Current Report Filing (8-k)

August 19 2015 - 4:08PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

Form 8-K

_____________________

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 19, 2015

_____________________

(Exact name of registrant as specified in its charter)

_____________________

|

| | | | |

| | | | |

DE | | 000-50368 | | 26-1631624 |

(State or other jurisdiction of incorporation) | | Commission File Number: | | (IRS Employer Identification No.) |

145 Hunter Drive, Wilmington, OH 45177

(Address of principal executive offices, including zip code)

(937) 382-5591

(Registrant's telephone number, including area code)

_____________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

| |

Item 2.02 | Results of Operations and Financial Condition. |

Quint O. Turner, the Chief Financial Officer, and Matthew E. Fedders, the Vice President, Controller, of Air Transport Services Group, Inc. (“ATSG”), will be holding a series of one-on-one meetings with investors in San Francisco, California, on August 19th and 20th, 2015. During the meetings, Messrs. Turner and Fedders will be providing an overview of ATSG, its historical financial performance and growth strategy, utilizing the written presentation attached hereto as Exhibit 99.1.

ATSG is furnishing the information contained herein, including Exhibit 99.1, pursuant to Item 2.02 of Form 8-K promulgated by the Securities and Exchange Commission (the "SEC"). This information shall not be deemed to be "filed" with the SEC or incorporated by reference into any other filing with the SEC.

|

| |

Item 7.01 | Regulation FD Disclosure. |

See Item 2.02 above. ATSG is furnishing the information contained herein, including Exhibit 99.1, pursuant to Item 7.01 of Form 8-K promulgated by the SEC. This information shall not be deemed to be "filed" with the SEC or incorporated by reference into any other filing with the SEC.

|

| |

Item 9.01 | Financial Statements and Exhibits. |

|

| | |

Exhibit No. | | Description |

99.1 | | Presentation, to be made available to investors on August 19, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

| |

AIR TRANSPORT SERVICES GROUP, INC. |

| |

By: | /S/ W. JOSEPH PAYNE |

| W. Joseph Payne |

| Sr. Vice President |

| Corporate General Counsel & Secretary |

| |

Date: | August 19, 2015 |

The global leader in midsize wide-body leasing and operating solutions INVESTOR MEETINGS August 2015 Quint Turner Chief Financial Officer Matt Fedders Vice President & Controller

Safe Harbor Statement Except for historical information contained herein, the matters discussed in this presentation contain forward-looking statements that involve risks and uncertainties. There are a number of important factors that could cause Air Transport Services Group's ("ATSG's") actual results to differ materially from those indicated by such forward-looking statements. These factors include, but are not limited to, changes in market demand for our assets and services, the number and timing of deployments of our aircraft, our operating airlines' ability to maintain on-time service and control and reduce costs, and other factors that are contained from time to time in ATSG's filings with the U.S. Securities and Exchange Commission, including its Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Readers should carefully review this presentation and should not place undue reliance on ATSG's forward-looking statements. These forward-looking statements were based on information, plans and estimates as of the date of this presentation. ATSG undertakes no obligation to update any forward-looking statements to reflect changes in underlying assumptions or factors, new information, future events or other changes. 2

Differentiated Business Model ATSG provides the world’s only comprehensive source of turn-key solutions for customers seeking midsize freighter services Dry Leasing 767-300, 767-200, 757-200 Engine Leasing Conversion Management Engine PBH Services Certification Support Leasing ACMI-CMI Support Services ACMI A+CMI CMI Wet Leasing Ad Hoc Charter Heavy Maintenance Line Maintenance Component Services Engineering Services GSE Leasing, Sales, Service 3

Value Creation Begins with Conversions Conversion process intended to yield more than 20 years of additional useful life; ATSG’s aircraft average less than 6 years since conversion Type Total Owned Gross Payload (lbs.) Avg. Yrs. In Service Since Conversion Projected Remaining Useful Life Fairmarket Value** 767-200 F 36 99,000 7 10+ 767-300 F 10 125,000 3 20+ 757-200 F 4 68,000 5 15+ 757-200 Combi* 4 58,000 2 15+ Total 54 $828M Converted Aircraft Fleet * Combis are designed to transport a combination of passengers and cargo on the main deck. ** ATSG estimate based on 2015 appraisal for bank financing. 4

Target Growing Network Demand E-commerce, distributed manufacturing trends creating demand for new express networks Abundant ACMI and Dry Lease Opportunities MIDDLE EAST • Strong growth - +15.3% Y-o-Y in June 2015 • Aging network fleets due for replacement ASIA • Rapid e-commerce, distributed manufacturing growth • China express market growing 35% • Air networks operating narrow-body freighters will require upgrades as payloads increase AMERICAS • Consistent DHL network growth, emerging ecommerce networks • Miami airport hub supports L. America trade lanes • 767 range/payload an ideal fit for north-south routes EUROPE • Investment in Sweden’s West Atlantic AB yields additional 767 dry leases • Opportunities with other carriers, include 767 lease to UPS affiliate Star Air 5

767 Turn-Key Solution The Global Leader of Medium Wide-Body Operating and Leasing Solutions 767-300 767-200 757-200 Flat panel cockpits Engine power-by-the-hour Best-in-class efficiency Quick start Begin with wet lease using ABX or ATI Test business assumptions and economics Build business lane Low risk Develop customized lease program Aircraft fresh from C-check Select navigation and program options Develop implementation plan to replace wet lease Maintenance program bridging Technical support Manual services Crew training Certification support Heavy and line maintenance AOG support Spare aircraft C-check coverage Spare engines Component services Engineering services Medium Range Aircraft Options Wet Lease or ACMI Transition To Dry Lease Support Services Ongoing Support 6

Favorable Industry Positioning Our midsize aircraft assets and our differentiated business model emphasize flexibility 767-300 Freighter Valuable as Yields Soften • 767-300 range covers five of the eight largest- volume transcontinental routes without refueling • Operating costs for 767-300 significantly less than for large freighters • Major freight integrators expand regional hub and spoke networks as manufacturing shifts to less- developed regions. Express Networks Less Vulnerable to Demand Swings • Competitive network need protects air network spokes through down markets • ACMI, lease contracts not directly volume sensitive Model Supports Unique, Flexible Solutions as Market Turns • Rapid response with aircraft, crew, and maintenance support to replace parked assets • Connect freight companies that can jointly, but not separately, fill 767 under block-space agreements • WET2DRY - low-risk transition from other aircraft into 767 Global Sources of Medium Wide-Body Freighters (ACMI Basis) Number of Aircraft by Type 1) ATSG totals include 767 freighter aircraft operated by ATSG airlines ABX Air and Air Transport International. Currently, 16 767Fs dry-leased to DHL through 2019 are operated by ABX Air under CMI. 2) Five 767-200Fs and one 767-300F operated by Cargojet provided by ATSG’s Cargo Aircraft Management (CAM) subsidiary under dry leases. 3) One 767-200F operated by Star Air is now leased from CAM. Source: Air Cargo Management Group and ACAS database, YE2014 7 25 5 5 2 12 7 3 2 7 1 5 3 ATSG* Cargojet** Atlas/Polar Air21 MNG myCargo StarAir*** ULS B767-200F B767-300F… A300-600F A300-B4F A310-300F

767 Lease Demand Drives Growth June 2014 43 CAM-Owned 767s June 2015 46 CAM-Owned 767s 18 13 8 4 ACMI/Charter Dry Leased with CMI Dry Leased w/o CMI Staging/Unassigned 15 16 13 2 8

Cargo Aircraft Deployments Portfolio of leased and operated assets offer customer flexibility, incremental returns 9 46 Owned 767s in Service 16 DHL-US 8 Owned 757s in Service 29 External Leases 15 Internal Leases (ACMI) 13 Other Carriers 10 ABX Air 5 ATI 8 Internal Leases (ACMI) to ATI DHL Network U.S. Military 767-200F 767-300F 757-200F 757-200 Combi As of June 30, 2015 2 767s Unassigned Leases extended through March 2019 Piloted by ABX Air crews under CMI 5 Amerijet, 2019-20 6 Cargojet, 2015-16 1 West Atlantic, 2019 1 Star, 2016

37 36 29 27 25 26 24 24 24 24 24 24 24 96 96 48 48 48 11 12 19 21 23 22 24 24 24 24 24 24 24 Four-Year Extension with DHL April 1, 2015 March 31, 2019 Amended CMI • Maintains ABX/CAM role as principal provider of air cargo transport for DHL’s North American network. • CMI term extends from March 2015 through March 2019, with • 12-month extension option. • Since April, one 767-300 added. Two other -300s to be added in 4Q under 8-year leases • CMI fixed revenue increases commensurate with number of leased aircraft, additional covered services. • CAM/ABX compensated for maintenance expenses under overall fee 767 Freighter Leases - 2015 CMI Amendment Months Added Under CMI Since April 2015 June 2015 June 2019 Projected Nov 2015 Projected Dec 2015 Nov 2023 Dec 2023 Aircraft lease months remaining under original seven-year leases Additional lease months added April 2015, to be leased through 3/2019 10

Dry Leasing Growth, Airline Fleet Utilization Gains Drive Earnings Growth 11 • Earnings gains reflect eight more externally leased 767s vs. June 2014 • Improved ACMI results stem from improved airline fleet utilization, lower cost of heavy maintenance $293 $295 $25 $31 $0.24 $0.30 $84 $98 First Half 2015 Results Revenues Adjusted Pre-Tax Income* (Cont. Oper.) EPS (Cont. Oper. Diluted) Adjusted EBITDA* 2014 2015 2014 2015 2014 2015 2014 2015 * Non-GAAP metric. See table at end of this presentation for reconciliation to nearest GAAP results. $M $M $M

Strong Capital Base Strong Adjusted EBITDA generation, minimal financial leverage, yield strong cash flow in 2015, backing expanded capacity under credit facility amendments. * Adjusted EBITDA is a non-GAAP metric. Debt Obligations are as of end of year. See table at end of this presentation for reconciliation to nearest GAAP results. 1.8x 1.9x 2.2x 2.4x 1.9x 1.7x 2010 2011 2012 2013 2014 2015E Debt Obligations / Adjusted EBITDA* 12

$148 $231 $180 $140 $133 $156E $166 $181 $163 $158 $179 $190-195E $0 $50 $100 $150 $200 $250 2010 2011 2012 2013 2014 2015E Growing Cash Flow Opportunity Improving cash flow, based on the world’s largest fleet of converted midsize freighters $M ill io ns * Non-GAAP metric. See table at end of this presentation for reconciliation to nearest GAAP results. $Adjusted EBITDA* Capex + Investment + Pension Cash Contribution 13

Highlights and Outlook Unique model augments leasing-driven base return on 100% owned aircraft fleet with complete packaged air cargo solutions Dominant market share in midsize freighter class key to ‘spoke’ transport among global and regional air cargo hubs Reduced cost structure through fleet and airline streamlining, freighter conversion investments in most efficient, reliable Boeing 757 & 767 airframes Sustained cash flow from continuing aircraft deployments with DHL, U.S. Military Reduced capital commitment as fleet upgrades completed; greater opportunity for other free cash allocation options 14

Expanding Free Cash Flow Creates Options Free Cash Flow Options Growth Investments Share Repurchases Debt Reduction ($3.9M May-July) 15

Non-GAAP Reconciliation Statement Adjusted Pre-Tax Earnings from Continuing Operations, Adjusted EBITDA from Continuing Operations, Adjusted Earnings (Loss) Per Share (Diluted) from Continuing Operations, Debt Obligations/Adjusted EBITDA Ratio and Adjusted Net Leverage Ratio are non- GAAP financial measures and should not be considered alternatives to net income or any other performance measure derived in accordance with GAAP. Adjusted Pre-Tax Earnings from Continuing Operations excludes pre-tax earnings from severance and retention activities with DHL that ended in 2010, gains or losses from derivative instruments, impairment charges for aircraft, goodwill & intangibles, costs from termination of credit agreements, and pension settlement costs. Adjusted EBITDA from Continuing Operations is defined as EBITDA (Pretax Earnings (loss) from Continuing Operations Before Income Taxes minus Interest Income, plus Interest Expense and plus Depreciation and Amortization) excluding results from Severance & Retention Activities, gains or losses in derivative instruments, impairment charges for aircraft, goodwill & intangibles, costs from termination of credit agreements, and pension settlement costs. Debt Obligations/Adjusted EBITDA Ratio is defined as Debt Obligations (Long-term Debt Obligations plus Current Portion of Debt Obligations at end of period) divided by Adjusted EBITDA from Continuing Operations. Adjusted Earnings (Loss) per Share (Diluted) from Continuing Operations is defined as Earnings (Loss) per Share (Diluted) from Continuing Operations excluding impairment charges for aircraft, goodwill & intangibles, and pension settlement costs. Management uses these adjusted financial measures in conjunction with GAAP finance measures to monitor and evaluate its performance, including as a measure of financial strength. Adjusted Pre-tax Earnings, Adjusted EBITDA and Debt Obligations/Adjusted EBITDA Ratio should not be considered in isolation or as a substitute for analysis of the Company’s results as reported under GAAP, or as alternative measures of liquidity. 16

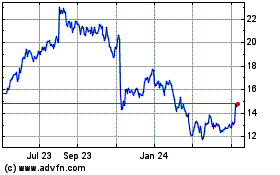

Air Transport Services (NASDAQ:ATSG)

Historical Stock Chart

From Mar 2024 to Apr 2024

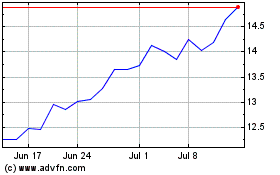

Air Transport Services (NASDAQ:ATSG)

Historical Stock Chart

From Apr 2023 to Apr 2024