SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 29, 2015

VAPOR CORP.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

(State of Incorporation)

|

|

(Commission File

Number)

|

|

(IRS Employer

Identification No.)

|

3001 Griffin Road, Dania Beach, Florida

|

|

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (888) 766-5351

| |

|

|

| |

(Former Name or Former Address, if Changed Since Last Report) |

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

VAPOR CORP.

FORM 8-K

CURRENT REPORT

|

Item 1.01

|

Entry into a Material Definitive Agreement

|

On January 29, 2015, Vapor Corp. (the “Registrant”) issued a $350,000 convertible promissory note (the “Note”) to Vaporin, Inc. (“Vaporin”) in consideration for a loan of $350,000 made by Vaporin to the Registrant. The Note accrues interest on the outstanding principal at an annual rate of 12%. The principal and accrued interest on the Note is due and payable on January 29, 2016 (the “Maturity Date”), however, if the merger between the Registrant and Vaporin (the “Merger”) does not close by May 31, 2015 (the “End Date”), the Maturity Date will accelerate and the outstanding principal and accrued but unpaid interest under the Note will become due June 1, 2015. If the Merger closes prior to the End Date, then the Note will be extinguished as a result of the Merger. However, if the Merger does not close by the End Date, or in the event of a default by the Registrant under the Note, the Note will become convertible into the Registrant’s common stock at a conversion price equal to 85% of the closing price of Registrant’s common stock on the Nasdaq Stock Market (“Nasdaq”) on May 29, 2015, provided, however, that the Note will not be convertible until such time as the Nasdaq Stock Market (“Nasdaq”) approves the listing of the shares to be issued upon conversion of the Note. In no event will the number of shares of the Registrant’s common stock issuable upon conversion of the Note exceed 19.99% of the Registrant’s issued and outstanding common stock, regardless of the conversion price.

The Registrant submitted a Listing of Additional Shares notification form with Nasdaq and has committed to take other actions required by Nasdaq in order to receive approval of the listing of the shares issuable upon conversion of the Note. If required by Nasdaq, the Registrant has agreed to use its best efforts to obtain stockholder approval of the issuance of shares to be issued upon conversion of the Note prior to the End Date.

The foregoing summary of the terms of the Note is not complete and is qualified in its entirety by reference to the full text of the Note, which is filed as an exhibit under Item 9.01 of this Current Report on Form 8-K and is incorporated herein by reference.

|

Item 2.03

|

Creation of a Direct Financial Obligation (DFO) or an Obligation under an Off- Balance Sheet Arrangement.

|

Item 1.01 of this Current Report on Form 8-K is incorporated into this Item 2.03 by reference.

|

Item 9.01

|

Financial Statements and Exhibits. |

(d) Exhibits

|

Exhibit No.

|

|

|

Exhibit

|

|

| |

|

|

|

10.1

|

|

Convertible Promissory Note, dated January 29, 2015.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

VAPOR CORP.

|

|

| |

|

|

|

| Date: |

February 3, 2015

|

|

By:

|

/s/ Harlan Press |

|

| |

Harlan Press |

|

| |

Chief Financial Officer |

|

| |

|

|

|

| |

|

|

|

Exhibit

Number

|

Description

|

|

| |

|

|

|

10.1

|

Convertible Promissory Note, dated January 29, 2015.

|

| |

|

Exhibit 10.1

THIS NOTE AND THE SECURITIES ISSUABLE UPON CONVERSION OF THIS NOTE HAVE NOT BEEN REGISTERED UNDER THE FEDERAL OR ANY STATE SECURITIES LAWS AND MAY NOT BE SOLD, TRANSFERRED OR HYPOTHECATED IN ABSENCE OF AN EFFECTIVE REGISTRATION STATEMENT UNDER SUCH LAWS AS MAY BE APPLICABLE OR, AN OPINION OF COUNSEL THAT AN EXEMPTION FROM SUCH APPLICABLE LAWS EXIST.

CONVERTIBLE NOTE

| |

|

| $350,000 |

Issuance Date: January 29, 2015 |

| |

Maturity Date: January 29, 2016 |

FOR VALUE RECEIVED, Vapor Corp., a Delaware corporation (the “Borrower”), with its principal offices located at 3001 Griffin Road, Dania Beach, FL 33312, hereby promises to pay to the order of Vaporin, Inc., a Delaware corporation (the “Holder”) with its principal offices at 4400 Biscayne Boulevard, Miami, FL 33137, or at such other address as the Holder designates in writing to the Borrower, the principal sum of Three Hundred Fifty Thousand and No/100 Dollars ($350,000), on the Maturity Date.

1. Principal, Interest and Maturity. Interest on this Convertible Note (“Note”) shall be computed at an annual rate of twelve percent (12%) based on a 360-day year, payable in arrears on the Maturity Date at which time all accrued and unpaid interest shall be immediately due and payable, provided, however, if the merger between Borrower and Holder (the “Merger”) as set forth in that certain Agreement and Plan of Merger dated December 17, 2014 does not close on or before May 31, 2015 (the “End Date”), the Maturity Date shall accelerate and become due June 1, 2015. While in default, this Note shall bear interest at the rate of 18% per annum or such maximum rate of interest allowable under the laws of the State of Florida, if less. Payments shall be made in lawful money of the United States.

2. Conversion to Common Stock. If Merger does not close by the End Date or in the Event of Default (as described below), this Note shall be convertible into shares of Borrower common stock at a price per share equal to 85% of the Borrower’s closing price on May 29, 2015 (the “Conversion Price”). If the Merger closes prior to the End Date, this Note shall not be convertible. By February 28, 2015, the Borrower shall submit a Listing of Additional Shares notification form with the Nasdaq Stock Market (“Nasdaq”) and take other actions required by Nasdaq in order to receive approval of the issuance of the shares underlying this Note. This Note shall not be convertible until such time as Nasdaq approves the issuance of the shares underlying this Note (unless the Borrower’s common stock is no longer listed on Nasdaq). Additionally, if required by Nasdaq, the Borrower shall use its best efforts to receive shareholder approval of the issuance of shares underlying this Note prior to the End Date. The number of shares convertible under this Note shall be limited to 19.99% of the Borrower’s common stock as of the date of this Note.

3. Anti-Dilution Protection.

(a) In the event, prior to the payment of this Note, that the Borrower shall issue any of its shares of common stock as a stock dividend or shall subdivide the number of outstanding shares of common stock into a greater number of shares, then, in either of such events, the Conversion Price shall be increased proportionately; and, conversely, in the event that the Borrower shall reduce the number of outstanding shares of common stock by combining such shares into a smaller number of shares, then, in such event, the Conversion Price shall be decreased proportionately. Any dividend paid or distributed upon the common stock in shares of any other class of capital stock of the Borrower or securities convertible into shares of common stock shall be treated as a dividend paid in common stock. In the event that the Borrower shall pay a dividend consisting of the securities of any other entity or in cash or other property, upon the next conversion of this Note, the Holder shall receive the securities, cash, or property which the Holder would have been entitled to if the conversion occurred immediately prior to the record date of such dividend.

(b) In the event, prior to the payment of this Note, that the Borrower shall be recapitalized by reclassifying its outstanding common stock (other than into shares of common stock with a different par value, or by changing its outstanding shares of common stock to shares without par value), or in the event the Borrower or a successor corporation, partnership, limited liability company or other entity (any of which is defined as a “Corporation”) shall consolidate or merge with or convey all or substantially all of its, or of any successor Corporation’s property and assets to any other Corporation or Corporations (any such other Corporation being included within the meaning of the term “successor Corporation” used in the context of any consolidation or merger of any other Corporation with, or the sale of all or substantially all of the property of any such other Corporation to, another Corporation or Corporations), or in the event of any other material change in the capital structure of the Borrower or of any successor Corporation by reason of any reclassification, reorganization, recapitalization, consolidation, merger, conveyance or otherwise, then, as a condition of any such reclassification, reorganization, recapitalization, consolidation, merger or conveyance, a prompt, proportionate, equitable, lawful and adequate provision shall be made whereby in lieu of the securities of the Borrower theretofore issuable upon the conversion of this Note, the Holder upon conversion shall receive the securities or assets as may be issued or paid as a result of the foregoing; and in any such event, the rights of the Holder of this Note to any adjustment in the number of shares of common stock obtainable upon conversion of this Note, as provided, shall continue and be preserved in respect of any shares, securities or assets which the Holder becomes entitled to obtain. Notwithstanding anything herein to the contrary, this Section 3 shall not apply to a merger with a subsidiary provided the Borrower is the continuing Corporation or involving a subsidiary merger and provided further such merger does not result in any reclassification, capital reorganization or other change of the securities issuable under this Note. The foregoing provisions of this Section 3(b) shall apply to successive reclassifications, capital reorganizations and changes of securities and to successive consolidations, mergers, sales or conveyances.

(c) In the event the Borrower, at any time while this Note shall remain outstanding, shall sell all or substantially all of its assets, or dissolve, liquidate, or wind up its affairs, prompt, proportionate, equitable, lawful and adequate provision shall be made as part of the terms of any such sale, dissolution, liquidation, or winding up such that the Holder of this Note may thereafter receive, upon exercise hereof, in lieu of the securities of the Borrower which it would have been entitled to receive, the same kind and amount of any shares, securities or assets as may be issuable, distributable or payable upon any such sale, dissolution, liquidation or winding up with respect to each common share of the Borrower; provided, however, that in the event of any such sale, dissolution, liquidation or winding up, the conversion provisions of this Note shall terminate on a date fixed by the Borrower, such date so fixed to be not earlier than 6:00 p.m., New York time, on the 30th day after the date on which notice of such termination of conversion provisions of this Note has been given by mail to the Holder of this Note at such Holder’s address as it appears on the books of the Borrower.

4. Event of Default. Upon an Event of Default, the entire unpaid balance of this Note then outstanding, together with accrued interest thereon, if any, shall be and become immediately due and payable upon written notice from the Holder. For purposes of this Note, an “Event of Default” shall consist of any of the following events:

(a) The Borrower shall fail to pay any portion of the obligations, which shall become due and payable to Holder under this Note, whether at the Maturity Date or at any accelerated date of maturity or at any other date fixed for payment (the “Obligations”).

(b) The Borrower shall commence any case, proceeding or other action under any existing or future law of any jurisdiction, domestic or foreign, relating to bankruptcy, insolvency, or relief of debtors, seeking to have an order for relief entered with respect to it, or seeking to adjudicate it as bankrupt or insolvent, or seeking other relief with respect to its debts; or a court shall enter an order for relief or any such adjudication or appointment, which case, proceeding or action or order, adjudication, or appointment, as the case may be, remains undismissed, undischarged or unbonded for a period of 30 days, then, or any time thereafter during the continuance of any of such events.

(c) A judgment for money damages (or the equitable equivalent) shall be entered against the Borrower, which has not been vacated or stayed within 10 days of entry.

(d) Any material representation or warranty of the Borrower herein shall prove to have been false in any material respect upon the date when made.

(e) The occurrence of a default under any material indebtedness of the Borrower resulting from other than the failure to timely pay interest or principal of such indebtedness which results in the acceleration of the maturity of such indebtedness.

5. Prepayment.

(a) This Note may be prepaid in whole or in part at any time for cash without the Holder’s prior written consent.

(b) All payments made on this Note shall be applied first to any interest accrued to the date of such payment with the remainder applied toward principal.

6. Miscellaneous.

(a) All makers and endorsers now or hereafter becoming parties hereto jointly and severally waive demand, presentment, notice of non-payment and protest.

(b) This Note may not be changed or terminated orally, but only with an agreement in writing, signed by the parties against whom enforcement of any waiver, change, modification, or discharge is sought with such agreement being effective and binding only upon attachment hereto.

(c) This Note and the rights and obligations of the Holder and of the undersigned shall be governed and construed in accordance with the laws of the State of Florida.

(d) Upon the occurrence of an Event of Default under this Note, the Borrower shall, upon demand, pay to the Holder the amount of any and all reasonable costs and expenses (including reasonable attorneys’ fees) that Holder may incur in connection with the enforcement or collection of this Note.

(e) No failure or delay on the part of the Holder hereof in the exercise of any power, right or privilege hereunder shall operate as a waiver thereof, nor shall any single or partial exercise of any such power, right or privilege preclude other or further exercise thereof or of any other right, power or privilege. All rights and remedies existing hereunder are cumulative to, and not exclusive of, any rights or remedies.

(f) The Borrower hereby, to the fullest extent permitted by applicable law, waives presentment, demand, notice (including without limitation notice of default (except as otherwise specifically set forth herein), notice of protest, notice of intention to accelerate maturity, notice of acceleration of maturity and notice of nonpayment or dishonor), protest and all other demands and notices in connection with delivery, acceptance, performance, default, acceleration or enforcement of or under this Note, and the bringing of suit and diligence in taking any action to collect amounts owing hereunder or in proceeding against any of the rights and properties securing payment hereof, and is directly and primarily liable for the amount of all sums owing or to be owing hereon. No extension of the time for the payment of this Note made by agreement with any person now or hereafter liable for the payment of this Note shall operate to release, discharge, modify, change or affect the original liability of the Borrower under this Note.

(g) To the extent that Holder receives any payment on account of any of Borrower’s Obligations, and any such payment(s) or any part thereof are subsequently invalidated, declared to be fraudulent or preferential, set aside, subordinate and/or required to be repaid to a trustee, receiver or any other person or entity under any bankruptcy act, state or federal law, common law or equitable cause, then, to the extent of such payment(s) received, the Borrower’s Obligations or part thereof intended to be satisfied shall be revived and continue in full force and effect, as if such payment(s) had not been received by the Holder and applied on account of Borrower’s Obligations.

(h) All notices, offers, acceptance and any other acts under this Note (except payment) shall be in writing, and shall be sufficiently given if delivered to the addressees in person, by FedEx or similar receipted next business day delivery, or by facsimile or email delivery followed by overnight next business day delivery to the Borrower at the address set forth above (or such other address as the Borrower may by notice to the Holder may designate from time to time) and to the Holder at the address set forth above (or such other address as the Holder by notice to the Borrower may designate from time to time). Time shall be counted to, or from, as the case may be, the date of delivery.

[Signature Page Follows]

IN WITNESS WHEREOF, the Borrower has caused this Note to be executed as of the Issuance Date.

| |

|

|

| |

BORROWER: |

| |

|

| |

VAPOR CORP. |

| |

|

|

|

|

By:

|

/s/ Jeffrey E. Holman |

| |

Jeffrey E. Holman, Chief Executive Officer |

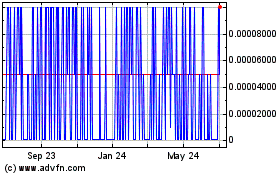

Healthier Choices Manage... (PK) (USOTC:HCMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

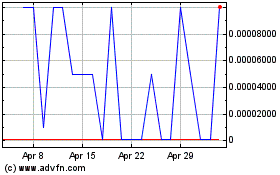

Healthier Choices Manage... (PK) (USOTC:HCMC)

Historical Stock Chart

From Apr 2023 to Apr 2024