UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): October 16, 2014

CONSOLIDATED COMMUNICATIONS HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

000-51446 |

|

02-0636095 |

|

(State of Incorporation) |

|

(Commission File Number) |

|

(IRS employer identification no.) |

|

121 South 17th Street |

|

|

|

Mattoon, Illinois |

|

61938-3987 |

|

(Address of principal executive offices) |

|

(Zip code) |

Registrant’s telephone number, including area code: (217) 235-3311

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

EXPLANATORY NOTE

On October 22, 2014, Consolidated Communications Holdings, Inc. (the “Company”) filed with the Securities and Exchange Commission a Current Report on Form 8-K (the “Original Form 8-K”) reporting, among other things, the completion of its acquisition of Enventis Corporation, formerly Hickory Tech Corporation (“Enventis”). This Current Report on Form 8-K/A amends Item 9.01 of the Original Form 8-K to include the required financial statements and to present certain unaudited pro forma financial information in connection with the acquisition, which unaudited pro forma financial information is filed as an exhibit hereto.

Item 9.01 Financial Statements and Exhibits.

(a) Financial statements of businesses acquired.

The audited consolidated financial statements of Enventis as of and for the year ended December 31, 2013 contained in pages 45 through 76 of Enventis’ Annual Report on Form 10-K for the year ended December 31, 2013 (File No. 000-13721), the unaudited condensed consolidated financial statements of Enventis as of and for the quarter ended March 31, 2014 contained in pages 3 through 16 of Enventis’ Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2014 (File No. 000-13721), and the unaudited condensed consolidated financial statements of Enventis as of and for the quarter ended June 30, 2014 contained in pages 3 through 17 of Enventis’ Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2014 (File No. 000-13721) are incorporated herein by reference.

(b) Pro forma financial information.

The unaudited pro forma condensed combined financial information relating to the Company’s acquisition of Enventis is filed as Exhibit 99.1 to this Current Report on Form 8-K/A and is incorporated herein by reference.

(d) Exhibits.

|

Exhibit No. |

|

Description |

|

|

|

|

|

23.1 |

|

Consent of Moss Adams LLP, Independent Registered Public Accounting Firm. |

|

|

|

|

|

23.2 |

|

Consent of Grant Thornton LLP, Independent Registered Public Accounting Firm. |

|

|

|

|

|

99.1 |

|

Unaudited Pro Forma Condensed Combined Financial Information. |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: December 22, 2014 |

|

|

|

Consolidated Communications Holdings, Inc. |

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Steven L. Childers |

|

|

|

Name: Steven L. Childers |

|

|

|

Title: Chief Financial Officer |

3

EXHIBIT INDEX

|

Exhibit No. |

|

Description |

|

|

|

|

|

23.1 |

|

Consent of Moss Adams LLP, Independent Registered Public Accounting Firm. |

|

|

|

|

|

23.2 |

|

Consent of Grant Thornton LLP, Independent Registered Public Accounting Firm. |

|

|

|

|

|

99.1 |

|

Unaudited Pro Forma Condensed Combined Financial Information. |

4

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in the Registration Statements (Form S-8 Nos. 333-135440, 333-128934, 333-166757 and 333-182597, Form S-4/A No. 333-187202, and Form S-8 to Form S-4/A No. 333-198000) of Consolidated Communications Holdings, Inc. of our reports dated March 6, 2014, relating to the consolidated financial statements of Enventis Corporation (formerly, Hickory Tech Corporation) (the “Company”), and the Company’s effectiveness of internal control over financial reporting, included in the Company’s Annual Report (Form 10-K) for the year ended December 31, 2013, filed with the Securities and Exchange Commission.

/s/ Moss Adams LLP

Spokane, Washington

December 22, 2014

Exhibit 23.2

Consent of Independent Registered Public Accounting Firm

We have issued our report dated November 9, 2012, with respect to the consolidated financial statements included in the Annual Report of Enventis Corporation (formerly Hickory Tech Corporation) on Form 10-K for the year ended December 31, 2013. We hereby consent to the incorporation by reference of the aforementioned report in this Form 8-K/A of Consolidated Communications, Inc. on Forms S-4/A (File No 333-187202) and Forms S-8 (File No. 333-135440, File No. 333-128934, File No. 333-166757, File No. 333-182597 and File No. 333-198000).

/s/ Grant Thornton LLP

Minneapolis, Minnesota

December 22, 2014

Exhibit 99.1

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL STATEMENTS

The following unaudited pro forma condensed combined financial statements (“pro forma financial statements”) of Consolidated Communications Holdings, Inc. (“Consolidated”) and Enventis Corporation, formerly known as Hickory Tech Corporation (“Enventis”), have been prepared to reflect Consolidated’s acquisition of Enventis (the “Merger”), based on the acquisition method of accounting, with Consolidated treated as the acquirer. The pro forma financial statements utilize the historical consolidated financial statements of Consolidated and Enventis. The historical consolidated financial statements have been adjusted to give effect to pro forma events that are directly attributable to the Merger and factually supportable and, in the case of the statement of income, that are expected to have a continuing impact. The unaudited pro forma condensed combined statements of income, which have been prepared for the nine months ended September 30, 2014 and the year ended December 31, 2013, give effect to the Merger as if it had occurred on January 1, 2013. The unaudited pro forma condensed combined balance sheet has been prepared as of September 30, 2014 and gives effect to the Merger as if it had occurred on that date.

The pro forma adjustments related to the Merger are based upon preliminary estimates, and are pending the completion of the valuations of the tangible and intangible assets acquired and liabilities assumed. Actual results are expected to differ from these preliminary estimates once Consolidated has completed the valuation studies necessary to finalize the fair value estimates. There can be no assurances that such finalization of the valuation studies will not result in material changes. Consolidated performed a preliminary assessment of accounting policies and financial statement presentation which has identified certain adjustments necessary to conform information in Enventis’ historical financial statements to Consolidated’s accounting policies and presentation. The review of the accounting policies and presentation is not yet complete and additional policy differences may be identified when completed.

These pro forma financial statements should be read in conjunction with Consolidated’s historical consolidated financial statements and accompanying notes included in its Annual Report on Form 10-K for the year ended December 31, 2013 and its Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2014, June 30, 2014 and September 30, 2014. Additionally, these pro forma financial statements should be read in conjunction with the historical consolidated financial statements and accompanying notes of Enventis included in its Annual Report on Form 10-K for the year ended December 31, 2013 and its Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2014 and June 30, 2014, which are incorporated by reference in this filing.

The pro forma financial statements are not intended to represent or be indicative of the consolidated results of operations or financial condition of the combined company that would have been reported had the Merger been completed as of the dates presented and should not be taken as representative of the future consolidated results of operations or financial condition of the combined company.

The pro forma financial statements do not include the realization of future cost savings or synergies or restructuring charges that are expected to result from the Merger.

CONSOLIDATED COMMUNICATIONS HOLDINGS, INC. AND SUBSIDIARIES

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF INCOME

FOR THE NINE MONTHS ENDED SEPTEMBER 30, 2014

(amounts in thousands, except per share amounts)

|

|

|

Consolidated

Communications |

|

Enventis

Corporation |

|

Pro Forma

Adjustments |

|

Note 3 |

|

Pro Forma

Combined |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating revenues |

|

$ |

449,724 |

|

$ |

148,373 |

|

$ |

— |

|

|

|

$ |

598,097 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses (exclusive of depreciation and amortization) |

|

267,593 |

|

113,405 |

|

(3,500 |

) |

(b) |

|

377,498 |

|

|

Depreciation and amortization |

|

106,515 |

|

22,557 |

|

13,010 |

|

(c) |

|

142,082 |

|

|

Total operating expenses |

|

374,108 |

|

135,962 |

|

9,510 |

|

|

|

519,580 |

|

|

Operating income |

|

75,616 |

|

12,411 |

|

(9,510 |

) |

|

|

78,517 |

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net of interest income |

|

(60,280 |

) |

(2,993 |

) |

(2,281 |

) |

(d) |

|

(65,554 |

) |

|

Investment income |

|

25,964 |

|

— |

|

— |

|

|

|

25,964 |

|

|

Other, net |

|

(862 |

) |

— |

|

— |

|

|

|

(862 |

) |

|

Income before income taxes |

|

40,438 |

|

9,418 |

|

(11,792 |

) |

|

|

38,064 |

|

|

Income tax expense |

|

14,380 |

|

3,832 |

|

(4,599 |

) |

(e) |

|

13,613 |

|

|

Net income |

|

26,058 |

|

5,586 |

|

(7,193 |

) |

|

|

24,451 |

|

|

Less: net income attributable to noncontrolling interest |

|

285 |

|

— |

|

— |

|

|

|

285 |

|

|

Net income attributable to common stockholders |

|

$ |

25,773 |

|

$ |

5,586 |

|

$ |

(7,193 |

) |

|

|

$ |

24,166 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per common share attributable to common shareholders: |

|

|

|

|

|

|

|

|

|

|

|

|

Net income per common share - basic |

|

$ |

0.63 |

|

$ |

0.41 |

|

n/a |

|

|

|

$ |

0.48 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per common share - diluted |

|

$ |

0.63 |

|

$ |

0.41 |

|

n/a |

|

|

|

$ |

0.48 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares of common stock used to calculate earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

39,877 |

|

13,634 |

|

(3,490 |

) |

(f) |

|

50,021 |

|

|

Diluted |

|

39,877 |

|

13,696 |

|

(3,552 |

) |

(f) |

|

50,021 |

|

See accompanying notes to the unaudited pro forma condensed combined financial statements.

CONSOLIDATED COMMUNICATIONS HOLDINGS, INC. AND SUBSIDIARIES

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF INCOME

FOR THE YEAR ENDED DECEMBER 31, 2013

(amounts in thousands, except per share amounts)

|

|

|

Consolidated

Communications |

|

Enventis

Corporation |

|

Pro Forma

Adjustments |

|

Note 3 |

|

Pro Forma

Combined |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating revenues |

|

$ |

601,577 |

|

$ |

189,200 |

|

$ |

— |

|

|

|

$ |

790,777 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses (exclusive of depreciation and amortization) |

|

358,642 |

|

142,260 |

|

— |

|

|

|

500,902 |

|

|

Depreciation and amortization |

|

139,274 |

|

29,322 |

|

18,101 |

|

(c) |

|

186,697 |

|

|

Total operating expenses |

|

497,916 |

|

171,582 |

|

18,101 |

|

|

|

687,599 |

|

|

Operating income |

|

103,661 |

|

17,618 |

|

(18,101 |

) |

|

|

103,178 |

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net of interest income |

|

(85,767 |

) |

(4,600 |

) |

(3,879 |

) |

(d) |

|

(94,246 |

) |

|

Loss on extinguishment of debt |

|

(7,657 |

) |

— |

|

— |

|

|

|

(7,657 |

) |

|

Investment income |

|

37,695 |

|

— |

|

— |

|

|

|

37,695 |

|

|

Other, net |

|

(456 |

) |

— |

|

— |

|

|

|

(456 |

) |

|

Income before income taxes |

|

47,476 |

|

13,018 |

|

(21,981 |

) |

|

|

38,513 |

|

|

Income tax expense |

|

17,512 |

|

5,286 |

|

(8,572 |

) |

(e) |

|

14,226 |

|

|

Income from continuing operations |

|

29,964 |

|

7,732 |

|

(13,408 |

) |

|

|

24,288 |

|

|

Less: net income attributable to noncontrolling interest |

|

330 |

|

— |

|

— |

|

|

|

330 |

|

|

Income from continuing operations attributable to common stockholders |

|

$ |

29,634 |

|

$ |

7,732 |

|

$ |

(13,408 |

) |

|

|

$ |

23,958 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from continuing operations per common share attributable to common shareholders: |

|

|

|

|

|

|

|

|

|

|

|

|

Income from continuing operations - basic |

|

$ |

0.73 |

|

$ |

0.57 |

|

n/a |

|

|

|

$ |

0.48 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from continuing operations - diluted |

|

$ |

0.73 |

|

$ |

0.57 |

|

n/a |

|

|

|

$ |

0.48 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares of common stock used to calculate earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

39,764 |

|

13,548 |

|

(3,404 |

) |

(f) |

|

49,908 |

|

|

Diluted |

|

39,764 |

|

13,606 |

|

(3,462 |

) |

(f) |

|

49,908 |

|

See accompanying notes to the unaudited pro forma condensed combined financial statements.

CONSOLIDATED COMMUNICATIONS HOLDINGS, INC. AND SUBSIDIARIES

UNAUDITED PRO FORMA CONDENSED COMBINED BALANCE SHEET

AS OF SEPTEMBER 30, 2014

(amounts in thousands)

|

|

|

Consolidated

Communications |

|

Enventis

Corporation |

|

Pro Forma

Adjustments |

|

Note 4 |

|

Pro Forma

Combined |

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

4,890 |

|

$ |

3,870 |

|

$ |

(8,636 |

) |

(b) |

|

$ |

124 |

|

|

Restricted cash |

|

204,803 |

|

|

|

(204,803 |

) |

(b) |

|

— |

|

|

Accounts receivable, net |

|

51,388 |

|

34,397 |

|

|

|

|

|

85,785 |

|

|

Inventories |

|

— |

|

4,343 |

|

(4,343 |

) |

(a) |

|

— |

|

|

Income tax receivable |

|

804 |

|

4,929 |

|

|

|

|

|

5,733 |

|

|

Deferred income taxes |

|

8,905 |

|

2,377 |

|

|

|

|

|

11,282 |

|

|

Prepaid expenses and other current assets |

|

13,756 |

|

4,357 |

|

4,343 |

|

(a) |

|

22,456 |

|

|

Total current assets |

|

284,546 |

|

54,273 |

|

(213,439 |

) |

|

|

125,380 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net |

|

859,620 |

|

178,686 |

|

2,455 |

|

(a) |

|

1,141,358 |

|

|

|

|

|

|

|

|

100,597 |

|

(c) |

|

|

|

|

Investments |

|

113,594 |

|

3,594 |

|

(1,056 |

) |

(c) |

|

116,132 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Intangible and other assets: |

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill |

|

603,446 |

|

29,028 |

|

136,721 |

|

(c) |

|

769,195 |

|

|

Other intangible assets, net |

|

33,018 |

|

3,629 |

|

16,941 |

|

(c) |

|

53,588 |

|

|

Deferred debt issuance costs, net and other assets |

|

19,231 |

|

6,412 |

|

(2,455 |

) |

(a) |

|

23,218 |

|

|

|

|

|

|

|

|

60 |

|

(c) |

|

|

|

|

|

|

|

|

|

|

(30 |

) |

(d) |

|

|

|

|

|

|

655,695 |

|

39,069 |

|

151,237 |

|

|

|

846,001 |

|

|

|

|

$ |

1,913,455 |

|

$ |

275,622 |

|

$ |

39,794 |

|

|

|

$ |

2,228,871 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

4,991 |

|

$ |

3,470 |

|

|

|

|

|

$ |

8,461 |

|

|

Extended term payable |

|

— |

|

15,539 |

|

|

|

|

|

15,539 |

|

|

Advance billings and deferred revenues |

|

23,512 |

|

5,257 |

|

|

|

|

|

28,769 |

|

|

Dividends payable |

|

15,607 |

|

— |

|

|

|

|

|

15,607 |

|

|

Accrued compensation |

|

17,534 |

|

— |

|

4,947 |

|

(a) |

|

22,481 |

|

|

Accrued interest |

|

12,433 |

|

61 |

|

|

|

|

|

12,494 |

|

|

Accrued expense |

|

33,008 |

|

10,573 |

|

(4,947 |

) |

(a) |

|

36,734 |

|

|

|

|

|

|

|

|

(1,900 |

) |

(b) |

|

|

|

|

Current portion of long-term debt and capital lease obligations |

|

9,809 |

|

1,451 |

|

(1,353 |

) |

(e) |

|

9,907 |

|

|

Current portion of derivative liability |

|

877 |

|

614 |

|

|

|

|

|

1,491 |

|

|

Total current liabilities |

|

117,771 |

|

36,965 |

|

(3,253 |

) |

|

|

151,483 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Long-term debt and capital lease obligations |

|

1,407,354 |

|

136,610 |

|

(175,076 |

) |

(e) |

|

1,368,888 |

|

|

Deferred income taxes |

|

180,204 |

|

37,260 |

|

35,062 |

|

(f) |

|

252,526 |

|

|

Pension and other post-retirement benefits |

|

60,822 |

|

12,273 |

|

(4,080 |

) |

(c) |

|

69,015 |

|

|

Other liabilities and deferred revenues |

|

12,463 |

|

2,712 |

|

200 |

|

(c) |

|

15,375 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total stockholders’ equity |

|

134,841 |

|

49,802 |

|

(11,500 |

) |

(g) |

|

371,584 |

|

|

|

|

|

|

|

|

(9,416 |

) |

(g) |

|

|

|

|

|

|

|

|

|

|

207,857 |

|

(g) |

|

|

|

|

|

|

$ |

1,913,455 |

|

$ |

275,622 |

|

$ |

39,794 |

|

|

|

$ |

2,228,871 |

|

See accompanying notes to the unaudited pro forma condensed combined financial statements.

NOTES TO UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL STATEMENTS

(amounts in thousands, except per share amounts)

1. Description of the Transaction

On October 16, 2014, Consolidated Communications Holdings, Inc. (“Consolidated”) completed its acquisition of Enventis Corporation, formerly Hickory Tech Corporation (“Enventis”). Pursuant to the Agreement and Plan of Merger (the “Merger Agreement”) dated June 29, 2014, Sky Merger Sub Inc. (“Merger Sub”), a wholly-owned subsidiary of Consolidated, merged with and into Enventis, with Enventis as the surviving entity (the “Merger”). As a result of the Merger, the separate corporate existence of Merger Sub ceased, and Enventis will continue as the surviving corporation and a wholly-owned subsidiary of Consolidated.

At the effective time of the Merger, each share of Enventis common stock converted into the right to receive 0.7402 shares of common stock, par value $0.01 per share, of Consolidated and cash in lieu of fractional shares, as set forth in the Merger Agreement.

Consolidated will account for its acquisition of Enventis using the acquisition method of accounting. The unaudited pro forma condensed combined statements of income for the nine months ended September 30, 2014 and the year ended December 31, 2013 give effect to the Merger as if it had occurred on January 1, 2013. The unaudited pro forma condensed combined balance sheet has been prepared as of September 30, 2014 and gives effect to the Merger as if it had occurred on that date.

The pro forma adjustments reflect preliminary estimates of the fair value of the consideration transferred, the assets acquired and the liabilities assumed, which are expected to change upon finalization of appraisals and other valuation studies. The final pro forma adjustments will be based on the fair value of the consideration transferred and the assets and liabilities that existed as of the effective time of the Merger. The final adjustments could be materially different from the pro forma adjustments presented herein.

The unaudited pro forma condensed combined statements of income include certain accounting adjustments related to the Merger that are expected to have a continuing impact on the combined results, such as increased depreciation and amortization on the acquired tangible and intangible assets, increased interest expense on the debt incurred to complete the Merger, amortization of deferred financing fees incurred in connection with the new borrowings and the tax impact of these pro forma adjustments.

The unaudited pro forma condensed combined statements of income do not reflect certain adjustments that are expected to result from the Merger that may be significant, such as costs that may be incurred by Consolidated for integration and restructuring efforts, as well as payments under certain change in control agreements or other contingent payments to certain Enventis employees, because they are considered to be of a non-recurring nature.

Upon completion of the Merger or shortly thereafter, various triggering events occurred which will result in the payment of various change in control payments and other contingent payments to certain Enventis employees. The estimated cash payments under these agreements will be approximately $6,200 of which $1,000 was paid shortly after the close with the remaining $5,200 to be paid in the second quarter of 2015. No adjustment has been included in the pro forma financial statements for these payments.

The summary pro forma financial information does not include the realization of future cost savings or synergies or restructuring charges that are expected to result from the Merger. The transaction is expected to generate annual operating synergies of approximately $14,000, which are expected to be achieved on a run-rate basis by the end of the second year after close. Consolidated also expects to incur merger and integration costs, excluding closing costs, of approximately $8,200 in operating expenses and $5,200 in capital expenditures over the first two years following the close. However, no assurance can be given with respect to the ultimate level of such synergies or costs or the timing of their realization.

2. Preliminary Purchase Consideration and Related Allocation

The following is the calculation of the preliminary purchase price for the acquisition of Enventis:

|

Number of shares of Enventis common stock and equity awards outstanding at the effective time of the Merger |

|

13,704 |

|

|

Exchange ratio |

|

0.7402 |

|

|

Number of shares of Consolidated common stock issued to holders of Enventis common stock |

|

10,144 |

|

|

Consolidated closing common stock price on October 15, 2014 |

|

$ |

25.40 |

|

|

Stock value issued to Enventis shareholders |

|

$ |

257,659 |

|

|

Cash consideration for fractional shares |

|

23 |

|

|

Repayment of Enventis debt |

|

149,917 |

|

|

Estimated purchase price |

|

$ |

407,599 |

|

The estimated fair value of the tangible and intangible assets acquired and liabilities assumed on a preliminary basis are as follows:

|

Assets: |

|

|

|

|

Accounts receivable |

|

$ |

34,397 |

|

|

Other current assets |

|

19,876 |

|

|

Property, plant and equipment |

|

279,283 |

|

|

Goodwill |

|

165,749 |

|

|

Customer relationships and tradenames |

|

20,570 |

|

|

Other assets |

|

6,808 |

|

|

Total assets |

|

526,683 |

|

|

|

|

|

|

|

Liabilities: |

|

|

|

|

Current liabilities |

|

35,612 |

|

|

Deferred income taxes |

|

72,322 |

|

|

Pension and other postretirement obligations |

|

8,193 |

|

|

Other long-term liabilities |

|

2,957 |

|

|

Total liabilities |

|

119,084 |

|

|

|

|

|

|

|

Net fair value of assets acquired |

|

$ |

407,599 |

|

For purposes of preparing the pro forma financial statements, the estimated fair value of the assets acquired and the liabilities assumed are based on their preliminary estimated fair value as of September 30, 2014. The final amount recorded will be based on the fair values of the assets acquired and liabilities assumed as of October 16, 2014 and could vary significantly from the pro forma amounts due to various factors, including but not limited to, changes in the composition of Enventis’ assets and liabilities including the amount of debt outstanding and changes in fair value assumptions prior to the completion of the valuation studies. Accordingly, the preliminary estimated fair values of the purchase price and the assets and liabilities recorded are subject to change pending additional information that may be developed by Consolidated and Enventis. Any changes to the initial estimates of the fair value of the acquired assets and assumed liabilities will be recorded as adjustments to those assets and liabilities and residual amounts will be allocated to goodwill.

3. Pro Forma Adjustments — Statements of Income

The following pro forma adjustments included in the unaudited pro forma condensed combined statements of income for the nine months ended September 30, 2014 and the year ended December 31, 2013 give effect to the Merger as if it had occurred on January 1, 2013:

(a) Accounting Policies and Presentation

In connection with the Merger, a preliminary review of the accounting policies and presentation of the financial statements of Enventis has been performed. Based on this review, no adjustments were necessary to conform the Enventis statements of income to the Consolidated accounting policies and presentation. The final results of the complete review of accounting policies and presentation may result in identifying differences that, when conformed, could have a material effect on the combined financial statements.

(b) Transaction Costs

The pro forma adjustment reflects the removal of transaction costs that were incurred by Consolidated and Enventis directly related to the Merger during the nine months ended September 30, 2014. These costs have been excluded from the unaudited pro forma condensed combined statements of income since they are considered to be of a non-recurring nature.

(c) Depreciation and Amortization

The pro forma adjustments to depreciation and amortization reflect the removal of the historical basis of depreciation and amortization for the Enventis assets and the recognition of the new depreciation and amortization expense for property and equipment and finite-lived intangible assets acquired in the Merger, based on the estimated fair value of these. The following table summarizes the pro forma adjustments to depreciation and amortization:

|

|

|

Nine Months |

|

|

|

|

|

|

Ended |

|

Year Ended |

|

|

|

|

September 30, 2014 |

|

December 31, 2013 |

|

|

Remove historical depreciation and amortization |

|

$ |

(22,557 |

) |

$ |

(29,322 |

) |

|

Record new depreciation and amortization |

|

35,567 |

|

47,423 |

|

|

|

|

$ |

13,010 |

|

$ |

18,101 |

|

(d) Interest Expense

The pro forma adjustments to interest expense, as summarized in the following table, reflect the removal of historical interest expense of Enventis, the removal of historical interest expense of Consolidated for the repurchase of a portion of its existing senior notes and the additional interest expense resulting from the new borrowings to finance the Merger, as described below. The pro forma adjustments are based on the amounts borrowed and the interest rates in effect at the closing of the Merger.

|

|

|

Estimated |

|

|

|

Nine Months |

|

|

|

|

|

|

Principal |

|

|

|

Ended |

|

Year Ended |

|

|

|

|

Outstanding |

|

Interest Rate |

|

September 30, 2014 |

|

December 31, 2013 |

|

|

Removal of historical interest expense for: |

|

|

|

|

|

|

|

|

|

|

Enventis interest expense including amortization of deferred financing costs |

|

|

|

|

|

$ |

(2,992 |

) |

$ |

(4,594 |

) |

|

Consolidated repurchase of 2020 Notes |

|

|

|

|

|

(3,946 |

) |

(5,219 |

) |

|

Consolidated amortization of debt issuance costs for bridge loan |

|

|

|

|

|

(1,050 |

) |

— |

|

|

Recording of new interest expense for: |

|

|

|

|

|

|

|

|

|

|

Issuance of senior notes |

|

$ |

200,000 |

|

6.50 |

% |

9,750 |

|

13,000 |

|

|

Borrowings from revolving credit facility |

|

$ |

8,000 |

|

3.16 |

% |

190 |

|

253 |

|

|

Amortization of debt issuance costs: |

|

|

|

|

|

|

|

|

|

|

Amortization of debt issuance costs on new senior notes |

|

|

|

|

|

329 |

|

439 |

|

|

Net adjustment to interest expense |

|

|

|

|

|

$ |

2,281 |

|

$ |

3,879 |

|

In connection with the Merger, on September 18, 2014, Consolidated completed an offering of $200,000 aggregate principal amount of its 6.50% senior notes due 2022 (the “2022 Notes”). The proceeds of the 2022 Notes offering were placed in an escrow account pending the consummation of the Merger. At September 30, 2014, the escrow funds were included in restricted cash in Consolidated’s historical condensed consolidated balance sheet. On October 16, 2014, the net proceeds of the offering were released from escrow and used to (i) pay the fees and expenses in connection with the Merger, (ii) repay existing indebtedness of Enventis, and (iii) repurchase, together with cash on hand, $46,754 of Consolidated’s outstanding 10.875% Senior Notes due 2020 (the “2020 Notes”). The 2020 Notes were repurchased at a price of 116.75%, including premium and fees, for $54,585 resulting in a loss on the partial extinguishment of debt of $9,416, which includes the unamortized discount and deferred financing costs associated with the repurchased notes. The pro forma adjustments are based on the issuance of the new borrowings and the repurchase of the existing notes as if such events had occurred on January 1, 2013. The unaudited pro forma condensed combined statements of income do not reflect a pro forma adjustment for the loss on the partial extinguishment of debt as it is considered to be nonrecurring.

Consolidated also used $8,000 in borrowings from its $75,000 secured revolving credit facility to fund transaction costs related to the Merger. An increase or decrease of 0.125% in the interest rate on the revolving credit facility would change annual pro forma interest expense by $10.

For all periods presented, pro forma interest expense includes the amortization of expected financing costs of $3,514 related to the issuance of the 2022 Notes based on a term of 8 years. Pro forma interest expense excludes amortization of financing costs of $1,050 incurred during the nine months ended September 30, 2014 related to the $140,000 senior unsecured bridge loan facility commitment (“Bridge Facility”) entered into in connection with the Merger. As anticipated, financing for the Merger was completed through the 2022 Notes offering, which replaced the Bridge Facility on the date of the Merger.

(e) Income Tax Expense

The blended effective tax rate applied to the pro forma adjustments related to the Merger and related financing is 39% for the periods presented.

(f) Earnings Per Share

The pro forma adjustment reflects the change in outstanding shares to calculate basic and dilutive earnings per share based on the Merger:

|

|

|

Nine Months |

|

|

|

|

|

|

Ended |

|

Year Ended |

|

|

|

|

September 30, 2014 |

|

December 31, 2013 |

|

|

Shares Used in Basic Earnings Per Share |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cancellation of Enventis shares |

|

(13,634 |

) |

(13,548 |

) |

|

Issuance of Consolidated shares |

|

10,144 |

|

10,144 |

|

|

|

|

(3,490 |

) |

(3,404 |

) |

|

|

|

|

|

|

|

|

Shares Used in Diluted Earnings Per Share |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cancellation of Enventis shares |

|

(13,696 |

) |

(13,606 |

) |

|

Issuance of Consolidated shares |

|

10,144 |

|

10,144 |

|

|

|

|

(3,552 |

) |

(3,462 |

) |

4. Pro Forma Adjustments — Balance Sheet

The following are the pro forma adjustments included in the unaudited pro forma condensed combined balance sheet as of September 30, 2014 and give effect to the Merger as if it had occurred on that date:

(a) Accounting Policies and Presentation

In connection with the Merger, a preliminary review of the accounting policies and presentation of the financial statements of Enventis has been performed to conform to those of Consolidated. Based on this review, certain amounts included in Enventis’ historical balance sheet have been reclassified to conform to the Consolidated accounting policies and presentation. The pro forma adjustments reflect the reclassification of Enventis inventory to other current assets, materials and supplies from deferred debt issuance costs, net and other assets to property, plant and equipment and the reclassification of accrued compensation from accrued expense.

The final results of the complete review of accounting policies and presentation may result in additional differences. There can be no assurances that such finalization will not result in material differences.

(b) Cash

Pro forma adjustments to cash are the result of proceeds from the issuance of debt, cash used to fund the acquisition of Enventis, estimated transaction costs and costs associated with entering into the new credit facilities. Following is a preliminary estimate of net cash used for the Merger:

|

Funds held in escrow account related to note offering |

|

$ |

204,803 |

|

|

Borrowings on revolving credit facility |

|

8,000 |

|

|

Retirement of Enventis debt |

|

(149,917 |

) |

|

Repurchase of 2020 Notes |

|

(54,585 |

) |

|

Deferred financing costs - bridge loan facility |

|

(1,400 |

) |

|

Deferred financing costs - senior notes issuance |

|

(3,514 |

) |

|

Estimated transaction costs |

|

(12,000 |

) |

|

Cash portion of the purchase price |

|

(23 |

) |

|

Net cash used |

|

$ |

(8,636 |

) |

As described above, the proceeds of the 2022 Notes offering and required deposits for fees and interest were placed in an escrow account pending the consummation of the Merger and were included in restricted cash in Consolidated’s historical condensed consolidated balance sheet at September 30, 2014. On October 16, 2014 with the completion of the Merger, the proceeds were released from escrow and used to fund the Merger. The cash payment for the retirement of Enventis debt represents the amount of long-term debt outstanding as of the close date of the Merger, which is an increase of $12,000 from the amount outstanding and included in the unaudited pro forma condensed combined balance sheet at September 30, 2014.

At September 30, 2014, deferred financing costs related to the bridge loan facility of $1,400 and transaction costs of $500 were incurred but unpaid and were included in the historical accrued expense in the unaudited pro forma condensed combined balance sheet.

(c) Fair Value Estimates

The pro forma adjustments reflect the preliminary estimated fair values for the net assets to be acquired. These estimates are preliminary and are subject to change upon completion of the valuation process.

|

|

|

|

|

|

Increase to property, plant and equipment |

|

$ |

100,597 |

|

|

Increase in customer relationships and tradenames |

|

16,941 |

|

|

Decrease in investments |

|

(1,056 |

) |

|

Increase in other assets |

|

60 |

|

|

Decrease in pension and other post retirement benefits |

|

(4,080 |

) |

|

Increase in other long term liabilities |

|

200 |

|

|

Increase in deferred income taxes |

|

35,062 |

|

|

|

|

|

|

|

Goodwill: |

|

|

|

|

Increase in goodwill |

|

$ |

165,749 |

|

|

Remove historical Enventis goodwill |

|

(29,028 |

) |

|

|

|

$ |

136,721 |

|

Goodwill reflects the preliminary estimate of the excess of the purchase price paid over the fair value of the identifiable assets acquired and liabilities assumed, and is not be amortized but will be assessed at least annually for impairment. Goodwill is not expected to be deductible for income tax purposes.

(d) Deferred Financing Costs

The pro forma adjustments to deferred financing costs and other assets are as follows:

|

Removal of Enventis deferred financing costs |

|

$ |

(2,202 |

) |

|

Removal of costs associated with the repurchase of the 2020 Notes |

|

(1,342 |

) |

|

New deferred financing costs associated with the senior notes |

|

3,514 |

|

|

|

|

$ |

(30 |

) |

(e) Debt

The pro forma adjustments to reflect the payment and incurrence of debt are as follows:

|

|

|

|

|

|

Non-current portion: |

|

|

|

|

Repayment of existing Enventis credit facility |

|

$ |

(136,565 |

) |

|

Repurchase of 2020 Notes and removal of associated discount |

|

(46,511 |

) |

|

Borrowings on revolving credit facility |

|

8,000 |

|

|

Adjustment to non-current portion of long-term debt |

|

$ |

(175,076 |

) |

|

|

|

|

|

|

Current portion: |

|

|

|

|

Repayment of existing Enventis credit facility |

|

$ |

(1,353 |

) |

(f) Income Taxes

The pro forma adjustments reflect the income tax impact assuming a marginal combined state and federal tax rate of approximately 39% of the pro forma adjustments resulting from the Merger. The pro forma adjustment to long-term deferred tax liabilities reflect the change in fair value of the net assets to be acquired.

(g) Stockholders’ Equity

The pro forma stockholders’ equity reflects the following adjustments:

|

Expected transaction costs of $15,000, less costs incurred to date of $3,500 |

|

$ |

(11,500 |

) |

|

|

|

|

|

|

Loss on extinguishment of debt related to the repurchase of 2020 Notes |

|

$ |

(9,416 |

) |

|

|

|

|

|

|

Equity issued to Enventis shareholders |

|

$ |

257,659 |

|

|

Elimination of historical Enventis shareholders’ equity |

|

(49,802 |

) |

|

|

|

$ |

207,857 |

|

Transaction costs incurred in connection with the Merger have not been assessed for deductibility for income tax purposes and accordingly are assumed to be nondeductible for pro forma purposes.

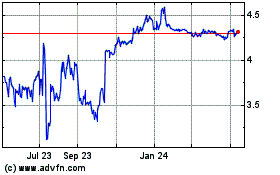

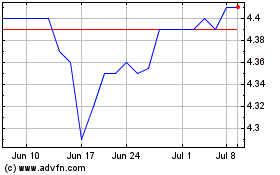

Consolidated Communicati... (NASDAQ:CNSL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Consolidated Communicati... (NASDAQ:CNSL)

Historical Stock Chart

From Apr 2023 to Apr 2024