UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

January 26, 2015

Commission File Number: 000-51380

Silicon

Motion Technology Corporation

(Exact name of Registrant as specified in its charter)

8F-1, No.36, Taiyuan St.

Jhubei City, Hsinchu County 302

Taiwan

(Address of

principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form

20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ¨ No

x

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if

submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(7):

Yes ¨ No

x

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if

submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s

“home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to

the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes ¨ No

x

If “Yes” is marked, indicate below the file number assigned to the registrant in

connection with Rule 12g3-2(b):

Not applicable

Exhibits

|

|

|

| Exhibit 99.1 |

|

Press Release issued by the Company on January 26, 2015. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

SILICON MOTION TECHNOLOGY CORPORATION |

|

|

|

|

| Date: January 26, 2015 |

|

|

|

By: |

|

/s/ Riyadh Lai |

|

|

|

|

Name: |

|

Riyadh Lai |

|

|

|

|

Title: |

|

Chief Financial Officer |

2

Exhibit 99.1

|

|

|

|

|

Silicon Motion Announces Results for the Period

Ended December 31, 2014 |

Fourth Quarter 2014

Financial Highlights

| |

• |

|

Net sales decreased 7% quarter-over-quarter to US$80.5 million from US$86.6 million in 3Q14 |

| |

• |

|

Gross margin (non-GAAP1) decreased to 52.5% from 52.9% in 3Q14 |

| |

• |

|

Operating expenses (non-GAAP) decreased to US$21.4 million from US$22.1 million in 3Q14 |

| |

• |

|

Operating margin (non-GAAP) decreased to 25.9% from 27.3% in 3Q14 |

| |

• |

|

Diluted earnings per ADS (non-GAAP) decreased to US$0.48 from US$0.57 in 3Q14 |

Business Highlights

| |

• |

|

Achieved highest level of annual revenue and operating income (non-GAAP) in our corporate history |

| |

• |

|

Began shipments of our SATA 3 client SSD controller to Micron and another NAND flash OEM |

| |

• |

|

Our storage OEM customer began shipping SSDs with our SATA 3 client SSD controllers to three global tier-1 PC OEMs |

| |

• |

|

Will begin shipments of our TLC SATA 3 client SSD controller to several module makers in the first quarter |

| |

• |

|

Our SATA 3 client SSD controller has secured SSD platform wins at four NAND flash makers for production in 2015—one additional NAND flash maker than last quarter |

Taipei, Taiwan, January 27, 2015 – Silicon Motion Technology Corporation (NasdaqGS: SIMO) (“Silicon Motion” or the “Company”)

today announced its financial results for the quarter ended December 31, 2014. For the fourth quarter, net sales decreased 7% quarter-over-quarter to US$80.5 million from US$86.6 million in the third quarter. Net income (non-GAAP) decreased

quarter-over-quarter to US$16.6 million or US$0.48 per diluted ADS from a net income (non-GAAP) of US$19.7 million or US$0.57 per diluted ADS in the third quarter.

GAAP net income for the fourth quarter decreased to US$11.9 million or US$0.35 per diluted ADS from a GAAP net income of US$14.6 million or US$0.43 per

diluted ADS in the third quarter.

| 1 |

Non-GAAP measures represent GAAP measures excluding the impact of stock-based compensation, foreign exchange gain (loss), and other non-recurring items. For reconciliation of non-GAAP to GAAP results and further

discussion, see accompanying financial tables and the note “Discussion of Non-GAAP Financial Measures” at the end of this press release. |

1

Fourth Quarter 2014 Financial Review

Commenting on the results of the fourth quarter, Silicon Motion’s President and CEO Wallace Kou said:

“As expected, our fourth quarter revenue was seasonally soft, largely due to the seasonality of eMMC sales. Our fourth quarter revenue

increased 53% as compared to the fourth quarter of 2013, led by a strong 70% year-over-year increase of our embedded storage sales, with strong growth by our eMMC and client SSD controllers.

For full-year 2014, we achieved the highest level of revenue in our corporate history. We are extremely pleased with the stellar growth of our

eMMC sales, which are now about 40% of total corporate sales, and with the solid position that our client SSD controllers have established with our NAND flash, storage OEM and module maker partners. Our overall embedded storage product sales,

consisting primarily of our eMMC, client SSD and industrial SSD controllers have grown to account for over half of our total corporate sales.

In the first quarter-to-date, our client SSD controllers have already achieved a number of important milestones. Micron and another NAND flash

vendor announced that they will start shipping SSDs with our controllers. Our storage OEM partner has already started shipping SSDs with our controllers to three global tier-1 PC OEMs. Our turnkey TLC SATA 3 client SSD controller, the world’s

first merchant solution, which began commercial sampling in August last year, began initial commercial sales to a module maker customer. Additionally, we secured an SSD platform win at another NAND flash OEM, which brings the total number of NAND

flash partners that will enter production in 2015 with our client SSD controllers to four.”

Sales

Net sales in the fourth quarter were US$80.5 million, a decrease of 7% compared with the third quarter. For the quarter, mobile storage products accounted for

81% of net sales and mobile communications 16% of net sales.

Net sales of our mobile storage products, which primarily include eMMC, SSD, memory card and

USB flash drive controllers, decreased 9% sequentially in the fourth quarter to US$65.5 million.

Net sales of mobile communications products, which

primarily include LTE transceivers and mobile TV IC solutions, increased 5% sequentially to US$13.3 million in the fourth quarter.

Gross and Operating

Margins

Gross margin (non-GAAP) decreased to 52.5% in the fourth quarter as compared to 52.9% in the third quarter. GAAP gross margin decreased in the

fourth quarter to 52.4% as compared to 52.8% in the third quarter.

2

Operating expenses (non-GAAP) in the fourth quarter were US$21.4 million, a decrease from US$22.1 million in the

third quarter. Operating margin (non-GAAP) was 25.9%, a decrease from 27.3% in the previous quarter. GAAP operating margin was 20.7% for the fourth quarter, a decrease from 21.9% in the third quarter.

Other Income and Expenses

Net total other income

(non-GAAP) was US$0.6 million, a slight increase from the third quarter. GAAP net total other income was US$0.2 million, a slight increase from the third quarter.

Earnings

Net income (non-GAAP) was US$16.6 million for

the fourth quarter, a decrease from US$19.7 million in the third quarter. Diluted earnings per ADS (non-GAAP) were US$0.48 in the fourth quarter, a decrease from US$0.57 per ADS in the third quarter.

GAAP net income was US$11.9 million for the fourth quarter, a decrease from US$14.6 million in the third quarter. Diluted GAAP earnings per ADS in the fourth

quarter were US$0.35, a decrease from US$0.43 per ADS in the third quarter.

Balance Sheet

Cash and cash equivalents, and short-term investments increased at the end of the fourth quarter to US$194.9 million from US$165.2 million at the end of the

third quarter.

3

Cash Flow

Our cash flows were as follows:

|

|

|

| 3 months ended December 31, 2014 |

|

|

|

|

|

| |

|

(In US$ millions) |

|

| Net income |

|

|

11.9 |

|

| Depreciation & amortization |

|

|

1.9 |

|

| Changes in operating assets and liabilities |

|

|

18.1 |

|

| Others |

|

|

5.1 |

|

|

|

|

|

|

| Net cash provided by (used in) operating activities |

|

|

37.0 |

|

|

|

|

|

|

| Acquisition of property and equipment |

|

|

(1.9 |

) |

| Others |

|

|

0.1 |

|

|

|

|

|

|

| Net cash provided by (used in) investing activities |

|

|

(1.8 |

) |

|

|

|

|

|

| Dividend |

|

|

(5.1 |

) |

| Others |

|

|

— |

|

|

|

|

|

|

| Net cash provided by (used in) financing activities |

|

|

(5.1 |

) |

|

|

|

|

|

| Effects of changes in foreign currency exchange rates on cash |

|

|

(0.4 |

) |

|

|

|

|

|

| Net increase (decrease) in cash and cash equivalents |

|

|

29.7 |

|

|

|

|

|

|

During the fourth quarter, we had US$1.9 million of capital expenditures primarily relating to the purchase of software and

design tools.

Returning Value to Shareholders

On

October 15, 2014 the Board of Directors of the Company declared a US$0.15 per ADS quarterly dividend. On November 19, we paid $5.1 million as dividend payments to our shareholders.

Business Outlook:

Silicon Motion’s President and

CEO, Wallace Kou, added:

“2014 was an outstanding year for Silicon Motion. We believe our strong 2014 sets the stage for continuing

growth in 2015. We are confident that our SK Hynix eMMC business will continue to grow and our client SSD controller sales will scale as our OEM projects enter production. We expect our first quarter to be seasonally soft due to removable storage

seasonality which should offset the initial ramp of our OEM client SSD sales. We expect our eMMC sales to be relatively flat sequentially, but represent an increase of over 50% as compared to the first quarter of 2014.”

For the first quarter of 2015, management expects:

| |

• |

|

Revenue to decrease 5% to 0% sequentially |

4

| |

• |

|

Gross margin (non-GAAP) to be in the 50% to 52% range |

| |

• |

|

Operating expenses (non-GAAP) of approximately US$22 to $23 million |

For full-year 2015, management expects:

| |

• |

|

Revenue to increase 15 % to 25 % as compared to full-year 2014 |

| |

• |

|

Gross margin (non-GAAP) to be in the 49.5% to 51.5% range |

| |

• |

|

Operating expenses (non-GAAP) of approximately US$91 to $97 million |

Conference Call & Webcast:

The Company’s management team will conduct a conference call at 8:00 am Eastern Time on January 27, 2015.

Speakers

Wallace Kou,

President & CEO

Riyadh Lai, CFO

Jason Tsai, Director of Investor Relations and Strategy

CONFERENCE CALL ACCESS NUMBERS:

USA (Toll Free): 1 866 519 4004

USA (Toll): 1 845 675 0437

Taiwan (Toll Free): 0080 112 6920

Participant Passcode: 5685 8169

REPLAY NUMBERS (for 7 days):

USA (Toll Free): 1 855 452 5696

USA (Toll): 1 646 254 3697

Participant Passcode: 5685 8169

A webcast of

the call will be available on the Company’s website at www.siliconmotion.com.

5

Discussion of Non-GAAP Financial Measures

To supplement the Company’s unaudited selected financial results calculated in accordance with U.S. Generally Accepted Accounting Principles

(“GAAP”), the Company discloses certain non-GAAP financial measures that exclude stock-based compensation and other items, including non-GAAP cost of sales, non-GAAP gross profit, non-GAAP selling, general, and administrative expenses,

non-GAAP operating income, non-GAAP net income, and non-GAAP earnings per diluted ADS. These non-GAAP measures are not in accordance with or an alternative to GAAP, and may be different from non-GAAP measures used by other companies. We believe that

these non-GAAP measures have limitations in that they do not reflect all the amounts associated with the Company’s results of operations as determined in accordance with GAAP and that these measures should only be used to evaluate the

Company’s results of operations in conjunction with the corresponding GAAP measures. The presentation of this additional information is not meant to be considered in isolation or as a substitute for the most directly comparable GAAP measure. We

compensate for the limitations of our non-GAAP financial measures by relying upon GAAP results to gain a complete picture of our performance.

Our

non-GAAP financial measures are provided to enhance the user’s overall understanding of our current financial performance and our prospects for the future. Specifically, we believe the non-GAAP results provide useful information to both

management and investors as these non-GAAP results exclude certain expenses, gains and losses that we believe are not indicative of our core operating results and because it is consistent with the financial models and estimates published by many

analysts who follow the Company. We use non-GAAP measures to evaluate the operating performance of our business, for comparison with our forecasts, and for benchmarking our performance externally against our competitors. Also, when evaluating

potential acquisitions, we exclude the items described below from our consideration of the target’s performance and valuation. Since we find these measures to be useful, we believe that our investors benefit from seeing the results from

management’s perspective in addition to seeing our GAAP results. We believe that these non-GAAP measures, when read in conjunction with the Company’s GAAP financials, provide useful information to investors by offering:

| |

• |

|

the ability to make more meaningful period-to-period comparisons of the Company’s on-going operating results; |

| |

• |

|

the ability to better identify trends in the Company’s underlying business and perform related trend analysis; |

| |

• |

|

a better understanding of how management plans and measures the Company’s underlying business; and |

| |

• |

|

an easier way to compare the Company’s operating results against analyst financial models and operating results of our competitors that supplement their GAAP results with non-GAAP financial measures.

|

6

The following are explanations of each of the adjustments that we incorporate into our non-GAAP measures, as well

as the reasons for excluding each of these individual items in our reconciliation of these non-GAAP financial measures:

Stock-based compensation

expense consists of non-cash charges related to the fair value of stock options and restricted stock units awarded to employees. The Company believes that the exclusion of these non-cash charges provides for more accurate comparisons of our

operating results to our peer companies due to the varying available valuation methodologies, subjective assumptions and the variety of award types. In addition, the Company believes it is useful to investors to understand the specific impact of

share-based compensation on its operating results.

Foreign exchange gains and losses consist of translation gains and/or losses of non-US$

denominated current assets and current liabilities, as well as certain other balance sheet items which result from the appreciation or depreciation of non-US$ currencies against the US$. We do not use financial instruments to manage the impact

on our operations from changes in foreign exchange rates, and because our operations are subject to fluctuations in foreign exchange rates, we therefore exclude foreign exchange gains and losses when presenting non-GAAP financial measures.

Other non-recurring items:

| |

• |

|

Litigation expenses consist of legal expenses relating to intellectual property disputes, commercial claims and other types of litigation. While litigation may arise in the ordinary course of our business, we

nevertheless consider litigation to be an unusual, non-recurring and unplanned activity and therefore exclude this charge when presenting non-GAAP financial measures. |

| |

• |

|

Vendor dispute charges relate to the write down of certain unsalable inventory due to defects in the components provided by our vendor. These parts were supplied to us at a quality below levels previously

specified and agreed. All parts known to be defective have been identified and are within our control. We have resolved this matter with our vendor and recovered in 1Q 2013 the full value of the inventory being written off. This charge (as well as

the amount recovered) has been excluded from our non-GAAP results as we believe this is an unusual, non-recurring and unplanned activity. |

7

Silicon Motion Technology Corporation

Consolidated Statements of Income

(in thousands, except percentages and per ADS data, unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months Ended |

|

| |

|

Dec. 31, 2013

(US$) |

|

|

Sep. 30, 2014

(US$) |

|

|

Dec. 31, 2014

(US$) |

|

| Net Sales |

|

|

52,489 |

|

|

|

86,561 |

|

|

|

80,503 |

|

| Cost of sales |

|

|

27,045 |

|

|

|

40,885 |

|

|

|

38,310 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

25,444 |

|

|

|

45,676 |

|

|

|

42,193 |

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

| Research & development |

|

|

12,339 |

|

|

|

17,728 |

|

|

|

17,627 |

|

| Sales & marketing |

|

|

3,578 |

|

|

|

4,724 |

|

|

|

4,461 |

|

| General & administrative |

|

|

2,592 |

|

|

|

4,230 |

|

|

|

3,433 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

|

6,935 |

|

|

|

18,994 |

|

|

|

16,672 |

|

| Non-operating income (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

| Gain on sale of investments |

|

|

1 |

|

|

|

1 |

|

|

|

1 |

|

| Interest income, net |

|

|

483 |

|

|

|

466 |

|

|

|

613 |

|

| Foreign exchange gain (loss),net |

|

|

73 |

|

|

|

(375 |

) |

|

|

(451 |

) |

| Others, net |

|

|

7 |

|

|

|

— |

|

|

|

(4 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Subtotal |

|

|

564 |

|

|

|

92 |

|

|

|

159 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income tax |

|

|

7,499 |

|

|

|

19,086 |

|

|

|

16,831 |

|

| Income tax expense |

|

|

2,083 |

|

|

|

4,465 |

|

|

|

4,911 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

|

5,416 |

|

|

|

14,621 |

|

|

|

11,920 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings per ADS |

|

$ |

0.16 |

|

|

$ |

0.43 |

|

|

$ |

0.35 |

|

| Diluted earnings per ADS |

|

$ |

0.16 |

|

|

$ |

0.43 |

|

|

$ |

0.35 |

|

| Margin Analysis: |

|

|

|

|

|

|

|

|

|

|

|

|

| Gross margin |

|

|

48.5 |

% |

|

|

52.8 |

% |

|

|

52.4 |

% |

| Operating margin |

|

|

13.2 |

% |

|

|

21.9 |

% |

|

|

20.7 |

% |

| Net margin |

|

|

10.3 |

% |

|

|

16.9 |

% |

|

|

14.8 |

% |

| Additional Data: |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted avg. ADS equivalents2 |

|

|

32,899 |

|

|

|

33,803 |

|

|

|

33,892 |

|

| Diluted ADS equivalents |

|

|

33,670 |

|

|

|

34,302 |

|

|

|

34,471 |

|

| 2 |

Assumes all outstanding ordinary shares are represented by ADSs. Each ADS represents four ordinary shares. |

8

Silicon Motion Technology Corporation

Reconciliation of GAAP to Non-GAAP Operating Results

(in thousands, except percentages and per ADS data, unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months Ended |

|

| |

|

Dec. 31,

2013

(US$) |

|

|

Sep. 30,

2014

(US$) |

|

|

Dec. 31,

2014

(US$) |

|

| GAAP net income |

|

|

5,416 |

|

|

|

14,621 |

|

|

|

11,920 |

|

| Stock-based compensation: |

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of sales |

|

|

160 |

|

|

|

109 |

|

|

|

104 |

|

| Research and development |

|

|

3,152 |

|

|

|

2,805 |

|

|

|

2,710 |

|

| Sales and marketing |

|

|

891 |

|

|

|

740 |

|

|

|

735 |

|

| General and administrative |

|

|

656 |

|

|

|

667 |

|

|

|

655 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total stock-based compensation |

|

|

4,859 |

|

|

|

4,321 |

|

|

|

4,204 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-recurring items: |

|

|

|

|

|

|

|

|

|

|

|

|

| Litigation expenses |

|

|

(5 |

) |

|

|

337 |

|

|

|

(7 |

) |

| Foreign exchange loss (gain),net |

|

|

(73 |

) |

|

|

375 |

|

|

|

451 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP net income |

|

|

10,197 |

|

|

|

19,654 |

|

|

|

16,568 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shares used in computing non-GAAP diluted earnings per ADS |

|

|

34,065 |

|

|

|

34,636 |

|

|

|

34,650 |

|

| Non-GAAP diluted earnings per ADS |

|

$ |

0.30 |

|

|

$ |

0.57 |

|

|

$ |

0.48 |

|

| Non-GAAP gross margin |

|

|

48.8 |

% |

|

|

52.9 |

% |

|

|

52.5 |

% |

| Non-GAAP operating margin |

|

|

22.5 |

% |

|

|

27.3 |

% |

|

|

25.9 |

% |

9

Silicon Motion Technology Corporation

Consolidated Statements of Income

(in thousands, except percentages, and per ADS data, unaudited)

|

|

|

|

|

|

|

|

|

| |

|

For the Year Ended |

|

| |

|

Dec. 31, 2013

(US$) |

|

|

Dec. 31, 2014

(US$) |

|

| Net Sales |

|

|

225,308 |

|

|

|

289,323 |

|

| Cost of sales |

|

|

118,698 |

|

|

|

139,629 |

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

106,610 |

|

|

|

149,694 |

|

| Operating expenses |

|

|

|

|

|

|

|

|

| Research & development |

|

|

46,460 |

|

|

|

61,048 |

|

| Sales & marketing |

|

|

13,597 |

|

|

|

16,351 |

|

| General & administrative |

|

|

11,250 |

|

|

|

13,378 |

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

|

35,303 |

|

|

|

58,917 |

|

| Non-operating expense (income) |

|

|

|

|

|

|

|

|

| Gain on sale of investments |

|

|

4 |

|

|

|

4 |

|

| Interest income, net |

|

|

1,735 |

|

|

|

2,101 |

|

| Foreign exchange gain (loss),net |

|

|

(25 |

) |

|

|

(606 |

) |

| Others, net |

|

|

131 |

|

|

|

(1 |

) |

|

|

|

|

|

|

|

|

|

| Subtotal |

|

|

1,845 |

|

|

|

1,498 |

|

|

|

|

|

|

|

|

|

|

| Income before income tax |

|

|

37,148 |

|

|

|

60,415 |

|

| Income tax expense |

|

|

9,772 |

|

|

|

16,101 |

|

|

|

|

|

|

|

|

|

|

| Net income |

|

|

27,376 |

|

|

|

44,314 |

|

|

|

|

|

|

|

|

|

|

| Basic earnings per ADS |

|

$ |

0.83 |

|

|

$ |

1.32 |

|

|

|

|

|

|

|

|

|

|

| Diluted earnings per ADS |

|

$ |

0.81 |

|

|

$ |

1.30 |

|

|

|

|

|

|

|

|

|

|

| Margin Analysis: |

|

|

|

|

|

|

|

|

| Gross margin |

|

|

47.3 |

% |

|

|

51.7 |

% |

| Operating margin |

|

|

15.7 |

% |

|

|

20.4 |

% |

| Weighted average ADS: |

|

|

|

|

|

|

|

|

| Basic |

|

|

33,065 |

|

|

|

33,651 |

|

| Diluted |

|

|

33,642 |

|

|

|

34,197 |

|

10

Silicon Motion Technology Corporation

Reconciliation of GAAP to Non-GAAP Operating Results

(in thousands, except percentages and per ADS data, unaudited)

|

|

|

|

|

|

|

|

|

| |

|

For the Year Ended |

|

| |

|

Dec. 31, 2013

(US$) |

|

|

Dec. 31, 2014

(US$) |

|

| GAAP net income |

|

|

27,376 |

|

|

|

44,314 |

|

| Stock-based compensation: |

|

|

|

|

| Cost of sales |

|

|

308 |

|

|

|

286 |

|

| Research and development |

|

|

6,351 |

|

|

|

6,872 |

|

| Sales and marketing |

|

|

2,197 |

|

|

|

1,773 |

|

| General and administrative |

|

|

1,406 |

|

|

|

1,569 |

|

|

|

|

|

|

|

|

|

|

| Total stock-based compensation |

|

|

10,262 |

|

|

|

10,500 |

|

|

|

|

|

|

|

|

|

|

| Non-recurring items: |

|

|

|

|

| Vendor dispute |

|

|

(1,717 |

) |

|

|

— |

|

| Litigation expenses |

|

|

249 |

|

|

|

237 |

|

| Foreign exchange loss (gain), net |

|

|

25 |

|

|

|

606 |

|

|

|

|

|

|

|

|

|

|

| Non-GAAP net income |

|

|

36,195 |

|

|

|

55,657 |

|

|

|

|

|

|

|

|

|

|

| Shares used in computing non-GAAP diluted earnings per ADS |

|

|

34,042 |

|

|

|

34,377 |

|

| Non-GAAP diluted earnings per ADS |

|

$ |

1.06 |

|

|

$ |

1.62 |

|

| Non-GAAP gross margin |

|

|

46.7 |

% |

|

|

51.8 |

% |

| Non-GAAP operating margin |

|

|

19.6 |

% |

|

|

24.1 |

% |

11

Silicon Motion Technology Corporation

Consolidated Balance Sheet

(In

thousands, unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Dec. 31,

2013

(US$) |

|

|

Sep. 30,

2014

(US$) |

|

|

Dec. 31,

2014

(US$) |

|

| Cash and cash equivalents |

|

|

161,720 |

|

|

|

164,445 |

|

|

|

194,211 |

|

| Short-term investments |

|

|

742 |

|

|

|

730 |

|

|

|

703 |

|

| Accounts receivable (net) |

|

|

30,963 |

|

|

|

37,152 |

|

|

|

28,742 |

|

| Inventories |

|

|

33,666 |

|

|

|

55,329 |

|

|

|

44,076 |

|

| Refundable deposits - current |

|

|

15,299 |

|

|

|

19,315 |

|

|

|

19,322 |

|

| Deferred income tax assets (net) |

|

|

1,278 |

|

|

|

368 |

|

|

|

— |

|

| Prepaid expenses and other current

assets |

|

|

2,870 |

|

|

|

4,032 |

|

|

|

3,386 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

246,538 |

|

|

|

281,371 |

|

|

|

290,440 |

|

| Long-term investments |

|

|

133 |

|

|

|

133 |

|

|

|

133 |

|

| Property and equipment (net) |

|

|

30,195 |

|

|

|

34,498 |

|

|

|

35,537 |

|

| Goodwill and intangible assets(net) |

|

|

35,474 |

|

|

|

35,474 |

|

|

|

35,467 |

|

| Other assets |

|

|

4,423 |

|

|

|

4,563 |

|

|

|

4,324 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

|

316,763 |

|

|

|

356,039 |

|

|

|

365,901 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Accounts payable |

|

|

14,661 |

|

|

|

22,725 |

|

|

|

14,246 |

|

| Income tax payable |

|

|

8,189 |

|

|

|

12,097 |

|

|

|

16,160 |

|

| Accrued expenses and other current liabilities |

|

|

17,826 |

|

|

|

20,453 |

|

|

|

24,494 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

40,676 |

|

|

|

55,275 |

|

|

|

54,900 |

|

| Other liabilities |

|

|

5,390 |

|

|

|

6,201 |

|

|

|

6,901 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

46,066 |

|

|

|

61,476 |

|

|

|

61,801 |

|

| Shareholders’ equity |

|

|

270,697 |

|

|

|

294,563 |

|

|

|

304,100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities & shareholders’ equity |

|

|

316,763 |

|

|

|

356,039 |

|

|

|

365,901 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12

About Silicon Motion:

We are a fabless semiconductor company that designs, develops and markets high performance, low-power semiconductor solutions to OEMs and other customers in

the mobile storage and mobile communications markets. For the mobile storage market, our key products are microcontrollers used in solid state storage devices such as SSDs, eMMCs and other embedded flash applications, as well as removable storage

products. For the mobile communications market, our key products are LTE transceivers and mobile TV IC solutions. Our products are widely used in smartphones, tablets, and industrial and commercial applications. For further information on Silicon

Motion, visit www.siliconmotion.com.

Forward-Looking Statements:

This press release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended, including without limitation, statements about Silicon Motion’s expected first quarter of 2015 and full year 2015 revenue, gross margin and operating expenses, all of which

reflect management’s estimates based on information available at this time of this press release. While Silicon Motion believes these estimates to be meaningful, these amounts could differ materially from actual reported amounts for the fourth

quarter of 2014. Forward-looking statements also include, without limitation, statements regarding trends in the multimedia consumer electronics market and our future results of operations, financial condition and business prospects. In some cases,

you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,”

“predict,” “potential,” “continue,” or the negative of these terms or other comparable terminology. Although such statements are based on our own information and information from other sources we believe to be reliable,

you should not place undue reliance on them. These statements involve risks and uncertainties, and actual market trends or our actual results of operations, financial condition or business prospects may differ materially from those expressed or

implied in these forward looking statements for a variety of reasons. Potential risks and uncertainties include, but are not limited to the unpredictable volume and timing of customer orders, which are not fixed by contract but vary on a purchase

order basis; the loss of one or more key customers or the significant reduction, postponement, rescheduling or cancellation of orders from these customers; general economic conditions or conditions in the semiconductor or consumer electronics

markets; decreases in the overall average selling prices of our products; changes in the relative sales mix of our products; the payment, or non-payment, of cash dividends in the future at the discretion of our board of directors; the effect, if

any, on the price of our ADS as a result of the implementation of the announced share repurchase program; changes in our cost of finished goods; the availability, pricing, and timeliness of delivery of other components and raw materials used in our

customers’ products; our customers’ sales outlook,

13

purchasing patterns, and inventory adjustments based on consumer demands and general economic conditions, its customers and consumers; our ability to successfully develop, introduce, and sell new

or enhanced products in a timely manner; and the timing of new product announcements or introductions by us or by our competitors. For additional discussion of these risks and uncertainties and other factors, please see the documents we file from

time to time with the Securities and Exchange Commission, including our Annual Report on Form 20-F filed on April 30, 2014. We assume no obligation to update any forward-looking statements, which apply only as of the date of this press release.

|

|

|

| Investor Contact: |

|

Investor Contact: |

|

|

| Jason Tsai |

|

Selina Hsieh |

|

|

| Director of IR and Strategy |

|

Investor Relations |

|

|

| Tel: +1 408 519 7259 |

|

Tel: +886 3 552 6888 x2311 |

|

|

| Fax: +1 408 519 7101 |

|

Fax: +886 3 560 0336 |

|

|

| E-mail: jtsai@siliconmotion.com |

|

E-mail: ir@siliconmotion.com |

Media Contact:

Sara Hsu

Project Manager

Tel: +886 2 2219 6688 x3509

Fax: +886 2 2219 6868

E-mail: sara.hsu@siliconmotion.com

14

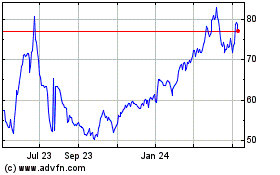

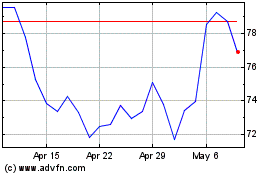

Silicon Motion Technology (NASDAQ:SIMO)

Historical Stock Chart

From Aug 2024 to Sep 2024

Silicon Motion Technology (NASDAQ:SIMO)

Historical Stock Chart

From Sep 2023 to Sep 2024