United States

Securities and Exchange Commission

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report: July 29, 2015

(Date of Earliest Event Reported)

REALTY INCOME CORPORATION

(Exact name of registrant as specified in its charter)

|

Maryland |

|

1-13374 |

|

33-0580106 |

|

(State or Other Jurisdiction of

Incorporation or Organization) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

11995 El Camino Real, San Diego, California 92130

(Address of principal executive offices)

(858) 284-5000

(Registrant’s telephone number, including area code)

N/A

(former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition

On July 29, 2015, Realty Income Corporation (the “Company”) issued a press release setting forth its results of operations for the quarter and six months ended June 30, 2015. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference. This information, including the information contained in the press release, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and is not incorporated by reference into any of the Company’s filings, whether made before or after the date hereof, regardless of any general incorporation language in any such filing.

Additionally, on July 29, 2015, the Company made available on its website a financial supplement containing operating and financial data of the Company (“Supplemental Operating and Financial Data”) for the quarter and six months ended June 30, 2015 and such Supplemental Operating and Financial Data is furnished as Exhibit 99.2 hereto. The Supplemental Operating and Financial Data included as Exhibit 99.2 to this report is being furnished pursuant to this Item 2.02 of Form 8-K and is also being furnished under Item 7.01—“Regulation FD Disclosure” of Form 8-K, and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act and is not incorporated by reference into any of the Company’s filings, whether made before or after the date hereof, regardless of any general incorporation language in any such filing.

Item 7.01 Regulation FD Disclosure.

On July 29, 2015, the Company made available on its website a financial supplement containing operating and financial data of the Company (“Supplemental Operating and Financial Data”) for the quarter and six months ended June 30, 2015 and such Supplemental Operating and Financial Data is furnished as Exhibit 99.2 hereto. The Supplemental Operating and Financial Data included as Exhibit 99.2 to this report is being furnished pursuant to this Item 7.01 of Form 8-K and is also being furnished under Item 2.02—“Results of Operations and Financial Condition” of Form 8-K, and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act and is not incorporated by reference into any of the Company’s filings, whether made before or after the date hereof, regardless of any general incorporation language in any such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

99.1 Press release dated July 29, 2015

99.2 Supplemental Operating and Financial Data for the quarter and six months ended June 30, 2015

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Dated: July 29, 2015 |

REALTY INCOME CORPORATION |

|

|

|

|

|

By: |

/s/ MICHAEL R. PFEIFFER

|

|

|

|

Michael R. Pfeiffer |

|

|

|

Executive Vice President, General Counsel

and Secretary |

INDEX TO EXHIBITS

Exhibit No. Description

99.1 Press release dated July 29, 2015

99.2 Supplemental Operating and Financial Data for the quarter and six months ended June 30, 2015

Exhibit 99.1

REALTY INCOME ANNOUNCES RECORD OPERATING RESULTS FOR

SECOND QUARTER AND FIRST SIX MONTHS OF 2015

SAN DIEGO, CALIFORNIA, July 29, 2015...Realty Income Corporation (Realty Income, NYSE: O), The Monthly Dividend Company®, today announced record operating results for the second quarter and first six months ended June 30, 2015. All per share amounts presented in this press release are on a diluted per common share basis unless stated otherwise.

COMPANY HIGHLIGHTS:

For the quarter ended June 30, 2015:

· AFFO per share increased 6.3% to $0.68, compared to the quarter ended June 30, 2014

· Invested $721.3 million in 100 new properties and properties under development or expansion

· Raised equity capital net proceeds of $382 million

· Added to the S&P 500 index

· Increased the monthly dividend in June for the 81st time and for the 71st consecutive quarter

· Dividends paid per common share increased 4.0%, compared to the quarter ended June 30, 2014

· Closed on a new $2.25 billion unsecured credit facility and term loan to replace the previous $1.5 billion unsecured credit facility

CEO Comments

“We continue to experience excellent momentum in our business,” said John P. Case, Realty Income’s Chief Executive Officer. “During the second quarter, we completed a near-record volume of acquisitions, executed attractively-priced capital markets transactions, and grew our portfolio occupancy from the first quarter. These activities contributed to record quarterly AFFO per share of $0.68, an increase of 6.3% year-over-year.”

“We completed $721.3 million in acquisitions during the second quarter, achieving our second-highest quarterly volume of property-level acquisitions in the company’s history. This brings us to $931.2 million in acquisitions completed during the first half of the year. We largely funded our year-to-date acquisition activities by raising $483.5 million of attractively-priced equity capital early in the year and executing a $250 million term loan at a fixed rate of 2.67% that comes due in 2020 when we have no scheduled unsecured debt maturities. We also recast and expanded our revolving credit facility this quarter to $2.0 billion, decreasing our all-in drawn borrowing costs by 20 basis points to LIBOR plus 1.05%. We are well-positioned with approximately $1.6 billion available on the facility to fund our future acquisition activities. We now estimate completing approximately $1.25 billion in acquisitions in 2015, an increase from our previous estimate of $1 billion.”

“With the backdrop of our positive performance during the first half of the year and the continued scalability of our business, we are raising and tightening our earnings guidance for the year from our previous AFFO per share estimate of $2.66 - $2.71. We now expect AFFO per share for 2015 of $2.69 - $2.73, representing year-over-year growth of 4.7% - 6.2%.”

Financial Results

Revenue

Revenue for the quarter ended June 30, 2015 increased 11.1% to $253.9 million, as compared to $228.6 million for the same quarter in 2014. Revenue for the six months ended June 30, 2015 increased 11.2% to $500.7 million, as compared to $450.2 million for the same period in 2014.

Net Income Available to Common Stockholders

Net income available to common stockholders for the quarter ended June 30, 2015 was $59.3 million, as compared to $51.4 million for the same quarter in 2014. Net income per share for the quarter ended June 30, 2015 was $0.25, as compared to $0.23 for the same quarter in 2014.

Net income available to common stockholders for the six months ended June 30, 2015 was $119.8 million, as compared to $98.6 million for the same period in 2014. Net income per share for the six months ended June 30, 2015 was $0.52, as compared to $0.46 for the same period in 2014.

The calculation to determine net income for a real estate company includes impairments and/or gains on property sales. Impairments and/or gains on property sales vary from quarter to quarter. This variance can significantly impact net income and period to period comparisons.

Funds From Operations (FFO) Available to Common Stockholders

FFO for the quarter ended June 30, 2015 increased 12.0% to $159.5 million, as compared to $142.4 million for the same quarter in 2014. FFO per share for the quarter ended June 30, 2015 increased 7.8% to $0.69, as compared to $0.64 for the same quarter in 2014.

FFO for the six months ended June 30, 2015 increased 12.8% to $312.4 million, as compared to $276.9 million for the same period in 2014. FFO per share for the six months ended June 30, 2015 increased 5.4% to $1.36, as compared to $1.29 for the same period in 2014.

Adjusted Funds From Operations (AFFO) Available to Common Stockholders

AFFO for the quarter ended June 30, 2015 increased 12.7% to $159.1 million, as compared to $141.2 million for the same quarter in 2014. AFFO per share for the quarter ended June 30, 2015 increased 6.3% to $0.68, as compared to $0.64 for the same quarter in 2014.

AFFO for the six months ended June 30, 2015 increased 13.7% to $311.2 million, as compared to $273.8 million for the same period in 2014. AFFO per share for the six months ended June 30, 2015 increased 6.3% to $1.36, as compared to $1.28 for the same period in 2014.

The company considers FFO and AFFO to be appropriate supplemental measures of a Real Estate Investment Trust’s (REIT’s) operating performance. Realty Income defines FFO consistent with the National Association of Real Estate Investment Trust’s (NAREIT’s) definition, as net income available to common stockholders, plus depreciation and amortization of real estate assets, plus impairments of real estate, reduced by gains on sales of investment properties and extraordinary items. AFFO further adjusts FFO for unique revenue and expense items, which the company believes are not as pertinent to the measurement of the company’s ongoing operating performance. See the reconciliations of net income available to common stockholders to FFO and AFFO on page six.

Dividend Information

In June 2015, Realty Income announced the 71st consecutive quarterly dividend increase, which is the 81st increase in the amount of the dividend since the company’s listing on the New York Stock Exchange in 1994. The annualized dividend amount as of June 30, 2015 was $2.28 per share. The amount of monthly dividends paid per share increased 4.0% to $0.569 in the second quarter of 2015 compared to $0.547 for the same period in 2014. Realty Income has a dividend reinvestment and stock purchase program that can be accessed at www.realtyincome.com. The program is administered by Wells Fargo Shareowner Services.

Real Estate Portfolio Update

As of June 30, 2015, Realty Income’s portfolio of freestanding, single-tenant properties consisted of 4,452 properties located in 49 states and Puerto Rico, leased to 235 commercial tenants doing business in 47 industries. The properties are leased under long-term, net leases with a weighted average remaining lease term of approximately 10.3 years.

Portfolio Management Activities

The company’s portfolio of commercial real estate, owned primarily under 10- to 20-year net leases, continues to perform well and provide dependable rental revenue supporting the payment of monthly dividends. As of June 30, 2015, portfolio occupancy was 98.2% with 81 properties available for lease out of a total of 4,452 properties in the portfolio, as compared to 98.3%, with 74 properties available for lease as of June 30, 2014. Economic occupancy, or occupancy as measured by rental revenue, was 99.2% as of June 30, 2015, as compared to 99.1% as of June 30, 2014.

Since March 31, 2015, when the company reported 86 properties available for lease, the company had 80 lease expirations, re-leased 81 properties and sold four vacant properties. Of the 81 properties re-leased during the second quarter of 2015, 73 properties were re-leased to existing tenants, one was re-leased to a new tenant without vacancy, and seven were re-leased to new tenants after a period of vacancy. The annual new rent on these re-leases was $12.8 million, as compared to the previous annual rent of $12.1 million on the same properties, representing a rent recapture rate of 105.7%.

- 2 -

Rent Increases

During the quarter ended June 30, 2015, same store rents on 3,681 properties under lease increased 1.5% to $200.2 million, as compared to $197.2 million for the same quarter in 2014. For the six months ended June 30, 2015, same store rents on 3,681 properties under lease increased 1.4% to $400.4 million, as compared to $394.9 million for the same period in 2014.

Investments in Real Estate

During the quarter ended June 30, 2015, Realty Income invested $721.3 million in 100 new properties and properties under development or expansion, located in 33 states. These properties are 100% leased with a weighted average lease term of approximately 18.2 years and an initial average lease yield of 6.3%. The tenants occupying the new properties operate in 13 industries, and the property types consist of 97.8% retail and 2.2% industrial, based on rental revenue. Approximately 49% of the rental revenue generated from acquisitions during the second quarter of 2015 is from investment grade-rated tenants.

During the six months ended June 30, 2015, Realty Income invested approximately $931.2 million in 166 new properties and properties under development or expansion, located in 35 states. These properties are 100% leased with a weighted average lease term of approximately 17.5 years and an initial average lease yield of 6.4%. The tenants occupying the new properties operate in 16 industries, and the property types consist of 92.1% retail and 7.9% industrial, based on rental revenue. Approximately 52% of the rental revenue generated from the year-to-date 2015 acquisitions is from investment grade-rated tenants.

Property Dispositions

During the quarter ended June 30, 2015, Realty Income sold five properties for $8.2 million, with a gain on sales of $3.7 million, as compared to six properties sold for $7.0 million, with a gain on sales of $2.0 million, during the same quarter in 2014. During the six months ended June 30, 2015, Realty Income sold 14 properties for $30.5 million, with a gain on sales of $10.9 million, as compared to 17 properties sold for $19.7 million, with a gain on sales of $5.8 million, during the same period in 2014.

Liquidity and Capital Markets

New Credit Facility

In June 2015, Realty Income closed on a $2.25 billion unsecured credit facility. This new credit facility is comprised of a $2.0 billion revolving credit facility and a $250 million five-year unsecured term loan. As of June 30, 2015, $1.57 billion was available on the revolving credit facility.

Issued 5.5 Million Shares in Common Stock Offering

In April 2015, Realty Income issued 5.5 million common shares. Net proceeds of $276.4 million were used to repay a portion of borrowings under the company’s revolving credit facility.

Direct Stock Purchase and Dividend Reinvestment Plan Activities

During the quarter ended June 30, 2015, Realty Income issued 2,312,304 common shares via its Direct Stock Purchase Plan, generating net proceeds of $105.5 million. During the six months ended June 30, 2015, Realty Income issued 4,335,580 common shares via its Direct Stock Purchase Plan, generating net proceeds of $207.1 million.

2015 Earnings Guidance

FFO per share for 2015 should range from $2.72 to $2.77 per share, an increase of 5.4% to 7.4% over 2014 FFO per share of $2.58. FFO per share for 2015 is based on a net income per share range of $1.01 to $1.06, plus estimated real estate depreciation of $1.80 per share, and reduced by potential estimated gains on sales of investment properties of $0.09 per share (in accordance with NAREIT’s definition of FFO).

AFFO per share for 2015 should range from $2.69 to $2.73 per share, an increase of 4.7% to 6.2% over the 2014 AFFO per share of $2.57. AFFO further adjusts FFO for unique revenue and expense items, which are not as pertinent to the measurement of the company’s ongoing operating performance.

Additional earnings guidance detail can be found in the company’s supplemental materials available on Realty Income’s corporate website at http://investors.realtyincome.com/quarterly-results.

Conference Call Information

In conjunction with Realty Income’s quarterly results, the company will host a conference call on July 30, 2015 at 11:30 a.m. PDT to discuss the operating results. To access the conference, dial (888) 504-7963. When prompted, provide the access code: 3578577.

- 3 -

Shareholders may also access a telephone replay of the conference call by calling (888) 203-1112 and entering the access code: 3578577. The telephone replay will be available through August 13, 2015. A live webcast will be available in listen-only mode by clicking on the webcast link at www.realtyincome.com. A replay of the conference call webcast will be available approximately two hours after the conclusion of the live broadcast. The webcast replay will be available through August 13, 2015. No access code is required for this replay.

Supplemental Materials and Website

Supplemental materials on the second quarter and year-to-date 2015 operating results are available on Realty Income’s corporate website at http://investors.realtyincome.com/quarterly-results.

About Realty Income

Realty Income, The Monthly Dividend Company®, is an S&P 500 company dedicated to providing shareholders with dependable monthly income. The company is structured as a REIT and its monthly dividends are supported by the cash flow from over 4,400 real estate properties owned under long-term lease agreements with regional and national commercial tenants. To date, the company has declared 541 consecutive common stock monthly dividends throughout its 46-year operating history and increased the dividend 81 times since Realty Income’s public listing in 1994 (NYSE: O). The company is an active buyer of net-leased commercial properties nationwide. Additional information about the company can be obtained from the corporate website at www.realtyincome.com or www.twitter.com/realtyincome.

Forward-Looking Statements

Statements in this press release that are not strictly historical are “forward-looking” statements. Forward-looking statements involve known and unknown risks, which may cause the company’s actual future results to differ materially from expected results. These risks include, among others, general economic conditions, local real estate conditions, tenant financial health, the availability of capital to finance planned growth, continued volatility and uncertainty in the credit markets and broader financial markets, property acquisitions and the timing of these acquisitions, charges for property impairments, and the outcome of any legal proceedings to which the company is a party, as described in the company’s filings with the Securities and Exchange Commission. Consequently, forward-looking statements should be regarded solely as reflections of the company’s current operating plans and estimates. Actual operating results may differ materially from what is expressed or forecast in this press release. The company undertakes no obligation to publicly release the results of any revisions to these forward-looking statements that may be made to reflect events or circumstances after the date these statements were made.

Investor Contact:

Jonathan Pong, CFA, CPA

AVP, Capital Markets

(858) 284-5177

- 4 -

CONSOLIDATED STATEMENTS OF INCOME

(dollars in thousands, except per share amounts) (unaudited)

|

|

|

Three Months |

|

Three Months |

|

Six Months |

|

Six Months |

|

|

|

|

Ended 6/30/15 |

|

Ended 6/30/14 |

|

Ended 6/30/15 |

|

Ended 6/30/14 |

|

|

REVENUE |

|

|

|

|

|

|

|

|

|

|

Rental |

|

$ |

241,431 |

|

$ |

221,868 |

|

$ |

476,554 |

|

$ |

435,989 |

|

|

Tenant reimbursements |

|

11,607 |

|

6,169 |

|

21,570 |

|

12,597 |

|

|

Other |

|

822 |

|

609 |

|

2,604 |

|

1,632 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenue |

|

253,860 |

|

228,646 |

|

500,728 |

|

450,218 |

|

|

|

|

|

|

|

|

|

|

|

|

|

EXPENSES |

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

101,101 |

|

92,894 |

|

199,138 |

|

182,864 |

|

|

Interest |

|

58,680 |

|

52,712 |

|

117,148 |

|

104,432 |

|

|

General and administrative |

|

12,609 |

|

11,587 |

|

25,471 |

|

24,473 |

|

|

Property (including reimbursable) |

|

14,937 |

|

10,127 |

|

28,914 |

|

20,704 |

|

|

Income taxes |

|

628 |

|

570 |

|

1,702 |

|

1,661 |

|

|

Provisions for impairment |

|

3,230 |

|

499 |

|

5,317 |

|

2,182 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total expenses |

|

191,185 |

|

168,389 |

|

377,690 |

|

336,316 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain on sales of real estate |

|

3,675 |

|

1,964 |

|

10,893 |

|

3,236 |

|

|

Income from continuing operations |

|

66,350 |

|

62,221 |

|

133,931 |

|

117,138 |

|

|

Income from discontinued operations |

|

- |

|

20 |

|

- |

|

3,097 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

66,350 |

|

62,241 |

|

133,931 |

|

120,235 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to noncontrolling interests |

|

(263 |

) |

(339 |

) |

(581 |

) |

(671 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to the Company |

|

66,087 |

|

61,902 |

|

133,350 |

|

119,564 |

|

|

Preferred stock dividends |

|

(6,770 |

) |

(10,482 |

) |

(13,540 |

) |

(20,965 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Net income available to common stockholders |

|

$ |

59,317 |

|

$ |

51,420 |

|

$ |

119,810 |

|

$ |

98,599 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Funds from operations (FFO) available to common stockholders |

|

$ |

159,470 |

|

$ |

142,409 |

|

$ |

312,370 |

|

$ |

276,910 |

|

|

Adjusted funds from operations (AFFO) available to common stockholders |

|

$ |

159,060 |

|

$ |

141,178 |

|

$ |

311,184 |

|

$ |

273,822 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Per share information for common stockholders: |

|

|

|

|

|

|

|

|

|

|

Income from continuing operations: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.26 |

|

$ |

0.23 |

|

$ |

0.52 |

|

$ |

0.45 |

|

|

Diluted |

|

$ |

0.25 |

|

$ |

0.23 |

|

$ |

0.52 |

|

$ |

0.45 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.26 |

|

$ |

0.23 |

|

$ |

0.52 |

|

$ |

0.46 |

|

|

Diluted |

|

$ |

0.25 |

|

$ |

0.23 |

|

$ |

0.52 |

|

$ |

0.46 |

|

|

|

|

|

|

|

|

|

|

|

|

|

FFO, basic and diluted |

|

$ |

0.69 |

|

$ |

0.64 |

|

$ |

1.36 |

|

$ |

1.29 |

|

|

|

|

|

|

|

|

|

|

|

|

|

AFFO, basic and diluted |

|

$ |

0.68 |

|

$ |

0.64 |

|

$ |

1.36 |

|

$ |

1.28 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash dividends paid per common share |

|

$ |

0.569 |

|

$ |

0.547 |

|

$ |

1.130 |

|

$ |

1.094 |

|

- 5 -

FUNDS FROM OPERATIONS (FFO)

(dollars in thousands, except per share amounts)

We define FFO, a non-GAAP measure, consistent with NAREIT’s definition, as net income available to common stockholders, plus depreciation and amortization of real estate assets, plus impairments of real estate assets, reduced by gains on sales of investment properties and extraordinary items.

|

|

|

Three Months |

|

Three Months |

|

Six Months |

|

Six Months |

|

|

|

|

Ended 6/30/15 |

|

Ended 6/30/14 |

|

Ended 6/30/15 |

|

Ended 6/30/14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income available to common stockholders |

|

$ |

59,317 |

|

$ |

51,420 |

|

$ |

119,810 |

|

$ |

98,599 |

|

|

Depreciation and amortization |

|

101,101 |

|

92,894 |

|

199,138 |

|

182,864 |

|

|

Depreciation of furniture, fixtures and equipment |

|

(240 |

) |

(104 |

) |

(425 |

) |

(196 |

) |

|

Provisions for impairment on investment properties |

|

3,230 |

|

499 |

|

5,317 |

|

2,182 |

|

|

Gain on sale of investment properties: |

|

|

|

|

|

|

|

|

|

|

Continuing operations |

|

(3,675 |

) |

(1,964 |

) |

(10,893 |

) |

(3,236 |

) |

|

Discontinued operations |

|

- |

|

- |

|

- |

|

(2,607 |

) |

|

FFO adjustments allocable to noncontrolling interests |

|

(263 |

) |

(336 |

) |

(577 |

) |

(696 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

FFO available to common stockholders |

|

$ |

159,470 |

|

$ |

142,409 |

|

$ |

312,370 |

|

$ |

276,910 |

|

|

|

|

|

|

|

|

|

|

|

|

|

FFO per common share, basic and diluted |

|

$ |

0.69 |

|

$ |

0.64 |

|

$ |

1.36 |

|

$ |

1.29 |

|

|

Distributions paid to common stockholders |

|

$ |

131,595 |

|

$ |

121,229 |

|

$ |

258,277 |

|

$ |

234,643 |

|

|

FFO in excess of distributions paid to common stockholders |

|

$ |

27,875 |

|

$ |

21,180 |

|

$ |

54,093 |

|

$ |

42,267 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares used for FFO: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

232,403,586 |

|

220,979,955 |

|

228,932,782 |

|

214,039,692 |

|

|

Diluted |

|

232,886,185 |

|

221,043,619 |

|

229,061,762 |

|

214,089,629 |

|

ADJUSTED FUNDS FROM OPERATIONS (AFFO)

(dollars in thousands, except per share amounts)

We define AFFO as FFO adjusted for unique revenue and expense items, which the company believes are not as pertinent to the measurement of the company’s ongoing operating performance. Most companies in our industry use a similar measurement to AFFO, but they may use the term “CAD” (for Cash Available for Distribution) or “FAD” (for Funds Available for Distribution).

|

|

|

Three Months |

|

Three Months |

|

Six Months |

|

Six Months |

|

|

|

|

Ended 6/30/15 |

|

Ended 6/30/14 |

|

Ended 6/30/15 |

|

Ended 6/30/14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income available to common stockholders |

|

$ |

59,317 |

|

$ |

51,420 |

|

$ |

119,810 |

|

$ |

98,599 |

|

|

Cumulative adjustments to calculate FFO (1) |

|

100,153 |

|

90,989 |

|

192,560 |

|

178,311 |

|

|

FFO available to common stockholders |

|

159,470 |

|

142,409 |

|

312,370 |

|

276,910 |

|

|

Amortization of share-based compensation |

|

2,811 |

|

2,752 |

|

5,362 |

|

5,449 |

|

|

Amortization of deferred financing costs (2) |

|

1,281 |

|

1,165 |

|

2,575 |

|

2,241 |

|

|

Amortization of net mortgage premiums |

|

(1,745 |

) |

(2,414 |

) |

(3,629 |

) |

(4,775 |

) |

|

Gain on early extinguishment of mortgage debt |

|

(117 |

) |

(595 |

) |

(195 |

) |

(619 |

) |

|

Loss on interest rate swaps |

|

899 |

|

984 |

|

1,958 |

|

1,042 |

|

|

Capitalized leasing costs and commissions |

|

(149 |

) |

(275 |

) |

(461 |

) |

(467 |

) |

|

Capitalized building improvements |

|

(977 |

) |

(1,090 |

) |

(2,009 |

) |

(2,267 |

) |

|

Straight-line rent |

|

(4,444 |

) |

(3,977 |

) |

(8,635 |

) |

(7,913 |

) |

|

Amortization of above and below-market leases |

|

1,954 |

|

2,213 |

|

3,696 |

|

4,207 |

|

|

Other adjustments (3) |

|

77 |

|

6 |

|

152 |

|

14 |

|

|

AFFO available to common stockholders |

|

$ |

159,060 |

|

$ |

141,178 |

|

$ |

311,184 |

|

$ |

273,822 |

|

|

|

|

|

|

|

|

|

|

|

|

|

AFFO per common share, basic and diluted |

|

$ |

0.68 |

|

$ |

0.64 |

|

$ |

1.36 |

|

$ |

1.28 |

|

|

Distributions paid to common stockholders |

|

$ |

131,595 |

|

$ |

121,229 |

|

$ |

258,277 |

|

$ |

234,643 |

|

|

AFFO in excess of distributions paid to common stockholders |

|

$ |

27,465 |

|

$ |

19,949 |

|

$ |

52,907 |

|

$ |

39,179 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares used for AFFO: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

232,403,586 |

|

220,979,955 |

|

228,932,782 |

|

214,039,692 |

|

|

Diluted |

|

232,886,185 |

|

221,043,619 |

|

229,061,762 |

|

214,089,629 |

|

(1) See FFO calculation above for reconciling items.

(2) Includes the amortization of costs incurred and capitalized upon issuance of our notes payable, assumption of our mortgages payable and upon issuance of our term loans. The deferred financing costs are being amortized over the lives of the respective mortgages and term loans. No costs associated with our credit facility agreements or annual fees paid to credit rating agencies have been included.

(3) Includes adjustments allocable to both noncontrolling interests and capital lease obligations.

- 6 -

HISTORICAL FFO AND AFFO

(dollars in thousands, except per share amounts)

|

For the three months ended June 30, |

|

2015 |

|

2014 |

|

2013 |

|

2012 |

|

2011 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income available to common stockholders |

|

$ |

59,317 |

|

$ |

51,420 |

|

$ |

45,957 |

|

$ |

32,950 |

|

$ |

33,185 |

|

|

Depreciation and amortization |

|

100,861 |

|

92,790 |

|

74,471 |

|

35,571 |

|

29,000 |

|

|

Provisions for impairment on investment properties |

|

3,230 |

|

499 |

|

2,496 |

|

- |

|

10 |

|

|

Gain on sales of investment properties |

|

(3,675 |

) |

(1,964 |

) |

(5,744 |

) |

(3,354 |

) |

(1,251 |

) |

|

Merger-related costs |

|

- |

|

- |

|

605 |

|

- |

|

- |

|

|

FFO adjustments allocable to noncontrolling interests |

|

(263 |

) |

(336 |

) |

(220 |

) |

- |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FFO |

|

$ |

159,470 |

|

$ |

142,409 |

|

$ |

117,565 |

|

$ |

65,167 |

|

$ |

60,944 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FFO per diluted share |

|

$ |

0.69 |

|

$ |

0.64 |

|

$ |

0.60 |

|

$ |

0.49 |

|

$ |

0.48 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AFFO |

|

$ |

159,060 |

|

$ |

141,178 |

|

$ |

115,584 |

|

$ |

66,499 |

|

$ |

62,370 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AFFO per diluted share |

|

$ |

0.68 |

|

$ |

0.64 |

|

$ |

0.59 |

|

$ |

0.50 |

|

$ |

0.49 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash dividends paid per share |

|

$ |

0.569 |

|

$ |

0.547 |

|

$ |

0.544 |

|

$ |

0.437 |

|

$ |

0.434 |

|

|

Weighted average diluted shares outstanding |

|

232,886,185 |

|

221,043,619 |

|

195,759,091 |

|

132,828,540 |

|

126,202,047 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the six months ended June 30, |

|

2015 |

|

2014 |

|

2013 |

|

2012 |

|

2011 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income available to common stockholders |

|

$ |

119,810 |

|

$ |

98,599 |

|

$ |

108,692 |

|

$ |

59,022 |

|

$ |

63,120 |

|

|

Depreciation and amortization |

|

198,713 |

|

182,668 |

|

141,673 |

|

70,806 |

|

55,791 |

|

|

Provisions for impairment on investment properties |

|

5,317 |

|

2,182 |

|

2,952 |

|

- |

|

210 |

|

|

Gain on sales of investment properties |

|

(10,893 |

) |

(5,843 |

) |

(44,304 |

) |

(3,965 |

) |

(1,379 |

) |

|

Merger-related costs |

|

- |

|

- |

|

12,635 |

|

- |

|

- |

|

|

FFO adjustments allocable to noncontrolling interests |

|

(577 |

) |

(696 |

) |

(395 |

) |

- |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FFO |

|

$ |

312,370 |

|

$ |

276,910 |

|

$ |

221,253 |

|

$ |

125,863 |

|

$ |

117,742 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FFO per diluted share |

|

$ |

1.36 |

|

$ |

1.29 |

|

$ |

1.20 |

|

$ |

0.95 |

|

$ |

0.96 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AFFO |

|

$ |

311,184 |

|

$ |

273,822 |

|

$ |

219,547 |

|

$ |

132,793 |

|

$ |

120,610 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AFFO per diluted share |

|

$ |

1.36 |

|

$ |

1.28 |

|

$ |

1.19 |

|

$ |

1.00 |

|

$ |

0.98 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash dividends paid per share |

|

$ |

1.130 |

|

$ |

1.094 |

|

$ |

1.057 |

|

$ |

0.874 |

|

$ |

0.866 |

|

|

Weighted average diluted shares outstanding |

|

229,061,762 |

|

214,089,629 |

|

183,873,647 |

|

132,785,213 |

|

122,691,418 |

|

- 7 -

REALTY INCOME CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

June 30, 2015 and December 31, 2014

(dollars in thousands, except per share data)

|

|

|

2015 |

|

2014 |

|

|

ASSETS |

|

(unaudited) |

|

|

|

|

Real estate, at cost: |

|

|

|

|

|

|

Land |

|

$ |

3,222,805 |

|

$ |

3,046,372 |

|

|

Buildings and improvements |

|

8,792,676 |

|

8,107,199 |

|

|

Total real estate, at cost |

|

12,015,481 |

|

11,153,571 |

|

|

Less accumulated depreciation and amortization |

|

(1,534,780 |

) |

(1,386,871 |

) |

|

Net real estate held for investment |

|

10,480,701 |

|

9,766,700 |

|

|

Real estate held for sale, net |

|

8,965 |

|

14,840 |

|

|

Net real estate |

|

10,489,666 |

|

9,781,540 |

|

|

Cash and cash equivalents |

|

18,741 |

|

3,852 |

|

|

Accounts receivable, net |

|

70,318 |

|

64,386 |

|

|

Acquired lease intangible assets, net |

|

1,051,713 |

|

1,039,724 |

|

|

Goodwill |

|

15,386 |

|

15,470 |

|

|

Other assets, net |

|

82,490 |

|

107,650 |

|

|

Total assets |

|

$ |

11,728,314 |

|

$ |

11,012,622 |

|

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

Distributions payable |

|

$ |

47,089 |

|

$ |

43,675 |

|

|

Accounts payable and accrued expenses |

|

112,824 |

|

123,287 |

|

|

Acquired lease intangible liabilities, net |

|

237,946 |

|

220,469 |

|

|

Other liabilities |

|

40,458 |

|

53,145 |

|

|

Lines of credit payable |

|

430,000 |

|

223,000 |

|

|

Term loans |

|

320,000 |

|

70,000 |

|

|

Mortgages payable, net |

|

769,461 |

|

852,575 |

|

|

Notes payable, net |

|

3,786,063 |

|

3,785,372 |

|

|

Total liabilities |

|

5,743,841 |

|

5,371,523 |

|

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

Preferred stock and paid in capital, par value $0.01 per share, 69,900,000 shares authorized, 16,350,000 shares issued and outstanding as of June 30, 2015 and December 31, 2014 |

|

395,378 |

|

395,378 |

|

|

Common stock and paid in capital, par value $0.01 per share, 370,100,000 shares authorized, 234,857,578 shares issued and outstanding as of June 30, 2015 and 224,881,192 shares issued and outstanding as of December 31, 2014 |

|

6,953,679 |

|

6,464,987 |

|

|

Distributions in excess of net income |

|

(1,388,854 |

) |

(1,246,964 |

) |

|

Total stockholders’ equity |

|

5,960,203 |

|

5,613,401 |

|

|

Noncontrolling interests |

|

24,270 |

|

27,698 |

|

|

Total equity |

|

5,984,473 |

|

5,641,099 |

|

|

Total liabilities and equity |

|

$ |

11,728,314 |

|

$ |

11,012,622 |

|

- 8 -

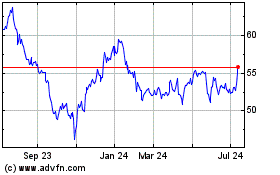

Realty Income Performance vs. Major Stock Indices

|

|

|

|

|

|

|

Equity |

|

|

|

|

|

|

|

|

|

NASDAQ |

|

|

|

Realty Income |

|

REIT Index (1) |

|

DJIA |

|

S&P 500 |

|

Composite |

|

|

|

Dividend |

|

Total |

|

Dividend |

|

Total |

|

Dividend |

|

Total |

|

Dividend |

|

Total |

|

Dividend |

|

Total |

|

|

|

yield |

|

return (2) |

|

yield |

|

return (3) |

|

yield |

|

return (3) |

|

yield |

|

return (3) |

|

yield |

|

return (4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10/18 to 12/31/1994 |

|

10.5% |

|

10.8% |

|

7.7% |

|

0.0% |

|

2.9% |

|

(1.6%) |

|

2.9% |

|

(1.2%) |

|

0.5% |

|

(1.7%) |

|

1995 |

|

8.3% |

|

42.0% |

|

7.4% |

|

15.3% |

|

2.4% |

|

36.9% |

|

2.3% |

|

37.6% |

|

0.6% |

|

39.9% |

|

1996 |

|

7.9% |

|

15.4% |

|

6.1% |

|

35.3% |

|

2.2% |

|

28.9% |

|

2.0% |

|

23.0% |

|

0.2% |

|

22.7% |

|

1997 |

|

7.5% |

|

14.5% |

|

5.5% |

|

20.3% |

|

1.8% |

|

24.9% |

|

1.6% |

|

33.4% |

|

0.5% |

|

21.6% |

|

1998 |

|

8.2% |

|

5.5% |

|

7.5% |

|

(17.5%) |

|

1.7% |

|

18.1% |

|

1.3% |

|

28.6% |

|

0.3% |

|

39.6% |

|

1999 |

|

10.5% |

|

(8.7%) |

|

8.7% |

|

(4.6%) |

|

1.3% |

|

27.2% |

|

1.1% |

|

21.0% |

|

0.2% |

|

85.6% |

|

2000 |

|

8.9% |

|

31.2% |

|

7.5% |

|

26.4% |

|

1.5% |

|

(4.7%) |

|

1.2% |

|

(9.1%) |

|

0.3% |

|

(39.3%) |

|

2001 |

|

7.8% |

|

27.2% |

|

7.1% |

|

13.9% |

|

1.9% |

|

(5.5%) |

|

1.4% |

|

(11.9%) |

|

0.3% |

|

(21.1%) |

|

2002 |

|

6.7% |

|

26.9% |

|

7.1% |

|

3.8% |

|

2.6% |

|

(15.0%) |

|

1.9% |

|

(22.1%) |

|

0.5% |

|

(31.5%) |

|

2003 |

|

6.0% |

|

21.0% |

|

5.5% |

|

37.1% |

|

2.3% |

|

28.3% |

|

1.8% |

|

28.7% |

|

0.6% |

|

50.0% |

|

2004 |

|

5.2% |

|

32.7% |

|

4.7% |

|

31.6% |

|

2.2% |

|

5.6% |

|

1.8% |

|

10.9% |

|

0.6% |

|

8.6% |

|

2005 |

|

6.5% |

|

(9.2%) |

|

4.6% |

|

12.2% |

|

2.6% |

|

1.7% |

|

1.9% |

|

4.9% |

|

0.9% |

|

1.4% |

|

2006 |

|

5.5% |

|

34.8% |

|

3.7% |

|

35.1% |

|

2.5% |

|

19.0% |

|

1.9% |

|

15.8% |

|

0.8% |

|

9.5% |

|

2007 |

|

6.1% |

|

3.2% |

|

4.9% |

|

(15.7%) |

|

2.7% |

|

8.8% |

|

2.1% |

|

5.5% |

|

0.8% |

|

9.8% |

|

2008 |

|

7.3% |

|

(8.2%) |

|

7.6% |

|

(37.7%) |

|

3.6% |

|

(31.8%) |

|

3.2% |

|

(37.0%) |

|

1.3% |

|

(40.5%) |

|

2009 |

|

6.6% |

|

19.3% |

|

3.7% |

|

28.0% |

|

2.6% |

|

22.6% |

|

2.0% |

|

26.5% |

|

1.0% |

|

43.9% |

|

2010 |

|

5.1% |

|

38.6% |

|

3.5% |

|

27.9% |

|

2.6% |

|

14.0% |

|

1.9% |

|

15.1% |

|

1.2% |

|

16.9% |

|

2011 |

|

5.0% |

|

7.3% |

|

3.8% |

|

8.3% |

|

2.8% |

|

8.3% |

|

2.3% |

|

2.1% |

|

1.3% |

|

(1.8%) |

|

2012 |

|

4.5% |

|

20.1% |

|

3.5% |

|

19.7% |

|

3.0% |

|

10.2% |

|

2.5% |

|

16.0% |

|

2.6% |

|

15.9% |

|

2013 |

|

5.8% |

|

(1.8%) |

|

3.9% |

|

2.9% |

|

2.3% |

|

29.6% |

|

2.0% |

|

32.4% |

|

1.4% |

|

38.3% |

|

2014 |

|

4.6% |

|

33.7% |

|

3.6% |

|

28.0% |

|

2.3% |

|

10.0% |

|

2.0% |

|

13.7% |

|

1.3% |

|

13.4% |

|

Q2 YTD 2015 |

|

5.1% |

|

(4.6%) |

|

3.9% |

|

(5.4%) |

|

2.4% |

|

0.0% |

|

2.1% |

|

1.2% |

|

1.2% |

|

5.3% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compound Average

Annual Total Return (5) |

|

|

|

16.4% |

|

|

|

10.8% |

|

|

|

10.0% |

|

|

|

9.5% |

|

|

|

9.5% |

Note: All of these dividend yields are calculated as annualized dividends based on the last dividend paid in applicable time period divided by the closing price as of period end. Dividend yield sources: NAREIT website and Bloomberg, except for the 1994 NASDAQ dividend yield which was sourced from Datastream / Thomson Financial.

(1) FTSE NAREIT US Equity REIT Index, as per NAREIT website.

(2) Calculated as the difference between the closing stock price as of period end less the closing stock price as of previous period, plus dividends paid in period, divided by closing stock price as of end of previous period. Does not include reinvestment of dividends for the annual percentages.

(3) Includes reinvestment of dividends. Source: NAREIT website and Factset.

(4) Price only index, does not include dividends. Source: Factset.

(5) All of these Compound Average Annual Total Return rates are calculated in the same manner: from Realty Income’s NYSE listing on October 18, 1994 through June 30, 2015, and (except for NASDAQ) assuming reinvestment of dividends. Past Performance does not guarantee future performance. Realty Income presents this data for informational purposes only and makes no representation about its future performance or how it will compare in performance to other indices in the future.

- 9 -

|

|

Q2 2015 Supplemental Operating & Financial Data NYSE: O Exhibit 99.2 |

|

|

Corporate Overview 3 Financial Summary Consolidated Statements of Income 4 Funds from Operations (FFO) 5 Adjusted Funds from Operations (AFFO) 6 Consolidated Balance Sheets 7 Debt Summary 8 Debt Maturities 9 Capitalization & Financial Ratios 10 EBITDA & Coverage Ratios 11 Debt Covenants 12 Transaction Summary Investment Summary 13 Disposition Summary 14 Development Pipeline 15 Real Estate Portfolio Summary Tenant Diversification 16 Industry Diversification 17 Geographic Diversification 19 Property Type Composition 20 Same Store Rental Revenue 21 Leasing Data Occupancy 23 Leasing Activity 24 Expirations 25 Earnings Guidance 26 Analyst Coverage 27 This Supplemental Operating & Financial Data should be read in connection with the company's second quarter 2015 earnings press release (included as Exhibit 99.1 of the company's Current Report on Form 8-K, filed on July 29, 2015) as certain disclosures, definitions and reconciliations in such announcement have not been included in this Supplemental Operating & Financial Data. TABLE OF CONTENTS 2 Q2 2015 Supplemental Operating & Financial Data |

|

|

Senior Management John P. Case, Chief Executive Officer and President Richard G. Collins, Executive VP, Portfolio Management Paul M. Meurer, Executive VP, Chief Financial Officer and Treasurer Michael R. Pfeiffer, Executive VP, General Counsel and Secretary Sumit Roy, Executive VP, Chief Operating Officer and Chief Investment Officer Credit Ratings Standard & Poor’s BBB+ Stable Outlook Moody's Baa1 Stable Outlook Fitch BBB+ Stable Outlook Dividend Information as of June 2015 Current annualized dividend of $2.28 per share Compound average annual dividend growth rate of approximately 4.6% 539 consecutive monthly dividends paid 71 consecutive quarterly dividend increases Corporate Headquarters 11995 El Camino Real San Diego, California 92130 Phone: (858) 284-5000 Website: www.realtyincome.com Transfer Agent Wells Fargo Shareowner Services Phone: (877) 218-2434 Email: stocktransfer@wellsfargo.com Website: www.shareowneronline.com Corporate Profile Realty Income, The Monthly Dividend Company®, is an S&P 500 real estate company with the primary business objective of generating dependable monthly cash dividends from a consistent and predictable level of cash flow from operations. Our monthly dividends are supported by the cash flow from our property portfolio. We have in-house acquisition, portfolio management, asset management, credit research, real estate research, legal, finance and accounting, information technology, and capital markets capabilities. Over the past 46 years, Realty Income has been acquiring and managing freestanding commercial properties that generate rental revenue under long-term, net lease agreements. Portfolio Overview At June 30, 2015, we owned a diversified portfolio of 4,452 properties located in 49 states and Puerto Rico, with over 74.1 million square feet of leasable space. Our properties are leased to 235 different commercial tenants doing business in 47 separate industries. Approximately 79% of our quarterly rental revenues were generated from retail properties, 13% from industrial properties, and the remaining 8% were from other property types. Our occupancy rate as of June 30, 2015 was 98.2%, with a weighted average remaining lease term of approximately 10.3 years. Common Stock Our Common Stock is traded on the New York Stock Exchange under the symbol "O" June 30, 2015 Closing price $ 44.39 Shares and units outstanding 235,594,146 Market value of common equity $ 10,458,024,000 Total market capitalization $ 16,173,494,000 CORPORATE OVERVIEW 3 Q2 2015 Supplemental Operating & Financial Data |

|

|

CONSOLIDATED STATEMENTS OF INCOME (dollars in thousands, except per share data) CONSOLIDATED STATEMENTS OF INCOME (dollars in thousands, except per share amounts) 4 Q2 2015 Supplemental Operating & Financial Data (unaudited) (unaudited) Three months ended June 30, Six months ended June 30, 2015 2014 2015 2014 REVENUE Rental $ 241,431 $ 221,868 $ 476,554 $ 435,989 Tenant reimbursements 11,607 6,169 21,570 12,597 Other 822 609 2,604 1,632 Total revenue 253,860 228,646 500,728 450,218 EXPENSES Depreciation and amortization 101,101 92,894 199,138 182,864 Interest 58,680 52,712 117,148 104,432 General and administrative 12,609 11,587 25,471 24,473 Property (including reimbursable) 14,937 10,127 28,914 20,704 Income taxes 628 570 1,702 1,661 Provisions for impairment 3,230 499 5,317 2,182 Total expenses 191,185 168,389 377,690 336,316 Gain on sales of real estate 3,675 1,964 10,893 3,236 Income from continuing operations 66,350 62,221 133,931 117,138 Income from discontinued operations - 20 - 3,097 Net income 66,350 62,241 133,931 120,235 Net income attributable to noncontrolling interests (263 ) (339 ) (581 ) (671 ) Net income attributable to the Company 66,087 61,902 133,350 119,564 Preferred stock dividends (6,770 ) (10,482 ) (13,540 ) (20,965 ) Net income available to common stockholders $ 59,317 $ 51,420 $ 119,810 $ 98,599 Amounts available to common stockholders per common share: Income from continuing operations: Basic $ 0.26 $ 0.23 $ 0.52 $ 0.45 Diluted $ 0.25 $ 0.23 $ 0.52 $ 0.45 Net income: Basic $ 0.26 $ 0.23 $ 0.52 $ 0.46 Diluted $ 0.25 $ 0.23 $ 0.52 $ 0.46 |

|

|

FUNDS FROM OPERATIONS (FFO) (dollars in thousands, except per share amounts) 5 Q2 2015 Supplemental Operating & Financial Data Three months ended June 30, Six months ended June 30, 2015 2014 2015 2014 Net income available to common stockholders $ 59,317 $ 51,420 $ 119,810 $ 98,599 Depreciation and amortization 101,101 92,894 199,138 182,864 Depreciation of furniture, fixtures and equipment (240 ) (104 ) (425 ) (196 ) Provisions for impairment on investment properties 3,230 499 5,317 2,182 Gain on sale of investment properties: Continuing operations (3,675 ) (1,964 ) (10,893 ) (3,236 ) Discontinued operations - - - (2,607 ) FFO adjustments allocable to noncontrolling interests (263 ) (336 ) (577 ) (696 ) FFO available to common stockholders $ 159,470 $ 142,409 $ 312,370 $ 276,910 FFO per common share, basic and diluted $ 0.69 $ 0.64 $ 1.36 $ 1.29 Distributions paid to common stockholders $ 131,595 $ 121,229 $ 258,277 $ 234,643 FFO in excess of distributions paid to common stockholders $ 27,875 $ 21,180 $ 54,093 $ 42,267 Weighted average number of common shares used for computation per share: Basic 232,403,586 220,979,955 228,932,782 214,039,692 Diluted 232,886,185 221,043,619 229,061,762 214,089,629 |

|

|

(1) See reconciling items for FFO presented under "Funds from Operations (FFO).” ADJUSTED FUNDS FROM OPERATIONS (AFFO) (dollars in thousands , except per share amounts) 6 Q2 2015 Supplemental Operating & Financial Data Three months ended June 30, Six months ended June 30, 2015 2014 2015 2014 Net income available to common stockholders $ 59,317 $ 51,420 $ 119,810 $ 98,599 Cumulative adjustments to calculate FFO (1) 100,153 90,989 192,560 178,311 FFO available to common stockholders 159,470 142,409 312,370 276,910 Amortization of share-based compensation 2,811 2,752 5,362 5,449 Amortization of deferred financing costs 1,281 1,165 2,575 2,241 Amortization of net mortgage premiums (1,745 ) (2,414 ) (3,629 ) (4,775 ) Gain on early extinguishment of mortgage debt (117) (595) (195) (619) Loss on interest rate swaps 899 984 1,958 1,042 Capitalized leasing costs and commissions (149 ) (275 ) (461 ) (467 ) Capitalized building improvements (977 ) (1,090 ) (2,009 ) (2,267 ) Straight-line rent (4,444 ) (3,977 ) (8,635 ) (7,913 ) Amortization of above and below-market leases 1,954 2,213 3,696 4,207 Other adjustments 77 6 152 14 Total AFFO available to common stockholders $ 159,060 $ 141,178 $ 311,184 $ 273,822 AFFO per common share, basic and diluted $ 0.68 $ 0.64 $ 1.36 $ 1.28 Distributions paid to common stockholders $ 131,595 $ 121,229 $ 258,277 $ 234,643 AFFO in excess of distributions paid to common stockholders $ 27,465 $ 19,949 $ 52,907 $ 39,179 Weighted average number of common shares used for computation per share: Basic 232,403,586 220,979,955 228,932,782 214,039,692 Diluted 232,886,185 221,043,619 229,061,762 214,089,629 |

|

|

June 30, 2015 December 31, 2014 ASSETS (unaudited) Real estate, at cost: Land $ 3,222,805 $ 3,046,372 Buildings and improvements 8,792,676 8,107,199 Total real estate, at cost 12,015,481 11,153,571 Less accumulated depreciation and amortization (1,534,780 ) (1,386,871 ) Net real estate held for investment 10,480,701 9,766,700 Real estate held for sale, net 8,965 14,840 Net real estate 10,489,666 9,781,540 Cash and cash equivalents 18,741 3,852 Accounts receivable, net 70,318 64,386 Acquired lease intangible assets, net 1,051,713 1,039,724 Goodwill 15,386 15,470 Other assets, net 82,490 107,650 Total assets $ 11,728,314 $ 11,012,622 LIABILITIES AND EQUITY Distributions payable $ 47,089 $ 43,675 Accounts payable and accrued expenses 112,824 123,287 Acquired lease intangible liabilities, net 237,946 220,469 Other liabilities 40,458 53,145 Lines of credit payable 430,000 223,000 Term loans 320,000 70,000 Mortgages payable, net 769,461 852,575 Notes payable, net 3,786,063 3,785,372 Total liabilities 5,743,841 5,371,523 Stockholders' equity: Preferred stock and paid in capital, par value $0.01 per share, 69,900,000 shares authorized and 16,350,000 shares issued and outstanding as of June 30, 2015 and December 31, 2014 395,378 395,378 Common stock and paid in capital, par value $0.01 per share, 370,100,000 shares authorized, 234,857,578 shares issued and outstanding as of June 30, 2015 and 224,881,192 shares issued and outstanding at December 31, 2014 6,953,679 6,464,987 Distributions in excess of net income (1,388,854 ) (1,246,964 ) Total stockholders' equity 5,960,203 5,613,401 Noncontrolling interests 24,270 27,698 Total equity 5,984,473 5,641,099 Total liabilities and equity $ 11,728,314 $ 11,012,622 CONSOLIDATED BALANCE SHEETS (dollars in thousands , except per share amounts) 7 Q2 2015 Supplemental Operating & Financial Data |

|

|

Principal Interest Weighted Balance as of Rate as of Average Years Maturity Date June 30, 2015 % of Debt June 30, 2015 until Maturity Credit Facility Credit Facility (1) June 30, 2019 $ 430,000 8.1% 1.09% 4.0 years Unsecured Term Loans Term Loan - Tau (2) January 21, 2018 70,000 1.3% 1.38% 2.6 years Term Loan - Realty Income (3) June 30, 2020 250,000 4.7% 1.14% 5.0 years Principal amount 320,000 Senior Unsecured Notes and Bonds 5.50% Notes due 2015 November 15, 2015 150,000 2.8% 5.50% 5.95% Notes due 2016 September 15, 2016 275,000 5.2% 5.95% 5.375% Notes due 2017 September 15, 2017 175,000 3.3% 5.38% 2.00% Notes due 2018 January 31, 2018 350,000 6.6% 2.00% 6.75% Notes due 2019 August 15, 2019 550,000 10.4% 6.75% 5.75% Notes due 2021 January 15, 2021 250,000 4.7% 5.75% 3.25% Notes due 2022 October 15, 2022 450,000 8.5% 3.25% 4.65% Notes due 2023 August 1, 2023 750,000 14.1% 4.65% 3.875% Notes due 2024 July 15, 2024 350,000 6.6% 3.88% 4.125% Notes due 2026 October 15, 2026 250,000 4.7% 4.13% 5.875% Bonds due 2035 March 15, 2035 250,000 4.7% 5.88% Principal amount 3,800,000 4.75% 6.7 years Unamortized discounts (13,937) Carrying value 3,786,063 Mortgages Payable 52 mortgages on 220 properties July 2015 - June 2032 756,720 (4) 14.3% 4.96% 3.5 years Unamortized premiums 12,741 Carrying value 769,461 TOTAL DEBT $ 5,306,720 (5) 4.27% Fixed Rate $ 4,861,236 92% Variable Rate $ 445,484 8% (1) We have a $2 billion unsecured revolving credit facility with an initial term that expires in June 2019. It includes, at our election, two 6-month extension options, at a cost of 0.075% of the facility commitment, or $1.5 million per option. As of June 30, 2015, $1.57 billion was available on the credit facility. (2) Borrowing under the term loan bears interest at the current one-month LIBOR, plus 1.2%. We have an interest rate swap which essentially fixes our per annum interest rate on the term loan at 2.15%. (3) Borrowing under the term loan bears interest at the current one-month LIBOR, plus 0.95%. We have an interest rate swap which essentially fixes our per annum interest rate on the term loan at 2.67%. (4) The mortgages payable are at fixed interest rates, except for variable rate mortgages totaling $15.5 million at June 30, 2015. (5) Excludes non-cash unamortized original issuance discounts recorded on the senior unsecured notes and bonds, as well as non-cash unamortized premiums recorded on the mortgages payable. DEBT SUMMARY (dollars in thousands) 8 Q2 2015 Supplemental Operating & Financial Data |

|

|

Debt Maturities Year of Credit Term Senior Unsecured Mortgages Weighted Average Maturity Facility Loan Notes and Bonds Payable Total Interest Rate (1) 2015 $ - $ - $ 150.0 $ 40.4 $ 190.4 5.49% 2016 - - 275.0 248.4 523.4 5.39% 2017 - - 175.0 142.5 317.5 5.53% 2018 - 70.0 350.0 15.1 435.1 2.02% 2019 430.0 - 550.0 26.0 1,006.0 6.56% Thereafter - 250.0 2,300.0 284.3 2,834.3 4.20% Totals $ 430.0 $ 320.0 $ 3,800.0 $ 756.7 $ 5,306.7 (1) Weighted average interest rate for 2019 excludes the credit facility. Mortgages Payable Maturities by Quarter Year of First Second Third Fourth Weighted Average Maturity Quarter Quarter Quarter Quarter Total Interest Rate 2015 $ - $ - $ 15.4 $ 25.0 $ 40.4 5.44% 2016 101.1 128.3 16.9 2.1 248.4 4.76% 2017 42.2 36.5 39.3 24.5 142.5 5.72% 2018 1.1 11.9 1.0 1.1 15.1 5.47% 2019 1.1 1.1 1.1 22.7 26.0 2.60% Thereafter 284.3 4.88% Totals $ 145.5 $ 177.8 $ 73.7 $ 75.4 $ 756.7 DEBT MATURITIES (dollars in millions) 9 Q2 2015 Supplemental Operating & Financial Data |

|

|

3.9 Capital Structure as of June 30, 2015 Liquidity as of June 30, 2015 Cash on Hand $ 18,741 Availability under Credit Facility 1,570,000 $ 1,588,741 CAPITALIZATION & FINANCIAL RATIOS (dollars in thousands , except per share amounts) 10 Q2 2015 Supplemental Operating & Financial Data Capitalization as of June 30, 2015 Carrying Debt Value Credit Facility $ 430,000 Unsecured Term Loans 320,000 Senior Unsecured Notes and Bonds 3,800,000 Mortgages Payable 756,720 Total Debt $ 5,306,720 Stock Redemption Market Equity Shares/units Price Price Value Common Stock (NYSE: O) 234,857,578 $ 44.39 $ 10,425,328 Common Units (1) 736,568 $ 44.39 32,696 Common Equity 10,458,024 Class F Preferred Stock 16,350,000 $ 25.00 408,750 Total Equity $ 10,866,774 Total Market Capitalization (2) $ 16,173,494 Debt/Total Market Capitalization (2) 32.8% Debt and Preferred Stock/Total Market Capitalization (2) 35.3% (1) Common units are exchangeable, into cash or common stock at our option, at a conversion ratio of 1:1, subject to certain exceptions. (2) Our enterprise value was $16,154,753 (total market capitalization less cash on hand). The percentages for both debt to enterprise value as well as debt and preferred stock to enterprise value are materially consistent with those presented for total market capitalization. Dividend Data Year-over-Year YTD 2015 YTD 2014 Growth Rate Common Dividend Paid per Share $ 1.13 $ 1.09 3.7% AFFO per Share (diluted) $ 1.36 $ 1.28 6.3% AFFO Payout Ratio 83.1% 85.2% Debt 33% Preferred 2% Common 65% |

|

|

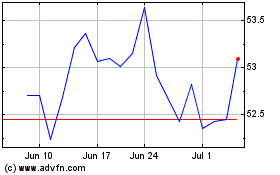

Debt Service Coverage (2) Fixed Charge Coverage (3) 3.9 Reconciliation of Net Income to EBITDA (1) Three months ended June 30, 2015 Net income $ 66,350 Interest 58,680 Taxes 628 Depreciation and amortization 101,101 Impairment loss 3,230 Gain on sales (3,675) Quarterly EBITDA $ 226,314 Annualized EBITDA $ 905,256 Debt/EBITDA 5.9 (1) EBITDA means, for the most recent quarter, annualized earnings (net income) before (i) interest expense, including non-cash loss (gain) on swaps, (ii) income and franchise taxes, (iii) real estate depreciation and amortization, (iv) impairment losses, and (v) gain on sales (Realty Income properties). (2) Refer to footnote 1 on page 12 for a detailed description of the calculation of debt service coverage. (3) Fixed charge coverage is calculated in exactly the same manner as the debt service coverage (defined on page 12), except that preferred stock dividends are also added to the denominator. EBITDA & COVERAGE RATIOS (dollars in thousands) 11 Q2 2015 Supplemental Operating & Financial Data 3.7 3.7 3.8 3.9 4.0 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 3.1 3.3 3.4 3.4 3.6 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 3.3 |

|

|

As of June 30, 2015 The following is a summary of the key financial covenants for our senior unsecured notes and bonds, as defined and calculated per their terms. These calculations, which are not based on U.S. GAAP measurements, are presented to investors to show our ability to incur additional debt under the terms of our senior notes and bonds as well as to disclose our current compliance with such covenants, and are not measures of our liquidity or performance. Required Actuals Limitation on incurrence of total debt < 60% of adjusted undepreciated assets 43.8% Limitation on incurrence of secured debt < 40% of adjusted undepreciated assets 6.3% Debt service coverage (trailing 12 months) (1) > 1.5 x 4.0x Maintenance of total unencumbered assets > 150% of unsecured debt 234.9% (1) This covenant is calculated on a pro forma basis for the preceding four-quarter period on the assumption that: (i) the incurrence of any Debt (as defined in the covenants) incurred by us since the first day of such four-quarter period and the application of the proceeds there from (including to refinance other Debt since the first day of such four-quarter period), (ii) the repayment or retirement of any of our Debt since the first day of such four-quarter period, and (iii) any acquisition or disposition by us of any asset or group since the first day of such four-quarters had in each case occurred on July 1, 2014, and subject to certain additional adjustments. Such pro forma ratio has been prepared on the basis required by that debt service covenant, reflects various estimates and assumptions and is subject to other uncertainties, and therefore does not purport to reflect what our actual debt service coverage ratio would have been had transactions referred to in clauses (i), (ii) and (iii) of the preceding sentence occurred as of July 1, 2014, nor does it purport to reflect our debt service coverage ratio for any future period. DEBT COVENANTS 12 Q2 2015 Supplemental Operating & Financial Data |

|

|

First Quarter 2015 Number of Properties Investment Cash Rents Leasable Square Feet Cash Capitalization Rate (1) Weighted Average Lease Term (Years) New Property Acquisitions (2) 58 $ 194,617 $ 13,101 951,490 6.7% 15.8 Properties under Development (3) 25 15,271 1,371 661,317 9.0% 12.8 Total Real Estate Investments 83 $ 209,888 $ 14,472 1,612,807 6.9% 15.5 Approximately 60% of the annualized revenue generated by these investments is from investment grade-rated tenants. Year-to-date 2015 Number of Properties Investment Cash Rents Leasable Square Feet Cash Capitalization Rate (1) Weighted Average Lease Term (Years) New Property Acquisitions (2) 136 $ 900,763 $ 57,041 3,488,783 6.3% 17.8 Properties under Development (3) 30 30,394 2,828 678,975 9.3% 12.2 Total Real Estate Investments 166 $ 931,157 $ 59,869 4,167,758 6.4% 17.5 Approximately 52% of the annualized revenue generated by these investments is from investment grade-rated tenants. (1) Cash capitalization rates are computed as contractual cash net operating income for the first twelve months following the acquisition date, divided by the total cost of the property (including all expenses borne by Realty Income). (2) The new property acquisitions were completed through nine independent transactions during the first quarter of 2015 and 16 independent transactions during the second quarter of 2015, respectively. (3) Includes investments during the period in new development, expansion of existing properties, and redevelopment of existing properties. Cash rents noted reflect total cash rents to be received on this investment amount upon completion of the properties under development. INVESTMENT SUMMARY (dollars in thousands) 13 Q2 2015 Supplemental Operating & Financial Data Second Quarter 2015 Number of Properties Investment Cash Rents Leasable Square Feet Cash Capitalization Rate (1) Weighted Average Lease Term (Years) New Property Acquisitions (2) 78 $ 706,146 $ 43,940 2,537,293 6.2% 18.4 Properties under Development (3) 22 15,123 1,457 17,658 9.6% 11.6 Total Real Estate Investments 100 $ 721,269 $ 45,397 2,554,951 6.3% 18.2 Approximately 49% of the annualized revenue generated by these investments is from investment grade-rated tenants. |

|

|

First Quarter 2015 Number of Properties Original Investment Net Book Value Net Proceeds (1) Cash Capitalization Rate (2) Occupied 4 $ 15,028 $ 12,487 $ 18,576 7.7% Vacant 5 4,468 2,362 3,534 - Total Real Estate Dispositions 9 $ 19,496 $ 14,849 $ 22,110 The unlevered internal rate of return on properties sold during the first quarter was 12.5% Year-to-date 2015 Number of Properties Original Investment Net Book Value Net Proceeds (1) Cash Capitalization Rate (2) Occupied 5 $ 19,804 $ 16,177 $ 24,557 7.8% Vacant 9 6,612 3,139 5,522 - Total Real Estate Dispositions 14 $ 26,416 $ 19,316 $ 30,079 The unlevered internal rate of return on properties sold during the year was 12.3% (1) Data excludes properties sold as a result of eminent domain activities. During the first quarter of 2015 we received net proceeds of $164,000 related to two eminent domain transactions. During the second quarter of 2015, we received net proceeds of $212,000 related to one eminent domain transaction. (2) Cash capitalization rates are computed as annualized current month contractual cash net operating income, divided by the net proceeds received upon sale of the property (including all expenses borne by Realty Income). DISPOSITION SUMMARY (dollars in thousands) 14 Q2 2015 Supplemental Operating & Financial Data Second Quarter 2015 Number of Properties Original Investment Net Book Value Net Proceeds (1) Cash Capitalization Rate (2) Occupied 1 $ 4,776 $ 3,690 $ 5,981 8.1% Vacant 4 2,144 777 1,988 - Total Real Estate Dispositions 5 $ 6,920 $ 4,467 $ 7,969 The unlevered internal rate of return on properties sold during the second quarter was 11.6% |

|

|

Non-Retail Number of Properties Investment to Date Remaining Investment Total Commitment Percent Leased (2) New Development (1) 2 $ - $ 49,132 $ 49,132 100% Expansion of existing properties 5 16,426 5,695 22,121 100% Redevelopment of existing properties 1 214 11 225 100% 8 $ 16,640 $ 54,838 $ 71,478 Total Number of Properties Investment to Date Remaining Investment Total Commitment Percent Leased (2) New Development (1) 5 $ 9,677 $ 50,653 $ 60,330 100% Expansion of existing properties 5 16,426 5,695 22,121 100% Redevelopment of existing properties 4 515 8,637 9,152 100% 14 $ 26,618 $ 64,985 $ 91,603 Retail Number of Properties Investment to Date Remaining Investment Total Commitment Percent Leased (2) New Development (1) 3 $ 9,677 $ 1,521 $ 11,198 100% Expansion of existing properties - - - - - Redevelopment of existing properties 3 301 8,626 8,927 100% 6 $ 9,978 $ 10,147 $ 20,125 (1) Includes build-to-suit developments and forward take-out commitments on development properties with leases in place. (2) Estimated rental revenue commencement dates on properties under development range between July 2015 and December 2015. DEVELOPMENT PIPELINE (dollars in thousands) 15 Q2 2015 Supplemental Operating & Financial Data |

|

|