UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SD

Specialized Disclosure Report

Generac Holdings Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

001-34627 |

|

20-5654756 |

|

(State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

|

of incorporation) |

|

File Number) |

|

Identification No.) |

|

S45 W29290 Hwy. 59 |

|

|

|

Waukesha, Wisconsin |

|

53189 |

|

(Address of principal executive offices) |

|

(Zip Code) |

York Ragen

Chief Financial Officer

(262) 544-4811(Ext. 2788)

(Name and telephone, including area code, of the person to contact in connection with this report).

Check the appropriate box to indicate the rule pursuant to which this form is being filed, and provide the period to which the information in this form applies:

| |

☑ |

Rule 13p-1 under the Securities Exchange Act of 1934 (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2014. |

Section 1 – Conflict Minerals Disclosure

Item 1.01 Conflict Minerals Disclosure and Report

Conflict Minerals Disclosure

Generac Holdings Inc. has filed a Conflict Minerals Report for the year ended December 31, 2014 with the Securities and Exchange Commission. A copy of our Conflict Minerals Report is provided as Exhibit 1.01 to this report. It is also publicly available in the investor relations section of our website at www.Generac.com. Information on our web site shall not be deemed incorporated into, or to be a part of, this report.

Item 1.02 Exhibit

See Exhibit 1.01 filed with this Report.

Section 2 - Exhibits

Item 2.01 Exhibits

Exhibit 1.01 – Conflict Minerals Report as required by Items 1.01 and 1.02 of this Form.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the duly authorized undersigned.

Date: May 28, 2015

|

|

Generac Holdings Inc.

By: /S/York A. Ragen

Name: York A. Ragen

Title: Chief Financial Officer |

Exhibit 1.01

Conflict Minerals Report

Of

Generac Holdings Inc.

For the Year Ended December 31, 2014

Overview

Generac Holdings Inc. (the “company,” “Generac,” “we,” or “our”) has filed this report in accordance with Rule 13p-1 under the Securities Exchange Act of 1934, as amended Rule 13p-1 (“Report”). Rule 13p-1 was adopted by the Securities and Exchange Commission (the “SEC”) to implement reporting and disclosure requirements mandated by Section 1502 of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. Rule 13p-1 imposes reporting obligations on public companies, including us, whose manufactured final products contain one or more conflict minerals that are necessary to the functionality or production of those products. For purposes of the Rule and the related disclosures, the term “Conflict Minerals” is defined to include cassiterite, columbite-tantalite, gold, wolframite, and their derivatives, which are limited to tin, tantalum, tungsten, and gold and are referred to in this report as “3TG.”

Generac is a leading designer and manufacturer of a wide range of power generation equipment and other engine powered products serving the residential, light commercial, industrial, oil & gas, and construction markets. Generac uses 3TG in some of our products and have undertaken to investigate their origins. As described more fully below, we examined our products for the presence of 3TG and investigated the origins of the 3TG found to be present in identified items. We also conducted a survey of our suppliers for the reporting period ending December 31, 2014. Our standard supplier agreement requires compliance with the content of our Conflict Mineral Policy and applicable laws.

Our due diligence framework was designed to be consistent with the Organization for Economic Co-operation and Development (“OECD”) OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas. The due diligence measures we performed are presented below according to the five (5) step framework established by the OECD.

Due Diligence Performed

Step 1. Establish Strong Company Management Systems

Conflict Minerals Policy (“Policy”)

Generac has adopted a Policy related to our sourcing of 3TG which is available to the public in the Investor Relations, Corporate Governance Highlights of our website at www.Generac.com.

Internal Team

Generac has established a management system to support supply chain due diligence related to 3TG. Our management system includes a Conflict Mineral Steering Committee consisting of a cross-functional senior management team from global trade compliance, supply chain, financial reporting and legal. Our team is responsible for implementing our conflict minerals program and is led by our Executive Vice President, Strategic Global Sourcing.

Control Systems

We relied on our direct suppliers to provide information on the origin of any 3TG contained in items that they supply to us — including any 3TG supplied to them from lower tier suppliers and the origin of the smelters involved in the refining of the material.

Grievance Mechanism

Our Corporate Governance Helpline acted as our grievance mechanism whereby employees and suppliers could report violations of our Code of Ethics and Business Conduct (“Code”). Our Code was, and remains, available on our website in the Investor Relations, Corporate Governance Highlights section of our website at www.Generac.com.

Step 2. Identify and Assess Risks in the Supply Chain

We conducted our supplier survey pursuant to the following steps:

| |

1. |

Developed a relevant corporate supplier list. |

| |

2. |

Provided these suppliers with a copy of our survey and instructed them to submit their response to “Supplierfeedback@generac.com” within the allotted time period. |

| |

3. |

Those suppliers who did not respond to the initial inquiry were sent a second round of surveys encouraging their response. |

| |

4. |

If the supplier had not responded by this stage, the situation was escalated to the commodity management team and reported to the Conflict Mineral Steering Committee. |

Step 3. Design and Implement a Strategy to Respond to Identified Risks

| |

● |

Senior management was briefed about our due diligence efforts and findings along with the Audit Committee of our Board of Directors. |

Step 4. Carry out Independent Third-Party Audit of Smelter/Refiner’s Due Diligence Practices

We are a downstream consumer of 3TG and are many steps removed from smelters and refiners who provide minerals and ore. We do not purchase raw ore or unrefined 3TG, and our suppliers do not, to the best of our knowledge, directly purchase these minerals from any of the Democratic Republic of the Congo or its neighboring countries (“DRC”). Therefore, we do not perform or direct audits of smelters and refiners within our supply chain.

Step 5. Report Annually on Supply Chain Due Diligence

This Report constitutes our annual report on our 3TG due diligence and is available on our website www.Generac.com/investorrelations and is filed with the SEC.

Expected Future Actions

We have taken, and intend to take, the following steps to mitigate the risk that Conflict Minerals contained in our products could benefit armed groups in the DRC.

| |

► |

Engage with suppliers and, as necessary, follow up to increase the response rate and improve the content of the supplier survey responses. |

| |

► |

Continue assessing and responding to supply chain risks. |

|

Caution Concerning Forward-Looking Statements |

|

Certain statements in this report may be “forward-looking” within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “intend(s),” “expects,” “plans,” “believes,” “estimates,” “anticipates,” and similar expressions are used to identify these forward-looking statements. Examples of forward-looking statements include statements relating to our future plans, and any other statement that does not directly relate to any historical or current fact. Forward-looking statements are based on our current expectations and assumptions, which may not prove to be accurate. These statements are not guarantees and are subject to risks, uncertainties and changes in circumstances that are difficult to predict. Actual outcomes and results may differ materially from these forward-looking statements. As a result, these statements speak only as of the date they are made and we undertake no obligation to update or revise any forward-looking statement, except as required by federal securities laws. |

3

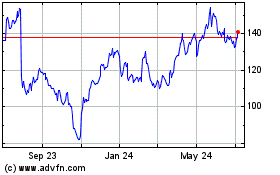

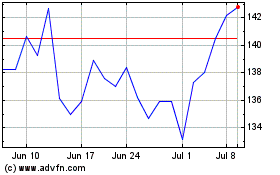

Generac (NYSE:GNRC)

Historical Stock Chart

From Aug 2024 to Sep 2024

Generac (NYSE:GNRC)

Historical Stock Chart

From Sep 2023 to Sep 2024