Exhibit 10.1

AMENDMENT NUMBER THREE TO

MASTER TRANSACTION AGREEMENT AND OTHER TRANSACTION DOCUMENTS

This Amendment Number Three to Master Transaction Agreement and Other Transaction Documents (this “Amendment”) is entered into as of June 17, 2015 by and between Apple Inc., a California corporation (“Apple”), Liquidmetal Technologies, Inc., a Delaware corporation (“LMT”), Liquidmetal Coatings, LLC, a Delaware limited liability company (“LMC”), and Crucible Intellectual Property, LLC, a Delaware limited liability company (“LMT-SPE”), with reference to the following facts:

A. Apple, LMT, LMC and LMT-SPE have previously entered into that certain Master Transaction Agreement, made effective as of August 5, 2010 (as amended and modified, from time to time, the “MTA”).

B. Pursuant to the MTA, LMT and LMT-SPE entered into that certain Contribution Agreement dated as of August 5, 2010 (as amended and modified, from time to time, the “Contribution Agreement”) pursuant to which LMT agreed to contribute to LMT-SPE the LMT Technology at the Closing Date and for eighteen (18) months thereafter.

C. Apple, LMC, LMT and LMT-SPE have previously entered into that certain Amendment Number One to Master Transaction Agreement and Other Transaction Documents, dated June 15, 2012, pursuant to which, among other things, the Capture Period (as defined in the MTA), was extended through February 5, 2014 (“Amendment Number One”), and Amendment Number Two to Master Transaction Agreement and other Transaction Documents, dated May 17, 2014, pursuant to which, among other things, the Capture Period was extended through February 5, 2015 (“Amendment Number Two”, and together with Amendment Number One, the “Prior Amendments”).

D. Apple, LMC, LMT, and LMT-SPE hereby desire to extend Apple’s rights of first notice and first refusal, and Apple, LMC, LMT, and LMT-SPE hereby desire to further extend the Capture Period upon the terms and conditions set forth in this Amendment.

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto amend the agreements described in the recitals above, as follows:

1. DEFINITIONS. All initially capitalized terms used in this Amendment shall have the meanings given to them in the MTA unless specifically defined herein. For the avoidance of doubt, the term “LMT Technology” shall have the meaning set forth in Amendment Number One (after giving effect to Amendment Number Two and this Amendment).

2. AMENDMENTS.

(a) Section 1(a)(v) of the MTA (as amended by the Prior Amendments) is hereby further amended by replacing “February 5, 2015” with “February 5, 2016”.

(b) Section 9(A)(a) of the MTA (which was added to the MTA pursuant to Amendment Number One) is hereby replaced by the following:

“(a) Apple’s rights under this Section 9(A) will commence February 6, 2014 and expire on February 5, 2018.”

(c) Recital A of the Contribution Agreement (as amended by the Prior Amendments) is hereby further amended by replacing “February 5, 2015” with “February 5, 2016”.

(d) Section 1 of the Contribution Agreement (as amended by the Prior Amendments) is hereby further amended by replacing “February 5, 2015” with “February 5, 2016”.

3. SECTION 16 OF MTA. Section 16 of the MTA (as amended by the Prior Amendments) is by this reference thereto incorporated into this Amendment as if restated in its entirety herein, except that each reference therein to the MTA shall be deemed a reference to this Amendment. This Amendment constitutes the entire agreement between the parties relating to the subject matter hereof and supersedes and cancels all other prior agreements and understandings of the parties in connection with subject matter.

4. EFFECTIVENESS. The effectiveness of this Amendment is hereby conditioned upon receipt by Apple of a fully executed copy of this Amendment from each party hereto.

5. REAFFIRMATION. Each party hereto acknowledges and reaffirms all of its obligations and duties under the Transaction Documents.

6. LIMITED EFFECT. In the event of a conflict between the terms and provisions of this Amendment and the terms and provisions of the Transaction Documents, the terms and provisions of this Amendment shall govern. In all other respects, the Transaction Documents, as amended and supplemented hereby, shall remain in full force and effect.

7. COUNTERPARTS; EFFECTIVENESS. This Amendment may be executed in any number of counterparts and by different parties on separate counterparts, each of which when so executed and delivered shall be deemed to be an original. All such counterparts, taken together, shall constitute but one and the same Amendment. This Amendment shall become effective upon the execution of a counterpart of this Amendment by each of the parties hereto. This Amendment is a Transaction Document and is subject to all the terms and conditions, and entitled to all the protections, applicable to Transaction Documents generally.

[remainder of page left blank intentionally; signatures to follow]

IN WITNESS WHEREOF, the parties hereto have executed this Amendment as of the date first set forth above.

APPLE INC.,

a California corporation

By: /s/ Zadesky

Name: Zadesky

Title: VP Product Design

LIQUIDMETAL TECHNOLOGIES, INC.

By: /s/ Ricardo A. Salas

Name: Ricardo A. Salas

Title: Executive Vice President

LIQUIDMETAL COATINGS, LLC

By: /s/ Ricardo A. Salas

Name: Ricardo A. Salas

Title: Secretary

CRUCIBLE INTELLECTUAL PROPERTY, LLC

By: /s/ Ricardo A. Salas

Name: Ricardo A. Salas

Title: President

Amendment Number Three to Master Transaction Agreement

Exhibit 31.1

certificationS

I, Thomas Steipp, certify that:

1. I have reviewed this quarterly report on Form 10-Q of Liquidmetal Technologies, Inc.;

2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3. Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report;

4. The registrant's other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

a) Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

b) Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

c) Evaluated the effectiveness of the registrant's disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

d) Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and

5. The registrant's other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant's auditors and the audit committee of the registrant's board of directors (or persons performing the equivalent functions):

a) All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant's ability to record, process, summarize and report financial information; and

b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting.

Date: August 6, 2015 /s/ Thomas Steipp

Thomas Steipp

President and Chief Executive Officer

(Principal Executive Officer)

Exhibit 31.2

CERTIFICATIONS

I, Tony Chung, certify that:

1. I have reviewed this quarterly report on Form 10-Q of Liquidmetal Technologies, Inc.;

2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3. Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report;

4. The registrant's other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

a) Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

b) Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

c) Evaluated the effectiveness of the registrant's disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

d) Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and

5. The registrant's other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant's auditors and the audit committee of the registrant's board of directors (or persons performing the equivalent functions):

a) All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant's ability to record, process, summarize and report financial information; and

b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting.

Date: August 6, 2015 /s/ Tony Chung

Tony Chung

Chief Financial Officer

(Principal Financial and Accounting Officer)

Exhibit 32.1

WRITTEN STATEMENT OF THE CHIEF EXECUTIVE OFFICER

PURSUANT TO 18 U.S.C. 1350

Solely for the purposes of complying with 18 U.S.C. 1350, I, the undersigned Chief Executive Officer of Liquidmetal Technologies, Inc. (the “Company”), hereby certify, based on my knowledge, that the Quarterly Report on Form 10-Q of the Company for the quarter ended June 30, 2015 (the “Report”) fully complies with the requirements of Section 13(a) of the Securities Exchange Act of 1934 and that the information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company.

/s/ Thomas Steipp

Thomas Steipp, President and Chief Executive Officer

August 6, 2015

Exhibit 32.2

WRITTEN STATEMENT OF THE CHIEF FINANCIAL OFFICER

PURSUANT TO 18 U.S.C. 1350

Solely for the purposes of complying with 18 U.S.C. 1350, I, the undersigned Chief Financial Officer of Liquidmetal Technologies, Inc. (the “Company”), hereby certify, based on my knowledge, that the Quarterly Report on Form 10-Q of the Company for the quarter ended June 30, 2015 (the “Report”) fully complies with the requirements of Section 13(a) of the Securities Exchange Act of 1934 and that the information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company.

/s/ Tony Chung

Tony Chung, Chief Financial Officer

August 6, 2015

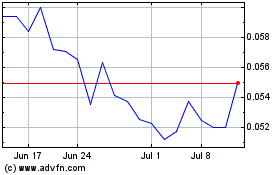

Liquidmetal Technologies (QB) (USOTC:LQMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

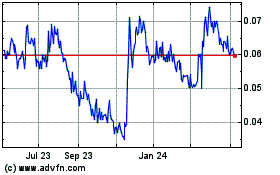

Liquidmetal Technologies (QB) (USOTC:LQMT)

Historical Stock Chart

From Apr 2023 to Apr 2024