UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 24, 2014

BARNES GROUP INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

|

| | |

| | |

1-4801 | | 06-0247840 |

(Commission File Number) | | (I.R.S. Employer Identification No.) |

| | |

123 Main Street, Bristol, Connecticut | | 06010 |

(Address of principal executive offices) | | (Zip Code) |

(860) 583-7070

Registrant's telephone number, including area code

Not Applicable

(Former name or former address, if changed since last report)

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

|

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

| | |

Item 2.02 | | Results of Operations and Financial Condition.

On October 24, 2014, Barnes Group Inc. issued a press release announcing the financial results of operations for the third quarter and nine months ended September 30, 2014. A copy is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information in this Current Report on 8-K and the exhibit attached hereto shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Exchange Act or Securities Act of 1933, as amended, except as expressly set forth by specific reference in such filing. |

Item 9.01 | | Financial Statements and Exhibits.

Exhibit 99.1: Press Release issued October 24, 2014, announcing the financial results of operations for the third quarter and nine months ended September 30, 2014. |

SIGNATURES

|

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. |

|

| | |

Dated: October 24, 2014 | BARNES GROUP INC. |

| (Registrant) |

| | |

| By: | /s/ CHRISTOPHER J. STEPHENS, JR. |

| | Christopher J. Stephens, Jr. Senior Vice President, Finance and Chief Financial Officer |

EXHIBIT INDEX

|

| | |

Exhibit No. | | Document Description |

99.1 | | Press Release, dated October 24, 2014 |

|

| | | | |

| | | | Exhibit 99.1

Barnes Group Inc. 123 Main Street Bristol, CT 06010 |

NEWS RELEASE

BARNES GROUP INC. REPORTS

THIRD QUARTER 2014 FINANCIAL RESULTS

| |

▪ | Net Sales of $318 million, up 18%; Organic Sales up 8% |

| |

▪ | Operating Margin of 16.0%; Adjusted Operating Margin of 16.5%, up 610 bps |

| |

▪ | Diluted EPS from Continuing Operations of $0.62; |

Adjusted Diluted EPS from Continuing Operations of $0.64, up 64%

| |

▪ | 2014 EPS from Continuing Operations Guidance Increased to $2.10 to $2.15 per diluted share; |

On an Adjusted Basis, $2.30 to $2.35 per diluted share, up 26% to 28%

BRISTOL, Conn., October 24, 2014 - Barnes Group Inc. (NYSE: B), an international industrial and aerospace manufacturer and service provider, today reported financial results for the third quarter 2014. Net sales of $317.7 million were up 18% from $269.5 million in the third quarter of 2013, driven by the sales contribution from the acquired Männer business and strong organic sales growth of 8%. Income from continuing operations for the third quarter was $34.3 million, or $0.62 per diluted share, compared to $21.4 million, or $0.39 per diluted share in the prior year period. In the third quarter of 2013, income from continuing operations included an $8.6 million pre-tax inventory valuation charge related to exchange engine parts within the Aerospace repair and overhaul business. On an adjusted basis, income from continuing operations was $0.64 per diluted share, up 64% from $0.39 a year ago. Third quarter 2014 adjusted diluted earnings from continuing operations exclude the impact of Männer short-term purchase accounting adjustments of $0.9 million pre-tax, or $0.01 per diluted share, and costs related to the close of production operations at Associated Spring’s Saline, Michigan facility which were $0.5 million pre-tax, or $0.01 per diluted share.

A table reconciling 2013 and 2014 non-GAAP adjusted results presented in this release to our GAAP results is included at the end of this press release.

“Barnes Group produced an excellent quarter of financial performance driven by continued margin expansion and strong revenue growth,” said Patrick J. Dempsey, President and Chief Executive Officer of Barnes Group Inc. “Our Industrial and Aerospace Segments each delivered high-single digit organic growth and orders in the quarter were solid which supports an improved outlook for 2014 and positive momentum heading into 2015,” added Dempsey.

Industrial

| |

• | Third quarter 2014 sales were $207.2 million, up 24% from $167.7 million in the same period last year. The Männer business, acquired in October 2013, provided $29.6 million of the sales increase while unfavorable foreign exchange negatively impacted sales by $1.8 million. Industrial’s organic sales grew 7% over the prior year period. |

| |

• | Operating profit of $33.2 million in the third quarter was up 59% from $20.9 million in the prior year period. Operating profit benefited from the contribution of Männer and higher organic sales, and was partially offset by $0.9 million of pre-tax Männer short-term purchase accounting adjustments and $0.5 million of pre-tax restructuring charges related to the closure of production operations at the Saline, Michigan facility. Excluding the acquisition related expenses and Saline closure costs, adjusted operating profit was $34.6 million, up 66%. Adjusted operating margin was 16.7%, up 430 bps from last year’s operating margin of 12.4%. |

Aerospace

| |

• | Third quarter 2014 sales were $110.4 million, up 9% from $101.7 million in the same period last year. Increased sales from original equipment manufacturing ("OEM") business were partially offset by lower sales in the aftermarket repair and overhaul ("MRO") business. Aerospace spare part sales were flat on a year-over-year basis. |

| |

• | Operating profit was $17.7 million for the third quarter of 2014 as compared to $7.2 million for the prior year period. Operating profit benefited from the contributions of increased sales in the OEM business, higher profits in the MRO business and the absence of the $8.6 million inventory valuation charge taken in last year’s third quarter. These benefits were partially offset by increased employee related costs. Operating margin was 16.0% in the quarter, compared to 7.0% a year ago. |

| |

• | Aerospace backlog was $511 million at the end of the third quarter, down 3% from the second quarter of 2014. |

Additional Information

| |

• | The Company's effective tax rate from continuing operations for the third quarter of 2014 was 28.1% compared with 15.8% in the third quarter of 2013 and 32.8% for the full year 2013. Included in the full year 2013 income tax is a charge of approximately $16 million associated with the April 2013 U.S. Tax Court’s unfavorable decision. Excluding this charge, the full year 2013 adjusted effective tax rate was 17.5%. The effective tax rate increase in 2014 over the adjusted full year 2013 rate is due to a projected mix of earnings attributable to higher-taxing jurisdictions, the expiration of certain tax holidays, and the increase in planned repatriation of a portion of current foreign earnings to the U.S. |

2014 Updated Outlook

Barnes Group now expects 2014 total revenue to grow 15% to 16%, 5% to 6% on an organic basis, and forecasts adjusted operating margins of approximately 15.5%. GAAP earnings from continuing operations are expected to be in the range of $2.10 to $2.15 per diluted share. Excluding Männer short-term purchase accounting adjustments and the Saline closure costs, adjusted diluted earnings per share from continuing operations are anticipated to be in the range of $2.30 to $2.35, up 26% to 28% from 2013’s adjusted diluted earnings per share of $1.83. Further, the Company continues to expect capital expenditures of approximately $60 million and cash conversion to be approximately 100% of net income.

Conference Call

Barnes Group Inc. will conduct a conference call with investors to discuss third quarter 2014 results at 8:30 a.m. EDT today, October 24, 2014. A webcast of the live call and an archived replay will be available on the Barnes Group investor relations link at www.BGInc.com. The conference is also available by direct dial at (888) 680-0879 in the U.S. or (617) 213-4856 outside of the U.S. (request the Barnes Group Earnings Call), Participant Code: 44759175.

In addition, the call will be recorded and available for playback until Friday, October 31, 2014 by dialing (617) 801-6888; Passcode: 34810509.

About Barnes Group

Founded in 1857, Barnes Group Inc. (NYSE: B) is an international industrial and aerospace manufacturer and service provider, serving a wide range of end markets and customers. The products and services provided by Barnes Group are used in far-reaching applications that provide transportation, communication, manufacturing and technology to the world. Barnes Group’s approximately 4,400 dedicated employees, at more than 60 locations worldwide, are committed to achieving consistent and sustainable profitable growth. For more information, visit www.BGInc.com.

Forward-Looking Statements

This press release contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements often address our expected future operating and financial performance and financial condition, and often contain words such as "anticipate," "believe," "expect," "plan," "strategy," "estimate," "project," and similar terms. These forward-looking statements do not constitute guarantees of future performance and are subject to a variety of risks and uncertainties that may cause actual results to differ materially from those expressed in the forward-looking statements. These include, among others: difficulty maintaining relationships with employees, including unionized employees, customers, distributors, suppliers, business partners or governmental entities; failure to successfully negotiate collective bargaining agreements or potential strikes, work stoppages or other similar events; difficulties leveraging market opportunities; changes in market demand for our products and services; rapid technological and market change; the ability to protect intellectual property rights; introduction or development of new products or transfer of work; higher risks in international operations and markets; the impact of intense competition; and other risks and uncertainties described in documents filed with or furnished to the Securities and Exchange Commission ("SEC") by the Company, including, among others, those in the Management's Discussion and Analysis of Financial Condition and Results of Operations and Risk Factors sections of the Company's filings. The risks and uncertainties described in our periodic filings with the SEC include, among others, uncertainties relating to conditions in financial markets; currency fluctuations and foreign currency exposure; future financial performance of the industries or customers that we serve; our dependence upon revenues and earnings from a small number of significant customers; a major loss of customers; inability to realize expected sales or profits from existing backlog due to a range of factors, including insourcing decisions, material changes, production schedules and volumes of specific programs; the impact of government budget and funding decisions; changes in raw material or product prices and availability; integration of acquired businesses including the Männer business; restructuring costs or savings including those related to the closure of production operations at the Company’s facility in Saline, Michigan; the continuing impact of strategic actions, including acquisitions, divestitures, restructurings, or strategic business realignments, and our ability to achieve the financial and operational targets set in connection with any such actions; the outcome of pending and future legal, governmental, or regulatory proceedings and contingencies and uninsured claims; future repurchases of common stock; future levels of indebtedness; and numerous other

matters of a global, regional or national scale, including those of a political, economic, business, competitive, environmental, regulatory and public health nature. The Company assumes no obligation to update our forward-looking statements.

Contact:

Barnes Group Inc.

William Pitts

Director, Investor Relations

860.583.7070

# # #

BARNES GROUP INC.

CONSOLIDATED STATEMENTS OF INCOME

(Dollars in thousands, except per share data)

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, |

| 2014 | | 2013 | | % Change | | 2014 | | 2013 | | % Change |

Net sales | $ | 317,659 |

| | $ | 269,491 |

| | 17.9 | | $ | 951,832 |

| | $ | 800,430 |

| | 18.9 |

|

| | | | | | | | | | | |

Cost of sales | 206,410 |

| | 189,488 |

| | 8.9 | | 632,671 |

| | 544,615 |

| | 16.2 |

|

Selling and administrative expenses | 60,364 |

| | 51,972 |

| | 16.1 | | 187,770 |

| | 166,679 |

| | 12.7 |

|

| 266,774 |

| | 241,460 |

| | 10.5 | | 820,441 |

| | 711,294 |

| | 15.3 |

|

Operating income | 50,885 |

| | 28,031 |

| | 81.5 | | 131,391 |

| | 89,136 |

| | 47.4 |

|

| | | | | | | | | | | |

Operating margin | 16.0 | % | | 10.4 | % | | | | 13.8 | % | | 11.1 | % | | |

| | | | | | | | | | | |

Interest expense | 2,435 |

| | 2,401 |

| | 1.4 | | 8,558 |

| | 10,000 |

| | (14.4 | ) |

Other expense (income), net | 741 |

| | 241 |

| | NM | | 1,768 |

| | 1,702 |

| | 3.9 |

|

Income from continuing operations before income taxes | 47,709 |

| | 25,389 |

| | 87.9 | | 121,065 |

| | 77,434 |

| | 56.3 |

|

Income taxes | 13,407 |

| | 4,008 |

| | NM | | 33,782 |

| | 31,426 |

| | 7.5 |

|

Income from continuing operations | 34,302 |

| | 21,381 |

| | 60.4 | | 87,283 |

| | 46,008 |

| | 89.7 |

|

| | | | | | | | | | | |

(Loss) income from discontinued operations, net of income taxes | (425 | ) | | (476 | ) | | 10.7 | | (425 | ) | | 197,696 |

| | NM |

|

Net income | $ | 33,877 |

| | $ | 20,905 |

| | 62.1 | | $ | 86,858 |

| | $ | 243,704 |

| | (64.4 | ) |

Common dividends | $ | 5,988 |

| | $ | 5,775 |

| | 3.7 | | $ | 17,925 |

| | $ | 16,495 |

| | 8.7 |

|

| | | | | | | | | | | |

Per common share: | | | | | | | | | | | |

| | | | | | | | | | | |

Basic: | | | | | | | | | | | |

Income from continuing operations | $ | 0.63 |

| | $ | 0.40 |

| | 57.5 | | $ | 1.60 |

| | $ | 0.86 |

| | 86.0 |

|

(Loss) income from discontinued operations, net of income taxes | (0.01 | ) | | (0.01 | ) | | — | | (0.01 | ) | | 3.67 |

| | NM |

|

Net income | $ | 0.62 |

| | $ | 0.39 |

| | 59.0 | | $ | 1.59 |

| | $ | 4.53 |

| | (64.9 | ) |

| | | | | | | | | | | |

Diluted: | | | | | | | | | | | |

Income from continuing operations | $ | 0.62 |

| | $ | 0.39 |

| | 59.0 | | $ | 1.57 |

| | $ | 0.84 |

| | 86.9 |

|

(Loss) income from discontinued operations, net of income taxes | (0.01 | ) | | (0.01 | ) | | — | | (0.01 | ) | | 3.60 |

| | NM |

|

Net income | $ | 0.61 |

| | $ | 0.38 |

| | 60.5 | | $ | 1.56 |

| | $ | 4.44 |

| | (64.9 | ) |

| | | | | | | | | | | |

Dividends | 0.11 |

| | 0.11 |

| | — | | 0.33 |

| | 0.31 |

| | 6.5 |

|

| | | | | | | | | | | |

Weighted average common shares outstanding: | | | | | | | | | | | |

Basic | 54,879,329 |

| | 53,009,720 |

| | 3.5 | | 54,756,794 |

| | 53,818,950 |

| | 1.7 |

|

Diluted | 55,509,658 |

| | 54,304,990 |

| | 2.2 | | 55,803,370 |

| | 54,854,456 |

| | 1.7 |

|

NM - Not Meaningful

BARNES GROUP INC.

OPERATIONS BY REPORTABLE BUSINESS SEGMENT

(Dollars in thousands)

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, | |

| 2014 | | 2013 | | % Change | | 2014 | | 2013 | | % Change | |

Net sales | | | | | | | | | | | | |

Industrial | $ | 207,230 |

| | $ | 167,747 |

| | 23.5 | | $ | 623,886 |

| | $ | 503,809 |

| | 23.8 | |

Aerospace | 110,429 |

| | 101,744 |

| | 8.5 | | 327,951 |

| | 296,622 |

| | 10.6 | |

Intersegment sales | — |

| | — |

| | — | | (5 | ) | | (1 | ) | | NM | |

Total net sales | $ | 317,659 |

| | $ | 269,491 |

| | 17.9 | | $ | 951,832 |

| | $ | 800,430 |

| | 18.9 | |

| | | | | | | | | | | | |

Operating profit | | | | | | | | | | | | |

Industrial | $ | 33,205 |

| | $ | 20,874 |

| | 59.1 | | $ | 81,344 |

| | $ | 56,406 |

| | 44.2 | |

Aerospace | 17,680 |

| | 7,157 |

| | 147.0 | | 50,047 |

| | 32,730 |

| | 52.9 | |

Total operating profit | $ | 50,885 |

| | $ | 28,031 |

| | 81.5 | | $ | 131,391 |

| | $ | 89,136 |

| | 47.4 | |

| | | | | | | | | | | | |

Operating margin | | | | | Change | | | | | | Change | |

Industrial | 16.0 | % | | 12.4 | % | | 360 | bps. | 13.0 | % | | 11.2 | % | | 180 | bps. |

Aerospace | 16.0 | % | | 7.0 | % | | 900 | bps. | 15.3 | % | | 11.0 | % | | 430 | bps. |

Total operating margin | 16.0 | % | | 10.4 | % | | 560 | bps. | 13.8 | % | | 11.1 | % | | 270 | bps. |

NM - Not Meaningful

BARNES GROUP INC.

CONSOLIDATED BALANCE SHEETS

(Dollars in thousands)

(Unaudited)

|

| | | | | | | |

| September 30, 2014 | | December 31, 2013 |

Assets | | | |

Current assets | | | |

Cash and cash equivalents | $ | 63,007 |

| | $ | 70,856 |

|

Accounts receivable | 282,858 |

| | 258,664 |

|

Inventories | 214,291 |

| | 211,246 |

|

Deferred income taxes | 31,794 |

| | 18,226 |

|

Prepaid expenses and other current assets | 19,093 |

| | 18,204 |

|

Total current assets | 611,043 |

| | 577,196 |

|

| | | |

Deferred income taxes | 783 |

| | 2,314 |

|

Property, plant and equipment, net | 302,882 |

| | 302,558 |

|

Goodwill | 613,298 |

| | 649,697 |

|

Other intangible assets, net | 570,368 |

| | 534,293 |

|

Other assets | 57,587 |

| | 57,615 |

|

Total assets | $ | 2,155,961 |

| | $ | 2,123,673 |

|

| | | |

Liabilities and Stockholders' Equity | | | |

Current liabilities | | | |

Notes and overdrafts payable | $ | 25,695 |

| | $ | 1,074 |

|

Accounts payable | 95,122 |

| | 88,721 |

|

Accrued liabilities | 175,507 |

| | 154,514 |

|

Long-term debt - current | 885 |

| | 56,009 |

|

Total current liabilities | 297,209 |

| | 300,318 |

|

| | | |

Long-term debt | 513,215 |

| | 490,341 |

|

Accrued retirement benefits | 86,768 |

| | 80,884 |

|

Deferred income taxes | 88,350 |

| | 94,506 |

|

Other liabilities | 14,748 |

| | 16,210 |

|

| | | |

Total stockholders' equity | 1,155,671 |

| | 1,141,414 |

|

Total liabilities and stockholders' equity | $ | 2,155,961 |

| | $ | 2,123,673 |

|

BARNES GROUP INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Dollars in thousands)

(Unaudited)

|

| | | | | | | |

| Nine months ended September 30, |

| 2014 | | 2013 |

Operating activities: | | | |

Net income | $ | 86,858 |

| | $ | 243,704 |

|

Adjustments to reconcile net income to net cash provided by operating activities: | | | |

Depreciation and amortization | 62,556 |

| | 44,957 |

|

Amortization of convertible debt discount | 731 |

| | 1,776 |

|

Loss (gain) on disposition of property, plant and equipment | 103 |

| | (632 | ) |

Stock compensation expense | 5,453 |

| | 16,092 |

|

Withholding taxes paid on stock issuances | (4,357 | ) | | (2,045 | ) |

Loss (gain) on the sale of businesses | 1,586 |

| | (313,471 | ) |

Changes in assets and liabilities, net of the effects of divestitures: | | | |

Accounts receivable | (26,648 | ) | | (11,694 | ) |

Inventories | (8,481 | ) | | (405 | ) |

Prepaid expenses and other current assets | (3,074 | ) | | (815 | ) |

Accounts payable | 8,237 |

| | 8,988 |

|

Accrued liabilities | 8,630 |

| | 27,784 |

|

Deferred income taxes | (6,942 | ) | | (6,603 | ) |

Long-term retirement benefits | (6,400 | ) | | 238 |

|

Other | 3,519 |

| | 4,700 |

|

Net cash provided by operating activities | 121,771 |

| | 12,574 |

|

| | | |

Investing activities: | | | |

Proceeds from disposition of property, plant and equipment | 627 |

| | 895 |

|

(Payments for) proceeds from the sale of businesses | (1,181 | ) | | 539,116 |

|

Change in restricted cash | 4,886 |

| | — |

|

Capital expenditures | (43,594 | ) | | (33,799 | ) |

Component Repair Program payments | (41,000 | ) | | — |

|

Other | (1,030 | ) | | (1,901 | ) |

Net cash (used) provided by investing activities | (81,292 | ) | | 504,311 |

|

| | | |

Financing activities: | | | |

Net change in other borrowings | 24,663 |

| | 3,887 |

|

Payments on long-term debt | (183,673 | ) | | (482,158 | ) |

Proceeds from the issuance of long-term debt | 158,883 |

| | 178,000 |

|

Payment of assumed liability to Otto Männer Holding AG | (19,796 | ) | | — |

|

Premium paid on convertible debt redemption | (14,868 | ) | | — |

|

Proceeds from the issuance of common stock | 10,323 |

| | 10,873 |

|

Common stock repurchases | (8,389 | ) | | (68,608 | ) |

Dividends paid | (17,925 | ) | | (16,495 | ) |

Excess tax benefit on stock awards | 4,625 |

| | 3,312 |

|

Other | (185 | ) | | (1,320 | ) |

Net cash used by financing activities | (46,342 | ) | | (372,509 | ) |

| | | |

Effect of exchange rate changes on cash flows | (1,986 | ) | | (447 | ) |

(Decrease) increase in cash and cash equivalents | (7,849 | ) | | 143,929 |

|

| | | |

Cash and cash equivalents at beginning of period | 70,856 |

| | 86,356 |

|

Cash and cash equivalents at end of period | $ | 63,007 |

| | $ | 230,285 |

|

BARNES GROUP INC.

RECONCILIATION OF NET CASH PROVIDED BY OPERATING ACTIVITIES TO FREE CASH FLOW

(Dollars in thousands)

(Unaudited)

|

| | | | | | | |

| Nine months ended September 30, |

| 2014 | | 2013 |

Free cash flow: | | | |

Net cash provided by operating activities | $ | 121,771 |

| | $ | 12,574 |

|

Capital expenditures | (43,594 | ) | | (33,799 | ) |

Free cash flow (1) | $ | 78,177 |

| | $ | (21,225 | ) |

| | | |

Free cash flow to net income cash conversion ratio (as adjusted): | | | |

Free cash flow (from above) | $ | 78,177 |

| | $ | (21,225 | ) |

Income tax payments related to the gain on the sale of BDNA | — |

| | 95,714 |

|

Free cash flow (as adjusted)(2) | 78,177 |

| | 74,489 |

|

| | | |

Net income | 86,858 |

| | 243,704 |

|

Gain on the sale of BDNA, net of income taxes | — |

| | (194,417 | ) |

April 2013 tax court decision | — |

| | 16,388 |

|

Net income (as adjusted)(2) | $ | 86,858 |

| | $ | 65,675 |

|

| | | |

Free cash flow to net income cash conversion ratio (as adjusted)(2) | 90 | % | | 113 | % |

Notes:

(1) The Company defines free cash flow as net cash provided by operating activities less capital expenditures. The Company believes that the free cash flow metric is useful to investors and management as a measure of cash generated by business operations that can be used to invest in future growth, pay dividends, repurchase stock and reduce debt. This metric can also be used to evaluate the Company's ability to generate cash flow from business operations and the impact that this cash flow has on the Company's liquidity.

(2) For the purpose of calculating the cash conversion ratio, the Company has excluded the income tax payments related to the gain on the sale of BDNA made during the nine months ended September 30, 2013 from free cash flow and the gain on the sale of BDNA and the tax charge associated with the April 2013 tax court decision from net income.

BARNES GROUP INC.

NON-GAAP FINANCIAL MEASURE RECONCILIATION

(Dollars in thousands, except per share data)

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, | |

| 2014 | | 2013 | | % Change | | 2014 | | 2013 | | % Change | |

SEGMENT RESULTS | | | | | | | | | | | | |

Operating Profit - Industrial Segment (GAAP) | $ | 33,205 |

| | $ | 20,874 |

| | 59.1 |

| | $ | 81,344 |

| | $ | 56,406 |

| | 44.2 |

| |

Männer short-term purchase accounting adjustments | 930 |

| | — |

| | | | 7,712 |

| | — |

| | | |

Restructuring charges | 501 |

| | — |

| | | | 5,553 |

| | — |

| | | |

CEO transition costs | — |

| | — |

| | | | — |

| | 6,589 |

| | | |

Operating Profit - Industrial Segment as adjusted (Non-GAAP) (1) | $ | 34,636 |

| | $ | 20,874 |

| | 65.9 |

| | $ | 94,609 |

| | $ | 62,995 |

| | 50.2 |

| |

| | | | | | | | | | | | |

Operating Margin - Industrial Segment (GAAP) | 16.0 | % | | 12.4 | % | | 360 |

| bps. | 13.0 | % | | 11.2 | % | | 180 |

| bps. |

Operating Margin - Industrial Segment as adjusted (Non-GAAP) (1) | 16.7 | % | | 12.4 | % | | 430 |

| bps. | 15.2 | % | | 12.5 | % | | 270 |

| bps. |

| | | | | | | | | | | | |

Operating Profit - Aerospace Segment (GAAP) | $ | 17,680 |

| | $ | 7,157 |

| | 147.0 |

| | $ | 50,047 |

| | $ | 32,730 |

| | 52.9 |

| |

CEO transition costs | — |

| | — |

| | | | — |

| | 3,903 |

| | | |

Operating Profit - Aerospace Segment as adjusted (Non-GAAP) (1) | $ | 17,680 |

| | $ | 7,157 |

| | 147.0 |

| | $ | 50,047 |

| | $ | 36,633 |

| | 36.6 |

| |

| | | | | | | | | | | | |

Operating Margin - Aerospace Segment (GAAP) | 16.0 | % | | 7.0 | % | | 900 |

| bps. | 15.3 | % | | 11.0 | % | | 430 |

| bps. |

Operating Margin - Aerospace Segment as adjusted (Non-GAAP) (1) | 16.0 | % | | 7.0 | % | | 900 |

| bps. | 15.3 | % | | 12.4 | % | | 290 |

| bps. |

| | | | | | | | | | | | |

CONSOLIDATED RESULTS | | | | | | | | | | | | |

Operating Income (GAAP) | $ | 50,885 |

| | $ | 28,031 |

| | 81.5 |

| | $ | 131,391 |

| | $ | 89,136 |

| | 47.4 |

| |

Männer short-term purchase accounting adjustments | 930 |

| | — |

| | | | 7,712 |

| | — |

| | | |

Restructuring charges | 501 |

| | — |

| | | | 5,553 |

| | — |

| | | |

CEO transition costs | — |

| | — |

| | | | — |

| | 10,492 |

| | | |

Operating Income as adjusted (Non-GAAP) (1) | $ | 52,316 |

| | $ | 28,031 |

| | 86.6 |

| | $ | 144,656 |

| | $ | 99,628 |

| | 45.2 |

| |

| | | | | | | | | | | | |

Operating Margin (GAAP) | 16.0 | % | | 10.4 | % | | 560 |

| bps. | 13.8 | % | | 11.1 | % | | 270 |

| bps. |

Operating Margin as adjusted (Non-GAAP) (1) | 16.5 | % | | 10.4 | % | | 610 |

| bps. | 15.2 | % | | 12.4 | % | | 280 |

| bps. |

| | | | | | | | | | | | |

Diluted Income from Continuing Operations per Share (GAAP) | $ | 0.62 |

| | $ | 0.39 |

| | 59.0 |

| | $ | 1.57 |

| | $ | 0.84 |

| | 86.9 |

| |

Männer short-term purchase accounting adjustments | 0.01 |

| | — |

| | | | 0.10 |

| | — |

| | | |

Restructuring charges | 0.01 |

| | — |

| | | | 0.06 |

| | — |

| | | |

CEO transition costs | — |

| | — |

| | | | — |

| | 0.12 |

| | | |

April 2013 tax court decision | — |

| | — |

| | | | — |

| | 0.30 |

| | | |

Diluted Income from Continuing Operations per Share as adjusted (Non-GAAP) (1) | $ | 0.64 |

| | $ | 0.39 |

| | 64.1 |

| | $ | 1.73 |

| | $ | 1.26 |

| | 37.3 |

| |

| | | | | | | | | | | | |

| Full-Year 2013 | | | | Full-Year 2014 Outlook | | | | | |

Diluted Income from Continuing Operations per Share (GAAP) | $ | 1.31 |

| | | | $ | 2.10 |

| to | $ | 2.15 |

| | | | | |

Männer short-term purchase accounting adjustments | 0.07 |

| | | | | 0.13 |

| | | | | | |

Männer acquisition transaction costs | 0.03 |

| | | | | — |

| | | | | | |

Restructuring charges | — |

| | | | | 0.07 |

| | | | | | |

CEO transition costs | 0.12 |

| | | | | — |

| | | | | | |

April 2013 tax court decision | 0.30 |

| | | | | — |

| | | | | | |

Diluted Income from Continuing Operations per Share as adjusted (Non-GAAP) (1) | $ | 1.83 |

| |

|

| | $ | 2.30 |

| to | $ | 2.35 |

| | | | | |

| | | | | | | | | | | | |

Notes:

(1) The Company has excluded the following from its "as adjusted" financial measurements: 1) short-term purchase accounting adjustments related to its Männer acquisition in 2014, 2) restructuring charges related to the closure of production operations at the Company's Associated Spring facility located in Saline, Michigan in 2014, 3) short-term purchase accounting adjustments and transaction costs related to its Männer acquisition in 2013, 4) CEO transition costs associated with the modification of outstanding equity awards in 2013 and 5) the tax charge associated with the April 2013 tax court decision in 2013. Management believes that these adjustments provide the Company and its investors with an indication of our baseline performance excluding items that are not considered to be reflective of our ongoing results. Management does not intend results excluding the adjustments to represent results as defined by GAAP, and the reader should not consider it as an alternative measurement calculated in accordance with GAAP, or as an indicator of the Company's performance. Accordingly, the measurements have limitations depending on their use.

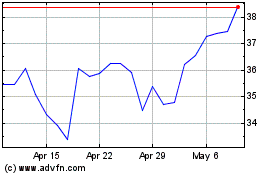

Barnes (NYSE:B)

Historical Stock Chart

From Mar 2024 to Apr 2024

Barnes (NYSE:B)

Historical Stock Chart

From Apr 2023 to Apr 2024