UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): March 9, 2015

IMMUNOCELLULAR THERAPEUTICS, LTD.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-35560 |

|

93-1301885 |

| (State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

23622 Calabasas Road

Suite 300

Calabasas,

California 91302

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (818) 264-2300

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.01. |

Results of Operations and Financial Condition. |

On March 9, 2015, ImmunoCellular

Therapeutics, Ltd. (the “Company”) issued a press release announcing financial results for the fourth quarter and year ended December 31, 2014. A copy of this press release is attached as Exhibit 99.1.

This information, including exhibits attached hereto and the information under item 9.01 below, shall not be deemed “filed” for the

purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. This information shall not be deemed to be incorporated by reference in any

filing under the Securities Act of 1933, as amended, or the Exchange Act.

| Item 9.01. |

Financial Statements and Exhibits. |

|

|

|

| Exhibit |

|

Description |

|

|

| 99.1 |

|

Press Release, dated March 9, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

| Date: March 9, 2015 |

|

|

|

IMMUNOCELLULAR THERAPEUTICS, LTD. |

|

|

|

|

|

|

|

|

By: |

|

/s/ David Fractor |

|

|

|

|

|

|

David Fractor |

|

|

|

|

|

|

Principal Accounting Officer |

EXHIBIT INDEX

|

|

|

| Exhibit |

|

Description |

|

|

| 99.1 |

|

Press Release, dated March 9, 2015 |

Exhibit 99.1

Contact:

ImmunoCellular

Therapeutics, Ltd.

Investor Relations

Jane Green

415.348.0010 direct

415.652.4819 mobile

jane@jmgcomm.com

ImmunoCellular

Therapeutics Announces Fourth Quarter

and Full Year 2014 Financial Results

ICT-107 Poised to Begin Phase 3 Registration Trial in Second Half of 2015;

Business Update Conference Call to be Held on March 12, 2015

Los Angeles, CA – March 9, 2015 – ImmunoCellular Therapeutics, Ltd. (“ImmunoCellular”) (NYSE MKT: IMUC) today announced financial

results for the fourth quarter and year ended December 31, 2014.

“We continued to make progress in 2014 toward building ImmunoCellular into a

leading cancer immunotherapy company, including key accomplishments in all aspects of our business: advancing our dendritic cell-based vaccine pipeline; working with regulatory bodies in the United States and Europe to design a high quality phase

III registration trial for ICT-107; achieving phase III operational readiness and commercial-grade manufacturing; strategically expanding our immunotherapy technology platform; and significantly strengthening our financial standing,” said

Andrew Gengos, ImmunoCellular’s Chief Executive Officer. “Today, ImmunoCellular has a valuable phase III clinical asset in ICT-107, which is poised to begin a registration trial in newly diagnosed glioblastoma in the second half of 2015.

With our recently completed financing, we have a strong balance sheet with which to begin this registration trial, advance the ICT-121 phase I trial in recurrent glioblastoma toward data in 2016, move our preclinical Stem-to-T-cell program toward

its first clinical candidate and potentially pursue additional collaborative opportunities to strengthen and diversify our immune-oncology platform. We believe that 2015 has the potential to be a pivotal year of value creation for our shareholders,

moving us closer to our goal of transforming the treatment of cancer by utilizing multiple approaches to immune system stimulation.”

For the year

ended December 31, 2014, ImmunoCellular incurred a net loss of $9.4 million, or $0.16 per basic and diluted share, compared to a net loss of $8.8 million, or $0.16 per basic and diluted share, for the year ended December 31, 2013. During

2014, ImmunoCellular increased its research and development expenditures related to ICT-121 and ICT-140 and continued to incur

ICT-107 Phase 2 expenses related to patient follow-up and data analysis. These expenses decreased during the second half of the year as the study is complete. Also, during 2014 ImmunoCellular

recognized a gain of $530,000 related to the revaluation of its warrant derivatives and a charge of $654,000 related to stock-based compensation. The loss for 2013 included a gain of $642,000 related to the revaluation of its warrant derivatives and

a charge of $724,000 related to stock-based compensation.

For the quarter ended December 31, 2014, ImmunoCellular incurred a net loss of $2.1

million, or $0.03 per basic and diluted share, compared to net income of $117,000, or $0.00 per basic and diluted share, for the quarter ended December 31, 2013. The net income for the quarter ended December 31, 2013, reflects a gain of

$2.7 million related to the revaluation of ImmunoCellular’s warrant derivatives.

In February of 2015, ImmunoCellular completed an underwritten

public offering pursuant to which it sold 26,650,000 shares of common stock and warrants to purchase 18,655,000 shares of common stock, at a combined public offering price of $0.60 per share. The net proceeds from the offering were approximately

$14.6 million, after deducting the underwriting discount and offering expenses payable by ImmunoCellular. The warrants have an exercise price of $0.66 per share and a term of 60 months from the date of issuance. The warrants also provide for a

weighted-average adjustment to the exercise price if the Company issues additional shares of common stock at a price per share less than then effective exercise price of the warrants, subject to certain exceptions.

Business Update Conference Call and Webcast to be Held March 12, 2015

ImmunoCellular plans to hold a conference call and webcast on Thursday, March 12 at 5:00 pm ET to provide a business update. The call will be hosted by

Andrew Gengos, President and CEO.

|

|

|

| LIVE CALL: |

|

(877) 853-5636 (toll-free); international dial-in: (631) 291-4544; conference code 92238648 |

|

|

| WEBCAST: |

|

Interested parties who wish to listen to the webcast should visit the Investor Relations section of ImmunoCellular’s website at www.imuc.com, under the Events and Presentations tab. A replay of the webcast will be

available one hour after the conclusion of the event. |

The conference call will contain forward-looking statements. The information provided on the teleconference is accurate only

at the time of the conference call, and ImmunoCellular will take no responsibility for providing updated information except as required by law.

About

ImmunoCellular Therapeutics, Ltd.

ImmunoCellular Therapeutics, Ltd. is a Los Angeles-based clinical-stage company that is developing immune-based

therapies for the treatment of brain and other cancers. ImmunoCellular has concluded a phase II trial of its lead product candidate, ICT-107, a dendritic cell-based vaccine targeting multiple tumor-associated antigens for glioblastoma.

ImmunoCellular’s pipeline also includes: ICT-121, a dendritic cell vaccine targeting CD133; ICT-140, a dendritic cell vaccine targeting ovarian cancer antigens and cancer stem cells; and the Stem-to-T-cell research program which engineers the

patient’s hematopoietic stem cells to generate antigen-specific cancer killing T-cells.

Forward-Looking Statements for ImmunoCellular Therapeutics

This press release contains certain forward-looking statements, including statements regarding the development and commercialization of ICT-107, initiation of

a phase III study in ICT-107, the advancement of the ICT-121 phase I trial and the development of our preclinical Stem-to-T-cell program. These statements are based on ImmunoCellular’s current expectations and involve significant risks and

uncertainties, including those described under the heading “Risk Factors” in ImmunoCellular’s most recently filed quarterly report on Form 10-Q and annual report on Form 10-K. Except as required by law, ImmunoCellular undertakes no

obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Condensed Consolidated

Balance Sheets

|

|

|

|

|

|

|

|

|

| |

|

12/31/2014 |

|

|

12/31/2013 |

|

| Cash |

|

$ |

23,222,296 |

|

|

$ |

27,646,351 |

|

| Other current assets |

|

|

1,219,873 |

|

|

|

763,299 |

|

| Non current assets |

|

|

736,392 |

|

|

|

531,027 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

25,178,561 |

|

|

$ |

28,940,677 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Current liabilities |

|

$ |

1,289,199 |

|

|

$ |

1,402,273 |

|

| Warrant liability |

|

|

597,719 |

|

|

|

1,064,810 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

1,886,918 |

|

|

|

2,467,083 |

|

| Shareholders’ equity |

|

|

23,291,643 |

|

|

|

26,473,594 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and shareholders’ equity |

|

$ |

25,178,561 |

|

|

$ |

28,940,677 |

|

|

|

|

|

|

|

|

|

|

Condensed Consolidated Statements of Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Year

ended

2014 |

|

|

Year

ended

2013 |

|

|

Year

ended

2012 |

|

| Revenue |

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

| Research and development |

|

|

5,969,182 |

|

|

|

5,339,716 |

|

|

|

7,711,233 |

|

| Stock based compensation |

|

|

654,260 |

|

|

|

724,212 |

|

|

|

496,007 |

|

| General and administrative |

|

|

3,235,099 |

|

|

|

3,396,391 |

|

|

|

3,619,291 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss before other expenses (income) |

|

|

(9,858,541 |

) |

|

|

(9,460,319 |

) |

|

|

(11,826,531 |

) |

| Interest income |

|

|

13,917 |

|

|

|

17,345 |

|

|

|

8,609 |

|

| Financing expense |

|

|

(62,683 |

) |

|

|

0 |

|

|

|

(397,294 |

) |

| Change in fair value of warrant liability |

|

|

529,774 |

|

|

|

642,411 |

|

|

|

(2,279,923 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

($ |

9,377,533 |

) |

|

($ |

8,800,563 |

) |

|

($ |

14,495,139 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per share, basic and diluted: |

|

$ |

(0.16 |

) |

|

$ |

(0.16 |

) |

|

$ |

(0.35 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

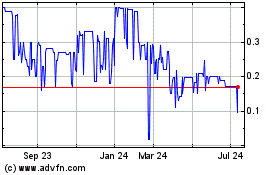

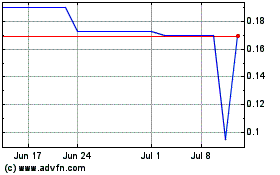

EOM Pharmaceutical (PK) (USOTC:IMUC)

Historical Stock Chart

From Mar 2024 to Apr 2024

EOM Pharmaceutical (PK) (USOTC:IMUC)

Historical Stock Chart

From Apr 2023 to Apr 2024