Diluted EPS for the Nine Months Ended

October 31, 2014 Rise 250% to $8.20

Repays All Bank Debt on Consolidated Plants

and Authorizes Repurchase of Additional 500,000 Shares

REX American Resources Corporation (NYSE: REX) today reported

record financial results for its fiscal 2014 third quarter (“Q3

‘14”) ended October 31, 2014. The Company also announced that its

Board of Directors approved a 500,000 share increase in the number

of shares in its common stock repurchase plan. REX management will

host a conference call and webcast today at 11:00 a.m. ET.

Conference Call:

212/231-2907

Webcast / Replay URL:

www.rexamerican.com/Corp/Page4.aspx

The webcast will be available for replay for 30 days

REX American Resources’ Q3 ‘14 results principally reflect its

alternative energy segment interests in seven ethanol production

facilities. The operations of One Earth Energy, LLC (“One Earth”)

and NuGen Energy, LLC (“NuGen”) are consolidated, while those of

its five remaining plants are reported as equity in income of

unconsolidated ethanol affiliates.

REX’s Q3 ‘14 net sales and revenue were $138.5 million, compared

with $166.2 million in Q3 ‘13, principally reflecting reduced

ethanol and distillers grains pricing. As a result of lower corn

prices and strong ethanol crush spread margins in Q3 ‘14, the

Company’s gross profit rose to $36.5 million, from $18.0 million in

the prior year period. Reflecting the continued strength of ethanol

industry metrics, Q3 ‘14 equity in income of unconsolidated ethanol

affiliates increased to $8.8 million, compared with $3.3 million in

Q3 ‘13, leading to net income from continuing operations before

income taxes and non-controlling interests in Q3 ‘14 of $40.6

million, compared with $15.9 million in Q3 ‘13.

Net income attributable to REX shareholders in Q3 ‘14 rose to

$23.3 million, compared with $9.9 million in Q3 ‘13, while Q3 ‘14

diluted net income per share attributable to REX common

shareholders rose to a record $2.86 per share, compared to $1.21

per share in Q3 ‘13. Per share results in Q3 ‘14 and Q3 ‘13 are

based on 8,170,000 and 8,179,000 diluted weighted average shares

outstanding, respectively.

REX CEO, Stuart Rose, commented, “REX’s consolidated ethanol

plants and minority interests in ethanol production facilities

continue to benefit from the positive industry environment, the

efficiency of our plants, and our operating disciplines. These

factors drove record third quarter net income and diluted EPS,

which further strengthened our already solid financial foundation.

At October 31, 2014, cash and cash equivalents rose 56% to

approximately $164.3 million, compared to the fiscal 2013 year-end

levels, even as we allocated approximately $8.3 million to share

repurchases during the quarter.

“During the third quarter, we also continued to allocate cash

from operations to reduce consolidated plant-level debt. At the end

of the fiscal third quarter, consolidated plant-level debt was

$33.5 million, marking a $28.5 million, or 46% decrease, compared

to 2014 Q2 consolidated plant level debt of $62.0 million. As a

result, interest expense declined by 53%, compared to Q3 ‘13, while

our debt-to-capital ratio dropped to 9% from 16% at the end of Q2

and 21% at January 31, 2014. Subsequent to the end of fiscal third

quarter, we paid off the $33.5 million debt balance on our two

consolidated plants.”

Balance Sheet

At October 31, 2014, REX had cash and cash equivalents of $164.3

million, $48.5 million of which was at the parent company and

$115.8 million of which was at its consolidated ethanol production

facilities. This compares with cash and cash equivalents of $105.1

million at January 31, 2014, $63.3 million of which was at the

parent company and $41.8 million of which was at its consolidated

ethanol production facilities.

REX repurchased 121,200 common shares in Q3 ‘14 at an average

price of $68.58. In Q4 ‘14 to date, the Company repurchased an

additional 57,610 common shares at an average price of $68.19.

Combining the 500,000 common share repurchase authorization

announced today with the 101,096 shares remaining from the prior

authorization, the Company now has the authority to repurchase up

to 601,096 shares of its common stock. Reflecting all common share

repurchases to date, REX has 8,003,221 shares outstanding.

At October 31, 2014, REX had lease agreements, as landlord for

four former retail store locations. REX also has a seasonal

(temporary) lease agreement, as landlord, for one former retail

store location. In addition, REX has four owned former retail

stores that were vacant at October 31, 2014, which it is marketing

to either lease or sell. The current net book value for the

Company’s remaining real estate holdings is approximately $3.6

million. The real estate segment revenue reflects rental income

derived from these sites.

Segment Income Statement Data:

Three MonthsEnded

Nine MonthsEnded

($ in thousands)

October 31, October 31, 2014

2013 2014 2013 Net

sales and revenue: Alternative energy (1) $

138,363 $ 166,039 $ 444,323 $ 519,653 Real estate (2)

91 149 299

348 Total net sales and revenues

$ 138,454 $

166,188 $ 444,622

$ 520,001 Gross profit

(loss): Alternative energy (1) $ 36,506 $ 18,002 $ 111,940 $

37,918 Real estate (2)

(9)

26 17 6

Total gross profit $ 36,497

$ 18,028 $

111,957 $ 37,924

Segment profit (loss): Alternative energy segment (1) $

41,412 $ 16,491 $ 121,797 $ 34,231 Real estate segment (2) (34)

(35) (63) (179) Corporate expense, net

(801)

(604) (2,319)

(2,010)

Income from continuing operations

beforeincome taxes and non-controlling interests (2)

$

40,577

$

15,852

$

119,415

$

32,042

(1)

Includes results attributable to

non-controlling interests of approximately 26% for One Earth and

approximately 1% for NuGen.

(2)

Certain amounts differ from those

previously reported as a result of certain sold real estate assets

being reclassified as discontinued operations.

The following table summarizes select

data related to the Company’s consolidated alternative energy

interests:

Three Months Ended

Nine Months Ended

October 31, October 31,

2014

2013

2014

2013

Average selling price per gallon of ethanol

$

1.89

$

2.25

$

2.06

$

2.32

Average selling price per ton of dried distillers grains

$

145.87

$

228.00

$

181.54

$

244.29

Average selling price per ton of modified distillers grains

$

41.78

$

93.50

$

68.19

$

117.47

Average cost per bushel of grain $ 3.64 $ 6.24 $ 4.14 $ 6.95

Average cost of natural gas (per mmbtu)

$

4.69

$

4.02

$

6.41

$

4.24

Segment Balance Sheet Data:

October 31, 2014 January 31, 2014

Assets: Alternative energy $416,703 $356,589 Real estate 4,145

4,722 Corporate

49,530 66,557 Total

assets

$470,378 $427,868

Supplemental Data Related to REX’s

Alternative Energy Interests:

REX American Resources

CorporationEthanol Ownership Interests/Effective Annual

Gallons Shipped as of October 31, 2014(gallons in

millions)

Entity

TrailingTwelveMonthsGallonsShipped

CurrentREXOwnershipInterest

REX’s Current EffectiveOwnership

of Trailing TwelveMonth Gallons Shipped

One Earth Energy, LLC(Gibson City,

IL)

112.2 74% 83.0

NuGen Energy, LLC(Marion, SD)

115.0 99% 113.9

Patriot Holdings, LLC (Annawan,

IL)

122.7 27% 33.1

Big River Resources West Burlington,

LLC(West Burlington, IA)

109.2 10% 10.9

Big River Resources Galva, LLC

(Galva, IL)

120.1 10% 12.0

Big River United Energy, LLC

(Dyersville, IA)

124.8 5% 6.2

Big River Resources Boyceville,

LLC(Boyceville, WI)

57.2 10% 5.7

Total 761.2

n/a 264.8

About REX American Resources Corporation

REX American Resources has interests in seven ethanol production

facilities, which in aggregate shipped approximately 761 million

gallons of ethanol over the twelve month period ended October 31,

2014. REX’s effective ownership of the trailing twelve month

gallons shipped (for the twelve months ended October 31, 2014) by

the ethanol production facilities in which it has ownership

interests was approximately 265 million gallons. Further

information about REX is available at www.rexamerican.com.

This news announcement contains or may contain forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Such statements can be identified by use of

forward-looking terminology such as “may,” “expect,” “believe,”

“estimate,” “anticipate” or “continue” or the negative thereof or

other variations thereon or comparable terminology. Readers are

cautioned that there are risks and uncertainties that could cause

actual events or results to differ materially from those referred

to in such forward-looking statements. These risks and

uncertainties include the risk factors set forth from time to time

in the Company’s filings with the Securities and Exchange

Commission and include among other things: the impact of

legislative changes, the price volatility and availability of corn,

dried and modified distillers grains, ethanol, corn oil, gasoline

and natural gas, ethanol plants operating efficiently and according

to forecasts and projections, changes in the national or regional

economies, weather, transportation delays, the effects of terrorism

or acts of war, changes in real estate market conditions and the

impact of Internal Revenue Service audits. The Company does not

intend to update publicly any forward-looking statements except as

required by law.

- statements of operations follow -

REX AMERICAN RESOURCES CORPORATION AND

SUBSIDIARIES

Consolidated Statements of

Operations

(in thousands, except per share

amounts)

Unaudited

Three MonthsEnded

Nine MonthsEnded

October

31,

October

31,

2014

2013

2014

2013

Net sales and revenue $138,454 $166,188 $444,622 $520,001 Cost of

sales

101,957 148,160

332,665 482,077 Gross profit 36,497

18,028 111,957 37,924 Selling, general and administrative expenses

(4,353) (4,589) (15,369) (12,530) Equity in income of

unconsolidated ethanol affiliates 8,780 3,331 24,322 9,558 Interest

and other income 103 69 243 158 Interest expense (454) (964)

(1,737) (3,039) Gains (losses) on derivative financial instruments,

net

4 (23) (1)

(29)

Income from continuing operations before

income taxes andnon-controlling interests

40,577

15,852

119,415

32,042

Provision for income taxes

(12,126)

(5,261) (40,049)

(11,034)

Income from continuing operations

including non-controllinginterests

28,451

10,591

79,366

21,008

Income from discontinued operations, net of tax - 287 5 556 Gain on

disposal of discontinued operations, net of tax

138

600 136 732

Net income including non-controlling

interests

28,589 11,478 79,507 22,296 Net income attributable to

non-controlling interests

(5,249)

(1,611) (12,518) (3,097) Net

income attributable to REX common shareholders

$23,340

$ 9,867 $66,989 $19,199

Weighted average shares outstanding – basic

8,170 8,140 8,157

8,154 Basic income per share from continuing

operations $2.84 $1.10 $8.19 $2.19 Basic income per share from

discontinued operations - 0.04 - 0.07

Basic income per share on disposal of

discontinuedoperations

0.02

0.07

0.02

0.09

Basic net income per share attributable to

REX commonshareholders

$2.86

$1.21

$8.21

$ 2.35

Weighted average shares outstanding – diluted

8,170 8,179 8,168

8,197 Diluted income per share from continuing

operations $2.84 $1.10 $8.18 $2.18 Diluted income per share from

discontinued operations - 0.04 - 0.07

Diluted income per share on disposal of

discontinuedoperations

0.02

0.07

0.02

0.09

Diluted net income per share attributable

to REX commonshareholders

$2.86

$1.21

$8.20

$2.34

Amounts attributable to REX common shareholders: Income from

continuing operations, net of tax $ 23,202 $ 8,980 $66,848 $17,911

Income from discontinued operations, net of tax

138

887

141 1,288 Net income

$

23,340 $ 9,867 $66,989

$19,199

Certain amounts differ from those

previously reported as a result of certain real estate assets being

reclassified as discontinued operations.

REX AMERICAN RESOURCES CORPORATION AND

SUBSIDIARIES

Consolidated Balance Sheets

(in thousands) Unaudited

ASSETS:

October 31,2014

January 31,2014

CURRENT ASSETS: Cash and cash equivalents $ 164,267 $ 105,149

Restricted cash - 500 Accounts receivable 10,586 16,486 Inventory

11,496 19,370 Refundable income taxes - 268 Prepaid expenses and

other 5,029 4,891 Deferred taxes-net

-

2,146

Total current assets 191,378 148,810 Property and equipment-net

197,645 202,258 Other assets 5,831 5,388 Equity method investments

75,524 71,189 Restricted investments and deposits

- 223 TOTAL ASSETS

$

470,378 $ 427,868

LIABILITIES AND SHAREHOLDERS’ EQUITY CURRENT

LIABILITIES: Current portion of long term debt $ 19,000 $

12,226 Accounts payable – trade 9,066 6,626 Deferred taxes 3,400 -

Derivative financial instruments - 1,141 Accrued expenses and other

current liabilities

19,511

12,147

Total current liabilities

50,977

32,140

LONG TERM LIABILITIES: Long term debt 14,500 63,500 Deferred taxes

19,597 19,613 Other long term liabilities

1,904

1,862 Total long term liabilities

36,001

84,975

COMMITMENTS AND CONTINGENCIES EQUITY: REX shareholders’ equity:

Common stock, 45,000 shares authorized, 29,853 shares issued at par

299 299 Paid in capital 144,791 144,051 Retained earnings 424,090

357,101 Treasury stock, 21,793 and 21,753 shares, respectively

(229,731)

(222,170)

Total REX shareholders’ equity 339,449 279,281 Non-controlling

interests

43,951 31,472

Total equity

383,400

310,753

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY

$

470,378 $ 427,868

- statements of cash flows follow -

REX AMERICAN RESOURCES CORPORATION AND

SUBSIDIARIES

Consolidated Statements of Cash

Flows

(in thousands) Unaudited

Nine Months

Ended

October

31,

2014

2013

CASH FLOWS FROM OPERATING ACTIVITIES: Net income $ 79,507 $ 22,296

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation, impairment charges and

amortization 12,480 13,178 Income from equity method investments

(24,322) (9,558) Gain on disposal of real estate and property and

equipment (209) (989) Dividends received from equity method

investments 19,881 200 Deferred income - (590) Derivative financial

instruments (1,141) (1,249) Deferred income tax 5,323 8,241 Excess

tax benefit from stock option exercises (441) - Changes in assets

and liabilities: Accounts receivable 5,900 293 Inventories 7,874

8,613 Other assets 728 1,933 Accounts payable-trade 2,075 2,589

Accrued expenses and other liabilities

7,406

(1,529)

Net cash provided by operating

activities

115,061 43,428 CASH FLOWS

FROM INVESTING ACTIVITIES: Capital expenditures (8,107) (2,159)

Restricted cash 500 (500) Repayment of loan receivable - 681

Restricted investments and deposits 273 280 Proceeds from sale of

real estate and property and equipment

596

3,406 Net cash (used in) provided by investing

activities

(6,738)

1,708

CASH FLOWS FROM FINANCING ACTIVITIES:

Payments of long term debt

(42,226) (18,520) Stock options exercised 931 794 Payments to

noncontrolling interests holders (39) (5) Excess tax benefit from

stock option exercises 441 - Treasury stock acquired

(8,312) (3,079) Net cash used in

financing activities

(49,205)

(20,810) NET INCREASE IN CASH AND CASH EQUIVALENTS

59,118 24,326 CASH AND CASH EQUIVALENTS-Beginning of period

105,149 69,073

CASH AND CASH EQUIVALENTS-End of

period

$ 164,267 $

93,399 Non cash investing activities – Accrued capital

expenditures

$ 615 $

198

Non cash investing activities – Loan

receivable granted inconnection with sale of real estate

$

475

$

-

REX American Resources CorporationDouglas Bruggeman,

937-276-3931Chief Financial OfficerorJCIRJoseph Jaffoni / Norberto

Aja, 212-835-8500rex@jcir.com

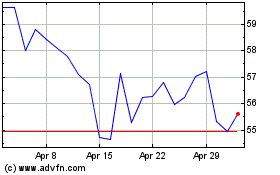

REX American Resources (NYSE:REX)

Historical Stock Chart

From Aug 2024 to Sep 2024

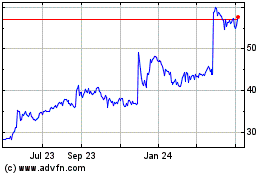

REX American Resources (NYSE:REX)

Historical Stock Chart

From Sep 2023 to Sep 2024