.

3.

This Certificate of Amendment to Certificate of Incorporation was duly adopted and approved by the shareholders of this Company

on the _____ day of ______ 2015 in accordance with Section 242 of the Delaware General Corporation Law.

IN

WITNESS WHEREOF, the undersigned has executed this Certificate of Amendment to Certificate of Incorporation as of the ___ day

of ______ 2015.

| |

VAPOR

CORP. |

| |

|

|

| |

By: |

|

| |

|

____________________________________, |

| |

|

____________________________ |

Annex

C

CERTIFICATE

OF AMENDMENT TO CERTIFICATE OF INCORPORATION OF VAPOR CORP.

Vapor

Corp. (the “Company”), a corporation organized and existing under the General Corporation Law of the State of Delaware

(the “Delaware General Corporation Law”), hereby certifies as follows:

1.

Pursuant to Sections 242 and 228 of the Delaware General Corporation Law, the amendment herein set forth has been duly approved

by the Board of Directors and holders of a majority of the outstanding capital stock of the Company.

2.

Section 4 of the Certificate of Incorporation is amended to read as follows:

4.

The total number of shares of stock which the Corporation is authorized to issue is 505,000,000. 500,000,000 shares shall be common

stock, par value $0.001 per share (“Common Stock”), and 5,000,000 shall be preferred stock, par value $0.001

per share (“Preferred Stock”). Except as otherwise provided in this Corporations Certificate of Incorporation,

authority is hereby vested in the Board of Directors of the Corporation from time to time to provide for the issuance of shares

of one or more series of Preferred Stock and in connection therewith to fix by resolution or resolutions providing for the issue

of any such series, the number of shares to be included therein, the voting powers thereof, and such of the designations, preferences

and relative participating, optional or other special rights and qualifications, limitations and restrictions of each such series,

including, without limitation, dividend rights, voting rights, rights of redemption, or conversion into Common Stock rights, and

liquidation preferences, to the fullest extent now or hereafter permitted by the Delaware General Corporation Law and any other

provisions of this Amended and Restated Certificate of Incorporation. The Board of Directors is further authorized to increase

or decrease (but not below the number of such shares of such class or series then outstanding) the number of shares of any such

class or series subsequent to the issuance of shares of that class or series.

3.

This Certificate of Amendment to Certificate of Incorporation was duly adopted and approved by the shareholders of this Company

on the _____ day of ______ 2015 in accordance with Section 242 of the Delaware General Corporation Law.

IN

WITNESS WHEREOF, the undersigned has executed this Certificate of Amendment to Certificate of Incorporation as of the ___ day

of ______ 2015.

| |

VAPOR

CORP. |

| |

|

|

| |

By: |

|

| |

|

____________________________________, |

| |

|

____________________________ |

VAPOR

CORP.

THIS

PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

SPECIAL

MEETING OF SHAREHOLDERS – OCTOBER 16, 2015 AT 1:00 PM

VOTING

INSTRUCTIONS

If

you vote by phone or internet, please DO NOT mail your proxy card.

| |

MAIL: |

Please

mark, sign, date, and return this Proxy Card promptly using the enclosed envelope. |

| |

|

|

| |

PHONE: |

Call

1 (800) 690-6903 |

| |

|

|

| |

INTERNET: |

https://www.proxyvote.com |

| Control

ID: |

|

| Proxy ID: |

|

| Password: |

|

MARK

“X” HERE IF YOU PLAN TO ATTEND THE MEETING: [ ]

MARK

HERE FOR ADDRESS CHANGE [ ] New Address (if applicable):

IMPORTANT:

Please sign exactly as your name or names appear on this Proxy. When shares are held jointly, each holder should sign. When

signing as executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation,

please sign full corporate name by duly authorized officer, giving full title as such. If signer is a partnership, please sign

in partnership name by authorized person.

Dated:

_______, 2015

(Print

Name of Shareholder and/or Joint Tenant)

(Signature

of Shareholder)

(Second

Signature if held jointly)

The

shareholder(s) hereby appoints Jeffrey Holman and Greg Brauser, or either of them, as proxies, each with the power to appoint

his substitute, and hereby authorizes them to represent and to vote, as designated on the reverse side of this ballot, all of

the shares of voting stock of VAPOR CORP. that the shareholder(s) is/are entitled to vote at the Special Meeting of Shareholder(s)

to be held at 1:00 p.m., New York time on October 16, 2015, at Vapor ’s headquarters, located at 3001 Griffin Road, Dania

Beach, Florida 33312, and any adjournment or postponement thereof.

This

proxy, when properly executed, will be voted in the manner directed herein. If no such direction

is made, this proxy will be voted “FOR” Proposals 1, 2, 3, 4 and 5. If any other business is presented at the meeting,

this proxy will be voted by the above-named proxies at the direction of the Board of Directors. At the present time, the Board

of Directors knows of no other business to be presented at the meeting.

Proposal:

| 1.

To approve the amendment to the Certificate of Incorporation to increase the authorized shares of common stock to 500,000,000 |

|

FOR

[ ] |

|

AGAINST

[ ] |

|

ABSTAIN

[ ] |

| |

|

|

|

|

|

|

| 2.

To approve the amendment to the Certificate of Incorporation to increase the authorized shares of preferred stock to 5,000,000 |

|

FOR

[ ] |

|

AGAINST

[ ] |

|

ABSTAIN

[ ] |

| |

|

|

|

|

|

|

| 3.

To approve the issuance of 1,798,676 additional shares of common stock |

|

FOR

[ ] |

|

AGAINST

[ ] |

|

ABSTAIN

[ ] |

| |

|

|

|

|

|

|

| 4.

To approve reducing the exercise price of 1,442,126 outstanding warrants to $1.10 |

|

FOR

[ ] |

|

AGAINST

[ ] |

|

ABSTAIN

[ ] |

| |

|

|

|

|

|

|

| 5.

To approve reducing the conversion price of $1,250,000 original principle amount of convertible notes to $1.10 |

|

FOR

[ ] |

|

AGAINST

[ ] |

|

ABSTAIN

[ ] |

Control

ID:

Proxy

ID:

Password:

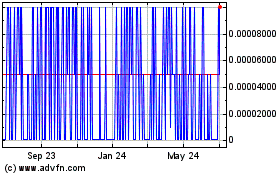

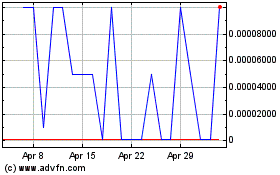

Healthier Choices Manage... (PK) (USOTC:HCMC)

Historical Stock Chart

From Aug 2024 to Sep 2024

Healthier Choices Manage... (PK) (USOTC:HCMC)

Historical Stock Chart

From Sep 2023 to Sep 2024