UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 11-K

FOR ANNUAL REPORTS OF EMPLOYEE STOCK

PURCHASE, SAVINGS AND SIMILAR PLANS

PURSUANT TO SECTION 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

|

| | |

| | |

þ | | ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

OR

|

| | |

| | |

o | | TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-33579

A. Full title of the plan and the address of the plan, if different from that of the issuer named below:

INTERDIGITAL

SAVINGS AND PROTECTION PLAN

B. Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

INTERDIGITAL, INC.

200 Bellevue Parkway, Suite 300, Wilmington, DE 19809-3727

INTERDIGITAL

SAVINGS AND PROTECTION PLAN

C O N T E N T S

Other supplemental schedules required by Section 2520.103-10 of the Department of Labor Rules and Regulations for Reporting and Disclosure under the Employment Retirement Income Security Act of 1974, as amended, have been omitted because they are not applicable.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Participants and Plan Administrator of

InterDigital Savings and Protection Plan

Wilmington, Delaware

We have audited the accompanying statements of net assets available for benefits of the InterDigital Savings and Protection Plan as of December 31, 2014 and 2013, and the related statements of changes in net assets available for benefits for the years then ended. These financial statements are the responsibility of the Plan's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2014 and 2013, and the changes in net assets available for benefits for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

The supplemental information in the accompanying schedule of assets held at end of year as of December 31, 2014 and schedule of delinquent participant contributions for the year ended December 31, 2014 has been subjected to audit procedures performed in conjunction with the audit of the InterDigital Savings and Protection Plan's financial statements. The supplemental information is presented for the purpose of additional analysis and is not a required part of the financial statements but include supplemental information required by the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. This supplemental information is the responsibility of the Plan's management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information in the accompanying schedules, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information in the accompanying schedules is fairly stated in all material respects in relation to the financial statements as a whole.

/s/ Morison Cogen LLP

Bala Cynwyd, Pennsylvania

June 29, 2015

INTERDIGITAL

SAVINGS AND PROTECTION PLAN

STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS

DECEMBER 31, 2014 AND 2013

|

| | | | | | | | |

| | | | |

| | 2014 | | 2013 |

Investments at fair value (see Notes 3 and 4) | | $ | 76,111,810 |

| | $ | 68,366,513 |

|

Cash | | 57,933 |

| | 38,300 |

|

Notes receivable from participants | | 233,063 |

| | 202,323 |

|

NET ASSETS AVAILABLE FOR BENEFITS AT FAIR VALUE | | $ | 76,402,806 |

| | $ | 68,607,136 |

|

| | | | |

Adjustment from fair value to contract value for fully benefit-responsive investment contracts | | (359,456 | ) | | (214,617 | ) |

| | | | |

NET ASSETS AVAILABLE FOR BENEFITS | | $ | 76,043,350 |

| | $ | 68,392,519 |

|

| | | | |

The accompanying notes are an integral part of these financial statements.

INTERDIGITAL

SAVINGS AND PROTECTION PLAN

STATEMENTS OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

FOR THE YEARS ENDED DECEMBER 31, 2014 AND 2013

|

| | | | | | | | |

| | | | |

| | 2014 | | 2013 |

ADDITIONS | | | | |

Investment income: | | | | |

Dividend income | | $ | 1,034,739 |

| | $ | 934,422 |

|

Interest from notes receivable from participants | | 8,342 |

| | 10,467 |

|

Net appreciation in fair value of investments | | 5,854,203 |

| | 9,355,095 |

|

| |

| |

|

Total investment income | | 6,897,284 |

| | 10,299,984 |

|

| | | | |

CONTRIBUTIONS | | | | |

Employer | | 1,140,603 |

| | 943,887 |

|

Participants | | 3,208,487 |

| | 3,173,640 |

|

Rollover | | 281,480 |

| | 454,839 |

|

Expense Budget Account | | 97,615 |

| | 108,902 |

|

| | | | |

Total contributions | | 4,728,185 |

| | 4,681,268 |

|

| |

| |

|

TOTAL ADDITIONS | | 11,625,469 |

| | 14,981,252 |

|

| | | | |

DEDUCTIONS | | | | |

Payment of benefits | | 3,823,404 |

| | 10,793,085 |

|

Other deductions | | 151,234 |

| | 105,753 |

|

| | | | |

TOTAL DEDUCTIONS | | 3,974,638 |

| | 10,898,838 |

|

| |

| |

|

NET INCREASE | | 7,650,831 |

| | 4,082,414 |

|

| | | | |

NET ASSETS AVAILABLE FOR BENEFITS - BEGINNING OF YEAR | | 68,392,519 |

| | 64,310,105 |

|

| |

| |

|

NET ASSETS AVAILABLE FOR BENEFITS - END OF YEAR | | $ | 76,043,350 |

| | $ | 68,392,519 |

|

| | | | |

The accompanying notes are an integral part of these financial statements.

INTERDIGITAL

SAVINGS AND PROTECTION PLAN

NOTES TO FINANCIAL STATEMENTS

NOTE 1 - DESCRIPTION OF THE PLAN

The following description of the InterDigital Savings and Protection Plan (the “Plan”) is provided for general information purposes. Plan participants should refer to the Plan agreement for a more complete description of the Plan's provisions.

General

The Plan is a defined contribution 401(k) plan of InterDigital, Inc. and its participating subsidiaries (the “Company” or “InterDigital”) for its eligible employees. An eligible employee will be eligible to participate in the Plan in the next payroll period, or as soon as administratively possible, following the date the eligible employee attained age 18 and completed one month of service with the Company.

The following individuals are not eligible to participate in the Plan: (i) individuals employed by the Company as part of an academic course of study, such as a work-study program, co-op program or similar arrangements; (ii) collective bargaining employees; (iii) leased employees within the meaning of Internal Revenue Code (“IRC”) Sections 414(n)(2) and 414(o)(2); and (iv) nonresident aliens who receive no earned income that constituted income from sources within the United States.

The Plan was established effective February 1, 1985, restated January 1, 1997, restated January 1, 2007, when the Plan name was changed from InterDigital Communications Corporation Savings and Protection Plan to InterDigital Savings and Protection Plan, and most recently amended and restated effective January 1, 2010. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”). State Street Bank & Trust is the trustee of the Plan. Transamerica Retirement Solutions Corporation ("Transamerica"), formerly known as Diversified Investment Advisors, is the Plan custodian and third party administrator of the Plan's assets.

Contributions

Participant contributions are made on a pre-tax basis and/or an after-tax basis. Each participant may invest from 1% to 100% of eligible compensation as a basic contribution subject to state, local, and certain Federal taxes. The total of the basic and supplemental contributions cannot exceed IRC limitations for each Plan year. For the 2014 and 2013 Plan years, such limit was $17,500. Participants who have attained the age of 50 before the end of the Plan year are eligible to make catch-up contributions. In both 2014 and 2013, the maximum additional annual contribution was $5,500. If a participant's annual contributions exceed the dollar limitation set by the IRC, thereby requiring a distribution of such excess contributions, the participant will forfeit any employer matching contributions related to the distribution amount. Amounts forfeited will be used by the Company to reduce future employer matching contributions.

The Company may, at its sole discretion, contribute to the Plan through matching contributions and/or discretionary employer contributions. The Company currently matches 50% of the first 6% of each participant's eligible earnings contributed to the Plan. There were no discretionary employer contributions made for the years ended December 31, 2014 and December 31, 2013. Effective January 1, 2013, the Plan was amended to allow discretionary employer matching contributions to be made by the Company in an amount not to exceed 6% of a participant's annual compensation, thereby allowing for true-ups to be made to ensure participants receive the maximum matching contributions irrespective of deduction timing.

The IRC limits the amount of pay that may be used to determine participants' discretionary contributions. The limit was $260,000 and $255,000 in 2014 and 2013, respectively. The IRC also limits the amount of all contributions that can be made for or by a participant to the Plan in a given year. The limit was the lesser of 100% of pay or $52,000 or $51,000 for 2014 and 2013, respectively.

Employee rollover contributions from other qualified retirement plans are permitted; such contributions are subject to the conditions and procedures set forth in the Plan.

Participant Accounts

Each participant's account is credited with that participant's contributions, allocations of the Company's matching contributions, discretionary employer contributions, if any, and Plan earnings and losses. Allocations of discretionary employer contributions are based on a percentage of a participant's eligible compensation as determined by the Board of Directors of the Company. The benefit to which a participant is entitled is the benefit that can be provided from the participant's vested account. Terminated participants forfeit unvested Company contributions. Forfeitures are used to reduce future employer matching contributions.

Vesting

Rollover contributions and participants' before-tax contributions are 100% vested and nonforfeitable. Plan participants who were credited with an Hour of Service (as defined in the Plan) shall be vested in their discretionary matching and employer contributions as follows:

|

| | | |

Periods of Service | | Percentage |

Less than 1 year | | — | % |

At least 1, less than 2 years | | 33 | % |

At least 2, less than 3 years | | 67 | % |

3 or more years | | 100 | % |

Participants who die while an employee of InterDigital or retire at their normal retirement age (age 65) are 100% vested in their account, regardless of their length of service.

Notes Receivable from Participants

Any participant who is an active employee may apply for a secured loan provided the request does not exceed the lesser of 50% of their vested account balance or $50,000. The minimum loan amount is $500. Only one loan per participant may be made every 365 days and all loans are subject to approval by the Company as Plan Administrator. Loan terms are limited to five years set at the inception of each loan. Interest rates are set at an annual rate of prime + 1%. The rate on all outstanding loans at December 31, 2014 and 2013 was 4.25%. Interest paid by the participant is credited to the participant's account. If a participant's balance remains unpaid for more than 90 days after it is due, the loan will be in default on the outstanding loan amount and the participant's vested account will be reduced by the amount of the unpaid principal and interest. The unpaid amount is treated as a taxable withdrawal and is subject to federal income taxes. Loans in default, in principal plus interest that were reclassified to distributions, amounted to $23,875 and $55,532 for the years ended December 31, 2014 and 2013, respectively. Effective October 2, 2012, participants may continue to make scheduled loan payments after the related participant ceases to be an employee or party-in-interest as defined by ERISA.

When a participant receives a distribution from the Plan, any outstanding principal plus accrued interest will be deducted from the amount of the distribution. A participant may then either default on the loan or make arrangements to continue loan repayments beyond when they become entitled to a distribution as long as their remaining interest in the Plan exceeds their outstanding loan balance.

Payment of Benefits

If a participant retires, dies, becomes permanently disabled, or otherwise separates from the Company, the participant or participant's beneficiary, as applicable, is entitled to the vested amount of their account as valued on the applicable valuation date. In the event of a participant's death, distribution of their account will be made as soon as administratively practicable upon the receipt of appropriate documentation from their designated beneficiary. Distributions for reasons of retirement, permanent disability or termination will be made upon written request. Distributions from a participant's account are made in a single lump sum payment. Employees may defer payment of their account under the Plan.

Plan Termination

The Company may amend or suspend the Plan and may terminate the Plan at any time subject to the provisions of ERISA; although there is no present intent to do so. However, no such action may cause the Plan's assets to be used for purposes other than the exclusive benefit of the participants and their beneficiaries. If the Plan is terminated, all such participants' accounts shall become fully vested and all accounts of participants shall be distributed as soon as administratively possible.

Investment Options

All investments are participant-directed including the Company matching contributions and any discretionary employer contributions. Fund descriptions below were obtained from fund brochures and other Plan documents:

AGGRESSIVE BONDS:

BlackRock High Yield Institutional Bond Fund

The investment seeks to maximize total return, consistent with income generation and prudent investment management. The fund invests primarily in non-investment grade bonds with maturities of ten years or less.

INTERMEDIATE/LONG-TERM BONDS:

JPMorgan Core Bond A Fund

The investment seeks to maximize total return by investing primarily in a diversified portfolio of intermediate and long-term debt securities. The fund is designed to maximize total return by investing in a portfolio of investment grade intermediate and long-term debt securities.

LARGE-CAP STOCKS:

Vanguard 500 Index Fund Admiral

The investment seeks to track the performance of a benchmark index that measures the investment return of large-capitalization stocks. The fund seeks to achieve its objective by employing an indexing investment approach designed to track the performance of the Standard & Poor's 500 Index.

Vanguard Equity Income Fund Admiral

The investment seeks to provide an above-average level of current income and reasonable long-term capital appreciation. The fund seeks to achieve its objective by investing mainly in common stocks of mid-size and large companies whose stocks typically pay above-average levels of dividend income and are, in the opinion of the purchasing advisor, undervalued relative to other stocks.

Wells Fargo Advantage Premier Large Company Growth Fund, Class A

The investment seeks long-term capital growth. It invests principally in equity securities of large-capitalization companies, which the advisor defines as securities of companies with market capitalizations within the range of the

Russell 1000 Index.

SMALL/MID-CAP STOCKS:

American Beacon Mid Cap Value Institutional Fund

The investment seeks long-term capital appreciation and current income. Under normal circumstances, at least 80% of the fund's net assets (plus the amount of any borrowings for investment purposes) are invested in equity securities of middle market capitalization U.S. companies.

Baron Small Cap Retail Fund

The investment seeks capital appreciation through investments primarily in securities of small-sized growth companies.

Diamond Hill Small Cap A Fund

The investment seeks to provide long-term capital appreciation.

Dreyfus/The Boston Company Small/Mid Cap Growth I Fund

The investment seeks long-term growth of capital. To pursue its goal, the fund normally invests at least 80% of its net assets, plus any borrowings for investment purposes, in equity securities of small-cap and mid-cap U.S. companies.

Invesco Real Estate Institutional Fund

The investment seeks high total return through growth of capital and current income. It primarily invests in equity securities. The fund may invest in equity and debt securities of issuers unrelated to the real estate industry that the portfolio managers believe are undervalued and have potential for growth of capital. It may invest in non-investment grade debt securities of real estate and real estate-related issuers.

Vanguard Small Cap Index Fund Admiral

The investment seeks to track the performance of a benchmark index that measures the investment return of small-capitalization stocks. The fund employs an indexing investment approach designed to track the performance of the CRSP U.S. Small Cap Index, a broadly diversified index of stocks of small U.S. companies.

INTERNATIONAL STOCKS:

American Funds EuroPacific Growth R4 Fund

The investment seeks to provide long-term growth of capital. The fund invests primarily in common stock of issuers in Europe and the Pacific Basin that the investment adviser believes have the potential for growth.

Wells Fargo Advantage Emerging Markets Equity Fund

The investment seeks long-term capital appreciation. It considers emerging market companies to include companies that are traded in, have their primary operations in, are domiciled in or derive a majority of their revenue from emerging market countries as defined by the MSCI Emerging Markets Index.

MULTI-ASSET/OTHER:

Vanguard Target Retirement 2010 Fund

The investment seeks to provide capital appreciation and current income consistent with its current asset allocation. The fund primarily invests in other Vanguard mutual funds according to an asset allocation strategy designed for investors planning to retire and leave the work force in or within a few years of 2010 (the target year).

Vanguard Target Retirement 2020 Fund

The investment seeks to provide capital appreciation and current income consistent with its current asset allocation. The fund primarily invests in other Vanguard mutual funds according to an asset allocation strategy designed for investors planning to retire and leave the work force in or within a few years of 2020 (the target year).

Vanguard Target Retirement 2030 Fund

The investment seeks to provide capital appreciation and current income consistent with its current asset allocation. The fund primarily invests in other Vanguard mutual funds according to an asset allocation strategy designed for investors planning to retire and leave the work force in or within a few years of 2030 (the target year).

Vanguard Target Retirement 2040 Fund

The investment seeks to provide capital appreciation and current income consistent with its current asset allocation. The fund primarily invests in other Vanguard mutual funds according to an asset allocation strategy designed for investors planning to retire and leave the work force in or within a few years of 2040 (the target year).

Vanguard Target Retirement 2050 Fund

The investment seeks to provide capital appreciation and current income consistent with its current asset allocation. The fund primarily invests in other Vanguard mutual funds according to an asset allocation strategy designed for investors planning to retire and leave the work force within a few years of 2050 (the target year).

INTERDIGITAL STOCK FUND:

This fund invests in the common stock of InterDigital, Inc.

STABLE POOLED FUND:

This fund seeks to provide positive income with reduced return volatility through investment in a diversified portfolio of high quality fixed income securities. The fund invests in stable value fixed income instruments, including Guaranteed Investment Contracts (“GIC's”), Bank Investment Contracts (“BIC's”), as well as GIC alternatives, such as synthetic GIC's.

NOTE 2 - SUMMARY OF ACCOUNTING POLICIES

The following accounting policies, which conform with accounting principles generally accepted in the United States(“GAAP”), have been used consistently in the preparation of the Plan's financial statements.

Basis of Accounting

Accounting records are maintained by the custodian on the cash basis of accounting. The financial statements of the Plan reflect all material adjustments to place the financial statements on the accrual basis of accounting.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements, as well as reported amounts of additions and deductions during the reporting period. Actual results could differ from those estimates.

Investment Contracts

As described in Financial Accounting Standards Board ("FASB") Staff Position, FSP AAG INV-1 and AICPA Statement of Position 962 (formerly 94-4-1) , Reporting of Fully Benefit Responsive Investment Contracts Held by Certain Investment Companies Subject to the AICPA Investment Company Guide and Defined Contribution Health and Welfare and Pension Plans (the “FSP”), investment contracts held by a defined contribution plan are required to be reported at fair value. However, contract value is the relevant measurement attribute for that portion of the net assets available for benefits of a defined contribution plan attributable to fully benefit-responsive investment contracts because contract value is the amount participants would receive if they were to initiate permitted transactions under the terms of the plan. As required by the FSP, the Statement of Net Assets Available for Benefits presents the fair value of the investment contracts as well as the adjustment of the fully benefit-responsive investment contracts from fair value to contract value. The Statement of Changes in Net Assets Available for Benefits is prepared on a contract value basis.

Investment Valuation and Income Recognition

Shares of registered investment companies are valued at quoted market prices that represent the net asset value of shares held by the Plan at year-end. The InterDigital Stock Fund is valued at its year-end unit closing price (comprised of common stock market price plus uninvested cash position).

Purchases and sales of investments are recorded on a trade-date basis. Interest income is accrued when earned. Dividend income is recorded on the ex-dividend date. Capital gain distributions are included in dividend income.

Notes Receivable from Participants

Notes receivable from participants are measured at their unpaid principal balance plus any accrued but unpaid interest. Interest income is recorded on the accrual basis. Related fees are recorded as administrative expenses and are expensed when they are incurred. No allowance for credit losses has been recorded as of December 31, 2014 or December 31, 2013. If a participant ceases to make loan repayments and the plan administrator deems the participant loan to be in default, the participant loan balance is reduced and a benefit payment is recorded.

Payment of Benefits

Benefits are recorded when paid.

Forfeited Accounts

At December 31, 2014 and 2013, forfeited non-vested accounts totaled $30,537 and $9,359, respectively. No amounts were used to reduce employer matching contributions in either year.

Recently Adopted Accounting Pronouncements

As of December 31, 2014 and for the period then ended, there were no recently adopted accounting pronouncements that had a material effect on the Plan's financial statements.

Recently Issued Accounting Pronouncements Not Yet Adopted

As of December 31, 2014, there were no recently issued accounting standards not yet adopted which would have a material effect on the Plan's financial statements.

NOTE 3 - FAIR VALUE MEASUREMENTS

The framework for measuring fair value provides a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (level 1) and the lowest priority to unobservable inputs (level 3). The three levels of the fair value hierarchy under FASB ASC 820 are described as follows:

Level 1

Inputs to the valuation methodology are unadjusted quoted prices for identical assets or liabilities in active markets that the Plan has the ability to access;

Level 2

Inputs to the valuation methodology include:

-Quoted prices for similar assets or liabilities in active markets;

-Quoted prices for identical or similar assets or liabilities in inactive markets;

-Inputs other than quoted prices that are observable for the asset or liability; and

-Inputs that are derived principally from or corroborated by observable market data by correlation or other means.

If the asset or liability has a specified (contractual) term, the Level 2 input must be observable for substantially the full term of the asset or liability.

Level 3

Inputs to the valuation methodology are unobservable and significant to the fair value measurement.

The asset's or liability's fair value measurement level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. Valuation techniques used need to maximize the use of observable inputs and minimize the use of unobservable inputs.

Following is a description of the valuation methodologies used for assets measured at fair value. There have been no changes in the methodologies used at December 31, 2014 and 2013.

InterDigital stock : Valued at its year-end unit closing price (comprised of common stock market price plus uninvested cash position).

Registered investment companies : Valued at the quoted market prices representing the net asset value (“NAV”) of shares held by the Plan at year-end.

Stable Pooled Fund : Valued at fair value by discounting the related cash flows based on current yields of similar instruments with comparable durations considering the credit worthiness of the issuer.

The methods described above may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, while the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

The following tables set forth by level, within the fair value hierarchy, the Plan's assets at fair value as of December 31, 2014 and December 31, 2013: |

| | | | | | | | | | | | | | | | |

| | Assets at Fair Value as of December 31, 2014 |

| | Level 1 | | Level 2 | | Level 3 | | Total |

| | | | | | | | |

Registered investment companies: | | | | | | | | |

Aggressive Bonds | | $ | 1,534,234 |

| | $ | — |

| | $ | — |

| | $ | 1,534,234 |

|

Intermediate/Long-term Bonds | | 4,896,627 |

| | — |

| | — |

| | 4,896,627 |

|

Large-Cap Stocks | | 22,597,113 |

| | — |

| | — |

| | 22,597,113 |

|

Small/Mid-Cap Stocks | | 18,593,489 |

| | — |

| | — |

| | 18,593,489 |

|

International Stocks | | 5,564,176 |

| | — |

| | — |

| | 5,564,176 |

|

Multi-Asset/Other | | 11,295,403 |

| | — |

| | — |

| | 11,295,403 |

|

InterDigital Stock Fund | | — |

| | 4,735,622 |

| | — |

| | 4,735,622 |

|

Stable Pooled Fund | | — |

| | 6,895,146 |

| | — |

| | 6,895,146 |

|

| | | | | | | | |

Total assets at fair value | | $ | 64,481,042 |

| | $ | 11,630,768 |

| | $ | — |

| | $ | 76,111,810 |

|

| | | | | | | | |

| | | | | | | | |

| | Assets at Fair Value as of December 31, 2013 |

| | Level 1 | | Level 2 | | Level 3 | | Total |

| | | | | | | | |

Registered investment companies: | | | | | | | | |

Short-term Bonds | | $ | 2,308,967 |

| | $ | — |

| | $ | — |

| | $ | 2,308,967 |

|

Aggressive Bonds | | 1,246,410 |

| | — |

| | — |

| | 1,246,410 |

|

Intermediate/Long-term Bonds | | 4,624,264 |

| | — |

| | — |

| | 4,624,264 |

|

Large-Cap Stocks | | 19,444,563 |

| | — |

| | — |

| | 19,444,563 |

|

Small/Mid-Cap Stocks | | 18,538,954 |

| | — |

| | — |

| | 18,538,954 |

|

International Stocks | | 5,753,274 |

| | — |

| | — |

| | 5,753,274 |

|

Multi-Asset/Other | | 9,560,671 |

| | — |

| | — |

| | 9,560,671 |

|

InterDigital Stock Fund | | — |

| | 3,017,751 |

| | — |

| | 3,017,751 |

|

Stable Pooled Fund | | — |

| | 3,871,659 |

| | — |

| | 3,871,659 |

|

| | | | | | | | |

Total assets at fair value | | $ | 61,477,103 |

| | $ | 6,889,410 |

| | $ | — |

| | $ | 68,366,513 |

|

The following table summarizes investments measured at fair value based on NAV per share as of December 31, 2014 and December 31, 2013, respectively.

|

| | | | | | |

December 31, 2014 | Fair Value | Unfunded Commitments | Redemption Frequency | Redemption Notice Period |

Stable Pooled Fund | $ | 6,895,147 |

| n/a | Daily | 30 days |

| | | | |

December 31, 2013 | Fair Value | Unfunded Commitments | Redemption Frequency | Redemption Notice Period |

Stable Pooled Fund | $ | 3,871,659 |

| n/a | Daily | 30 days |

NOTE 4 - INVESTMENTS

The following table presents investments that represented five percent or more of the Plan's net assets at December 31, 2014 and 2013:

|

| | | | | | | | |

| | 2014 | | 2013 |

Vanguard 500 Index Admiral * | | $ | 10,220,358 |

| | $ | — |

|

Wells Fargo Advantage Premier Large Company Growth Fund, Class A | | 7,247,391 |

| | 6,610,240 |

|

Stable Pooled Fund | | 6,895,147 |

| | 3,871,659 |

|

American Beacon Mid Cap Value Institutional Fund * | | 5,518,296 |

| | — |

|

Vanguard Target Retirement 2030 Fund | | 5,356,643 |

| | 4,791,098 |

|

Vanguard Equity Income Fund Admiral * | | 5,129,364 |

| | — |

|

JPMorgan Core Bond A Fund | | 4,896,627 |

| | 4,624,264 |

|

American Funds EuroPacific Growth R4 Fund | | 4,839,345 |

| | 4,939,757 |

|

InterDigital Stock Fund | | 4,735,622 |

| | 3,017,751 |

|

Transamerica Partners Institutional Stock Index Fund ** | | — |

| | 8,004,658 |

|

Goldman Sachs Mid Cap Value Institutional Fund ** | | — |

| | 5,250,806 |

|

BlackRock Equity Dividend Institutional Fund ** | | — |

| | 4,829,665 |

|

Columbia Small Cap Index A Fund ** | | — |

| | 3,491,468 |

|

* This fund did not represent five percent or more of the Plan's net assets at December 31, 2013. It is shown for comparative purposes.

** This fund did not represent five percent or more of the Plan's net assets at December 31, 2014. It is shown for comparative purposes.

At December 31, 2014 and 2013, the Plan's investments, including gains and losses on investments bought and sold, as well as held during the year, appreciated (depreciated) in value as follows:

|

| | | | | | | | |

| | 2014 | | 2013 |

Investment in common trusts | | $ | 66,125 |

| | $ | 39,555 |

|

Registered investment companies | | 3,472,225 |

| | 10,323,281 |

|

InterDigital Stock Fund | | 2,315,853 |

| | (1,007,741 | ) |

| | $ | 5,854,203 |

| | $ | 9,355,095 |

|

The Plan invests in various investment securities. Investment securities are exposed to various risks such as interest rate, market, and credit risks. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect participants' account balances and the amounts reported in the Statement of Net Assets Available for Benefits.

NOTE 5 - SECURITY-BACKED CONTRACTS AND GUARANTEED INVESTMENT CONTRACTS

In 2004, the Plan entered into a benefit-responsive investment contract with the Stable Pooled Fund (the “Fund”). The Fund primarily invests in security-backed contracts issued by insurance companies and other financial institutions as well as traditional GICs. The Fund's principal objective is to protect principal while providing a higher rate of return than shorter maturity investments, such as money market funds or certificates of deposit. The account is credited with earnings on the underlying investments and charged for participant withdrawals and administrative expenses.

As described in Note 2, because the investment contracts are fully benefit-responsive, contract value is the relevant measurement attribute for that portion of the net assets available for benefits attributable to the investment contract. Contract value, as reported to the Plan by Transamerica, represents contributions made under the contract, plus earnings, less participant withdrawals and administrative expenses. Participants may ordinarily direct the withdrawal or transfer of all or a portion of their investment at contract value.

Risks arise when entering into any investment contract due to the potential inability of the issuer to meet the terms of the contract. In addition, security-backed contracts have the risk of default or the lack of liquidity of the underlying portfolio assets. There are no reserves against contract value for credit risk of the contract issuer or otherwise. The

crediting interest rate is based on a formula agreed upon with the issuer. Such interest rates are reviewed on a quarterly basis for resetting.

NOTE 6 - RELATED PARTY TRANSACTIONS

The Plan invests in shares of the Company's common stock through the InterDigital Stock Fund. In 2013, and for the first half of 2014, the Plan also invested in funds managed by Transamerica. Transactions in such investments qualify as party-in-interest transactions that are exempt from the prohibited transaction rules.

NOTE 7 - PLAN EXPENSES

Effective March 1, 2014, an amendment to the Pension Services Agreement between Transamerica and the Company was made to revise the way costs and expenses incurred in the administration of the Plan are paid and allocated among participants. Pursuant to Transamerica’s Fund Revenue Equalization method, Transamerica uses certain revenue sharing payments it receives from the Investment Options available in the Plan to offset the costs of administration of the Plan on an individual fund basis. If the revenue Transamerica collects from a fund provider is greater than the administrative fee negotiated, Transamerica refunds the difference to the participants invested in the fund. If the revenue Transamerica collects from a fund provider is less than the negotiated fee, it collects the difference by deducting an administrative fee from the participants invested in the fund. Transamerica’s Fund Revenue Equalization method ensures that all participants bear a similar percentage charge for the Plan's administrative fees irrespective of the investment funds they choose. Additional amounts in excess of its required revenue are credited to the "Expense Budget Account." If the amount received by Transamerica is less than its required revenue and the funds in the Expense Budget Account are insufficient to cover the shortfall, the Company pays the shortfall.

The amount of the credit to the Expense Budget Account in 2014 and 2013 was $97,615 and $108,902, respectively.

NOTE 8 - TAX STATUS

The Internal Revenue Service (“IRS”) has determined and informed the Company by letter dated July 5, 2012 that the Plan satisfies the qualification requirements under IRC Section 401(a) and that the trust maintained in connection with the Plan satisfies the requirements for exemption under IRC Section 501(a). The Company believes the Plan is designed and is currently being operated in compliance with the applicable requirements of the IRC.

GAAP requires Plan management to evaluate tax positions taken by the Plan and recognize a tax liability (or asset) if the Plan had taken an uncertain position that more likely than not would not be sustained upon examination by the IRS. The Plan administrator has analyzed the tax positions taken by the Plan, and has concluded that, as of December 31, 2014, there are no uncertain positions taken or expected to be taken that would require recognition of a liability (or asset) or disclosure in the financial statements.

The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax period in progress. The Plan Administrator believes it is no longer subject to income tax examinations for years prior to 2012.

NOTE 9 - NON EXEMPT PARTY-IN-INTEREST TRANSACTIONS

For the Plan years 2014 and 2013, the Company has not remitted certain participant contributions and loan repayments to Transamerica in a timely manner based on when the participant contributions and loan repayments were withheld from participant paychecks as required under Department of Labor Regulation §2510.3-102.

The Company is in the process of filing IRS Form 5330 to report and pay an excise tax with respect to the 2014 and 2013 late remittances, and participant accounts will be credited with the amount of investment income that would have been earned had the participant contributions been remitted on a timely basis. Such amounts are not material to the Plan’s financial statements.

INTERDIGITAL

SAVINGS AND PROTECTION PLAN

EIN 23-1882087

SCHEDULE H, LINE 4(i) - SCHEDULE OF ASSETS (HELD AT END OF YEAR)

DECEMBER 31, 2014 |

| | | | | | | |

| | | | Current/Contract | |

Identity of Issue | | Investment Type | | Value | |

State Street Bank & Trust* | | Cash | | $ | 57,933 |

| |

American Funds EuroPacific Growth R4 Fund | | Registered investment companies | | 4,839,345 |

| |

American Beacon Mid Cap Value Institutional Fund | | Registered investment companies | | 5,518,296 |

| |

Baron Small Cap Retail Fund | | Registered investment companies | | 2,511,878 |

| |

BlackRock High Yield Institutional Bond Fund | | Registered investment companies | | 1,534,234 |

| |

Diamond Hill Small Cap A Fund | | Registered investment companies | | 1,185,966 |

| |

Dreyfus/The Boston Company Small/Mid Cap Growth Fund

| | Registered investment companies | | 2,346,551 |

| |

Invesco Real Estate Institutional Fund | | Registered investment companies | | 3,282,634 |

| |

JPMorgan Core Bond A Fund | | Registered investment companies | | 4,896,627 |

| |

Vanguard 500 Index Fund Admiral | | Registered investment companies | | 10,220,358 |

| |

Vanguard Equity Income Fund Admiral | | Registered investment companies | | 5,129,364 |

| |

Vanguard Small Cap Index Fund Admiral | | Registered investment companies | | 3,748,164 |

| |

Vanguard Target Retirement 2010 Fund | | Registered investment companies | | 776,822 |

| |

Vanguard Target Retirement 2020 Fund | | Registered investment companies | | 1,795,722 |

| |

Vanguard Target Retirement 2030 Fund | | Registered investment companies | | 5,356,643 |

| |

Vanguard Target Retirement 2040 Fund | | Registered investment companies | | 2,976,507 |

| |

Vanguard Target Retirement 2050 Fund | | Registered investment companies | | 389,709 |

| |

Wells Fargo Advantage Emerging Markets Equity Fund | | Registered investment companies | | 724,831 |

| |

Wells Fargo Advantage Premier Large Company Growth Fund, Class A | | Registered investment companies | | 7,247,391 |

| |

| | Registered Investment Companies Total | | $ | 64,481,042 |

| |

| | | | |

| |

Stable Pooled Fund* | | Investments in common trusts | | $ | 6,535,690 |

| ** |

| | | | |

| |

InterDigital Stock Fund* | | Employer Stock Fund | | $ | 4,735,622 |

| |

| | | | |

| |

Notes Receivable from Participants* | | Notes Receivable with Interest Rate of 4.25% | | $ | 233,063 |

| |

TOTAL ASSETS HELD AT END OF YEAR | | | | $ | 76,043,350 |

| |

* Transaction with party in interest

** Fair value is $6,895,146

Cost is not required for participant-directed investments.

INTERDIGITAL

SAVINGS AND PROTECTION PLAN

EIN 23-1882087

SCHEDULE H, LINE 4(a) - SCHEDULE OF DELINQUENT PARTICIPANT CONTRIBUTIONS

DECEMBER 31, 2014

|

| | | | | | | | | | | | |

| Totals that Consitute Nonexempt Prohibited Transactions |

| Contributions Not Corrected | Contributions Corrected outside VFCP | Contributions Pending Correction in VFCP | Total Fully Corrected Under VFCP and PTE 2002-51 |

Participant Contributions Transferred Late to Plan for year ended 12/31/2014 | $ | 928,540 |

| $ | — |

| $ | — |

| $ | — |

|

Participant Contributions Transferred Late to Plan for year ended 12/31/2013 | 969,602 |

| — |

| — |

| — |

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | |

| | | | |

| INTERDIGITAL SAVINGS AND PROTECTION PLAN |

| By: | InterDigital, Inc., in its capacity as Plan Sponsor and Plan Administrator | |

| | |

Date: June 29, 2015 | By: | /s/ Richard J. Brezski | |

| | Richard J. Brezski | |

| | Chief Financial Officer | |

EXHIBIT INDEX

The following is a list of Exhibits filed as part of this Annual Report on Form 11-K:

|

| | |

| | |

Exhibit | | Exhibit |

Number | | Description |

23.1 | | Consent of Morison Cogen LLP |

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in the Registration Statement (No. 333-66626) on Form S-8 of InterDigital, Inc. of our report dated June 29, 2015, with respect to the statements of net assets available for benefits of the InterDigital Savings and Protection Plan as of December 31, 2014 and 2013, the related statements of changes in net assets available for benefits for the years then ended, and the related supplemental schedules as of and for the year ended December 31, 2014, which report appears in the annual report on Form 11-K for the year ended December 31, 2014 of the InterDigital Savings and Protection Plan.

/s/ Morison Cogen LLP

Bala Cynwyd, Pennsylvania

June 29, 2015

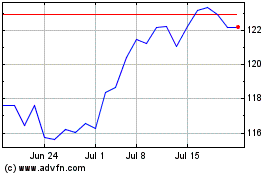

InterDigital (NASDAQ:IDCC)

Historical Stock Chart

From Mar 2024 to Apr 2024

InterDigital (NASDAQ:IDCC)

Historical Stock Chart

From Apr 2023 to Apr 2024